Volume price Qi Fei, Yadi 2022 performance record increase! Sodium power landing once again consolidate the leading position.

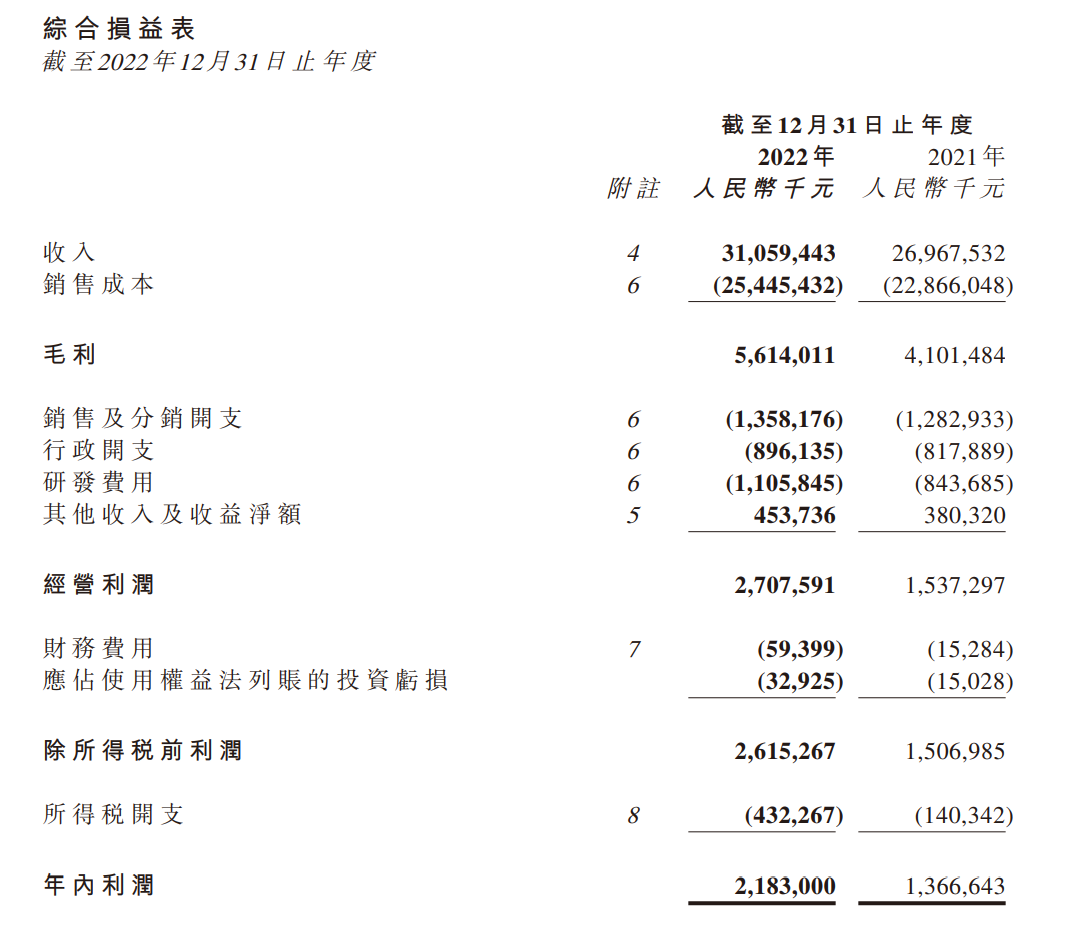

On March 27, Yadi Holdings released its 2022 annual results announcement.。Financial data show that the company's operating income in 2022 reached 310.5.9 billion yuan, up 15% year-on-year.2%。

On March 27, Yadi Holdings released its 2022 annual results announcement.。Financial data show that the company's operating income in 2022 reached 310.5.9 billion yuan (RMB, the same below), up 15.2%; gross profit of 56.1.4 billion yuan, up 36.9%; profits attributable to company owners amounted to 21.6.1 billion yuan, up 57.8%; basic EPS of 0.74, while declaring a final dividend of HK $40 per share.。

Volume price Qi Fei electric stepping power from the combination of double swords to help Yadi record increase

Yadi Holdings said it had record sales, revenue and profit in mid-2022, cementing its leadership position in China's electric two-wheeler market.。

In 2022, the Group launched 15 new electric scooters and 34 new electric bicycles with enhanced design, intelligent functions and advanced performance characteristics.。As a result, the average selling price of electric scooters increased from RMB 1,662 in 2021 to RMB 1,816 in 2022, while the average selling price of electric bicycles increased from RMB 1,265 in 2021 to RMB 1,429 in 2022.。

In addition, the total sales of Yadi electric scooters and electric bicycles in 2022 also increased from 1386 in 2021..30,000 to 14.01 million。In response, the company said that although the increase was modest, it was a positive reflection of Yadea's ability to generate strong revenue and profit growth through product innovation and product portfolio improvements, and to maintain its leading market position.

