BYD Q1 Faces Price-War’s Side Effect

On April 29, BYD released its financial report for the first quarter of 2024, citing lower-than-expected revenue due to intense domestic price competition and regulatory pressures from the West.

On April 29, BYD released its financial report for the first quarter of2024, recording its weakest quarterly profit growth since 2022 due to intense domestic price competition and Western regulatory pressures, with revenue falling short of expectations.

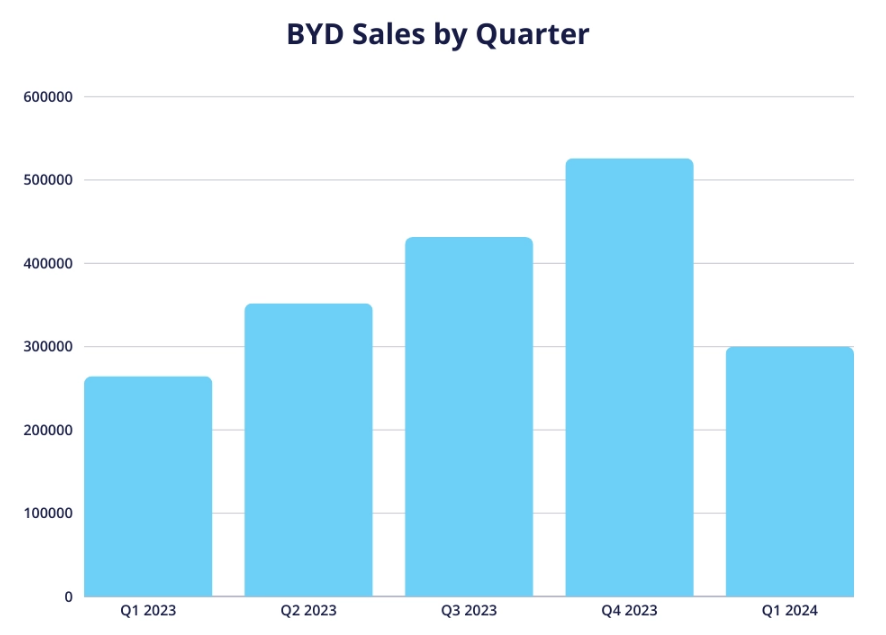

Last year, BYD set a profit record of 30 billion yuan, surpassing Tesla in the fourth quarter to become the world's largest electric vehicle sales company. Tesla regained this title in the first quarter of this year, but BYD still maintains its lead in the domestic market.

