BYD's revenue exceeds Tesla's profits for the first time is still difficult to relax

BYD's revenue in the third quarter exceeded Tesla's for the first time, and the market sentiment is optimistic. However, the EU's imposition of high tariffs on imported electric vehicles from China has brought challenges to its overseas expansion.

On October 30, BYD disclosed its third-quarter earnings report for the period ending September 30 on the Hong Kong Stock Exchange.

Financial Report Overview

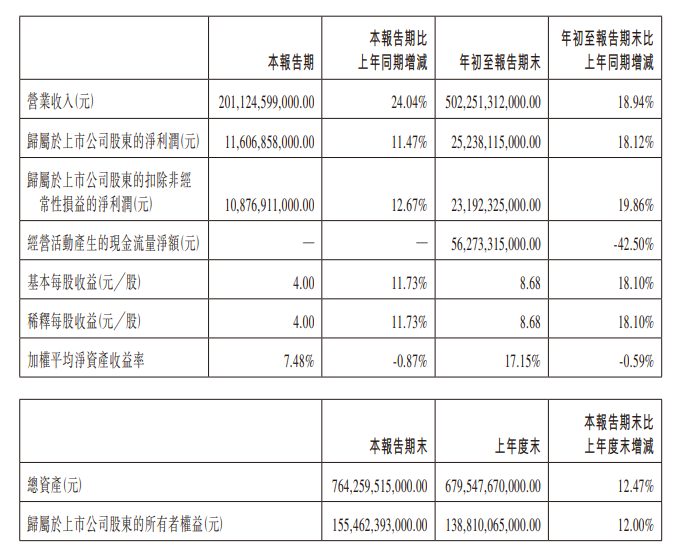

According to the financial report, BYD's operating revenue for the third quarter was 201.125 billion yuan (RMB, same below), an increase of 24.04% year-on-year; net profit attributable to the parent company was 11.607 billion yuan, up 11.47% year-on-year; and basic earnings per share were 4.00 yuan.

For the first three quarters, BYD's total revenue reached 502.251 billion yuan, a year-on-year increase of 18.94%; net profit was 25.238 billion yuan, a rise of 18.12%; and basic earnings per share were 8.68 yuan.

As a reference, Tesla reported on October 24 that its total revenue for the third quarter was 25.182 billion USD (approximately 179.366 billion yuan), an increase of 7.85% compared to 23.350 billion USD in the same period last year; net profit was 2.167 billion USD (approximately 15.438 billion yuan), a year-on-year increase of 17.07%.

This marks the first time BYD has surpassed Tesla in quarterly revenue, achieving another milestone in the development of electric vehicles.

