Ali Q3 earnings report after the negative frequency: cloud business is no longer split box horse IPO suspension Ma Yun will again reduce holdings

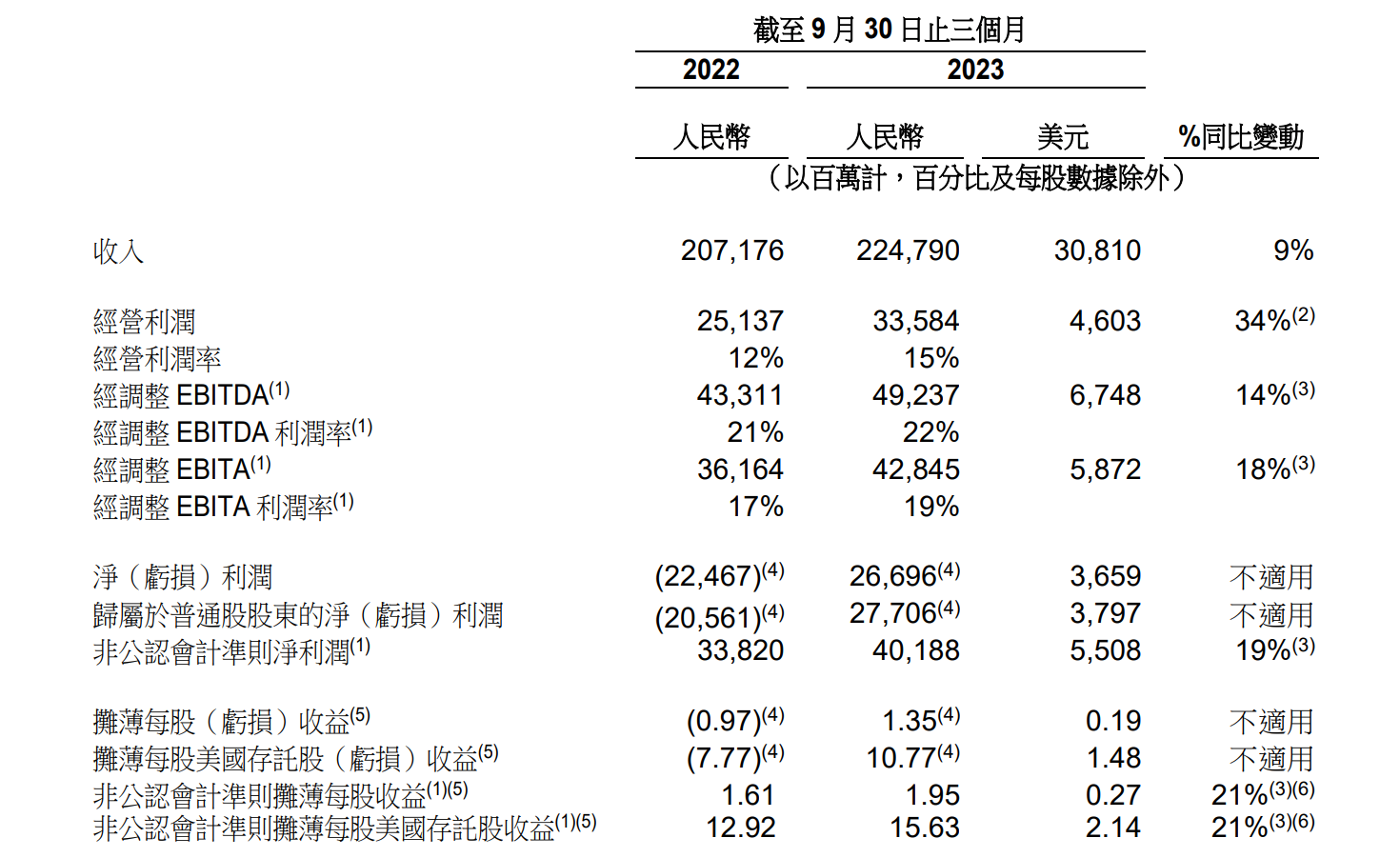

On November 16, Alibaba released its quarterly results for the three months ended September 30, 2023, with overall results exceeding expectations。In the third quarter, Ali achieved revenue of 2,247.900 million yuan, up 9% year-on-year。Net profit was 266.9.6 billion yuan, a year-on-year turnaround。

