Hawkinsight Hong Kong Market Closing Roundup (2.26) | Hang Seng Index slightly down 0.54% Pharmaceutical Stocks Rise, Science and Technology Net Stocks Weak Collectively

On February 26, the three major indexes of Hong Kong stocks fell back again in early trading, languishing throughout the day and closing down in shock.。Hang Seng Index closes down 0 at close.54%, at 16,634.74 points。

On February 26, the three major indexes of Hong Kong stocks fell back again in early trading, languishing throughout the day and closing down in shock.。Hang Seng Index closes down 0 at close.54%, at 16,634.74 points; Hang Seng SOE Index closes down 0.72%, at 5723.36 points; Hang Seng Tech Index closes down 0.19%, at 3393.29 points。

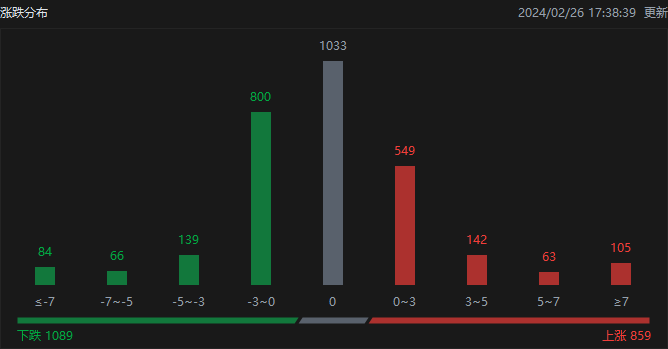

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 859, fell 1089, and closed flat 1033.。

Hong Kong stock market on the same day, North Water turnover net buy 17.HK $5.8 billion, of which HK Stock Connect (Shanghai) traded a net purchase of 16.HK $4.4 billion, Hong Kong Stock Connect (Shenzhen) net buy 1.HK $1.4 billion。

Sectors and Fundamentals

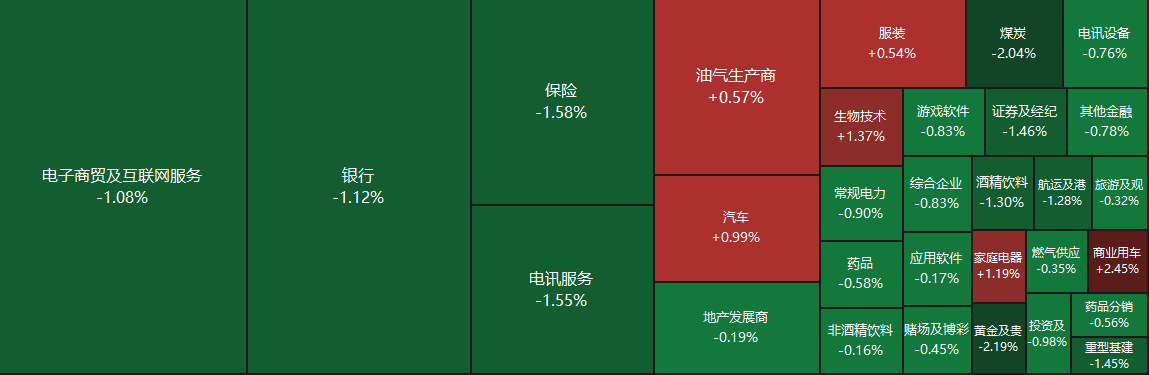

From the disk point of view, today's science and network stocks collectively weakened, beep mile, Baidu fell more than 2%, Netease, Tencent fell more than 1%, millet, Jingdong fell nearly 1%, the United States group, Alibaba slightly down。Auto stocks diverged, with zero-run cars up more than 5%, Weilai down more than 4%, as did inner housing stocks and property management stocks; pharmaceutical stocks mostly rose.。On the other hand, domestic insurance stocks fell, coal stocks were sluggish, Yancoal Australia fell more than 7%, Yancoal Energy fell nearly 5%。

Fundamentals: Pharmaceutical stocks rise。On the afternoon of February 18, WuXi AppTec issued another clarification announcement, reiterating that it "has not, is and will not pose a national security risk to the United States in the past."。The industry believes that although the follow-up action of U.S. politicians to speculate on the drug Ming system will not stop, investors may gradually enter the "desensitization" stage for U.S. related news.。Xiangcai Securities pointed out that it is expected that domestic and foreign pharmaceutical R & D expenditure will continue to grow and the penetration rate of pharmaceutical R & D outsourcing will continue to increase will become an important support for the development of the CXO industry.。Although the current CXO by domestic and foreign pharmaceutical investment and financing decline in the impact of performance pressure, but in view of the Fed's interest rate hike is expected to gradually weaken, as well as after nearly two years of global biotech field valuation bubble out, the global biotech industry cost-effective has been highlighted, innovative drug investment and financing environment is expected to gradually pick up, optimistic about the long-term good short-term improvement of CXO.。

Internal housing stocks, property management stocks continued the rally.。Bank of China International issued a report pointing out that in the past year, it has observed that the impact of China's real estate market adjustment on the property management industry is more concentrated in the field of value-added services for developers.。The bank believes that the property management industry is more defensive in a lower inflation environment and expects the companies covered by the bank to achieve positive operating cash flow。Given that most companies have single-digit to low-double-digit P / E ratios this year, valuations are attractive, reiterating an "overweight" rating on the industry.。

Increase or decrease in institutional holdings

According to the HKEx, on February 19, JPMorgan Chase increased its holdings of Follett Glass 224.10,000 shares, price per share 14.HK $0032, with a total increase of approximately 3,138.HK $120,000。The latest number of shares held after the increase is about 4598..560,000 shares, with a change in shareholding to 100,000.21%。

On February 20, BlackRock reduced its holdings of Goldwind 160.360,000 shares, price per share 2.HK $8,627, total reduction of approximately 459.HK $060,000。The latest number of shares held after the reduction is about 5363..160,000 shares, with the shareholding ratio changed to 6.93%。

On February 20, BlackRock reduced its holdings by 559.350,000 shares, price per share 1.HK $8,917, total reduction of approximately 1,058.HK $120,000。The latest number of shares held after the reduction is about 6372..090,000 shares, with the shareholding ratio changed to 50,000.87%。

On February 21st, Schroders PLC increased its holdings of Gloria 79.03 million shares, price per share 68.HK $5,379, total increase of about 5,416.HK $550,000。The latest number of shares held after the increase is about 215..220,000 shares, shareholding ratio changed to 7.81%。

New Stock News

None

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.