Surging Sales for BYD, Weak Growth for Tesla

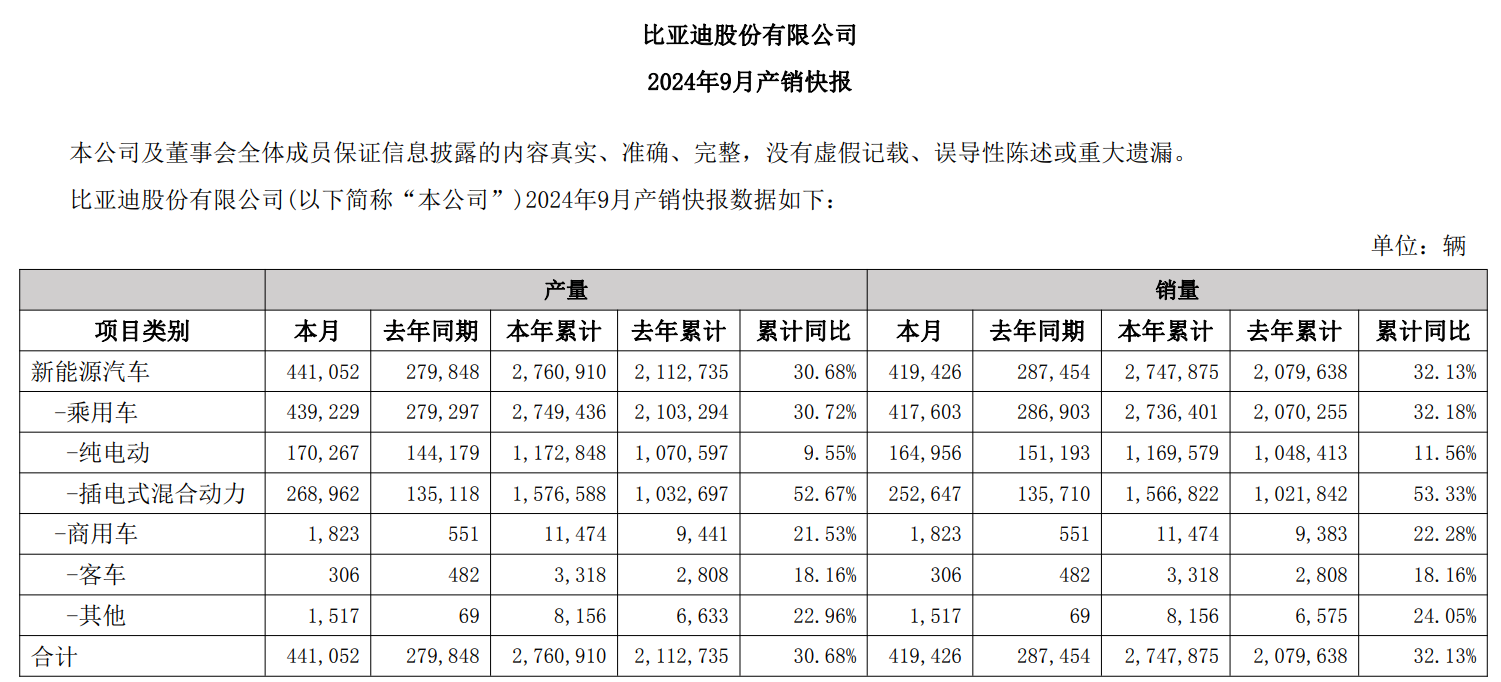

It is evident that BYD's revenue surpassing Tesla is mainly attributed to a surge in sales. Throughout the third quarter, BYD sold approximately 1.1349 million new energy vehicles, breaking the previous quarterly sales record.

In the first three quarters of this year, China's new energy vehicle sales reached 8.32 million units, a year-on-year increase of 32.5 percentage points. Since July, the Chinese new energy vehicle market penetration rate has exceeded 50% for three consecutive months, marking a historic breakthrough.

Against this backdrop, BYD's sales in September alone grew by 45.6% year-on-year to 419,400 units, making it the first new energy vehicle company globally to sell over 400,000 units in a single month; cumulative sales reached 2.7479 million units, a year-on-year increase of 32.13%. Insider sources indicated that BYD's sales target for the full year of 2024 is to grow by 20% from the 3.0244 million units planned for 2023, aiming for over 3.6 million units for the entire year.

Since officially launching its "passenger vehicle overseas" plan in May 2021, BYD has been accelerating its expansion into overseas markets. The company has now entered 96 countries and regions globally and has invested in new energy passenger car factories in Uzbekistan, Thailand, Brazil, and Hungary.

Data released by the China Association of Automobile Manufacturers revealed that from January to September 2024, BYD ranked first among the top ten vehicle exporters, with cumulative exports of 302,000 units, a year-on-year increase of 96.3%.

In contrast, Tesla's sales growth appears somewhat sluggish. In the third quarter, Tesla's global electric vehicle deliveries were approximately 463,000 units, a year-on-year increase of 6.4%, marking the first year-on-year increase this year, attributed to the reduction of vehicle sales costs to the lowest historical level of around 35,100 USD (approximately 250,000 yuan) per vehicle during this period.

However, even though Tesla has also implemented price reductions, its average vehicle price remains higher than BYD's. Coupled with cost reductions, BYD still lags behind in net profit.

During the earnings call, Tesla CEO Elon Musk stated, "Despite the ongoing challenging macroeconomic situation, thanks to the reduction in vehicle costs and the emergence of autonomous driving, Tesla's vehicle sales are expected to grow by 20% to 30% next year."

BYD's Stock Price Soars, Short Sellers Withdraw

With the double harvest of production and sales data, BYD's stock price has significantly risen.

Since the beginning of the year, BYD's A-share stock price has increased by 56.22%, while its Hong Kong stock price has risen by 39.68%. Furthermore, before the earnings report was released, BYD's short positions decreased significantly from 7.7% earlier this year to 0.9%, reflecting the optimistic market sentiment.

On the other hand, Tesla has only recently reversed its downward trend this year, achieving a slight 3% increase, and expects to drive stock price recovery in 2025 with innovative products such as the Cybertruck, FSD system, humanoid robot Optimus, and Robotaxi.

Morgan Stanley released a research report predicting that investors will gradually shift their attention to BYD's high-end brands and overseas sales to observe whether they can recover and drive growth in sales and profits in the fourth quarter, which is crucial for further increases in its stock price.

EU Tariffs Heat Up Challenges for Chinese Automakers

On October 29 local time, the European Commission announced the final results of its anti-subsidy investigation into electric vehicles from China, deciding to impose an additional five-year tariff on electric vehicles imported from China, in addition to the standard EU tariff of 10%.

Specifically, BYD faces an additional tariff of 17.0%, Geely Auto 18.8%, and SAIC Group as high as 35.3%; other cooperating companies will be charged a 20.7% tariff, while Tesla's tariffs for its factory in China are 7.8%.

This decision officially took effect on October 30 and will have a certain impact on Chinese automakers' expansion in the international market. While BYD continues to grow, it still faces significant challenges; despite the impressive results of its third-quarter financial report, the road ahead remains demanding.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.