China Life Interim Financial Report: Performance Declines Top in Industry = Products + Services?

On August 23, China Life Insurance Company Limited ("China Life") released its semi-annual results report for 2023.。

On Wednesday, August 23, after the Hong Kong stock market, China Life Insurance Company Limited ("China Life") released its semi-annual results report for 2023.。

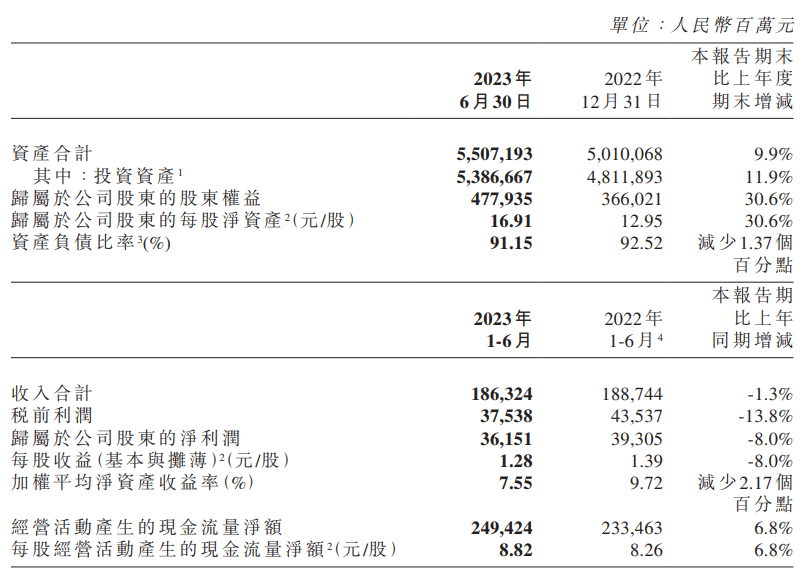

Performance data show that in the first half of this year, China Life achieved a total revenue of 1,863.2.4 billion yuan (RMB, the same below), down 1.3%; net income attributable to IFRS 361.$5.1 billion, up from $393 million last year due to continued equity market volatility and changes in accounting standards..$0.5 billion down 8%; basic earnings per share 1.$28, no interim dividend。

