Baidu Q3 revenue net profit exceeded expectations! Robin Li: U.S. chip export restrictions have limited impact in the short term

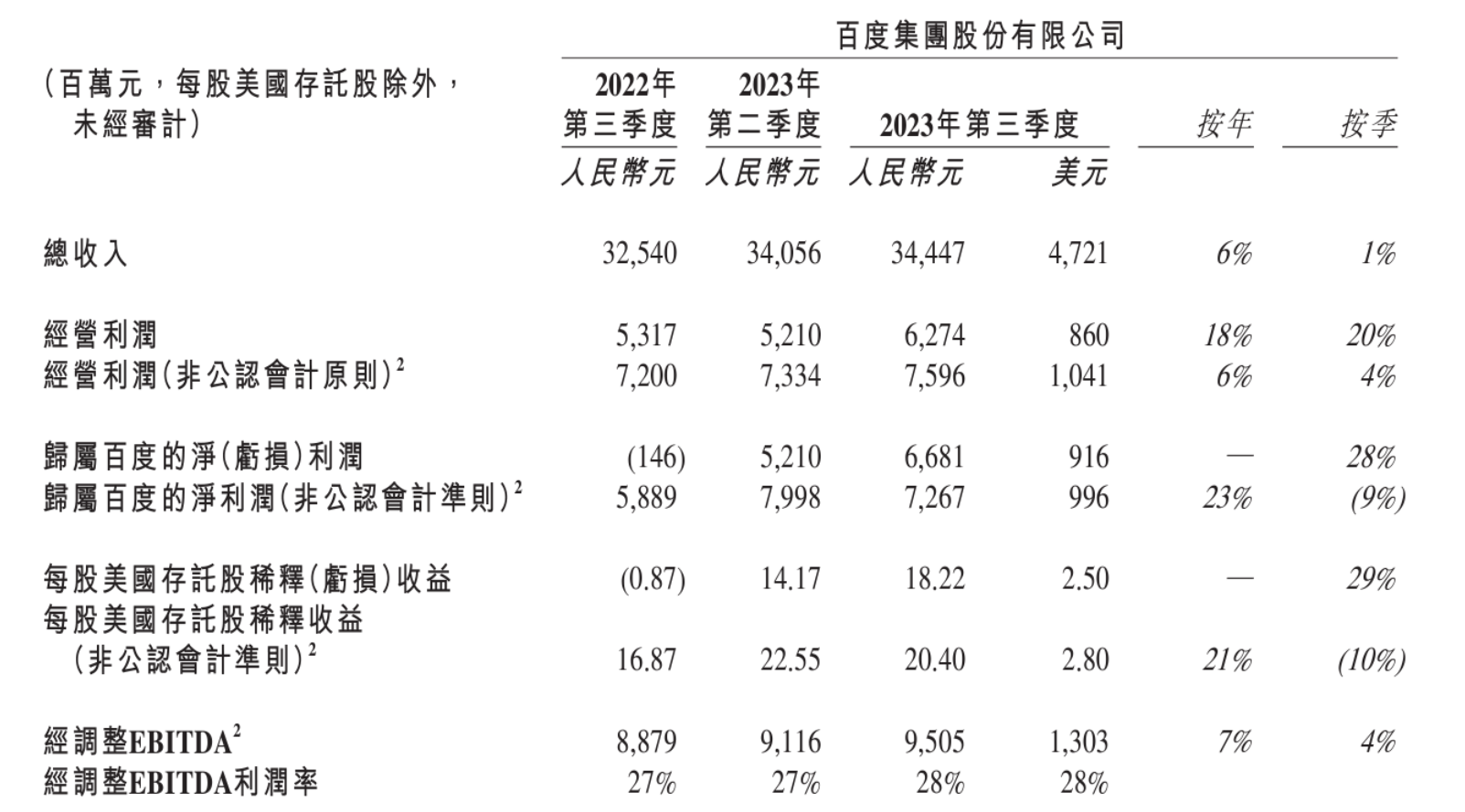

On November 21, Baidu Group announced its third quarter financial results。According to the data, Baidu's total revenue in the third quarter was 34.4 billion yuan, up 6% year-on-year and 1% month-on-month.。Net profit attributable to Baidu was RMB6.7 billion, a year-on-year turnaround and a 28% increase from the previous year.。

