Q1 Loss Narrowed 70% Year - on - Year?

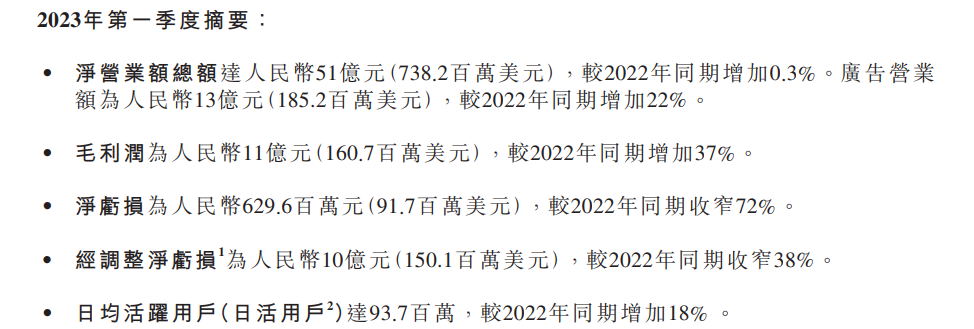

On the evening of June 1, Bilibili disclosed its first quarter 2023 financial results announcement.。Performance data show that in the first quarter, the total net turnover reached 5.1 billion yuan, an increase of 0.3%; gross profit of $1.1 billion, up 37% YoY; net loss of 6.300 million yuan, down 72% year-on-year。93.7 million daily active users, up 18%。

On the evening of June 1, Bilibili disclosed its first quarter 2023 financial results announcement.。Performance data show that in the first quarter of 2023, the total net turnover reached 5.1 billion yuan (RMB, the same below), an increase of 0.3%; advertising turnover of $1.3 billion, up 22% YoY; gross profit of $1.1 billion, up 37% YoY; net loss of 6.300 million yuan, down 72% YoY; adjusted net loss of 1 billion yuan, down 38% YoY。

In terms of business data:

● In terms of value-added services, first-quarter turnover was $2.2 billion, up 5% year-on-year.。The company said it was mainly due to enhanced commercialization capacity building and an increase in the number of paying subscribers for live streaming services.。

● In terms of advertising, the first quarter turnover was 1.3 billion yuan, an increase of 22% year-on-year, mainly due to the optimization of advertising products provided by the company and the improvement of advertising efficiency.。

● In terms of mobile games, the lack of new game launches in the first quarter resulted in a 17% year-on-year decrease in turnover of the business to $1.1 billion.。In order to reverse this situation, in the next few quarters, Bilibili said it will launch a total of 13 games worldwide, of which 8 games will be launched in China (which has been awarded version numbers), and the remaining 5 games will be released overseas.。

● IP derivatives and others (also known as e-commerce and others), with a first-quarter turnover of 5.100 million yuan, down 15% year-on-year, mainly due to lower sales of animation, comics and games ("ACG") IP derivatives on the Company's e-commerce platform.。

Based on first-quarter revenue, the Company expects full-year net turnover to reach $24 billion to $26 billion in 2023, unchanged from previous estimates。

In terms of users, the number of DAUs (daily active users) in the first quarter reached 93.7 million, up 18% year-on-year.。However, MAU (number of monthly active users) declined month-on-month, from 3 in the previous quarter..2.6 billion down to 3.1.5 billion。The average daily usage time of users in the first quarter of 2023 is 96 minutes.。Bilibili believes that improving commercialization efficiency is one of the most important tasks of the company at this stage, and the healthy growth of DAU is an important cornerstone of driving commercialization efficiency.。Therefore, the company will shift its focus from the past MAU to the present DAU.。

In terms of live streaming, the number of people who played both live anchor and UP host in the first quarter increased by 38% year-on-year, and 90% of new anchors came from video UP hosts and regular users.。The number of active anchors at Station B increased 34% year-on-year in the first quarter, and live MPU (average monthly paying subscribers) increased 15% year-on-year, with 700,000 video UPs generating revenue through live streaming。

In this regard, Chen Rui, chairman and CEO of Bilibili, said of the virtual anchor, "Our virtual anchor is very active on the platform, and I think with the popularity of AIGC technology, there will be more and more vivid virtual images appear on our platform, and the way the virtual anchor interacts with users can also be more humane, I am very optimistic about this area.。"

In response to the above data, Chen Rui said in the financial report: "We have achieved a good start in the first quarter of 2023, our gross profit has improved significantly and our losses have narrowed significantly," he said, "Looking ahead, our main objectives will remain to improve commercialization efficiency and strengthen profitability.。At the same time, we are fully committed to creating a better stage for creators and fostering a welcoming community to enrich the daily lives of the younger generation in China.。"

Q1 losses narrowed by 70% year-on-year, when will consecutive years of losses take a break??