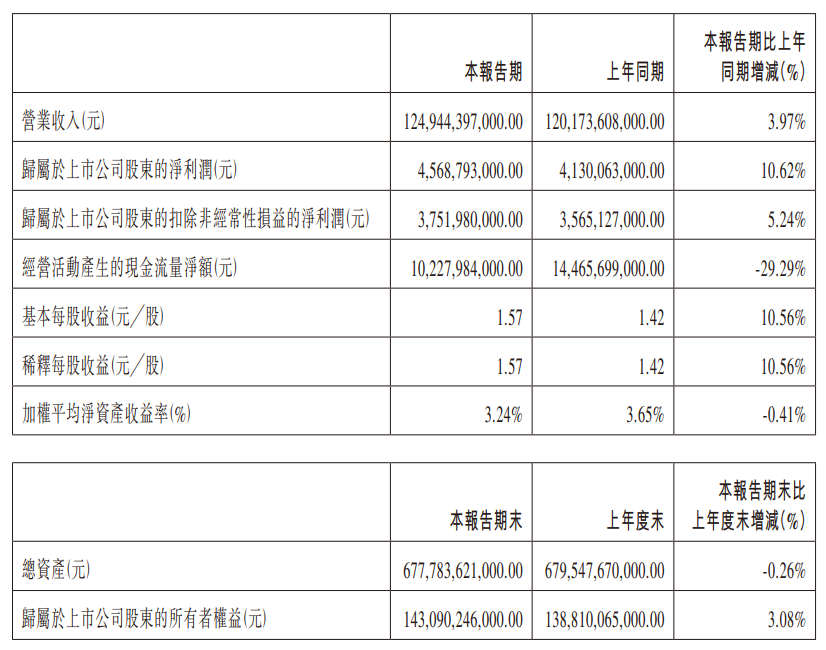

Data shows that in the first three months of this year, BYD's operating income was 124.944 billion yuan, a year-on-year increase of 3.97%, but a decrease of 30.6% quarter-on-quarter. Net profit attributable to shareholders was 4.569 billion yuan, although it increased by 10.62% year-on-year, it decreased by 47.33% quarter-on-quarter. Diluted earnings per share were 1.57 yuan, up 10.56% from the same period last year's 1.42 yuan. The gross profit margin reached 21.88%, achieving double-digit growth year-on-year and quarter-on-quarter, setting a new record.

In summary, there are three key factors regarding BYD's revenue situation this quarter:

Low-Price Strategy Makes Little Sense

According to previous data, in the first quarter of 2024, the production and sales of BYD's new energy vehicles reached 612,000 and 626,300 respectively, with year-on-year growth of 8% and 13% respectively. Sales successfully exceeded production, reducing inventory pressure.

Affected by the Spring Festival and other seasonal factors, BYD had a bleak start in 2024. However, in March, 302,500 vehicles were sold, including 139,900 pure electric vehicles. Analysis suggests that this sales rebound benefited from the brand's significant price reduction, seizing the initiative over other competitors, and this strong momentum has continued into April.

For BYD, in the first quarter, the company adopted an aggressive price war strategy, mainly targeting plug-in hybrid models priced around 100,000 yuan, which were about 20,000 yuan cheaper than their own pure electric models. Therefore, the price reduction promotion drove sales of low-end models in the Dynasty and Ocean series, with the overall revenue growth rate (3.97%) far below the sales growth rate (13%). Consequently, both per-vehicle revenue (141,000 yuan) and per-vehicle profit (6,300 yuan) inevitably declined. Whether they can return to the growing trend still depends on the sales of high-end brands.

Taking the first full month after the price reduction (March) as an example, the Dynasty and Ocean series sold a total of 286,700 units, with a year-on-year growth of 47% and a month-on-month growth of 151%, far exceeding the high-end brands like FangChengBao (monthly increase of 54%) and Yangwang (monthly increase of 44%).

For high-end brands, after the rapid growth quarter-on-quarter in the fourth quarter of 2023, sales have now stabilized. In the first quarter of this year, sales of DENZA, FangChengBao, and Yangwang were 31,000, 11,000, and 3,500 respectively, accounting for about 7% of the overall market.

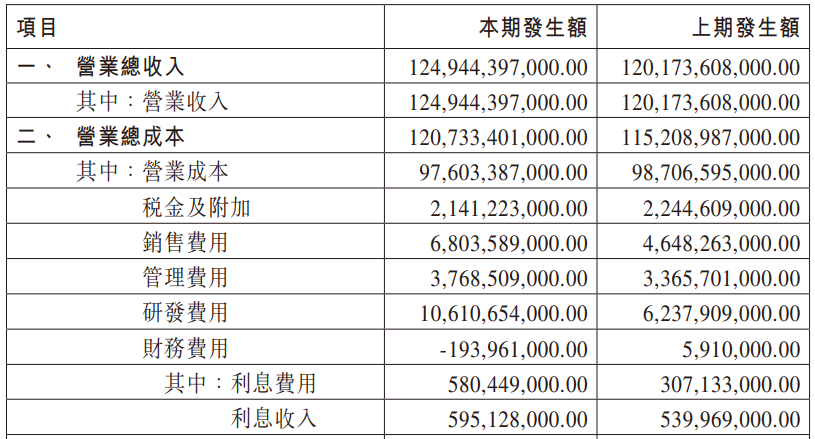

What's important, the decline in profit for BYD's single car is far less than the decrease in single car‘s revenue, primarily due to the reduction in costs. It is reported that during this period, the price of essential raw materials for new energy vehicles, such as lithium carbonate, has significantly decreased, to some extent relieving BYD's cost pressure. During the financial reporting period, BYD's operating costs decreased by 1.1 billion yuan year-on-year and by 44.2 billion yuan quarter-on-quarter, to 97.6 billion yuan.