On November 16, Alibaba Group (hereinafter referred to as "Ali") released its quarterly results report for the three months ended September 30, 2023, and its overall performance exceeded expectations.。

Performance data shows that in the third quarter, Ali achieved revenue of 2,247.900 million yuan (RMB, the same below), up 9% YoY。Net profit was 266.9.6 billion yuan, a net loss of 224 in the same period last year..6.7 billion yuan, a year-on-year turnaround。Adjusted net profit 401.8.8 billion yuan, up 19% year-on-year。

Net cash flow from operating activities was 492.3.1 billion yuan, up 4% year-on-year。Free cash flow is 452.2 billion yuan, up 27% year-on-year。

In the third quarter, Ali repurchased approximately $1.7 billion of approximately 18.6 million American depositary shares (equivalent to 1.48.4 billion shares of common stock)。Ali also said it would pay an annual dividend totaling about $2.5 billion.。

International Digital Business Group Outperforms in Revenue, Rookie Increases Six Times Adjusted EBITA

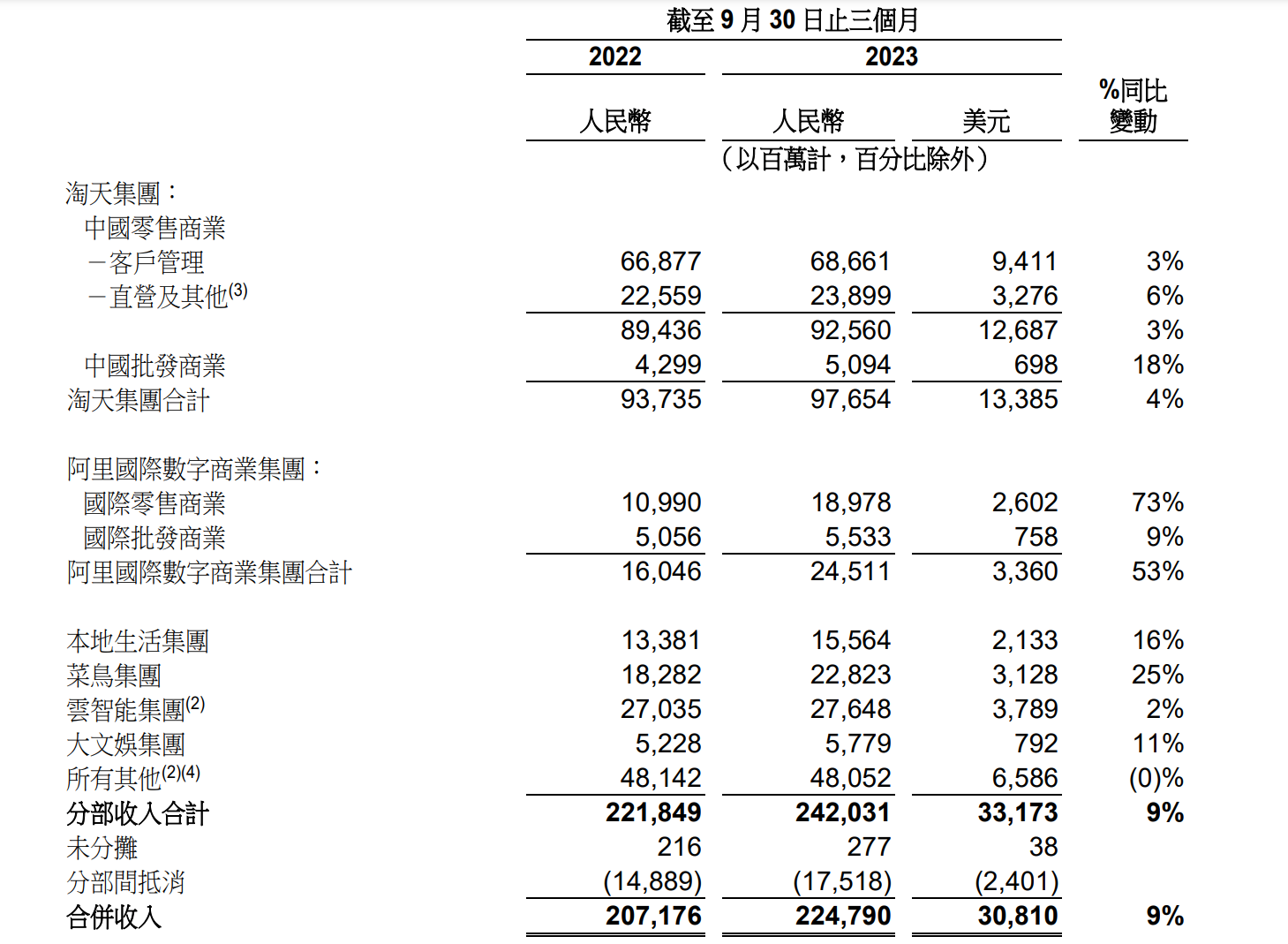

Specifically, the performance of Ali's businesses in the third quarter。

● Amoy Group

In the third quarter, Amoy Group recorded revenue of 976.5.4 billion yuan, up 4% year-on-year。Adjusted EBITA of 470.7.7 billion yuan, up 3% year-on-year。

In the third quarter, the number of buyers and orders on Taobao recorded growth.。88VIP membership exceeds 30 million in Q3, achieving double-digit year-over-year growth。During this year's Double Eleven, Tmall recorded positive growth in participating merchants, transaction buyers and orders compared to the same period last year.。In addition, in September, the average daily active user (DAU) of idle fish increased by more than 20% year-on-year.。

● Ali International Digital Business Group (AIDC)

In the third quarter, Ali International Digital Business Group achieved revenue of 245.1.1 billion yuan, up 53% year-on-year。Adjusted EBITA to -3.8.4 billion yuan, loss narrowed 49% year-on-year。

