Jingdong released Q3 earnings release: full chain layout to pull "low price" model growth

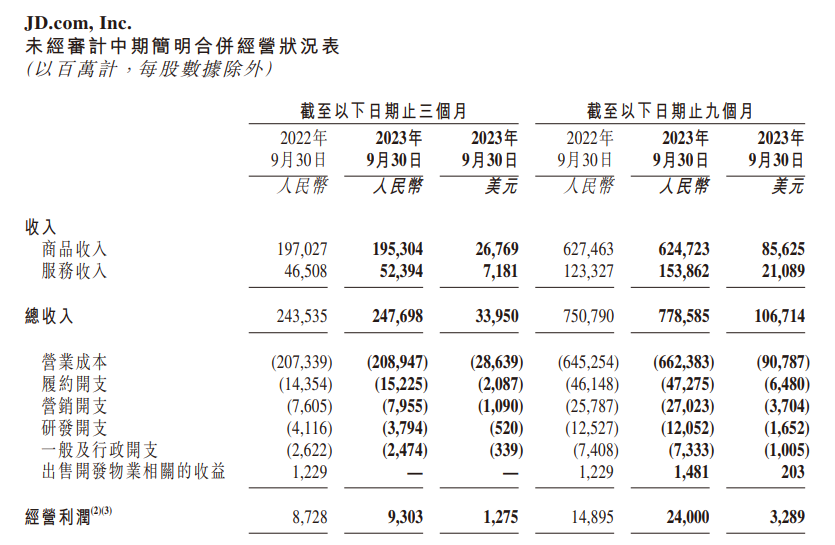

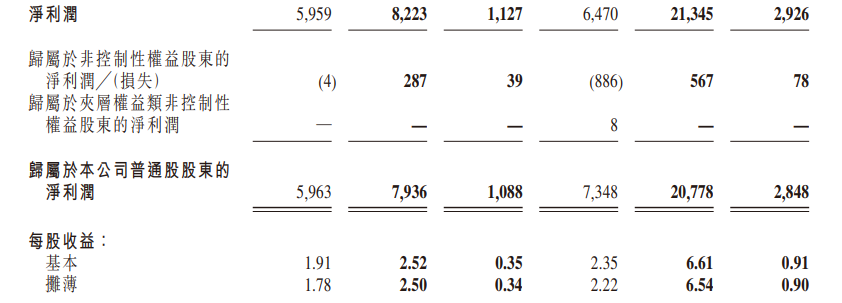

Jingdong Group disclosed its Q3 2023 results announcement, with total revenue of RMB247.7 billion during the period, up 1.7%, exceeding market expectations, net profit 82.2.3 billion yuan, with a net profit of 79.3.6 billion yuan。

On November 15, Jingdong Group ("Jingdong") disclosed its third quarter 2023 results announcement on the Hong Kong Stock Exchange.。

As of September 30, 2023, JD's total revenue was RMB247.7 billion (RMB, the same below), an increase of 1% over the same period in 2022..7%, exceeding market expectations; operating profit for the quarter was 93.03 billion yuan, compared with 87 in the same period last year..2.8 billion yuan; net profit 82.2.3 billion yuan, up 37.99%; net profit attributable to the parent was 79.3.6 billion yuan, up 33.09%; basic earnings per share 2.52 yuan。

Analysis of Performance Data

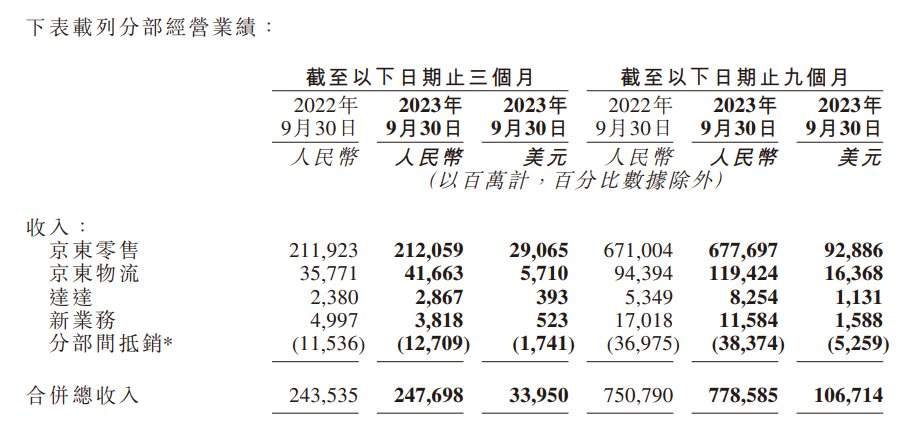

By business, in addition to the decline in revenue in the new business segment, the other three parts have increased.。

Jingdong Retail's third-quarter revenue was solid, with revenue of 2120 in the third quarter..5.9 billion yuan, compared with 2119 in the same period last year.2.3 billion yuan。Jingdong Logistics Revenue is 416.6.3 billion yuan, compared with 357 in the same period last year.7.1 billion yuan, mainly driven by increased revenue from integrated supply chain customers and other customers.。

