Rush on the hot search! Beep mile stop more tide hit 2022 net loss of 7.5 billion.

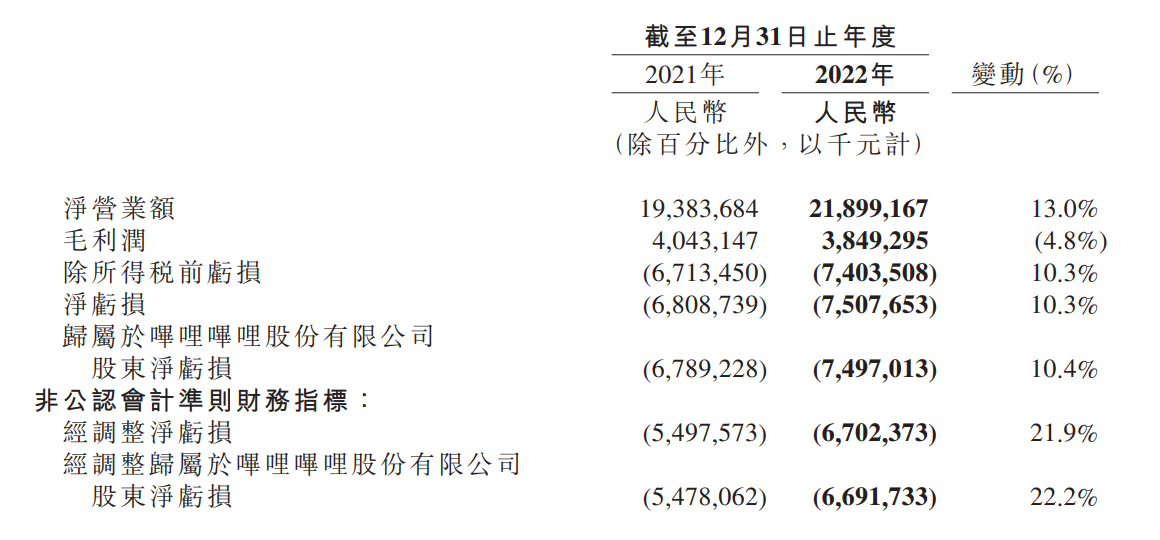

On March 30, Bilibili released its 2022 annual results announcement.。Financial data show that the company's total net turnover in 2022 was 21.9 billion yuan, compared with 19.4 billion yuan last year, up 13% year-on-year; net loss was 7.5 billion yuan, compared with 6.8 billion yuan in the same period last year, an increase of 10% year-on-year.。

On a restless weekend, Bilibili has been on the heat search for two days.。

Platform revenue sharply reduced UP main "stop more tide" hit

The incident began when a creator with millions of fans at Station B said his team was losing money due to a severe reduction in the platform's creative revenue this year and that his account was temporarily stopped from being updated.。In fact, since the middle of 2022, there have been creators who have said that they have stopped the shift due to platform revenue issues, but this time by the head of the creator "self-declared" thunder, there is no doubt that this vigorous stop movement to the climax.。

In the minds of young Chinese, Bilibili is undoubtedly a collection of cultural communities and video sites.。They can not only find almost any piece of their own interest in the world, but also in which to express their thoughts, into each other's life circle。

According to iResearch, users aged 35 and under accounted for more than 86% of the company's monthly live users in 2020, more than any other major Chinese video platform.。After more than ten years of development, around users, creators and content, B station has built an ecosystem that continuously produces high-quality content, which has covered more than 7000 multi-cultural communities of interest.。

Why such a thriving cultural ecological platform has provoked the creators to collectively "crusade against the rebellion," perhaps from its annual report, you can get a glimpse of one thing or two。

Annual results report: net loss increased by 10% YoY, average monthly active users reached 3.14.5 billion