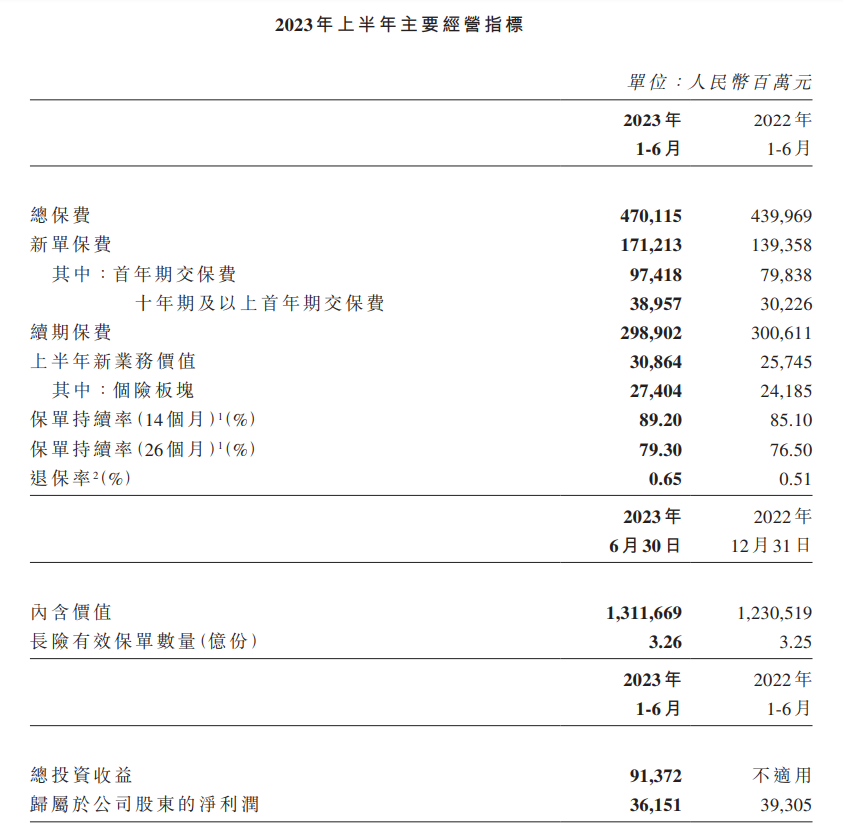

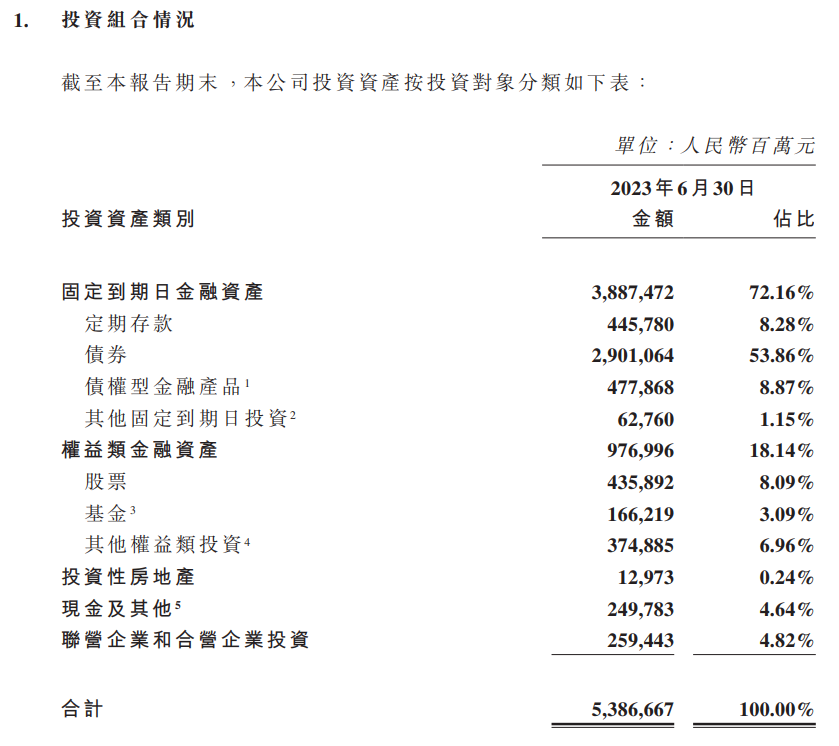

As of the end of the reporting period, the Company's total assets amounted to 5.51 trillion yuan, investment assets 5.39 trillion yuan, with an embedded value of 1.31 trillion yuan; of which total premiums were 4,701.1.5 billion yuan, up 6.9% hit a record high for the same period, ranking first in the industry; as of the end of June, the company's total investment income recorded 913.7.2 billion yuan。

In terms of future development, China Life mentioned in the report that in the second half of 2023, the Group will continue to adhere to the business strategy of "steady growth, value, excellent structure, strong team, push reform and risk prevention" to promote the company's high-quality innovation and development.。We will continue to focus on the main business of insurance, comprehensively enhance the company's ability to integrate health and old-age ecology, create a "product-service-payment" closed loop, build the core competitiveness of "product + service," and promote the company's transformation from risk compensation to risk chain management.。

Chairman Bai Tao stressed that China Life is confident in the future development of the life insurance industry.。"While the growth rate of new single premiums outperformed the industry, our first-year term structure and product structure have also been further optimized, and we have taken the lead in stabilizing the industry.。"

Vice President Liu Hui said that the equity market in 2023 will attach importance to the medium- and long-term layout, continue to do a good job in the optimization and adjustment of the position structure, and then through the diversification strategy, differentiated management means, in a stable reduction of volatility while co-ordinating income to achieve。

optimize the business structure,"Product + Service" benefits people's livelihood

In the first half of 2023, in the first half of this year, thanks to the liberalization of epidemic prevention and control policies, China Life's total premiums reached 4,701.1.5 billion yuan, a record high, the main business indicators have achieved rapid growth, business structure significantly optimized, new business value growth.。

In terms of business structure, new single premiums rose 22% year-on-year.9% to 1,723.$1.3 billion; first-year premium paid 974.1.8 billion yuan, up 22.0%, of which the first-year premium for ten years and above is 389.5.7 billion yuan, up 28.9%, business structure optimization is obvious。New business value reached 308 in the first half of the year..6.4 billion yuan, up 19.9%, continue to lead the industry。