In addition, US-listed local timely distribution and retail platforms reach revenue 28.6.7 billion yuan, up 20% year-on-year.5%。New business is down 23.6% to 38.1.8 billion yuan, the business mainly includes Jingdong production and development, Jingxi and overseas business.。

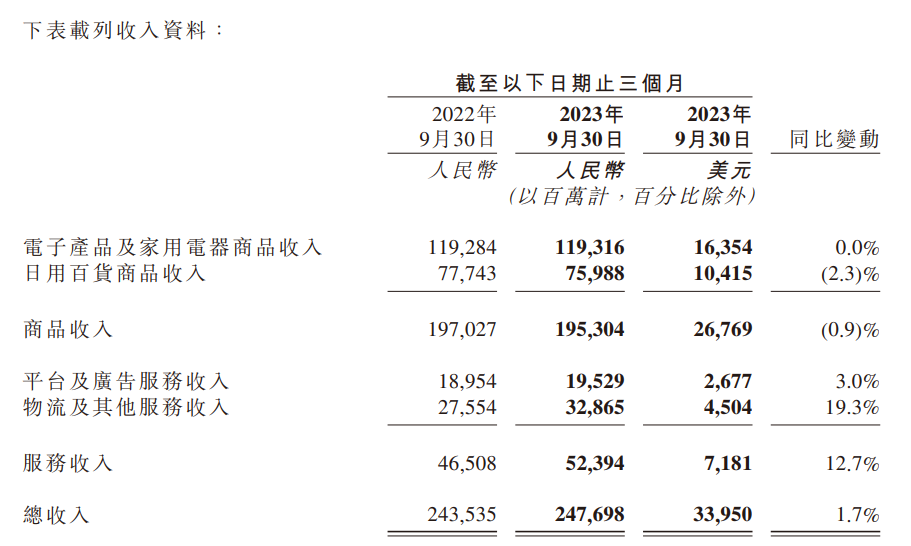

Looking at the revenue structure, Jingdong's 3C digital category revenue maintained a year-on-year growth rate, still higher than the industry average, but due to a small decline in daily necessities revenue (2.3%), resulting in a small decline in commodity revenue of 0..9%。

Service revenue reached RMB52.4 billion, accounting for 21% of overall revenue..2%, the first time more than 20%, of which, in addition to platform and advertising services revenue slightly increased (3%), logistics and other aspects of revenue growth of 19.3%, with a big breakthrough。

"The core categories of home appliances and electronics continued to expand market share," said Chief Financial Officer Dan, while general merchandise gained momentum in the quarter, mainly due to our continued focus on the user experience.。In the future, Jingdong will continue to promote high-quality growth, increase investment in user experience, and build a better ecology for the sustainable growth of merchants and suppliers.。"

All-round layout drives sustainable growth

Group CEO Xu Ran said in the financial report, Jingdong Q3 revenue performance is solid, profit level reached a record high, mainly due to price competitiveness and platform ecological construction efforts and supply chain advantages.。The expansion of the number of merchants and the improvement of user buying behavior have contributed to the group's long-term sustainable growth.。

Platform side: "Chunxiao" merchants benefit from unexpected growth in 3P direction

In the third quarter of this year, Jingdong continued to promote the platform ecological construction strategy and price competitiveness strategy, focusing on the three aspects of "cost, efficiency and experience," and tried its best to expand the group's development of high quality, sustainable and high value.。

It is reported that Jingdong has released a series of business support measures through the "Chunxiao Plan" to create a store experience of "more traffic, faster operation, better service and more cost-saving" for businesses.。

On the one hand, Jingdong cancelled the 90-day "0 yuan trial operation" period for some merchants, during which no deposit was required; on the other hand, Jingdong extended the technical service fee rate to 98% for categories as low as 0 yuan for individuals and self-employed merchants.。As a result, Jingdong Q3 saw a surge in the number of merchants and active merchants, both reaching record highs。Jingdong simplifies the process of merchants entering, so that more and more new merchants are familiar with the rules of the game, find their own business model, and continue to grow and grow。

At the same time, the platform is also the key strategic direction of Jingdong, and although the realization of third-party platform merchants is not Jingdong's top priority in this period, it still achieved a year-on-year growth in the number of third-party retailer (3P) orders and the number of 3P active users, and the frequency of user orders and participation has increased.。

As for offline stores, Jingdong has also never relaxed its pace.。During Q3, more than 50 stores such as Jingdong MALL and Jingdong Home landed in Ningbo, Shanghai, Wuhan and other places, initially building an industry ecology of home appliances, home furnishing and home improvement collaboration.。As for 3C digital stores, Jingdong continues to deepen its omni-channel layout, and Q3 promotes the opening of 47 new Jingdong Home and Jingdong Computer Digital stores, covering cities such as North, Shanghai, Guangzhou and Shenzhen.。

