Q3 Revenue Flat Year - on - Year Game Business Declines Nearly 30%?

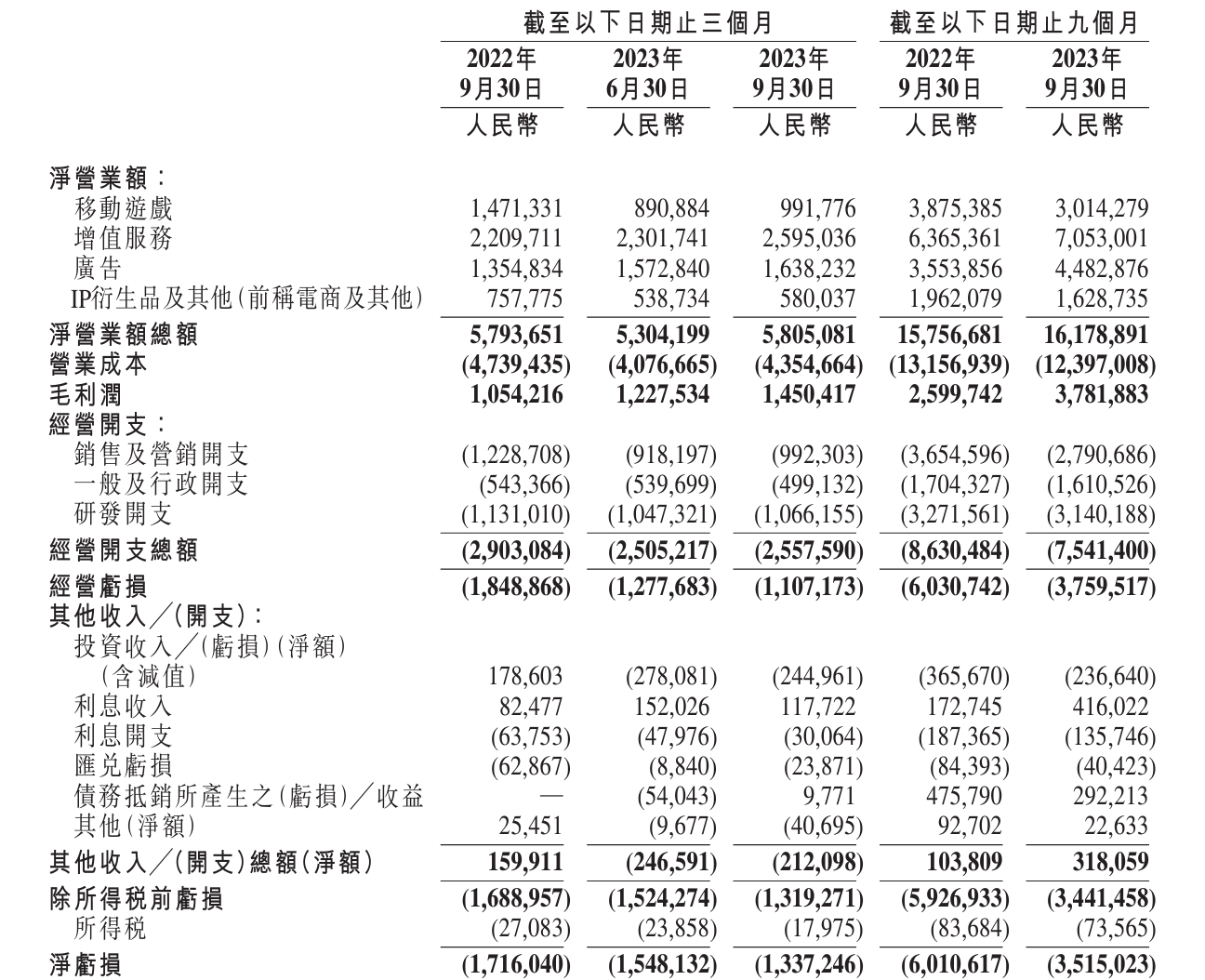

On November 29, Bilibili announced its third-quarter financial results.。Data show that the net turnover of Bilibili in the third quarter totaled 5.8 billion yuan, unchanged from the same period last year.。Net loss was $1.3 billion, down 22% from the same period last year.。