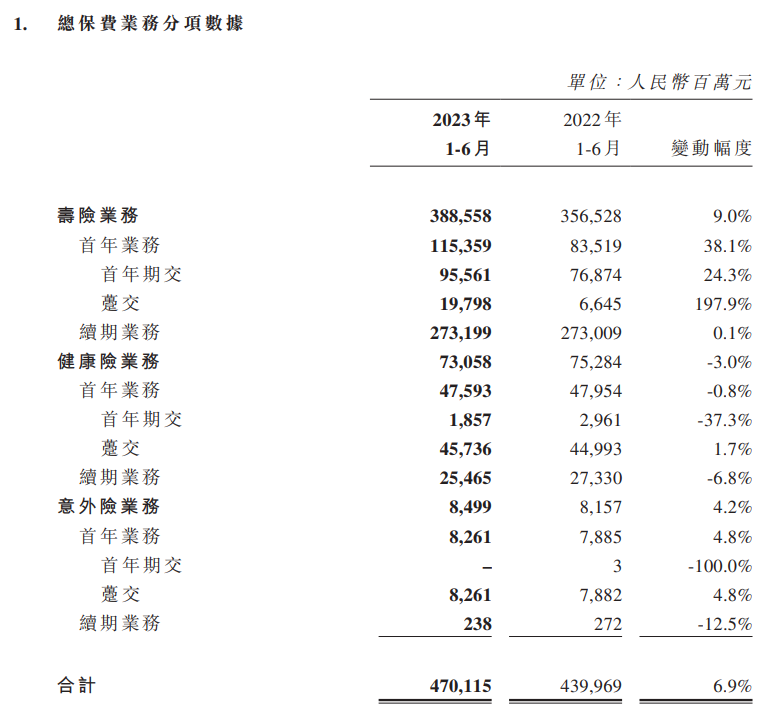

By type of insurance, total premiums for life insurance business 3,885.5.8 billion yuan, up 9.0%; total premiums for health insurance business 730.5.8 billion yuan, down 3.0%; total premium for accident insurance business 84.9.9 billion yuan, up 4.2%。

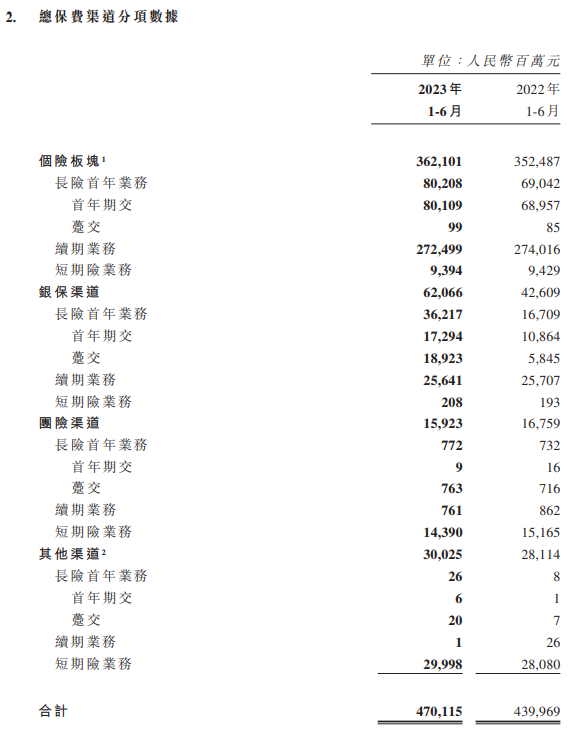

By channel, the business scale of individual insurance, bancassurance and other channels has increased, however, the group insurance channel has declined slightly.。

In terms of individual insurance, China Life has enhanced the specialization of its existing team and actively explored new marketing models, providing technical support for sales manpower and promoting continuous improvement in team quality and a significant increase in production capacity.。

According to the announcement, the total premium for individual insurance is 3,621.01 billion yuan, up 2.7 percentage points, of which the renewal business premium amounted to 2,724.9.9 billion yuan。In the first half of 2023, the value of new business reached 274.04 billion yuan, up 1.3.3%。

In terms of bancassurance, group insurance and other channels, China Life adheres to the transformation goal of diversification, diversification and refinement, broadens bank cooperation, coordinates scale and efficiency, realizes the innovation of channel management, and promotes the steady development of diversified sectors.。

Data for the period show that the total premium for the bancassurance channel amounted to 620.6.6 billion yuan, up 45% year-on-year.7 percentage points。The company insists on the transformation of its business structure, with a considerable optimization of the proportion of each business.。As for the group insurance channel, total premiums fell 5% YoY to 159.2.3 billion yuan, but the proportion of high-performance manpower in the team increased by 4.6%。

China Life Chairman Bai Tao said that the double-digit premium growth in the first half of the year is a recovery, and a short-term correction is expected in the second half of the year, but it will be better than 2022.。In the long run, fundamentals will continue to improve in the long run, and the insurance industry still has huge room for growth.。

It is reported that China Life is fully promoting the construction of "eight major projects," reform and innovation to cultivate new kinetic energy.。By continuously exploring the construction of the digital project of financial technology, expanding the Internet channel of insurance business, and integrating online direct sales with offline D2C sales, China Life successfully achieved a total online premium of 536 in the first half of the year..800 million yuan, up 38.1 percentage point。

In addition, the company has built a "life insurance +" integrated financial ecosystem, collaborated with major companies to achieve business innovation and strong expansion of business scale, and jointly carried out a number of business activities with them to improve customer service solutions.。It is worth mentioning that, with the insurance business as the core, China Life is fully promoting the "healthy old-age ecological construction project," with the people as the center and starting point of the "insurance + health care" construction.。