Supply chain side: full coverage of logistics network, cost reduction and efficiency improvement

Jingdong has proved through 20 years of practice that in the business ecology, consumers, brands and merchants are not "zero-sum games."。

As of the end of the third quarter, Jingdong's supply chain infrastructure assets grew 17% year-on-year to $148.6 billion.。Jingdong Logistics operates more than 1,600 warehouses, including the management area of the cloud warehouse ecological platform, and the total management area of Jingdong Logistics warehousing network has exceeded 32 million square meters.。In the overseas air cargo market, Jingdong Airlines has also officially opened the "Shenzhen-Ho Chi Minh" international cargo route.。

In terms of logistics services, Jingdong announced in August this year to lower the threshold of free mail for self-operated goods - Jingdong PLUS members can enjoy unlimited number of times, unlimited unit price, unlimited degree of annual free mail service, ordinary users "99 yuan free mail" upgrade to "59 yuan free mail."。At the same time, it can still be superimposed on the "211 time limit" and other services, from merchants to consumers, Jingdong's cost optimization initiatives continue to improve the universality of。

For different categories of goods, Jingdong will provide users with more diversified products, and will also work with brand manufacturers to develop new trends and lead the industry trend.。As for services, Jingdong will further improve its online and offline retail and service capabilities, strengthen its supply chain and cost performance, and improve service quality to leverage potential consumer demand.。

In the third quarter, JD's record profit level and healthy cash flow reflected successful business progress and supply chain strengths, "said Group Chief Financial Officer Shan。In the long run, our profit improvement still comes from the improvement of supply chain efficiency and the gradual improvement of the platform ecology, and the long-term and solid goal of improving profitability has not changed.。"

Low-cost model: cost reduction and efficiency is not a day's work win-win situation is just around the corner.?

On the Q3 earnings call, Xu Ran said that Jingdong did not shift its focus from the core competitiveness of its brand products or serving the high-end market.。

2023 is the year of Jingdong's full return to low prices and a year of intensive organizational adjustment.。At the same time, the e-commerce industry is also experiencing a game with low price competition and subsidy competition as the core.。In the "Double Eleven War" just past, Jingdong's low-cost model benefited consumers, brands and merchants, and Jingdong, making the turnover, order volume, and number of users record highs.。

But in fact, despite the e-commerce campaign in full swing, the growth trend in the industry is showing signs of weakness.。The competition in the e-commerce industry has shifted from the speed and price of the past to deeper competition.。

It is obvious that retail is the foundation of Jingdong and the main source of revenue and profit.。Since the implementation of the "low-cost strategy," Jingdong has increased subsidies and concessions, and promoted self-management and three-party business flow parity, which will affect revenue to a certain extent, which is also a short-term pain that must be experienced.。

For the low-cost model where to go, Liu Qiangdong's answer is: do not blindly low-cost subsidies, but by optimizing the cost of compliance, "save" can be used to subsidize the "funds," and through the scale effect to allow businesses to "reduce prices" while maximizing benefits.。

In the future, how Jingdong can reduce costs and increase efficiency in the supply chain, so that they can make money at the same time, so that the brand partners and users, so as to achieve sustainable growth, let us wait and see。

Xu Ran's Retail CEO Has Multiple Jobs

Along with the Q3 results, there is also a major personnel adjustment - Jingdong Group CEO Xu Ran will also serve as Jingdong Retail CEO, effective immediately, the former Jingdong Retail CEO Xin Lijun has another。

From CFO to group CEO to concurrently CEO of JD Retail, behind Xu Ran's appointment is Liu Qiangdong's emphasis on the retail sector。

From values to business models, Jingdong is bound to need a more detailed leader, and Xu Ran, who has a financial background, is just capable of carrying this banner.。After years of hard work, Xu Ran should have a more acute and in-depth insight into the fine management and cost reduction and efficiency of the enterprise, as well as a more professional ability.。

Xu Ran's appointment will bring many benefits to Jingdong:

First of all, Xu Ran's "lead" will change the previous operating model of Jingdong Retail, so that the synergy between the Group and the retail business has been significantly strengthened, the Group's will will be more direct, faster and more efficient implementation to the retail side.。This personnel change has essentially become a continuation of Jingdong's structural adjustment.。

Secondly, Xu Ran will better lead Jingdong to focus on the five elements of "product, price, service, cost and efficiency," and on the premise of not harming the user experience and the group's "wallet," optimize the profitability of the core e-commerce business through effective cost reduction and efficiency enhancement, and stimulate market vitality with "true low price," thus releasing the group's growth potential.。

After many years, Jingdong again let the same person as the group and retail CEO, and the last one is Liu Qiangdong himself。Jingdong's personnel adjustment is the "heat wave" in the killer, or fatigue under the "life-saving" good prescription, let Xu Ran for us to answer。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.