Years of losses have become the "heart disease" of the management.。Public information shows that Bilibili has been losing money for several years, with a net loss of 30% in 2020..5.4 billion yuan; 2021 net loss of 6.8 billion yuan; 2022 net loss of 75..100 million yuan。

To reverse the loss, Billie Billie Chief Financial Officer Fan Xin said at a March 2022 results presentation that starting in 2022, the company's full-year Non-GAAP (non-GAAP) operating loss rate will narrow year-over-year, with an interim target of breaking even in 2024.。Profit priority has become the company's strategic goal, under the guidance of this goal, the first quarter net loss of 6..300 million yuan, down 72% YoY and 58% YoY。

But with revenue almost stagnant, how did the Bmile Bmile net loss narrow by 70%??It's simply "save money."

On the one hand, the company's expenses and costs achieved a "double drop" in the first quarter.。Operating expenses for the first quarter of this year totaled $2.5 billion, down 11 percent from a year earlier.。Among them, sales and marketing expenses decreased significantly, by 30% year-on-year.。At the same time, Bilibili's operating costs also fell, with operating costs falling 7% year-on-year to $4 billion.。Of this, revenue sharing costs were $2 billion, down 8% year-on-year。Server and bandwidth cost 3.8.4 billion yuan, down 16% YoY, improved operations。

On the other hand, Bilibili set out to increase gross margin。In the first quarter, the company's gross profit was 1.1 billion yuan, up 37% year-on-year.。For example, the more profitable advertising business achieved double-digit growth in the quarter.。Fan Xin, chief financial officer of Bilibili, said: "Our focus this year is very clear, which is to reduce net losses while improving gross margins.。However, the company also made it clear that the increase in gross profit for the quarter was mainly due to lower revenue sharing costs, server and bandwidth costs.。

So at the end of the day, the narrowing of the net loss of the beep mile is mainly due to "saving money."。However, the method of increasing profits by reducing costs and increasing efficiency can only be used for a while, in order to truly achieve profitability, but also need the enterprise's endogenous growth momentum to promote。Therefore, in order to end years of losses, I'm afraid we need to come up with a "big killer" to drive revenue growth.。

With the UP Lord's "love and hate": UP Lord break more tide on the hot search Chen Rui responded that it was misleading.

Not only did they cut back on their own food and clothing, but the amount of "soup" given to UP owners also decreased.。In the first quarter, Bilibili's revenue sharing cost was $2 billion, down 8% year-on-year.。It is reported that this is the first decline in the indicator in recent years。

On April 2, a "B station UP master initiated a stop and change tide" on the micro-blog hot search, a number of UP master publicly announced the suspension of updates。Most UP owners said that reduced platform revenue and difficulty balancing revenue and expenditure were the main reasons for the shutdown.。With UP master feedback, the reward mechanism of station B has been greatly adjusted this year。A piece of video content that doesn't differ much from last year's data may give creators only 1 / 3 or 1 / 2 of last year's revenue.。

The platform revenue mentioned by the UP owner refers to the creative incentive program launched in 2018, which evaluates the value of video traffic based on data such as video playback, likes, coins, collections, etc., and gives the UP owner cash rewards in accordance with the rules.。

In the Q1 post-performance phone conference, Chen Rui responded to the "stop more tide."。Chen Rui said: "This article is basically misleading."。First, he denied the mention of stop-and-frisk in the hot search.。He said that only three UP owners were mentioned in the article, but there are still millions of active UP owners on site B, and two of the three mentioned are still being updated.。

On the issue of creative incentives, he believes that creative incentives are a "subsidy" given by the platform to UP owners who are not yet profitable, while for UP owners with more than 10,000 powder, it will help them find ways to make money through Station B, such as helping UP owners receive business orders through the fireworks system, making video UP owners become anchors, and allowing live broadcasts to bring them income.。

He also mentioned that more than 1.5 million UP owners received revenue at Station B in the first quarter, up 50% year-on-year。Among them, the number of creators who received revenue through channels other than creative incentive programs increased by more than 55% year-on-year.。

Chen Rui said that the revenue of UP owners is definitely one of the company's biggest concerns, whether it is the fireworks system to help UP owners receive business orders, or to make more video UP owners become anchors, so that live broadcast to bring them revenue, in these areas the company will continue to strengthen.。He said: "Because I've always thought it's a virtuous cycle that only by getting our good UPs to earn more money will they have more energy to focus on creation.。"

Finally, on the post-performance conference call, Station B executives responded to analyst questions, and the following were the key points mentioned on the call.