On November 29, Bilibili announced its results for the third quarter ended September 30, 2023.。

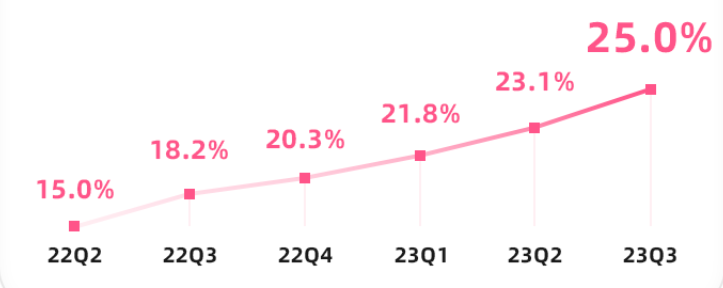

Performance data show that the net turnover of Bilibili in the third quarter totaled 5.8 billion yuan (RMB, the same below), unchanged from the same period last year.。Gross profit was $1.5 billion, up 38% year-on-year。Gross margin of 25.0%, compared to 18.2%。Net loss was $1.3 billion, down 22% from the same period last year.。Adjusted net loss of 8.600 million yuan, 51% lower than the same period last year。

Game business fell nearly 30% year-on-year, double eleven e-commerce sales increased by more than 250% year-on-year

Specifically, the business development of Bilibili in the third quarter。

● Value-added services。In the third quarter, value-added services turnover was 2.6 billion yuan, up 17% year-on-year.。The company said this was due to increased revenue from live streaming services and other value-added services.。This segment accounts for 45% of the company's total business revenue。

● 广告。In the third quarter, Bilibili's advertising turnover was $1.6 billion, up 21% year-on-year, mainly driven by the Company's improved advertising products and increased advertising efficiency.。This segment accounts for 21% of the company's total business revenue。

● Mobile games。In the third quarter, Bilibili's mobile game turnover was 9.900 million yuan, down 33% year-on-year, up 11% month-on-month。The company said the year-over-year decrease was mainly due to the high base of Time Hunter 3, which was launched in June last year, and lower-than-expected turnover for several new games in the third quarter of 2023.。This segment accounts for 17% of the company's total business revenue。

Recently, there have been a lot of adjustments to the game business at Station B.。One of the biggest moves is the announcement of the dissolution of Xinyuan Interactive, a Guangzhou R & D studio under Station B.。After two large-scale layoffs, Xinyuan Interactive currently has about 60 people left.。In addition to the studio has a "code name QQ13" project retained, other projects have been cut。It is worth noting that the heart of the source of interaction is last February B station spent 1 billion acquisition, only the acquisition of a year and a half on the hasty end, so that the market is very surprised.。

At the call, Chen Rui said that the new user bonus of game products has faded and has entered a standard stock competition stage, so some competition rules in the market have changed。He believes that in the new stage, the quality of the game may not be useful even if it is done well, either it is the best, or it has to be done very differently from others.。

Chen Rui further said that in the new market environment, the standard of game project has changed.。He believes that new games need to meet three criteria at this stage.。The first is long-term operations; the second is to be at least the head of a pendant class; and the third is reasonable cost。

Chen Rui said that this year the company has been combing its internal self-research projects according to this standard。After the adjustment, the company still retains a number of future projects that may be competitive in the market, and the company will focus its resources on these projects.。Chen Rui believes that B has a natural advantage on the track of the game, "What we have to do is to turn this advantage into reality."。

● IP derivatives and others (formerly known as e-commerce and others)。In the third quarter, revenue from IP derivatives and others was 5.800 million, down 23% year-on-year, mainly due to lower revenue from IP derivatives sales.。This segment accounts for 10% of the company's total business revenue。