On November 21, Baidu Group ("Baidu") announced its financial results for the third quarter ended September 30, 2023.。

According to the data, Baidu's total revenue in the third quarter was 34.4 billion yuan (RMB, the same below), up 6% year-on-year and 1% month-on-month.。On the earnings side, net profit attributable to Baidu was $6.7 billion, a year-on-year turnaround and up 28% from the previous year.。Adjusted EBITDA was $9.5 billion, up 7% YoY and 4% YoY, and adjusted EBITDA margin was 28%, up one percentage point YoY.。Baidu's revenue and net profit both performed well, exceeding market expectations。

As of September 30, 2023, cash, cash equivalents, restricted funds and short-term investments were $202.7 billion and free cash flow was $6 billion.。In the third quarter, Baidu spent $6.1 billion on research and development, up 6 percent from a year earlier.。

Baidu also disclosed data on some of its applications.。

● Baidu APP has 6 monthly active users in September 2023.6.3 billion, up 5% year-on-year。

● Baidu's automatic ride-hailing service Radish Run provided 82 in the third quarter.10,000 rides, up 73%。As of September 30, 2023, the cumulative number of orders provided to the public by Radish Run reached 4.1 million.。

● The average daily total number of subscription members in the third quarter of iQiyi is 1.08 million, compared with 1 in the same period last year..01 billion, but up from 1 in the previous quarter..Shrinking compared to 1.1 billion。The average monthly membership service income (average monthly membership income per member) contributed by iQiyi in the quarter was 15.54 yuan, up 12% year-on-year, up about 5% month-on-month。

It is worth mentioning that, along with the financial results released the news of Jingdong CEO Xu Ran as an independent director of Baidu。Baidu said it has appointed Xu Ran as an independent director of the company's board of directors, effective January 1, 2024.。

Xu Ran has been CEO and Executive Director of Jingdong Group since May 2023。Prior to that, Xu Ran served as Chief Financial Officer of JD Group from June 2020 to May 2023.。Prior to joining the Jingdong Group, Xu Ran was an audit partner and worked in the Beijing office of PricewaterhouseCoopers Zhongtian Certified Public Accountants (Special General Partnership) and the San Jose office of PricewaterhouseCoopers for nearly 20 years.。Xu Ran is also currently a director of Yonghui Supermarket Co., Ltd.。

Q3Baidu's advertising business growth slowed

Baidu's business revenue consists of Baidu Core and iQiyi.。In the third quarter, Baidu's core revenue was $26.6 billion, up 5% year-on-year.。Net profit attributable to Baidu Core was $6.4 billion, with a net profit margin of 24%。iQiyi's revenue was $8 billion, up 7% year-on-year。

Baidu's core business is mainly composed of online marketing and non-online marketing businesses.。Revenue from the online marketing business was $19.7 billion in the third quarter, up 5 percent year-on-year, a sharp slowdown from 15 percent in the previous quarter.。Managed page revenue accounted for 53% of online marketing revenue, up one percentage point from the previous quarter.。Non-online marketing revenue was $6.9 billion, up 6% year-over-year, also slowing from 12% growth in the previous quarter.。

In the third quarter results conference, to answer questions about the slowdown in advertising growth, Baidu Chairman and CEO Robin Li believes that in addition to the macroeconomic downturn, the relatively weak online marketing revenue of e-commerce platforms is also one of the reasons for the slowdown in advertising growth.。Revenue from e-commerce platforms is a big source of revenue for Baidu, accounting for about 10% of total online marketing revenue, he said。He also said that Baidu, like many other Internet platform companies, is building its own native e-commerce business and that its growth will be very strong as the native e-commerce shopping experience continues to improve.。

In addition, Robin Li specifically mentioned that Baidu is refactoring its advertising system with the Wenxin model.。He said Baidu's efforts to use generative artificial intelligence technology in creative construction, precision delivery and bidding optimization are gradually taking effect, and the revenue growth driven will exceed hundreds of millions of yuan in the fourth quarter.。

Li called the feedback from advertisers on its new features good, and said advertisers adopting AI's new features achieved an average high single-digit conversion rate growth in the third quarter.。In the case of IT professional education company Dane Education, for example, the conversion rate increased by 23% after using the new features..3%, ROI increased by 22.7%。He added: "We already have thousands of advertisers using the new platform, and while the numbers are small, the growth rate is certainly fast.。"