Alibaba International Digital Business Group operates multiple retail and wholesale market platforms, including Lazada, AliExpress, Trendyol, Daraz, Miravia and Alibaba..Com。In the third quarter, overall AIDC retail commerce orders grew by approximately 28% year-over-year, driven by the strong performance of all major retail platforms.。Meanwhile, AIDC recorded strong revenue growth, up 53% year-over-year。

Among the better performers were AliExpress, Lazada and Trendyol.。In the third quarter, AliExpress achieved double-digit year-on-year growth in the number of orders in its existing market platform business。Lazada's orders also recorded double-digit year-on-year growth.。According to Ali, Lazada continues to focus on improving its realisation rate, so each loss narrowed in the third quarter on the same and ring-fenced basis.。Trendyol, for its part, recorded strong order growth while investing in expanding its business outside Turkey。

● Local Living Group

Local Life Group achieved revenue of 155 in the third quarter.6.4 billion yuan, up 16% year-on-year。Adjusted EBITA to -25.6.4 billion yuan, loss narrowed 23% year-on-year。The business group consists mainly of Ele.me and Gode.。

In the third quarter, orders from the Local Living Group rose nearly 20% year-on-year, driven by strong growth in the Hungry Noodles and Golder businesses.。Benefiting from improved user acquisition and retention, as well as increased user demand, Local Life Group's annual active consumers continued to grow quarter-on-quarter for the 12 months ended 30 September 2023.。In the third quarter, the group's losses continued to narrow, driven by improvements in overall business size and efficiency.。

In the third quarter, Ele.me losses continued to narrow year-on-year, thanks to its improved operating efficiency and expanded scale。On the Gaud side, during this year's Mid-Autumn Festival and National Day holidays, Gaud's daily active users peaked at more than 2.800 million, a record high。