Industry experts state, "BYD has initiated the first round of price wars and captured market share from internal combustion engine vehicles. Although the popularity and sales of electric vehicles are increasing, they are accompanied by a decline in profits."

Furthermore, in the first quarter of this year, BYD continuously launched several "Honor" models with not only upgraded configurations but also reduced prices, escalating the industry's price war.

Higher R&D Investment On The Way

Notably in the financial data, BYD has visibly accelerated the research and development of high-end brand models and the intelligent driving field, with significant increases in expenses in various aspects including R&D during the period. R&D alone achieved a year-on-year growth of 70.1%, reaching 10.61 billion yuan.

BYD stated that the company plans to launch seven high-end brand models this year, including the FangChengBao 8, 3,Yangwang U7 and U9, as well as three new models from DENZO. Consequently, the introduction of more high-priced models is likely to drive up the median income from a single car.

In today's "Intelligent Driving Era", BYD needs to continuously optimize and iterate its "God's Eye" advanced intelligent driving assistance system to narrow the gap with front-runners like Huawei and Tesla, with R&D investment expected to increase further.

At the recent 2024 Beijing International Auto Show, BYD unveiled its latest intelligent achievements—the Yangwang U8 Player Edition, starting at 1.098 million yuan; the U7 equipped with the Cloud Chariot-Z suspension technology and the "God's Eye" advanced intelligent driving assistance system also debuted at the event; as well as the high-performance pure electric flagship hunting-type model DENZA Z9GT, born from the brand-new design concept of "Elegance in Motion."

Overseas Expansion Benefits Larger Export

Today, boosting the export of new energy vehicles seems to have become a consensus among various car manufacturers, with BYD slightly ahead in expanding overseas markets.

In China, BYD has intensified its efforts to enter the high-end market by offering brands at different price points while simultaneously increasing discounts to cater to the trend of sluggish economic recovery and compete for cautious potential buyers. Overseas, the company is rapidly entering foreign markets, with a presence in Southeast Asia, Latin America, Europe, and more.

By the end of the first quarter of this year, BYD's new energy vehicle models such as the Yuan Plus, ATTO 3, Dolphin, and Song Plus had successfully entered more than 70 countries and regions across six continents globally, with over 250 stores opened overseas. In terms of export growth, the export volume reached 99,000 vehicles in the first quarter (a growth rate of 153%), surpassing Tesla for the first time to become the top domestic manufacturer of new energy vehicle exports.

Overseas markets are expected to become the key to continued growth in sales and profits for BYD. BYD explicitly plans to build factories in Thailand (with a capacity of 150,000 vehicles, expected to start production in 2024), Brazil (with a capacity of 150,000 vehicles, expected to start production in 2024), Uzbekistan (total capacity of 300,000 vehicles, with the first phase already in operation), Segde City, Hungary (expected to start production in 2025), and Mexico (with a capacity of 150,000 vehicles, site selection in progress).

It is said that BYD's goal for 2024 is to achieve sales of 500,000 vehicles outside China, doubling by 2025. Therefore, accelerated exports, high-endization, and intelligence have become important labels for BYD this year and are expected to be the key drivers of sustained growth in automobile sales and profits for BYD in the future.

Meanwhile, European regulatory agencies have issued warnings of anti-dumping against Chinese manufacturers, stating that the "overcapacity" caused by excessive subsidies would lead to an influx of cheap cars into the global market. In 2023, the EU conducted an investigation into subsidies for electric cars from China.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.