After hours on March 30 (Thursday), Bilibili released its 2022 annual results announcement.。According to the financial report data, the company's total net turnover in 2022 was 21.9 billion yuan (RMB, the same below), compared with 19.4 billion yuan last year, an increase of 13% year-on-year; the net loss was 7.5 billion yuan, compared with 6.8 billion yuan in the same period last year, an increase of 10% year-on-year; the average daily active users in 2022 reached 86.5 million, compared with 66.8 million last year;.14.5 billion, up from 2 last year.49.8 billion; average monthly paying subscribers 27.8 million, up from 22.4 million last year。

On February 28, 2018, Bilibili was listed on NASDAQ in the United States, and on March 29, 2021, the company returned to Hong Kong as a secondary listing.。Since its IPO, Bilibili's operating income has continued to grow, but its net profit loss has also expanded.。The good news is that the company's net loss, while widening, has narrowed relative to previous years; the bad news is that the company's revenue, while recording double-digit year-over-year growth, has grown at a slightly lower rate than before.。

By business, in terms of content ecology, the average daily playback volume of "story mode" increased by more than 300% year-on-year in 2022, and the average daily playback volume of PUGV (professional user-generated video) content increased by nearly 50% year-on-year, driving the company's average daily video playback volume to increase to 3.4 billion in 2022, an increase of 75% year-on-year..9%。In addition, the number of monthly active content creators on the platform reached 3.7 million last year, an increase of 45.2%。At the same time, the platform's content submissions reached a new high, averaging 14.7 million videos per month, an increase of 58% from 2022..8%。

In terms of value-added services, the company's value-added services turnover in 2022 was RMB8.7 billion, an increase of 26% over 2021.。In addition, the number of users of the platform's top-up content "big members" has reached 21.4 million, an increase of 6.2%。It is worth noting that the pull-up in this business was mainly due to the company's increased monetization efforts, with an increase in value-added paying subscribers helping to increase turnover。

In the community, the average daily usage time of B-station users continued to grow in 2022, reaching 94 minutes, pushing the total usage time of users to increase by 46% year-on-year..7%。With the increase of user usage time, the community interaction is more close。In 2022, the average monthly interaction of the platform's community increased by 55% year-on-year to 13.2 billion。In terms of commercialization, Bilibili said that in mid-2022, the company's commercialization strategy is focused on improving efficiency and gross margin, as well as reducing losses.。The company will further integrate business opportunities and ecosystems, including live streaming and advertising, and focus resources on its core business.。In addition, in terms of advertising, the company's advertising revenue in 2022 was $5.1 billion, an increase of 12 percent from 2021..0%, which is mainly due to the increase in advertising traffic brought about by the increase in brand awareness of the B station.。In terms of mobile games,The business's contribution declined in 2022, from $5.1 billion in 2021 to $5 billion in 2022.。

Cost "Cut More and More" Investment

In the face of years of double-digit growth in revenue, losses have widened year after year, the root of which is that the cost of beeping is too heavy.。

According to the financial report, the company's general and administrative expenses reached RMB2.5 billion in 2022 alone, an increase of 37% from RMB1.8 billion in 2021..2%, which the Company attributed to the fact that severance payments related to the optimization of the organization during the year reached 3.4.1 billion yuan。

According to the data, although the B station on the "large-scale layoffs" has always been silent, but 2022 has been exposed in different departments of its ongoing layoffs of varying degrees, positions covering research and development, operations, personnel and so on.。According to "Interface News," a B-station employee reported on social media that the default internal layoffs reached 30% in December.。It's just that the layoff decision, which was originally made to streamline the organization and control costs, has instead led to such a high cost of severance, which is unexpected.。

In addition, the financial report also shows that the company spent RMB4.8 billion on research and development in 2022, an increase of 67% from RMB2.8 billion in 2021..8%。The company also noted that this increase was mainly due to expenses related to the termination of certain game projects of RMB 5..$2.6 billion, and increased depreciation of servers and equipment。

In sales and marketing expenses, Station B is already trying to save, already 15% less than $5.8 billion in 2021.1% to 4.9 billion yuan by 2022。While nearly a billion dollars have been saved, this mere billion dollars is really nothing compared to the first two high costs.。