● Cainiao Group

In the third quarter, Cainiao Group's revenue increased 25% year-on-year to 228.2.3 billion yuan, mainly driven by revenue from cross-border logistics fulfillment solutions。Adjusted EBITA to 9.06 billion yuan, up 625% year-on-year。

According to Ali, Cainiao launched a global 5-day high-quality logistics service for consumers in 8 countries and regions in the third quarter.。The project takes advantage of Cainiao's comprehensive capacity for full link operation optimization, including first-leg collection, trunk transportation, customs clearance, sorting and last-mile distribution.。In addition, rookies remain competitive through technology。To support the expansion of AliExpress Choice, Cainiao provides package consolidation and drop shipping capabilities through data analysis and algorithms to reduce delivery times and improve efficiency.。

● Cloud Intelligence Group

In the third quarter, cloud intelligence group revenue was 276.4.8 billion yuan, up 2% year-on-year。Adjusted EBITA to 14.0.9 billion yuan, up 44% year-on-year。

During the quarter, the Company continued to improve revenue quality by reducing revenue from lower-margin project-based contracts.。At the same time, revenue from public cloud products and services grew in the quarter, driving profitability optimization。

It is worth mentioning that at the annual cloud computing developer summit and exhibition - "cloud habitat conference 2023" held from October 31st to November 2nd, cloud intelligence group released new technologies under development, including the highlights of independent research and development technologies:

(1) Generative AI model: Alibaba's own large language model "Tongyi Thousand Questions" launched 2.0 Upgrade Version。

(2) Ecosystem: Currently, Alibaba's developer community, ModelScope, is one of the largest open source AI developer communities in China.。Since its launch, it has gathered more than 2,300 AI models, attracted 2.8 million AI developers, and accumulated more than 100 million model downloads.。Ali said that it will provide an open source version of the Tongyi Thousand Questions model on the magic ride, following the launch of the 7 billion parameter and 14 billion parameter versions, followed by the 72 billion parameter version.。

(3) Alibaba Cloud Bailian: As a one-stop AI application development platform, Alibaba Cloud Bailian can provide large language model application development services on a single platform, providing a variety of high-performance basic models, including models from third parties.。

● Big Entertainment Group

In the third quarter, Big Entertainment Group's revenue was 57.7.9 billion yuan, up 11% year-on-year, mainly driven by strong revenue growth in the offline entertainment business of Barley and Ali Pictures, as well as growth in Youku's subscription revenue, partially offset by a decline in Youku's advertising revenue.。Adjusted EBITA to -2.01 billion yuan, loss narrowed 44% year-on-year。

On September 19, Ali Pictures announced the acquisition of Barley, aiming to take advantage of Barley's leading position in the offline performance market to expand its influence in the offline entertainment industry.。Thanks to the recovery and strong demand in the offline entertainment market this summer, Barley GMV recorded triple-digit year-on-year growth in the third quarter, continuing to maintain its industry leadership, while profitability continued to improve year-on-year.。

● All other

Ali's "all other" businesses include nailing, flying books and smart information.。Revenue recorded in the third quarter was 480.5.2 billion yuan, basically flat year-on-year。Adjusted EBITA to -14.3.7 billion yuan, loss narrowed by 50% year-on-year。

In terms of nailing, from the quarter ended September 30, nailing was reclassified from the Cloud Intelligence Group to "all other" departments, the company explained that the purpose of the move is to provide greater autonomy for nailing to promote innovation and enhance market competitiveness.。As of September 30, 17 product lines have been fully integrated into the big model.。Nail also opens its intelligent base AIPaaS to customers and ecosystem partners to help ecosystem participants reshape their products.。

As for Feizhu, in the third quarter, Feizhu's GMV recorded rapid year-on-year growth amid a strong recovery in domestic and international tourism demand.。

Intelligent information aspects include quark, UC UTV, and other business。Among them, the DAU of quark increased by more than 35% year-on-year in September.。