Li also revealed that Baidu is experimenting with AI chatbots, which can replace advertising landing pages in the future.。This is particularly useful in verticals, he says, as users often spend a long time researching and making decisions before making a purchase.。"With our AI chatbot, users can quickly learn about brand-specific information, product details, and other information.。"

AI chat robot with general AI new search is generating revenue for Baidu。Li said, "We believe that AI chatbots can work well with General AI New Search and bring us more opportunities, and revenue in this area is expected to reach hundreds of millions of yuan in the quarter, and the growth rate is definitely very fast.。"

Wen Xin has become the first AI product to touch commercialization in China

On August 31, Baidu announced that Wenxin Yiyan took the lead in opening up to the whole society.。On October 17, Wenxin Yiyan announced the upgrade, officially released 4.Version 0。

According to the company, the number of users has reached 70 million.。At present, Baidu Smart Cloud Qianfan's large model platform serves more than 20,000 enterprises, covering nearly 500 scenarios.。

On November 1, Baidu officially launched Wenxin Yiyan Professional Edition, priced at 59.9 yuan / month, continuous monthly discount price 49.9 yuan / month。At the same time, the basic version of Wenxin Yiyan, which has been open to users before, is still free to use.。Among the many similar products in China, Wenxin Yiyan is the first to touch commercialization, which shows that Baidu is quite confident in its products.。

Baidu said that as its search service will be able to achieve natural language dialogue and multiple rounds of dialogue, the company's commercial monetization potential will be greater, Baidu is also testing advertising products for small and medium-sized enterprises and brands, which will help promote revenue conversion rate, from a single click charge (CPC) to the actual number of products sold to charge (CPS) shift, helping merchants to better operate their business on Baidu platform.。

On the other hand, given that it is very difficult to build large models from scratch, Baidu expects that more and more customers will switch to using advanced large language models on the market, including Wenxinyiyan.。And as users become more proficient in using large language models to develop applications, the native applications of artificial intelligence enabled by Wenxin Yiyan will be more widely used, and Baidu's revenue from model reasoning services will continue to grow.。Baidu will also adjust model services for customers to meet their individual needs in different scenarios.。

Robin Li said: "In general, generative artificial intelligence and large-scale language model technology have brought significant opportunities for the company's development, and we have also made a lot of progress in commercial realization, with unlimited future potential.。"

Robin Li: U.S. chip export restrictions have limited impact in the short term

In October, the United States opened a new round of chip export restrictions, and the relevant measures took effect on November 16.。

In its third-quarter earnings report, Alibaba said the restrictions could have a material adverse impact on the Cloud Intelligence Group, but could also have a broader impact on multiple related businesses, limiting the company's ability to upgrade its technology.。In this case, Alibaba has announced that it will not promote the complete spin-off of the cloud intelligence group.。

So Baidu, which is also making great efforts to catch up with AI, is also worried about the lack of chips.?

In response, Li responded that export restrictions will have a limited impact on Baidu in the short term。And said Baidu has a large reserve of artificial intelligence chips, which can support it in the next year or two to continue to update the Wenxin model.。In addition, the Wenxin big model does not require a powerful chip, Baidu's chip reserves and other alternatives will be enough to support a large number of AI native applications for end users.。

But Li also admitted that in the long run, the difficulty of obtaining the most advanced chips will inevitably affect the pace of China's AI development.。He said Baidu is actively looking for alternatives, although these options are not as advanced as U.S. chips.。

Shen Shake, president of Baidu Smart Cloud Business Group, mentioned that some of Baidu's customers are actually more willing to train their models, but export restrictions on chips will reduce this activity。

In this case, for the future competitive landscape of the basic model industry, Robin Li believes that the industry will soon enter the integration phase, taking into account the scarcity of high-performance chips, the large demand for data, artificial intelligence talent, and huge upfront investment.。

Li said: "We believe that there will only be a few basic models in the market, and Baidu is definitely one of them.。At this stage of industry development, more and more companies will use advanced basic models such as Wenxin Yiyan to create AI native products instead of spending resources to build their own large language models, and we expect the number of native applications based on Wenxin Yiyan to reach millions in the future。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.