Hawkinsight Hong Kong Market Closing Roundup (1.24) | Hong Kong Stock Rebound Continues Tech Net Stocks Lead the Market

On January 24, the three major indexes of Hong Kong stocks continued to rebound, with strong volatility throughout the day.。Hang Seng Index closes up 3 at close.56%, reported 15899.87 points。

On January 24, the three major indexes of Hong Kong stocks continued to rebound, with strong volatility throughout the day.。Hang Seng Index closes up 3 at close.56%, reported 15899.87; Hang Seng SOE Index closes up 4.13%, at 5,353.05 points; Hang Seng Tech Index closes up 4.24%, at 3,281.16 points。

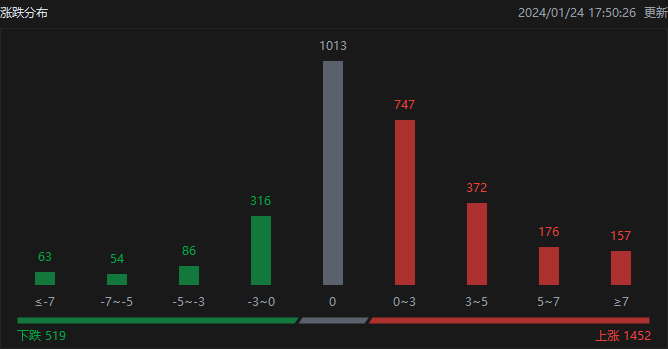

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 1,452, fell 519, and closed flat at 1,013.。

On the day of the Hong Kong stock market, North Water traded net buy 19.HK $8.1 billion, of which HK Stock Connect (Shanghai) traded a net purchase of 17.HK $1.3 billion, Hong Kong Stock Connect (Shenzhen) net buy 2.HK $6.8 billion。

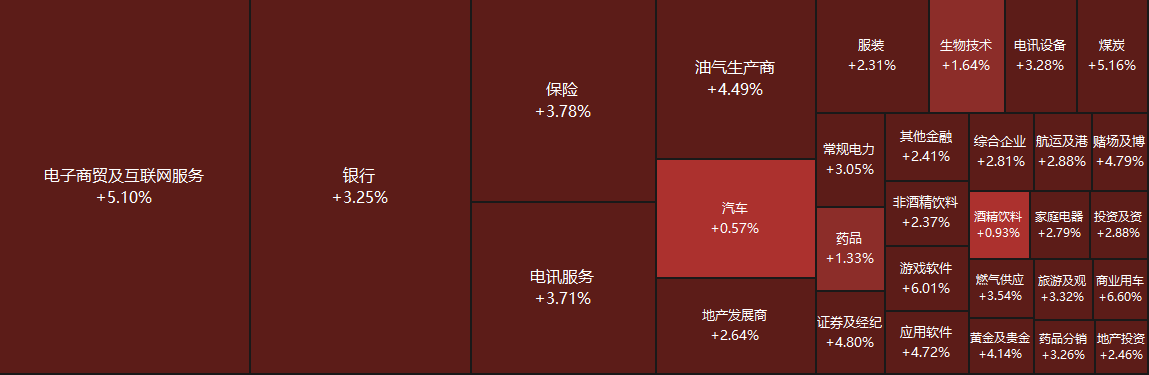

Sectors and Fundamentals

From the disk point of view, the network stocks led the market, including Alibaba, beep mile beep mile rose more than 7%, Baidu rose nearly 7%, Netease, the United States rose more than 6%, fast hand rose more than 5%, Jingdong rose about 5%, millet, Tencent rose nearly 4%;。On the other hand, a number of penny stocks fell sharply, including Jiangshan Holdings, which fell more than 47% during the session.。

Fundamentally, at a press conference held by the Information Office of the State Council, the relevant person in charge of the State-owned Assets Supervision and Administration Commission of the State Council said that it will further study the inclusion of market capitalization management in the performance appraisal of the heads of central enterprises, guide the heads of central enterprises to pay more attention to the market performance of the listed companies they hold, and timely convey confidence, stabilize expectations, and increase cash dividends to better return investors.。Founder Securities analysis believes that the stock-bond spread and safe-haven demand to promote the dividend sector continued to be strong, and high-dividend companies themselves have strong long bond properties, when the dividend yield is significantly higher than the bond yield, for the long-term allocation of funds has a strong attraction.。The current dividend sector stock bond yield difference is at an all-time high, although the dividend sector has performed well, but still has a high investment cost performance。

On January 23, Alibaba Group founder Jack Ma and chairman Cai Chongxin significantly increased their holdings of Ali shares, which to some extent boosted market confidence and provided support for Ali's share price.。After the news, Alibaba's U.S. stocks pulled up before the day, up more than 7% at one point.。

Zhongtai Securities pointed out that the data of the real estate industry in January-December is still hovering at a low level, but with the continuous promotion of the three major projects such as the transformation of villages in the city, as well as the optimization and adjustment of housing policy in Beijing and Shanghai, the future industry data is expected to continue to stabilize with the continuous introduction of policies, continue to be optimistic about plate investment opportunities, in the first-tier cities under the two major lines of policy。CICC said, looking forward, the bank believes that the mainland new housing push and transactions in the pre-holiday or maintain a low level of operation, second-hand housing heat is expected to be better than new housing, it is recommended to continue to pay attention to marginal changes in prices and supply and demand at both ends of the policy landing rhythm and effect。

Increase or decrease in institutional holdings

According to the HKEx, on January 17, Xiaomo increased its holdings of WuXi AppTec 224.36.19 million shares, price per share 76.HK $2,862, with a total increase of approximately 1.HK $7.1 billion。The latest number of shares held after the increase is about 4193..660,000 shares, with a change in shareholding to 100,000.41%。

On January 18, BlackRock increased its holdings of Mengniu Dairy 219.98.99 million shares, price per share 17.HK $5,567, with a total increase of approximately 3,862.HK $300,000。The latest number of holdings after the increase is about 2..7.6 billion shares, shareholding changed to 7.02%。

On January 18, Hangzhou Tiger Pharmaceutical Technology Co., Ltd. increased its holdings of Fonda Holdings 455.80,000 shares, price per share 2.HK $095, total increase of approximately 954.HK $90,000。The latest number of holdings after the increase is about 12..02 billion shares, with the shareholding ratio changed to 58.22%。

New Stock News

None

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.