After the Alibaba Cloud fault storm, the complete spin-off of the Cloud Intelligence Group presses the "pause button"

On the first day after Double Eleven, Ali had a "nightmare."。

On November 12, Ali's entire line of products broke down, and they "collapsed" on the hot search, triggering many netizens to discuss。

The cause of the accident came from Alibaba Cloud。Alibaba Cloud also announced later in the day that the console access and API call of Alibaba Cloud products were abnormal, and it was confirmed that the cause of the failure was related to an underlying service component.。After more than three hours of emergency maintenance by Alibaba Cloud engineers, the affected cloud products were restored one after another.。

The scope of Alibaba Cloud's failure this time is so wide and the time is so long, let alone inside Alibaba Cloud, even if you look at the cloud products of other friends, it is very rare.。This time the accident he also let Aliyun once boasted 99.99% High Security Questioned。

After the accident, there was a lot of discussion about the reasons behind the incident.。It is widely believed that Alibaba Cloud's "cost reduction and efficiency increase" strategy led to the loss of experienced senior technical personnel, or the main reason for the large-scale failure.。As of September 30, Ali's total number of employees was 224,955, and in the first nine months of this year, Ali laid off nearly 1.50,000 people。In addition, a major overhaul of the company's internal management model this year may also be one of the factors。

Less than a week after the failure of Alibaba Cloud products, Alibaba announced that the spin-off of the cloud intelligence group should press the "pause button."。

In its third-quarter earnings report, Ali said that the expansion of export restrictions on chips and semiconductors in the United States in October could have a material adverse effect on the ability of Cloud Intelligence Group to provide products and services and to fulfill existing contracts, thereby negatively affecting operating results and financial conditions.。These new restrictions could also have a broader impact on multiple related businesses, limiting a company's ability to upgrade its technology.。

The company says the situation creates uncertainty about the outlook for the Cloud Intelligence Group。The company believes that a complete spin-off of the Cloud Intelligence Group may not enhance shareholder value as originally envisaged, so it has decided not to move forward with a complete spin-off of the Cloud Intelligence Group, but will instead focus on building a model for the sustainable growth of the Cloud Intelligence Group in the face of uncertainty.。

It is worth noting that in addition to stating the suspension of the full spin-off of the Cloud Intelligence Group, Ali also disclosed the suspension of the IPO listing of another business group.。

According to the earnings report, Ali said that Hema's initial public offering (IPO) plan was suspended.。Ali mentioned in the first quarter of the financial report, the board of directors has approved the start of the implementation of the box horse listing process, and expects the listing will be completed in the next 6 to 12 months。In response to the sudden suspension of Hema's IPO, the company said it was assessing market conditions and other factors necessary to ensure successful progress in project implementation and enhance shareholder value.。

Ali also disclosed the spin-off and financing progress of other business groups, Ali International Digital Business Group is preparing for external financing; Cainiao Group has applied for an initial public offering in Hong Kong and has submitted A1 documents to the Hong Kong Stock Exchange。

