Tesla Model Y price increase 5000! The price war is over?

On March 20, a media report said that Tesla China decided to raise the price of Model Y by 5,000 yuan from April 1.。

While major car companies are rolling prices, Tesla is suddenly bucking the trend。

On March 20, a media report said that Tesla China decided to raise the price of Model Y by 5,000 yuan from April 1.。In addition, the current $8,000 insurance subsidy and up to $10,000 in car paint relief will expire on March 31, meaning that this combined price increase is up to 2.30,000。

Tesla China move not without omens。Tesla has already announced that its Model Y models will increase their prices by $1,000 and €2,000 in the U.S. and European markets from April 1, respectively.。

In China's new energy vehicle market to enter the price "fight," Tesla this wave of reverse operation, so that many netizens call "do not understand."。But there are also industry insiders believe that Tesla this price increase, or in order to "force a single"。

After the news of Tesla's upcoming price increase was released, a number of netizens said that their added Tesla salespeople have posted relevant information on social platforms and reminded everyone that the subsidy campaign will end at the end of this month, allowing customers interested in Tesla Model Y to seize the opportunity.。

Yan Jinghui, a member of the Expert Committee of the China Automobile Dealers Association, said in an interview with the media: "The fierce domestic market competition environment has also put pressure on Tesla.。Forecasting price increases in advance will also affect previously interested wait-and-see owners, prompting some owners to place orders and boost some sales.。"

According to ideal car statistics, from March 1 to March 17, Tesla's sales in the Chinese market were 3.10,000 vehicles。For comparison, Tesla China sold 71,447 vehicles in January, compared with 60,365 in February.。

February because there are only 29 days for the time being without discussion, the same 31 days of January and March can be expected after comparison, March Tesla China delivery data probability will not look good。This is also the main driving force of Tesla's "single"。

In addition to "forcing orders," Tesla's gross margin under pressure is also widely seen as a deep reason for its choice to raise prices.。

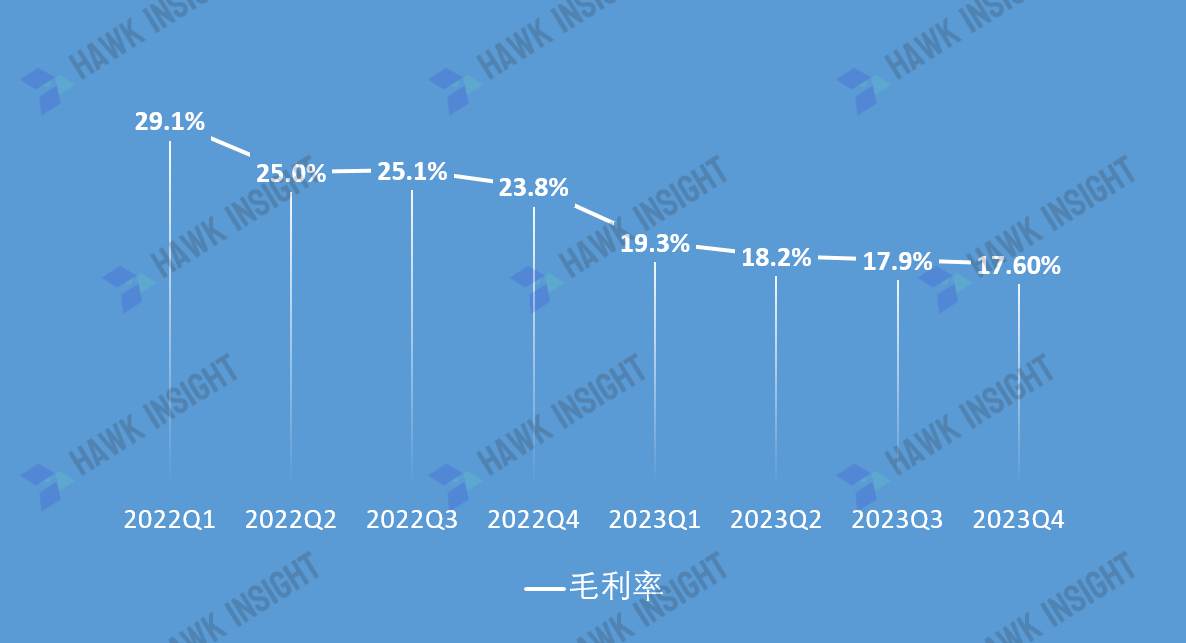

According to Tesla's fourth-quarter 2023 earnings release in January, the company's gross margin fell further in the fourth quarter to 17.6%, below Wall Street expectations of 18.1%, the lowest level since 2019。

For the full year, Tesla's average gross margin for the four quarters of 2023 was 18.25%, much lower than in 2022..75% quarterly average gross margin。Analysts generally agree that gross margin will be a key issue for Tesla this year。

It is worth noting that in the fourth quarter earnings report and subsequent conference calls, Tesla revealed its delivery targets for this year and did not give profit margin guidance.。In addition, Tesla did not directly articulate its price strategy throughout the year, as it did in early 2023, which is to reduce prices in exchange for sales.。This means that Tesla executives believe that the global electric vehicle market will face great uncertainty this year, Tesla may repeatedly jump between sales and profit, and then we may see more price changes from Tesla.。

In addition, there are also views that Tesla this time in the car market off-season price increases, may be in order to follow the car market "peak season" price cuts to leave room for the market to leave a "substantial price reduction" illusion。However, now the major car companies "volume" range from price to configuration, and then to supporting facilities, after-sales service, price is no longer the only consideration for consumers, this trick "price illusion" has been difficult to deceive consumers.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.