High in the cold! BYD 2022 won the global "sales crown" net profit soared nearly 4..5 times

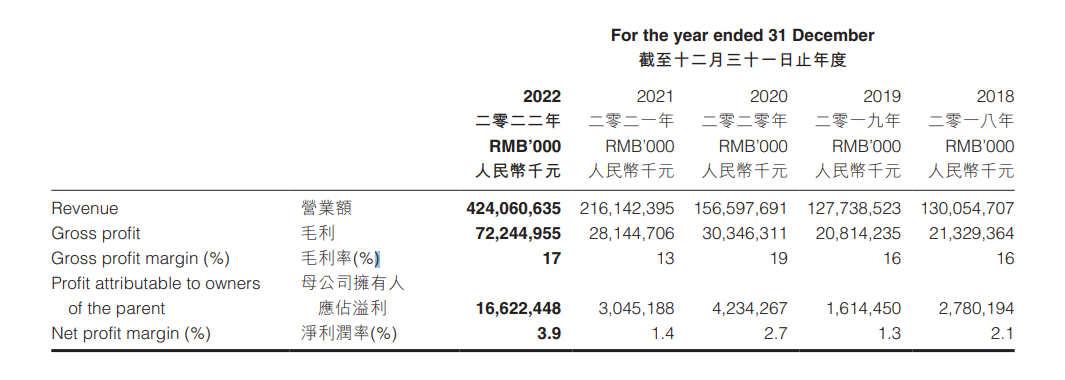

On March 28, BYD released its 2022 annual results announcement.。The company achieved revenue of 4,240 during the reporting period, according to earnings data..6.1 billion yuan, up 96.20%; net profit attributable to parent 166.2.2 billion yuan, up 445% year-on-year.86%。

Shortly after the start of the year, BYD was hit with a "sap" in the capital markets.。

Pre-performance profits are frequentBYDAt the beginning of the year, the stock gods reduced their holdings and were involved in a cruel "price war."

Buffett's Berkshire Hathaway sold 155 on January 27, according to a February 2 disclosure document from the HKEx.450,000 shares of BYD H shares, trading at an average price of 226.HK $32 / share, total cash out 3.HK $5.2 billion。Berkshire Hathaway still holds 1 after deal.4.2 BILLION BYD H SHARES, BUT HOLDINGS DROP TO 12.9%。It is worth noting that this is the eighth time since August last year that the HKEx has publicly disclosed the agency's reduction of BYD's holdings, but if you look at the number of holdings, you don't rule out the possibility that Berkshire has yet to disclose the reduction.。The sudden reduction in investor confidence by the "stock god" will undoubtedly take a hit, making them particularly concerned about BYD's upcoming 2022 annual results report.。

In addition, investors need to worry about, in addition to the bad news from the capital markets, there is a lingering price war in the new energy entity market.。

On March 27, Cui Dongshu, secretary-general of the National Passenger Car Market Information Joint Council, said that from January to February 2023, industrial production has recovered, but the cost is high, and the profit structure continues to favor the upstream mining and automotive industries, which are under great pressure to survive.。Data show that in January-February 2023, the automotive industry revenue of 1284.7 billion yuan, down 6% year-on-year; cost of 1126.4 billion yuan, down 5% year-on-year; profit of 41.4 billion yuan, down 42% year-on-year.。

In the face of the automotive industry's overall profit compression, superimposed on this year is the first year of the official withdrawal of state subsidies, another new energy head brand Tesla took the lead in setting off a price war, leading to the head of the car companies have to go to war.。According to incomplete statistics, as of now, more than 30 well-known car brands have joined this brutal battle, and BYD also includes them.。On February 10, BYD Qin PLUSDM-i2023 Championship Edition was officially launched, with the starting price reduced to 9.980,000, with unprecedented intensity。On February 25, BYD Dynasty series also began to cut prices ranging from 1,000 yuan to 10,000 yuan.。On March 9, BYD said again that it would conduct a special time-limited marketing campaign from March 10 to March 31, 2023.。Among them, the Song PLUS car can enjoy 88 yuan off 6888 yuan car purchase, seal can enjoy 88 yuan off 8888 yuan car purchase。

Although the price war has helped the sales of various car companies, it has really compressed the profit margins of the companies.。

On March 17, the Economic Daily wrote that the price war will definitely benefit consumers to some extent, after all, they can buy the same model with less money.。But be wary, the price war is also a double-edged sword, in the cut to the other side at the same time, but also hurt yourself。If the price war is too strong, it will not only cause damage to the brand, but also affect the accumulation of profits。

Faced with such a complex on-market and off-market situation, investors can't help but wonder what kind of answer BYD can bring to the market as the mainstay of China's new energy car companies.。

BYD's financial report has lived up to expectations, and its annual net profit has exceeded 10 billion yuan for the first time.