Ma Yun once again reduced his stake in Ali

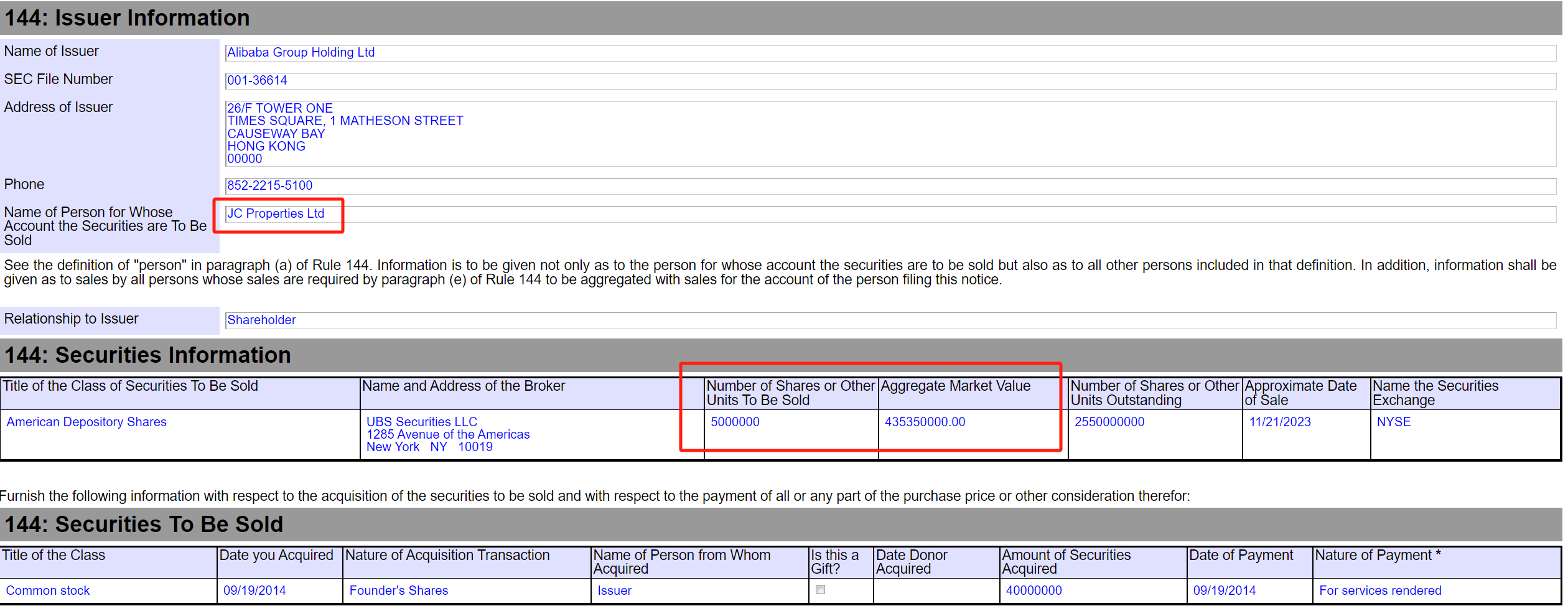

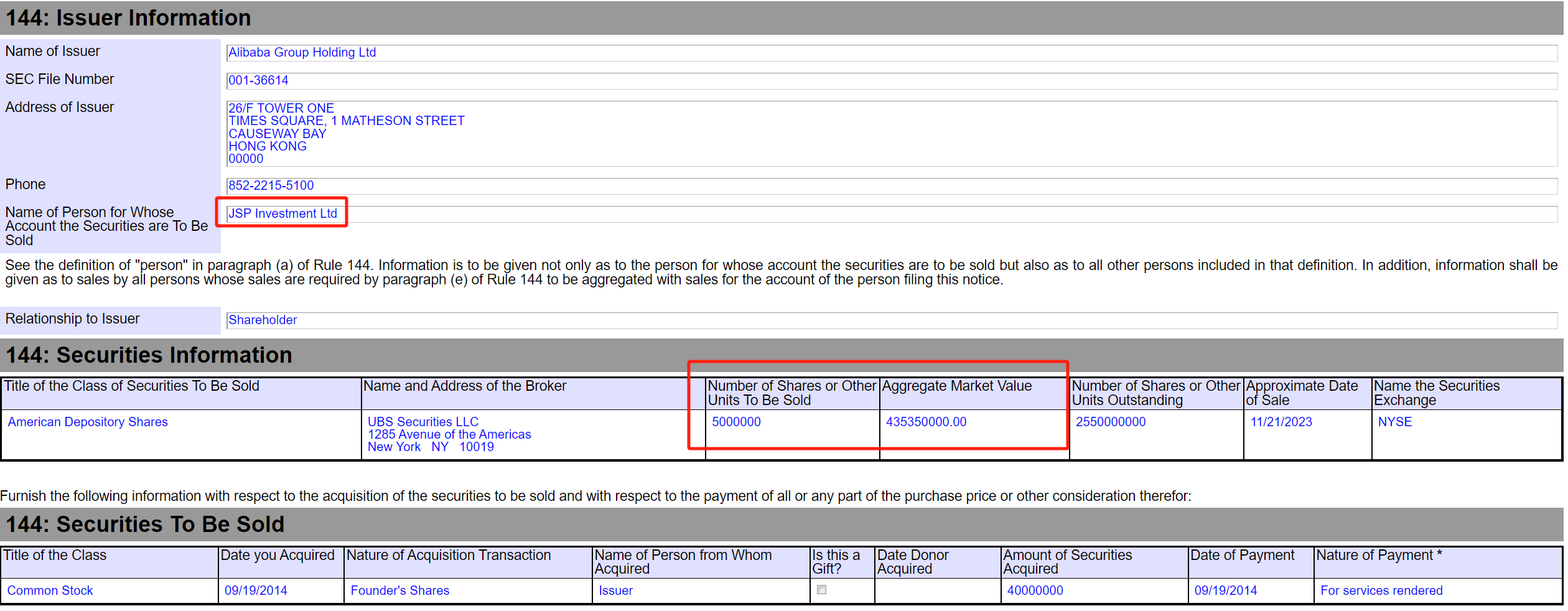

On November 14, local time, the U.S. Securities and Exchange Commission (SEC) official website disclosed 144 documents showing that two companies under the Jack Ma family trust - JC Properties Ltd.and JSP Investment Ltd.(both British Virgin Islands companies) to sell 5 million shares of Alibaba Founder on November 21, involving a total market value of 8.70.7 billion U.S. dollars (about 6.4 billion yuan)。

After the release of this news, and then superimposed on the cloud intelligence group will no longer promote a complete spin-off, box horse IPO suspension and other news, Ali's share price immediately under pressure。Today (November 17), Alibaba-SW experienced a rare plunge, closing at 73.HK $1, down more than 10%。

This is not the first time Ma has sold Alibaba shares.。Ma has sold his stake in Alibaba several times since the company went public。By Ali's return to HKEx in November 2019, Ma directly and indirectly held approximately 6.1% of Alibaba。Indirect holdings include JC Properties Ltd, which is wholly owned through a trust in which Jack Ma and his family are the beneficiaries..and JSP Investment Ltd., and APN Ltd, in which Ma owns 70%.

Ali's "Four Little Dragons" Appears

In the third quarter earnings call, Alibaba CEO Wu Yongming announced the first strategic level innovation business - 1688, idle fish, nail, quark。The status of "strategic level" has made netizens jokingly call these businesses Ali's future "four little dragons."。

