B station Q4 loss narrowed sharply Chen Rui: the third quarter of this year is expected to achieve profit

On March 7, Bilibili announced its results for the fourth quarter and fiscal year ended December 31, 2023.。The company's adjusted net loss for the fourth quarter was 5.600 million yuan, down 58% year-on-year, narrowing for six consecutive quarters。

On March 7, Bilibili ("Station B") announced its results for the fourth quarter and fiscal year ended December 31, 2023.。

Losses narrow sharply

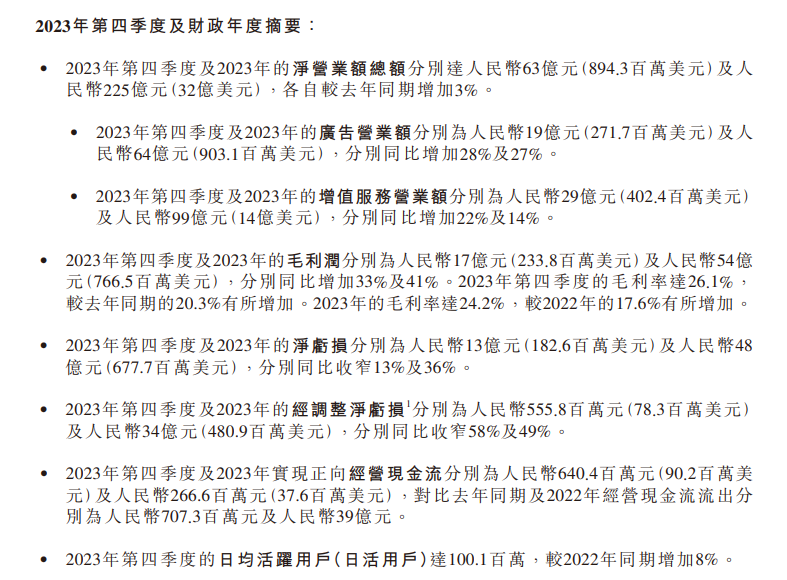

Performance data show that the total net turnover in the fourth quarter of 2023 was 6.3 billion yuan, an increase of 3% year-on-year.。Gross profit was $1.7 billion, up 33% year-on-year, and gross margin was 26%..1%, has been 6 consecutive quarters of improvement。

In terms of profit and loss, Station B said the company's adjusted net loss for the fourth quarter was 5.600 million yuan, down 58% year-on-year, narrowing for six consecutive quarters。In addition, B station also achieved 6 in the fourth quarter of 2023..400 million positive operating cash flow。

The narrowing of losses is not only due to business growth, but also to the company's insistence on cost reduction and efficiency.。Total operating expenses at Station B in the fourth quarter were $3 billion, down 17% from a year earlier.。Of these, general and administrative expenses fell the most, by 37 per cent year-on-year to 5 per cent..1.2 billion, compared to an 8% year-on-year decrease in the previous quarter。R & D spending also recorded a year-on-year decline, with R & D spending falling 11% in the fourth quarter to $1.3 billion.。

In terms of platform data, in the fourth quarter, the average daily active user of Station B reached 100 million, up 8% year-on-year, with an average monthly active user of 3.3.6 billion。The average daily usage time of users exceeds 95 minutes。The number of active UP owners per day increased by 16% year-on-year, the average monthly contribution volume increased by 31% year-on-year, and the number of UP owners above 10,000 powder increased by 30% year-on-year.。

For the whole year, the total net turnover of Station B was 22.5 billion yuan, up 3% year-on-year.。Adjusted net loss was $3.4 billion, down 49% YoY。For the full year 2023, Station B achieved positive operating cash flow。Annual average daily video playback volume of 4.3 billion, an increase of 25%。

For the full year 2023, Station B's total operating expenses were $10.5 billion, a 14% decrease from 2022。Among them, sales and marketing expenses decreased by 20% year-on-year, general and administrative expenses decreased by 16% year-on-year, and research and development expenses decreased by 6% year-on-year.。In particular, the decrease in R & D expenditure was due to a decrease in the number of R & D personnel and a decrease in expenses related to the termination of certain game projects.。