Faced with the anxious waiting of the market, BYD finally released its 2022 results announcement after the March 28 session.。The company achieved revenue of 4,240 during the reporting period, according to earnings data..6.1 billion yuan (RMB, the same below), up 96.20%; net profit attributable to parent 166.2.2 billion yuan, up 445% year-on-year.86%; non-net profit deducted by the parent 156.3.8 billion yuan, up 1146.42%。

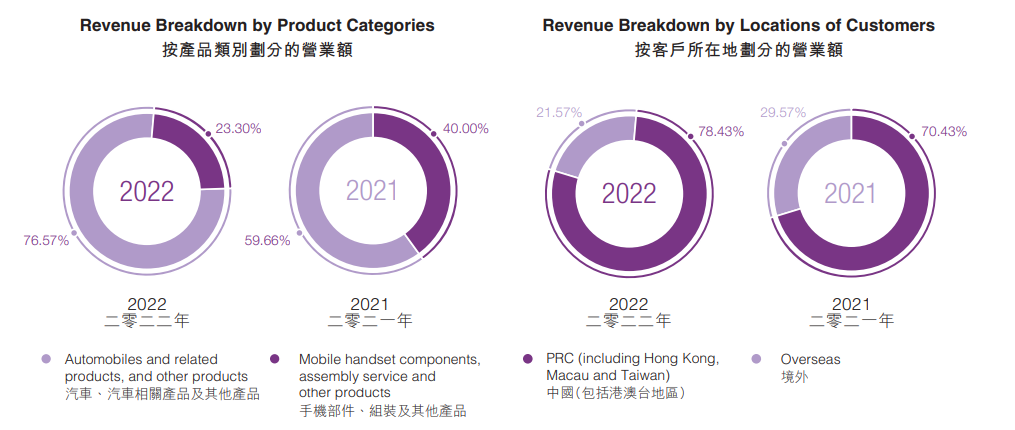

In terms of revenue composition, revenue from the automotive, automotive-related and other products business was 3,246.9.1 billion yuan, up 151.78%; mobile phone parts, assembly and other products business revenue 988.1.5 billion yuan, up 14.30%。In the face of this financial report, BYD can be said to have come up with its best performance since its listing, its annual net profit for the first time exceeded the scale of tens of billions of dollars, giving the market a shot in the arm.。

In the face of bright results, BYD showed its hard work in its earnings report, saying that in 2022, China's auto industry will face many difficulties and challenges, with structural shortages of chips, high raw material prices, a slowdown in the pace of auto supply, and suppressed consumer demand for automobiles.。In the face of difficulties, the government introduced a series of policies to stimulate automobile consumption, the whole industry worked together to ensure automobile production and delivery, the automobile market in the face of adversity month by month recovery, showing strong resilience, the annual car sales still reached 2,686.40,000 vehicles, up 2.1%。

The company said that BYD, as the pioneer and leader of the global new energy vehicle industry, actively responded to the national "double carbon" call, announced the cessation of fuel vehicle production during the year, focusing on the development of new energy vehicle business.。At the same time, with its precise strategic layout and deep technical accumulation, the company has achieved a full-scale outbreak of new energy vehicle business, once again won the global new energy vehicle sales champion, and has been ranked first in China's new energy vehicle sales for ten consecutive years.。

By business, in the automotive and battery business, not only BYD, but also new energy vehicle companies across the industry will be challenged by the structural shortage of chips and high raw material prices in 2022.。According to public data, on January 4, 2022, the average price of domestic battery-grade lithium carbonate was 27.80,000 yuan / ton, on November 9 of the same year, the price of the product has more than doubled.。At the 2022 World Power Battery Conference, Zeng Qinghong, chairman of GAC Group, said in his speech that GAC has half of its installed capacity and Ningde matching, and the cost of power batteries has accounted for 40% to 60% of the cost of automobiles.。

Under the pressure of upstream costs, BYD relies on technological innovation and firmly holds the initiative in its own hands through self-supplied battery technology.。