About DAU and MAU future growth trend outlook。Chen Rui said that in the first quarter, our marketing expenses fell 30% year-on-year, but DAU's year-on-year growth was still 18% to 93.7 million.。In my opinion, compared with MAU, DAU should be more able to show the activity of users, but also more able to show the commercial potential brought by the number of B station users。

Next, our strategy will continue to focus on the growth of DAU, and we will continue to improve our DAU by keeping MAU stable and further improving user retention and activity.。

Looking to the future, I always think that this model of B station is a continuous positive cycle model, that is, we continue to improve the content supply and content quality of the platform, with high-quality content to attract more users, and the community will retain users and increase user activity, and further motivate creators to provide richer and higher-quality content, such a positive cycle will promote the continued growth of our users, so I think our DAU in the next few years will certainly be able。

Future Strategy and Prospect of Live Broadcast Business。Chen Rui said that the achievements of the live broadcast business now come largely from the progress of the integration of our live broadcast and video business.。In the past, I would say at every earnings meeting that there is still twice as much room for growth in the live broadcast of Station B. To this day, I can still say that the live broadcast business of Station B will have more than twice as much room for growth in the future from now on, because I think the integration of our video and live broadcast can be further strengthened.。In theory, every video user should be a live user, and every video UP owner should be our live anchor。

It can also be seen from the current data that more and more UP owners are now earning revenue through live streaming, and in the first quarter, we already had 700,000 video UP owners earning revenue through live streaming.。I think the full integration of live streaming and video will also help increase the gross margin of our live streaming business and reduce our costs, as more and more video UPs and vegans become our anchors and we optimize our bandwidth costs, I believe the gross margin of our live streaming business will continue to improve in the future.。

Follow-up Strategy and Prospect of Game Business。Chen Rui said that from the game we are going to release recently, the first is that we are actively preparing an agent game "Shine! Youjun Girl," some of the localization of this game is in the final stages of completion, is working overtime to do.。Then there are two self-developed games that will meet you in the summer, one is the antique female presentation game "Shake Light Record," and the other is our self-developed second-dimensional card game "Slud."。

This year, because the supply of games is relatively large, so we also found that the advantages of B station in terms of distribution and intermodal transportation should be further reflected, reflecting that we are one of the most concentrated platforms for young users and secondary players in China.。For example, in April, Miha Tour's "Collapse: Star Dome Railway" was downloaded 2.8 million copies on the first day of the B station, which should be a download record in the history of the B station, and yesterday there was a masterpiece, that is, our intermodal "Return to the Future: 1999," which also achieved quite good results.。

The main driver of the company's gross profit improvement and loss narrowing.。Fan Xin said that our focus this year is very clear, that is, to improve gross margin while reducing net losses.。The company's gross profit in the first quarter increased by 37% year-on-year, and its net loss decreased significantly by 72% year-on-year and 58% month-on-month.。On the revenue side, we continued to improve the quality of our growth, with advertising revenue up 22% year-over-year, which is also a relatively high-margin business, and we are committed to continuing to improve operational efficiency, reducing total costs by 7% year-over-year, driving our gross profit up 37% and gross margin up 22% from 15% last year.。

We use technological innovations to assess operational improvements, such as the continued decline in bandwidth costs, which decreased by about 16% year-on-year and 12% month-on-month, and other fixed costs, including labor and operating costs, which also declined to some extent year-on-year and month-on-month.。In terms of expenses, we saw an 11% year-over-year decline in operating expenses and an 18% year-over-year increase in DAU。We will continue to control operating expenses, especially marketing expenses, which fell 30% year-on-year in the first quarter, and I believe this trend will continue, resulting in a quarter-by-quarter improvement in our gross margin levels this year and a significant year-on-year decline in operating expenses, driving net losses to narrow.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.