2023In the first half of the year, in terms of "insurance + health," China Life launched more than 100 service projects on the National Life Health Platform, covering seven categories of health management service projects, with a cumulative increase of more than 10% in the number of registered users compared with the end of 2022, ranking among the top in the industry.。In terms of "insurance + old-age care," the project has been carried out in a number of key cities to build a development model of "urban" institutional old-age care, "suburban" institutional, home and community old-age care.。

Investment business configuration flexible risk in the grasp

2023In the first half of the year, fixed income rates adjusted downward after a brief upturn at the beginning of the year, the low interest rate environment did not improve significantly, and quality assets remained scarce;。Against this backdrop, China Life rationally allocates assets and liabilities to ensure a balanced and flexible allocation and structure.。

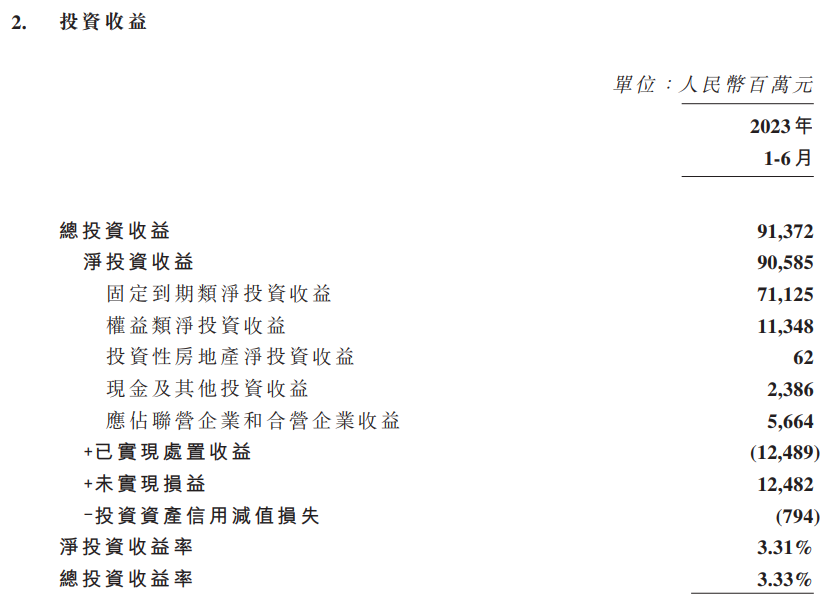

Data show that China Life's total investment in the first half of the year totaled 5.39 trillion yuan, of which bonds accounted for 53.86%, time deposits accounted for 8.87%; equity financial products, stocks, funds accounted for 8.09% and 3.09%。Net investment income realized at the end of the reporting period 905.8.5 billion yuan, net investment return of 3..31%。

As for the impact of short-term market fluctuations, China Life said that the company is facing the dual pressure of the continued decline in the yield of high-interest-bearing varieties and the increased volatility of the overall income of the investment portfolio, and will continue to strengthen asset and liability management to effectively balance short-term income stability and long-term value enhancement.。

On August 24, China Life's 2023 interim results conference, Vice President Liu Hui said that the company's allocation is more concerned about mature and stable cash flow assets, and life insurance funds as long-term funds, in the risk tolerance and liquidity requirements have certain advantages, the company is also further promoting the improvement of the long-cycle assessment system.。

According to the report, China Life strictly controls credit risk, credit investment products assets to maintain a high quality state, risk control, the first half of the company did not occur credit default events.。As for the risk of debt violation of Sino-Ocean Group, Zhao Guodong, vice president and secretary of the board of directors, stressed that the company is highly concerned about the operation of the group and the recent risk situation, but the Sino-Ocean Group held by China Life is a financial investment, and the impact of the project on the company's overall investment assets can be controlled.。

Business recovery effect is optimistic, the major banks have given "buy" rating.

Major banks make statements on China Life's first half performance after interim results。

According to Goldman Sachs, China Life's core solvency adequacy ratio ranks first among the insurance stocks covered by the bank, believing that it has provided a buffer against recent market volatility and supported its share price performance.。Moreover, the company's first-half results were largely in line with the bank's expectations, with the value of new business increasing by 20% year-on-year, ahead of the bank and market expectations of 6% and 8%, so it maintained its target price of 15.HK $5, rating "Buy"。

According to IFRS, China Life's weak earnings were mainly due to a year-on-year decline in investment income, a slowdown in insurance revenue and higher insurance expenses.。Therefore, the market is expected to react negatively, giving it a target price of HK $16 and a "buy" rating.。

The Bank of Communications International report pointed out that the value of China Life's new business is better than market expectations, and its savings insurance in the current market environment is still differentiated competitiveness, the pace of business is expected to be relatively stable compared to the industry.。Therefore, to China Life 18..HK $5 target price, rating "Buy"。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.