At the same time, increased sales of Yadi's battery and charger products also played an important role in Yadi's record growth last year。

Two-pronged "R & D + Design" Escort Yadi at the forefront of the industry

Yadi Holdings said that the company is committed to the forefront of innovation in the electric two-wheeler industry, continue to increase investment in research and development, and develop new products and technologies for core components.。In 2022, the company launched the Guanneng 3.0 series, which is a new generation of long-range intelligent electric two-wheelers, with a breakthrough long-term third-generation TTFAR graphene battery, which can be recycled more than 1000 times, with a capacity 30% higher than that of traditional lead-acid batteries, and low temperature protection function。At the same time, the company has also developed an electronic controller, which has significantly improved the anti-interference ability, three-phase circuit balance and overload capability compared to traditional controllers.。

In terms of style, the company has commissioned well-known design firms such as Yang Design and Giovannoni Design.。As of December 31, 2022, the Company had 1,890 patents (including appearance patents, utility model patents and invention patents), up from the previous year.。Yadea said that the company's continued investment in research and development allows it to stay ahead of industry trends and technological developments, thereby ensuring that it achieves more technological breakthroughs in the future.。

Attention epoch-making sodium ion battery car release Yadi super head brand certainty again enhanced

As early as the 17th of this month, Yadi announced that it has reached a cooperation with its Huayu New Energy Technology Company to launch the Yadi & Huayu first-generation sodium ion battery and its supporting car, Yadi Pole Sodium S9.。The company also announced on the same day that it had established a new company with a core business of sodium-ion batteries as a result of the company's development strategy.。The market believes that the new product release has a profound impact on the two companies.。

CITIC Construction Investment said that for Yadi, the release of sodium ion batteries and products can accelerate the increase in the proportion of its high-end self-electric products at the same time is expected to achieve its application scenario horizontal expansion, open B-side business increment;。

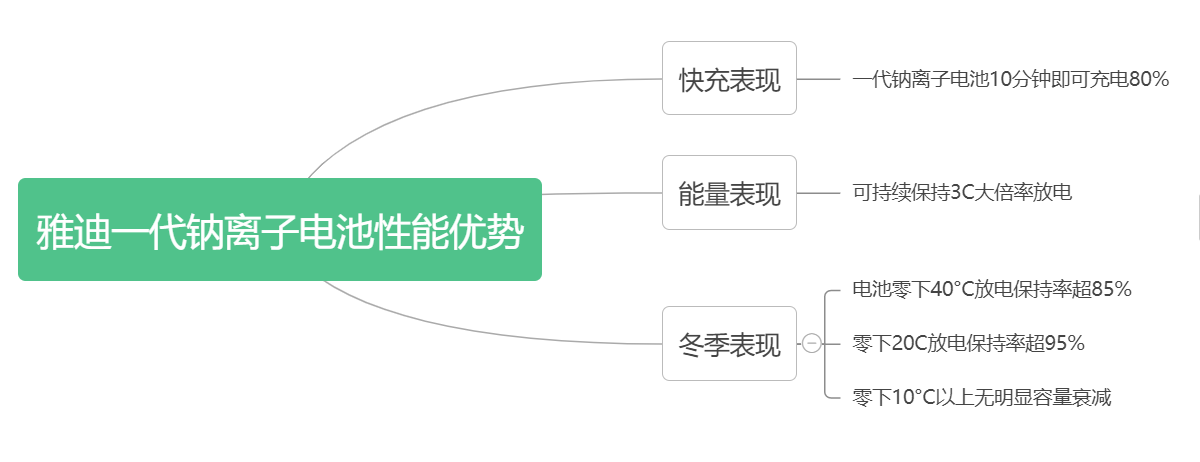

The agency also said that Yadi's first-generation sodium-ion battery and product performance can fully demonstrate the performance advantages of the sodium battery technology route.。First of all, in terms of fast charge performance, a generation of sodium ion battery can be charged 80% in 10 minutes; secondly, from the energy performance point of view, the battery can continue to maintain 3C large rate discharge; finally, from the winter performance point of view, the battery minus 40 ° C discharge retention rate of more than 85%, minus 20C discharge retention rate of more than 95%, and the battery pack has no obvious capacity attenuation above minus 10 ° C。