The company said that the future strategic-level innovation business, the organization will operate as an independent subsidiary, the business will break the previous positioning restrictions in the group, Ali to 3-5 years as a cycle of continuous investment.。

At the call, Wu also explained the selection criteria for strategic-level innovative businesses, including having a large enough market space, having a unique market positioning, meeting user demand trends and conforming to the Group's "AI-driven" strategy.。

Wu Yongming said that 1688 is Ali's oldest business, serving the mainstream manufacturers of China's manufacturing industry, with a solid foundation and great potential for a second venture, is expected to extend from B2B business to small and medium-sized enterprises and consumer procurement, while having the ability to support cross-border transactions.。Idle fish will be a lifestyle platform for young consumers' hobbies and fun。Nails and quarks because of the arrival of the era of AI, access to unprecedented imagination。Wu said: "Everyone and enterprises will have personalized intelligent assistant, and nail is expected to become the best AI intelligent assistant platform。In the era of big models, quarks have a huge opportunity to create innovative search products for young people.。"

Wu Yongming believes that successful technology companies must have the ability to cross the technology cycle。There is no long-term moat for any product.。Facing the AI era, Alibaba will resolutely devote itself to the scientific and technological revolution and product innovation, create and incubate innovative businesses and scientific and technological products, and meet the new expectations and demands of the expanding market for products and services.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.