Tesla's first quarter delivery volume increased by 36% year-on-year record high follow-up or will continue to carry out "price war"

Tesla cut prices sharply at the beginning of the year to boost demand after handing over deliveries that disappointed investors in the fourth quarter of last year。Tesla's first-quarter deliveries are now at an all-time high, driven by sharp price cuts around the world and U.S. tax credits.。

Tesla cut prices sharply at the beginning of the year to boost demand after handing over deliveries that disappointed investors in the fourth quarter of last year。Tesla's first-quarter deliveries are now at an all-time high, driven by sharp price cuts around the world and U.S. tax credits.。

Tesla increased 36% year-on-year in the first quarter, but still fell short of expectations.

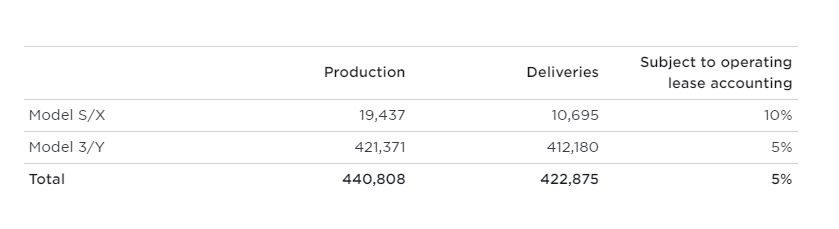

On the evening of April 2, local time, Tesla released its first quarter 2023 car production and delivery report on its website.。According to the report, Tesla delivered 422,875 vehicles worldwide in the first quarter of this year, slightly higher than the 421,164 previously expected by analysts, but lower than the 430,000 expected by Wall Street; in terms of production, Tesla produced 440,808 vehicles in the first quarter, which also exceeded the 432,513 previously expected by analysts.。

Ben Rose, president of Battle Road Research, said: "This shows that demand for electric vehicles remains strong and Tesla is a safe choice for electric vehicle buyers.。While the exact impact of recent price cuts and tax credits is difficult to determine, both factors have contributed positively to sales.。"

Although Tesla's deliveries barely met market expectations in the first quarter of this year and were up about 36 percent year-on-year compared to 310,000 vehicles in the first quarter of last year, they were still less than the 50 percent annual growth Musk had previously promised on his earnings call.。Musk also said at the meeting that Tesla's goal this year is to produce 1.8 million to 2 million vehicles.。

Gene Munster, managing partner at Deepwater Asset Management, said: "Tesla's deliveries are up 36% from a year ago, but Musk's comments on his last earnings call were that deliveries are up 50%.。For the rest of the year, they will have to speed up deliveries。"

Tesla did not break down sales by region in the report, but the United States and China remain its largest sales markets, and the vast majority of sales are Model 3 sedans and Y crossovers.。Tesla's first-quarter deliveries of Model 3 and Model Y vehicles increased 6% from the previous quarter, and these two models accounted for about 97% of Tesla's first-quarter deliveries.。The rest were Tesla's luxury models, the Model X and Model S, whose deliveries fell 38 percent.。The company did not disclose whether it sold the electric truck Semi during that period.。

Tesla shares have rebounded 68% at the bottom

On January 3, the day after failing to meet fourth-quarter delivery expectations, Tesla shares fell more than 12 percent.。That day was called the "worst day" for Tesla stock in 2023.。On January 6, Tesla announced sharp price cuts in China and Asia, and the electric car giant's stock price finally bottomed out and began to rebound。Then, on January 13, Tesla announced price cuts for Model S and X in Europe and the U.S., and new U.S. tax credits of up to $7,500 also boosted demand for Tesla, which began to soar.。Tesla's stock has risen 68% this year.

On Friday, Tesla shares rose 6 percent, according to an analysis by MarketSmith..2% to 207.$46, above 200.$76 Cup Handle Buy Point。However, the share price is close to its 200-day moving average, which is a possible area of resistance.。

As deliveries go smoothly, the next question is how the price cut will affect Tesla's earnings and gross margins。The electric car giant will report first-quarter results on April 19。

CFRA analyst Garrett Nelson raised Tesla stock to a "strong buy" rating on Friday。The analyst also raised the company's Tesla price target to $275 from $250.。Nelson told investors that Tesla is more likely to exceed the market's generally expected delivery volume than miss。

Long-time Tesla bullish Wedbush analyst Daniel Ives wrote on Wednesday that Wall Street is paying close attention to "how demand can support (CEO Elon) Musk in this unstable macro economy."。

"Macroeconomic uncertainty remains, and we wouldn't be surprised if Tesla makes further small price cuts in the U.S. and China in the coming months to further stimulate consumer demand."。"

Tesla or further price cuts

Tesla CEO Elon Musk has warned that the prospect of a recession and rising interest rates means Tesla may cut prices to maintain growth at the expense of profits.。In January, Musk said orders had picked up after Tesla cut prices。Zach Kirkhorn, the company's chief financial officer, also acknowledged that the price cuts could erode Tesla's profitability, but said he believes Tesla's profit margins will "remain healthy and industry-leading."。

Last Tuesday, Tesla's main rival BYD issued its annual results report, which showed that BYD's fourth-quarter and full-year earnings soared。Tesla's price cuts in China have sparked a price war, and a number of local manufacturers, including BYD and Xiaopeng, have also cut prices to protect their market share.。In the first two months of this year, BYD accounted for 41% of new energy vehicle sales.。Tesla's market share is 8%.。

In this regard, Tesla may further reduce prices in order to compete for market share。Tesla's lowest-priced model, the Model 3, is expected to reduce its $7,500 U.S. electric vehicle tax credit by April 18.。

On Friday, the Biden administration announced that vehicles eligible for the full $7,500 tax credit must be equipped with batteries containing a specified number of North American components as well as key minerals from the United States or certain countries.。Vehicles that meet one of the key mineral or battery assembly requirements will be eligible for a $3,750 tax credit.。The battery standard will take effect on April 18, when a list of models eligible for the full $7,500 tax credit will be released.。

Analysts said the average selling price of a Tesla car in the first quarter was about $47,410, according to FactSet.。That's down from $51,400 in the fourth quarter and $52,100 a year ago.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.