Project personnel do not cut down, the cost can not be reduced; project personnel cut down, but pay more, which may be last year belongs to the "riding a tiger" proposition.。

Thus, it is no wonder that "small broken station" revenue has been climbing, but the loss is also expanding.。

In addition to high costs, the return on investment at Station B is decreasing in 2022.。According to the financial report, in 2022, the net investment loss of B station is 5.3.2 billion yuan, up 63.53%。Among them, the change in fair value of investments in listed companies from 2 in 2021..0.4 billion yuan fell to 5266 in 2022.50,000 yuan。

According to the data, in addition to China Telecom, the listed companies in which B Station currently holds shares also include Joy Media, Palm Reading Technology, Heartbeat and China Mobile Games.。And in 2022, the shares of several companies are in a down range, with Heartbeat falling the most, reaching 44.83%。

Losses on investments, which directly result in an already poor net profit, add insult to injury。

The essence of incentive reduction is the problem of "more monks and less porridge." Station B wants to increase profits and achieve break-even by 2024.

Surprisingly, despite the constraints of cost reduction and efficiency, but in 2022 B station to the creators of incentives did not fall but rose, an increase of 18% over the previous year, reaching 9.1 billion yuan, it can be said that B station no longer bitter no bitter "creators."。

Since incentives have increased compared to the past, why do many UP owners say their video revenue is not as good as before??

This problem is related to the classification of creators of the platform.。

Pan and Lin, co-director of the Digital Economy and Financial Innovation Research Center of Zhejiang University's International Joint Business School, said recently that there are two factions of B station UP owners, one relying solely on traffic, relying on users to support by throwing platform coins, in fact, the platform to give subsidies, while the other faction is their own business orders to cash out, the biggest impact is the traffic support of those up owners.。

In other words, the former relies solely on platform traffic to be incentivized, while the latter relies on video advertising soft placement to maintain revenue, and the biggest impact this time is on the former, which has a single profit path.。Due to the limitation of the incentive feedback path, the former can only rely on the platform's broadcast volume and other data conversion rewards, its rules are actually set by the platform, creators are in a relatively weak position.。

In fact, the root cause of the decrease in creators' income is the problem of "too many monks and too few porridge."。

According to the financial report, the average number of active content creators on the platform reached 3.7 million last year, an increase of 45.2%。At the same time, the platform's content submissions increased by 58% year-on-year compared to 2022..8%。The implication behind these two large increases in data is that as the platform's operating span and content richness increase, more and more publishers are entering this vibrant platform, and the growth rate of creator traffic is far greater than the rate at which the platform shares it with creators, and the amount of dividends per unit of traffic is inevitably diluted to some extent.。Even though the incentives given to creators at Station B have increased by 18% over the previous year, in the face of such a huge new force of UP owners, the cake that everyone can get is actually minimal.。

Although it can be seen that Station B has indeed gone to great lengths to retain creators, I'm afraid Bilibili still has a long way to go to reach the incentive volume that matches the growth in traffic.。

The journey of a thousand miles begins with a single step, and how to go, Station B also gives its own answer, which is to start with improving profitability。

In its earnings report, Bilibili said that after the company's active adaptation and continuous efforts in 2022, the company has become more focused and streamlined.。In 2023, new industry changes require more efficient operations, and the company will continue to follow this path, putting profitability first, accelerating commercialization and tightening spending.。In addition, the company will continue to focus on user quality to achieve growth in daily live users and increase the ratio of daily live users to monthly live users.。As the company continues to strengthen the implementation of these measures, the Group expects to achieve higher gross margins and narrower losses in 2023。

In addition, Bilibili said that this year, the company will continue to accelerate commercialization, improve gross margins, narrow losses, and achieve 2024 non-U.S. GAAP breakeven.。

Dragged down by negative news, as of press time, the beep-mile day fell 4.54% at HK $181。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.