BYD said that in the field of new energy passenger vehicles, relying on technological innovation and application, the company's sales rose steadily in 2022, achieving a significant year-on-year growth of more than twice, a record high, and won the first place in one fell swoop, becoming China's largest passenger car sales car companies.。Among them, technological innovation is the core driving force for the high-quality development of the business, the company adheres to the pure electric and plug-in hybrid "two legs, step by step," has launched the "blade battery," "DM-i super hybrid," "e-platform 3.0, "" CTB battery body integration "and" DM-p king hybrid "and other disruptive technologies to help their own business to achieve leapfrog development and promote technological change in the new energy vehicle industry.。In terms of secondary rechargeable batteries, the company continues to cultivate, the scale of technology has reached the domestic leading, product development and production capacity improvement during the year is progressing smoothly, helping the steady development of the traditional battery business and the continuous development of energy storage business.。

In addition, Biya, as the head brand of new energy vehicles, has continuously improved its brand layout during the period, gradually forming two series of products, including the "Dynasty" series named after dynasties and the "Ocean" series named after "Marine Life" and "Warship."。In 2022, the "Dynasty" and "Ocean" series of brand models continued to exert their strength, each with a bright performance, which won unanimous praise from the market and further improved the company's product matrix.。

BYD also revealed that the "Dengshi" brand and the upcoming high-end brand "look up" will also face the market with a new look, improve the company's product matrix, and strengthen the brand's influence in the high-end market.。

According to data from the China Automobile Association, BYD's market share of new energy vehicles will reach 27% in 2022, up nearly 10 percentage points from the previous year, and its leading position in the industry will become more prominent.。At the same time, the company also reached the double milestone of the first million new energy vehicles sold annually among Chinese brands and the first 3 million new energy vehicles off the production line in 2022, helping China to move from an automobile power to an automobile power.。

In the mobile phone parts and assembly business, revenue from the business increased 14.30%, but gross margin fell 1.52 percentage points。The company said that the decline in gross margin of the business was mainly due to macroeconomic malaise, high inflation and weak consumer demand, resulting in continued sluggish global demand for smartphones and continued downward shipments.。

According to market research firm IDC, global smartphone shipments in 2022 were 12.100 million units and a year-on-year decrease of 11.3%。China's smartphone market also continued the previous year's full-year downturn, according to data released by the China Institute of Information and Communications Technology, the overall shipment volume of the domestic mobile phone market in 2022 totaled 2.7.2 billion units, down about 22.6%。In terms of PCs, global PC shipments fell by 16% in 2022..5% to 2.9.2 billion units; global tablet shipments of 1.6.3 billion units, down 3.3%。

Major breakthrough in overseas business BYD strives to break through capacity limits

In the international market, BYD has also taken an important step to accelerate overseas development.。In February 2022, BYD Yuan PLUS (also known as "BYD ATTO 3") opened pre-sale in Australia, and orders were hot.。In July 2022, BYD held a brand conference in Tokyo to announce its official entry into the Japanese passenger car market。In September 2022, BYD held a European new energy passenger car conference to launch three models of Han EV, Tang EV and Yuan PLUS for the European market, which were unveiled at the Paris Motor Show in October of the same year.。In November 2022, BYD entered Brazil and held a press conference in Sao Paulo, Brazil, to launch the Song PLUS DM-i and Yuan PLUS models.。

BYD said that in 2022, in order to meet the growing market demand, the company has actively increased production capacity, delivery speed to achieve double growth, but still less than the order hot demand.。Data show that BYD has exported 5 cars in the whole year..590,000 vehicles, accounting for more than 8% of China's total exports of new energy vehicles, and overseas sales of the company's cars have been increasing this year.。

In the face of the hot market state, how to expand their own production capacity, this may be BYD is currently facing "happiness troubles."。The good news is that Songzhi shares said in the interactive platform on March 27 that the company expects some of BYD's passenger car projects to enter mass production in 2023。It is reported that Songzhi shares and BYD is a strategic partnership, if the mass production project goes well, will to some extent alleviate BYD's urgent need for production capacity issues.。

Focus on the results of the conference BYD semiconductor listing plan unchanged Wang Chuanfu "forgive" Buffett continued to reduce holdings.