During the Double Eleven period, sales of B-station video and live delivery increased by more than 250% year-on-year。During the promotion period, the number of videos with goods at Station B increased by more than 230% year-on-year, and the number of live broadcasts with goods increased by more than 100% year-on-year.。Advertising water from the head e-commerce platform increased by more than 80% year-on-year, with goods GMV year-on-year high-speed growth of more than 250%, for the eight vertical industry merchants to bring new customers rate of more than 50%。

Losses continue to narrow, gross margin increases for five consecutive quarters

In the third quarter, Bilibili's financial situation continued to improve.。

On the one hand, losses are narrowing。In the third quarter, Bilibili's operating loss was $1.1 billion, down 40% from the same period last year.。Net loss was $1.3 billion, down 22% from the same period last year.。Adjusted net loss of 8.600 million yuan, 51% lower than the same period last year。And losses are narrowing compared to the previous quarter。

On the other hand, gross margin continued to grow。The company's gross margin for the third quarter was 25.0%, compared to 18.2%。The company's gross margin has increased for five consecutive quarters.。

At the same time, the company's cost reduction and efficiency gains achieved further results。The total operating expenses of Station B in the third quarter were $2.6 billion, a decrease of 12% year-on-year.。Sales and marketing expenses, general and administrative expenses decreased by 19% and 8% respectively。At the same time, R & D spending also decreased by 6% year-on-year to $1.1 billion.。The company said the decrease in research and development was mainly due to lower employee-related costs in the third quarter.。

Chief Financial Officer Fan Xin said: "In the third quarter, our gross profit margin increased from 18% year-on-year to 25%, while gross profit increased by 38% year-on-year.。Our total operating expenses decreased by a further 12% year-on-year and our adjusted net loss decreased by 51% year-on-year, while our daily users grew.。Notably, our operating cash flow turned positive in the third quarter, marking the beginning of a positive cycle in our operations。Next, we remain committed to further improving our financial position and creating value for all stakeholders。"

As at 30 September 2023, Bilibili's cash and cash equivalents, time deposits and short-term investments were $14.5 billion.。

Daily life breaks billion, monthly life reaches 3.4.1 billion, both record highs

Over the past year, Bilibili has been emphasizing that the company will pay more attention to the quality of growth in terms of user growth.。

In the third quarter of this year, the average daily active user (DAU) of B station exceeded 100 million, an increase of 14% year-on-year to 1..03 billion, with an average monthly active user (MAU) of 3.4.1 billion, both record highs。

'This is a clear indication that our user growth strategy over the past year has been successful and a new beginning, 'Mr. Chen said in a third quarter phone call.。Chen Rui said that the current user scale still has great growth potential, "If we can continue to make the content more prosperous, we should be able to get more users。"

Chen Rui said: "I am now speaking to the company's internal is 9 words, increase gross profit, reduce losses, maintain growth, these three points we are going to do at the same time, will not sacrifice the first two points to do user growth."。"

In addition to user growth, user activity at Station B also performed better in the third quarter。In the third quarter, the average daily usage time of users reached 100 minutes。Average daily video playback volume of 4.7 billion, up 26% year-on-year。

Average Daily Active UP Main Growth 21% YoY。Active UP main creative enthusiasm led to an increase in monthly average submission volume, up 37% year-on-year。The increase in monthly average submissions can drive up the number of fans of UP owners, and in the third quarter, the number of UP owners above 10,000 fans increased by 36% year-on-year。UP owners are motivated by rising fan numbers and will further increase their activity。One by one, the whole forms a positive cycle.。

In terms of membership, Bilibili members are divided into two types: full members and large members, who can become full members after answering questions, and can post barrages, comments and so on at Station B.。And large members need to pay, after becoming a large member can be free to watch VIP video content and paid comics, etc.。

According to Bilibili, the number of "full members" who passed the exam in the third quarter increased by 23% year-on-year.。The retention rate of full members reached 80% in the 12th month.。In the third quarter, Bilibili had 21.1 million large members, with more than 80% being annual subscriptions or auto-renewals.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.