Domestic Complaints Rising, Thai EV Subsidies Lose Its Way?

Thailand's subsidies to Chinese EV manufacturers have severely impacted the automotive industry, with massive oversupply forcing the country's traditional firms to cut production and even close down.

According to industry insiders, the Thai government's subsidies to Chinese electric vehicle (EV) manufacturers have triggered a series of chain reactions. Currently, the Thai EV market faces a significant oversupply, leading to fierce price wars in the fuel vehicle market, causing related factories to reduce production and shut down.

Moreover, the supply chain sector has been unexpectedly affected, with at least a dozen parts manufacturers going out of business because Chinese EV manufacturers hardly source products from them.

Data from the Thai Revenue Department shows that since the Thai government launched its EV subsidy program in 2022, 185,029 imported EVs have been recorded. However, data from the Thai Land Transport Department reveals that only 86,043 new EVs have been registered, indicating that at least 90,000 EVs are in an oversupply state.

Krisda Utamote, president of the Electric Vehicle Association of Thailand (EVAT), stated, "A large number of EVs imported from China in the past two years are still in the hands of dealers, and our country is facing an oversupply issue. Meanwhile, more and more Chinese EV manufacturers are investing in production in Thailand."

The Thai EV subsidy program, launched in 2022 under the ASEAN-China Free Trade Agreement, aims to make cars more affordable. The Thai government offers Chinese manufacturers subsidies of up to 150,000 baht per vehicle.

Furthermore, the agreement eliminates tariffs on Chinese-imported EVs sold in Thailand, provided that starting this year, the number of EVs produced by China in Thailand must match the number of EVs imported to the country since 2022.

BYD is undoubtedly the most active investor under this program. The company has significantly reduced the price of its new Atto model from the launch price of 899,000 baht by 340,000 baht, a decrease of up to 37%. Neta also reduced the price of its V-II model from the launch price of 549,000 baht by 50,000 baht, a decrease of 9%.

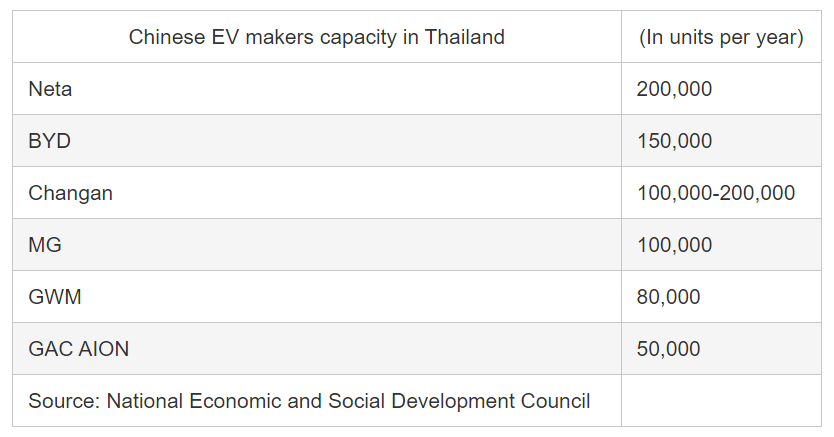

Once fully operational, the annual production capacity of Chinese manufacturers like BYD will reach about 750,000 units, though it remains unclear if a price war will ensue.

The impact of subsidies has already spread to other areas of the country's automotive industry. Statistics show that the industry employs over 750,000 people, accounting for about 11% of the country's GDP. Consequently, the automotive industry is the fourth largest contributor to Thailand's economy, forming part of the overall industrial sector, which accounts for 25.2% of GDP.

After the EV subsidies led to price reductions, the sales of fuel vehicles began to decline. Japanese automakers have been the most affected, as their fuel vehicles produced in Thailand account for 90%.

The overall weakness of the Thai economy has also led to a reduction in consumer spending. The Federation of Thai Industries (FTI) reported that 260,365 vehicles were sold in the first five months of this year, a 23% decrease compared to the same period in 2023, marking the lowest sales in a decade.

To survive, fuel vehicle manufacturers have been cutting their production capacity.

Earlier this month, Honda, Japan's second-largest automaker, announced it would cease production at its Ayutthaya plant by 2025 and consolidate operations at its Prachinburi plant, reducing annual production from 270,000 units to 120,000 units. Other Japanese manufacturers have also halted production activities.

Subaru announced it would cease its car assembly operations in Thailand by the end of this year, and Suzuki stated it would follow suit in 2025.

Auto parts manufacturers have also been affected.

Sompol Tanadumrongsak, president of the Thai Auto Parts Manufacturers Association, stated, "So far this year, our parts orders have decreased by 40%, and each auto assembly plant has reduced its capacity by 30%-40%. Due to declining demand, most local parts manufacturers have shortened their operation time to only three days a week, and over a dozen have been forced to close."

He expects the industry to further contract during this transition period, adding that out of 660 Thai parts manufacturers, only a dozen can supply Chinese EV manufacturers, who either import from their own country or rely on their own low-cost supply chains.

Despite the pressure on traditional automakers and their parts suppliers, the Thai government has not shown signs of changing its policy direction.

On July 26, the National Electric Vehicle Policy Committee (BOARD EV) approved new subsidies for hybrid electric vehicles (HEVs). Thai parts manufacturers have long supplied HEVs, which combine batteries with internal combustion engines, containing many of the same parts as traditional cars and are cheaper than battery electric vehicles (BEVs).

Narit Therdsteerasukdi, secretary-general of the Thailand Board of Investment (BOI), stated, "In the next 5-10 years, sales will mainly come from HEVs and BEVs, so it is necessary to support the development of HEVs to encourage investment in domestic value-added parts."

If approved by the cabinet, the consumption tax on hybrid vehicles will be reduced to 6% or 9%, depending on the CO2 emissions of the model. For automakers investing 3 billion baht in Thailand from 2024-2027, the tax rate will remain unchanged from 2028 to 2032.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.