On March 29, at BYD's results conference, the company's chairman, Wang Chuanfu, responded to several issues of concern to BYD in the market.。First, he said that China's auto demand in January-February was weaker than last year, but BYD's sales increased significantly from the same period last year.。He said BYD aims to become China's largest automaker by the end of the year, but has no plans to enter the U.S. passenger car market for the time being.。

In addition, Wang Chuanfu said in response to the recent price war in China's auto industry that the reason for the price war is essentially a contradiction between supply and demand.。The price war did have some psychological impact on consumers, but it is believed that the impact will be reduced by the end of April。With the launch of auto shows around the world in May, market confidence will gradually recover and the Chinese auto market will return to a relatively good level of growth.。

For BYD's semiconductor listing plan, Wang Chuanfu said, BYD semiconductor listing plan unchanged, but there are some adjustments in the process。

Finally, for the "old friend" Buffett on BYD's continuous reduction, Wang Chuanfu said, Buffett is a very important shareholder and supporter, equity changes are shareholders' own rights, no matter how much the reduction is still grateful to the other party's support.。BYD will also do its own business in the future, and I believe the reduction will have less impact on the company.。

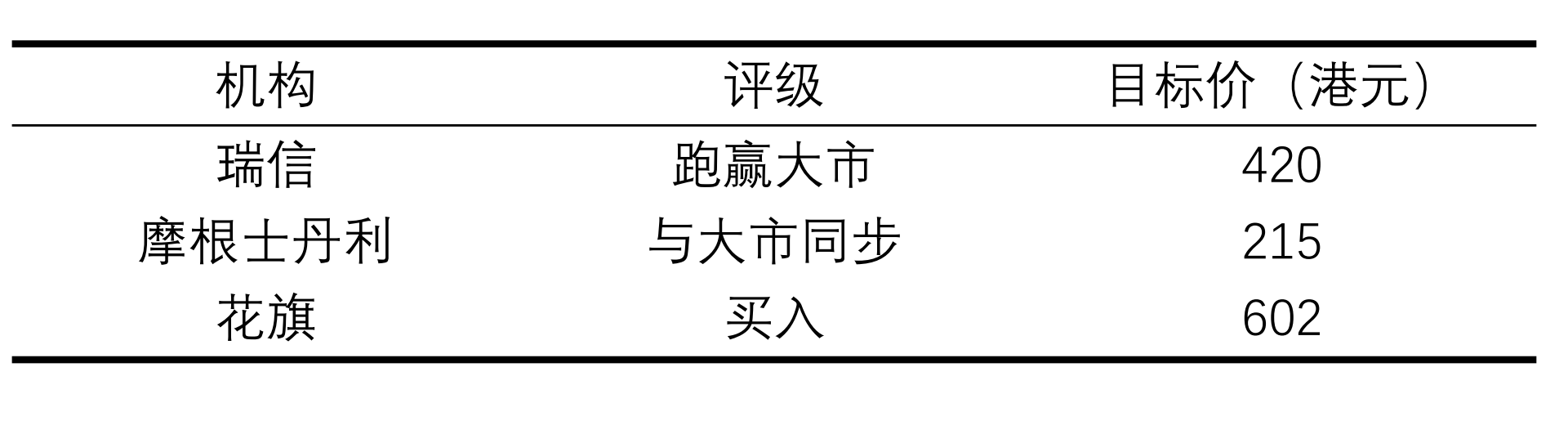

BYD's A-shares and H-shares rose after the earnings announcement, with A-shares closing up 1.1%, reported 247.70 yuan; Hong Kong stocks up 3.12%, late 218.00 Hong Kong dollars。In addition, the major banks also gave their own views。

Credit Suisse said that BYD's net profit last year was in line with performance expectations, and due to the cancellation of new energy subsidies in the Mainland this year, the company's first quarter results will be affected in the short term, maintaining its rating of "outperforming the market" with a target price of HK $420.。

Morgan Stanley said BYD recorded net profit of 16.6 billion yuan in 2022 and net profit of 7.7 billion yuan in the fourth quarter (up 11.14 times)。Damo pointed out that BYD's net profit surge in the last quarter was mainly due to a record 68.30,000 EV sales, improvement in mobile phone business, and good cost control。As a result, the bank maintains its "market-in-step" rating and its target price of HK $215.。

Citi said that BYD's strong performance last year was mainly due to the excellent performance of the automotive sector in the second half of the year and the significant improvement in the gross margin of plug-in hybrid vehicles in the fourth quarter.。At present, the market focuses on BYD's medium-term cost control, how higher operating leverage can offset the price reduction strategies of industry competitors, and the impact of declining subsidies.。As a result, the bank has given it a target price of HK $602 and maintains a "buy" rating.。

In 2022, BYD's achievements are obvious to all。In 2023, it is expected that new energy vehicles will further release production capacity and enhance product penetration, driven by price cuts in upstream raw materials and breakthroughs in battery technology.。BYD is expected to have more room to rise in 2023 as the industry's ecological environment and business base conditions continue to improve。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.