It is also worth noting that in 2023, the cost of revenue sharing in Station B's operating costs (i.e., the cost of revenue allocated by Station B to UP owners) was $9.5 billion, up 4% year-over-year.。For comparison, $9.1 billion in 2022, up 18% year-on-year, with a significant decline in growth.。According to official data, for the full year 2023, more than 3 million UP owners received revenue at Station B, up more than 30% year-on-year.。The number of large members is 21.9 million, and over 80% are annual subscriptions or auto-renewals.。

Bright advertising revenue,The game is still hard to stopYoYdownward trend

Specifically, let's look at the business development of Bilibili。

● Value-added services (VAS)

Value-added services turnover at Station B was $2.9 billion in the fourth quarter, up 22% year-on-year.。Value-added services turnover for the full year 2023 was $9.9 billion, up 14% year-on-year。The company said that the growth of this business segment was mainly due to the increase in turnover of live streaming and other value-added services.。

It is understood that the current B station has a series of value-added products and services, including live, large members, comics, audio drama, paid class, charging, etc., this series of services and product features are the company's VAS revenue source.。

Chen Rui, Chairman and CEO of Station B, mentioned in a telephone conference that among all VAS services, the most potential and fastest growing in the future will be live streaming, because live streaming is a value-added service that many UP owners can go to engage in.。He said 1.8 million UP owners received revenue from live streaming in all of last year.。UP's main single live delivery turnover exceeds 50 million。

Chen Rui also said, "B station last year the overall ecological with goods transactions have exceeded 10 billion, I believe that the commercial potential of B station users has just been released, the future as long as our scene is completed, there is a huge room for growth."。"

●广告

Advertising turnover at Station B was $1.9 billion in the fourth quarter, up 28% year-on-year, and up 27% to $6 billion for the full year 2023.。The increase was mainly due to the optimization of B station advertising products and the improvement of advertising efficiency.。

Station B said that advertising accounted for 30% of the company's overall revenue from 25% last year, which also directly led to an increase in the company's overall gross margin.。Station B also revealed that the number of UP owners earning revenue through advertising for the full year 2023 increased 94% year-over-year。

● Mobile games

In the fourth quarter, mobile games at Station B still struggled to stop the year-on-year downward trend, with turnover down 12% year-on-year to $1 billion and up 2% from the previous quarter.。The company said the year-on-year decrease was mainly due to the high base of Time Hunter 3, which was launched in the second half of 2022.。For the full year, mobile games recorded a 20% year-on-year decline in turnover to $4 billion.。The company said the year-on-year decline was mainly due to a decrease in the number of new game launches, coupled with a decline in turnover for a number of games, although turnover for the best performing older games in 2023, such as Blue Route and FGO, remained relatively stable.。

● IP derivatives and others (formerly known as e-commerce and others)

The business segment had a turnover of 5 in the fourth quarter..5.6 billion yuan, a decrease of 51%。For the full year 2023, the business segment's turnover was $2.2 billion, down 29% year-on-year.。The year-on-year decline was due to lower turnover from e-sports copyright sublicensing and IP derivatives.。

Chen Rui:have confidence inThis yearThird QuarterImplementationProfitable

In the telephone conference, B station chairman and CEO Chen Rui said that looking forward to 2024, B station has two most important work。The first is to achieve the goal of profitability, he said, the company is confident that in the third quarter of 2024 to start profitable。Second, the company will maintain the healthy development of the content ecology on the basis of ensuring profitability, and ensure the reputation and quality of B Station in terms of high-quality content.。

For the new year's performance outlook, Chen Rui said that the company's revenue growth is expected to accelerate in 2024 and achieve double-digit growth rates, and the revenue growth rate of the advertising business is expected to be faster.。Gross margin levels are expected to improve further as the share of advertising business with higher gross margins increases, and gross profit figures are expected to remain high this year。

In addition, Chen Rui also expects to be able to break even at the operational level in the third quarter of this year as the company continues to improve its operational efficiency, and expects to maintain positive operating cash flow throughout the year.。

In terms of liabilities, Chen said that as of December 31, 2023, the company had $1 billion in cash reserves, while the outstanding convertible bonds were 8..600 million dollars。This means that the company's cash reserves are sufficient to cover all of the company's debt。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.