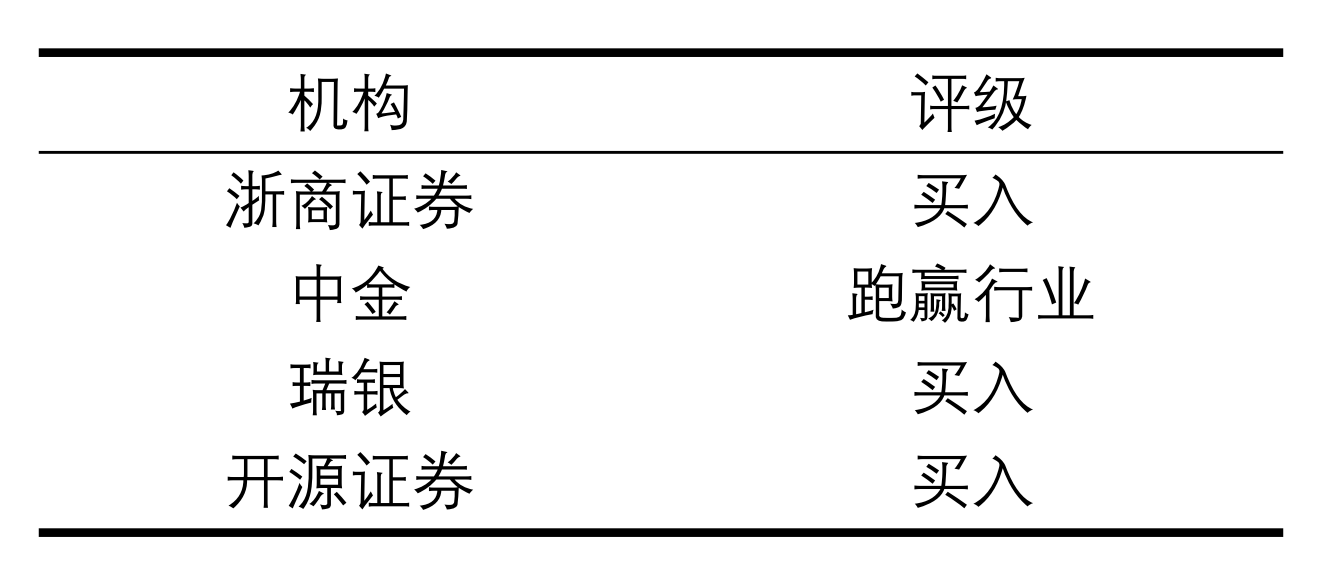

Zheshang Securities, on the other hand, said the sodium power release was of great strategic significance to both Yadi's two-wheeler business and Yadi Huayu's battery business.。First of all, the electric two-wheeler industry duopoly pattern has been set, Ssangyong's position is difficult to shake。Secondly, the industry super-head brand "market share increase + profitability improvement" certainty again enhanced。As a result, Zheshang gave Yadi Holdings a "buy" rating.。

Praise has been added. Major banks have given positive feedback.

After the release of the results, CICC released a research report saying that Yadi's 2022 results exceeded market expectations, in which bicycle revenue remained high in the second half of last year, gross margin and bicycle net profit further improved, driving earnings beyond market expectations.。The bank believes that in 2023 Yadi market share is expected to further enhance, mainly due to: 1) improve the low-end product line layout; 2) Guaneng 5 new product release, the high-end market to maintain the lead; 3) sinking channel network laying.。As a result, the bank expects the company's gross margin to maintain solid growth in 2023。

In addition, CICC also pointed out that in overseas markets, Yadi's initial layout of channels, production capacity and teams in Vietnam, Indonesia and other countries has been completed, and sales in overseas markets are expected to further increase to 300,000 vehicles in 2023.。In addition, Yadi released its sodium power products in March, is expected to go public this year is expected to contribute to sales, for sodium power to reduce the cost of achieving large-scale capacity.。As a result, CICC maintained Yadi Holdings's "Outperform Industry" rating and raised its target price by 10% to HK $23.。

UBS said that Yadi Holdings's sales in the first quarter of this year increased by more than 20% year-on-year, exceeding the bank and market expectations, so the corresponding increase in this year's full-year sales forecast to about 17.7 million vehicles, or more than 25% year-on-year growth, the adjustment is mainly based on the company's mid-range products to increase market share.。

In addition, driven by economies of scale and internal battery production, UBS expects Yadi's combined gross margin to increase by 0% year-on-year this year..5% to 18.6%, which also raised its 2023-25 earnings forecast by 5% to 8% and maintained its "buy" rating.。At the same time, the bank also set its target price from 23.HK $5 rose slightly to HK $25, corresponding to about 22 times this year's forecast P / E ratio.。

Open source securities also said that the agency is optimistic about the steady growth of Yadi Holdings in 2023 under the traction of new product iteration, and maintain its "buy" rating.。

Yadi Holdings closes up 1 on HKEx by close.72%, reported 18.HK $96。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.