The share price is close to halving! Jingdong subsidiary Dada financial thunder spooked the market

On January 8, Jingdong announced that its consolidated subsidiary Dada had discovered some questionable behavior during its regular internal audit, which could raise questions about revenue from certain online marketing services and operating support costs in the first three quarters of 2023.。

On January 8, Jingdong announced that its consolidated subsidiary Dada Nexus Limited (hereinafter referred to as "Dada") in the regular internal audit process found some suspicious behavior, these behaviors may cause some of the first three quarters of 2023 Dada online marketing service revenue and operating support costs questioned。

To this end, the Audit Committee under Dada's Board of Directors has decided to conduct an independent review, which will be conducted with the assistance of independent professional advisers, including a forensic accounting firm that is not a corporate auditor and an international law firm.。

Jingdong stressed that the Group has always been and will continue to be committed to maintaining high standards of corporate governance and internal control, as well as transparent and timely information disclosure in compliance with relevant rules and regulations.。

In addition to the announcement issued by Dada, the Company's preliminary assessment is that the Company's online advertising and marketing services revenue (approximately RMB 500 million) and operating and support costs (approximately RMB 500 million) for the first three quarters of 2023 may have been exaggerated.。Therefore, the Company's previously provided revenue guidance for the fourth quarter and full year 2023 should no longer be relied upon until further notice.。

According to reports, some Dada insiders said that the incident was voluntarily discovered by Dada during the audit, or caused by an individual suspected of fraud.。"We have reported the case to the public security organs. In addition, the matter does not involve Dada's core business and the scope of impact is very limited."。

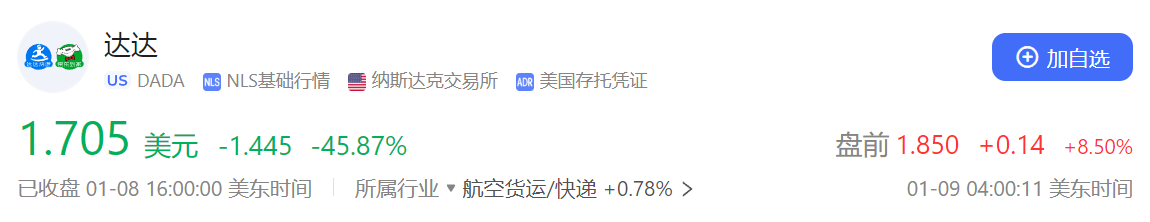

Dada U.S. stocks plunge on news。On January 8, local time, Dada shares were close to halving, closing at 1.705 dollars, down 45.87%。

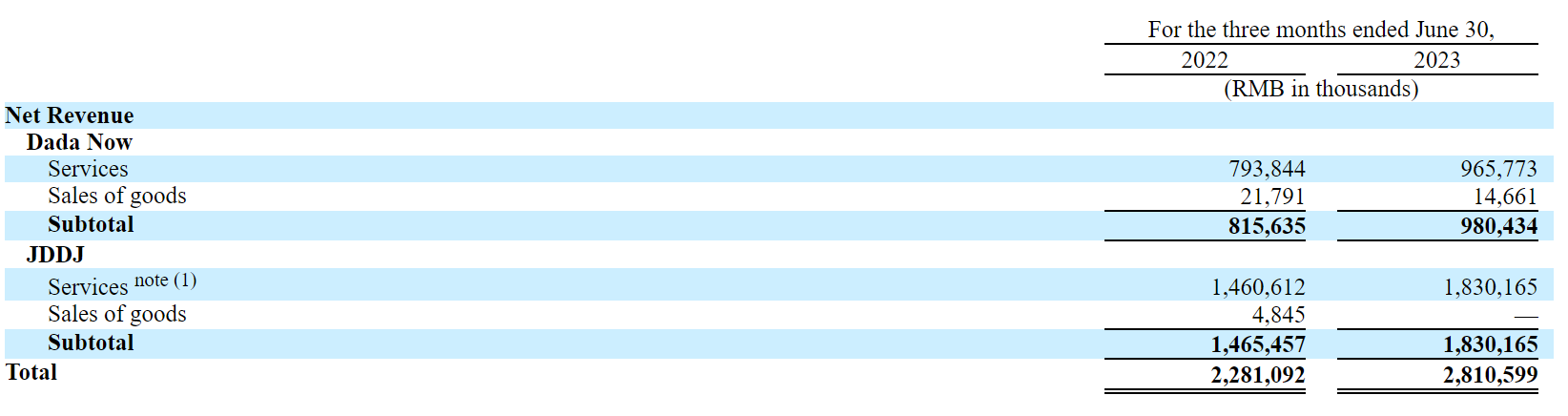

Dada is China's leading local on-demand retail and distribution platform.。The company has two main businesses - JDDJ (JDDJ) and Dada Now (Dada Now), the former for retailers and brand owners, and the latter for merchants and individual senders across industries and product categories.。At present, Dada Express's business covers more than 2,700 counties, districts and cities nationwide, and Jingdong Home's business covers more than 1,700 counties, districts and cities nationwide.。

In addition, Dada, as a consolidated subsidiary of Jingdong, had a 53% stake in Dada as of March 31, 2023.。

According to Dada's third quarter 2023 results, the company's net income was 20.6.7 billion yuan (RMB, same below), up 20% YoY。Of these, Dada Express's net income was 17.8.5 billion yuan, up about 29% year-on-year; Jingdong's net income from home was 10.7.2 billion yuan, up about 16% year-on-year。

In its earnings report, Dada expects the company's total net income to be between $3 billion and $3.3 billion in the fourth quarter of 2023, up 12% to 23% year-over-year.。

It's worth noting that Dada has been losing money since its U.S. listing in 2020, and it wasn't until the second quarter of 2023 that Dada turned a profit.。At the time, Dada's president, He Huijian, said in the financial report: "This extraordinary milestone is a testament to the competitive vitality of our unique business model and the results of our strategy to pursue high-quality growth.。We are convinced of the long-term market potential of the on-demand retail and distribution industry, and we will continue to create sustainable value for all stakeholders by deepening our partnerships with retailers and brands, optimizing the consumer experience, bringing flexible employment opportunities to riders, and strengthening our strategic cooperation with Jingdong.。"

In addition, Dada just recently experienced a high-level shock.。On December 19, 2023, Xin Lijun, Chairman of the Board of Directors and Member of the Nomination and Governance Committee of the Company, resigned for personal reasons.。According to public information, Xin Lijun is currently Executive Vice President of Jingdong Group and CEO of Jingdong Retail.。At the same time, the company's chief financial officer Chen Zhaoming also resigned from the company for personal reasons.。

Citi takes quick rating action after Dada blows up financial problems。On January 9, Citi cut Dada's target price from $6 to $1..$8 and downgraded its rating from "buy" to "sell"。

Citi said that after the resignation of the chairman and chief financial officer of the city distribution services company Dada Group last month, it submitted documents on the 8th that some of the questionable behavior was found during the regular internal audit process.。The bank believes that the incident may be partly related to the departure of Dada's management last month, which, in addition to affecting the confidence of business partners and users, also has uncertain prospects for future business growth, and therefore downgrades Dada's forecasts for the fourth quarter of last year and this year and next.。

Citi pointed out that the $500 million in online promotion services revenue that could be straddled is equivalent to about $600 million in total revenue in the first three quarters of last year..1%, $500 million in operating and support costs is equivalent to 9% of total operating and support costs..8%。At the parent company Jingdong level, each is equivalent to 0% of total revenue in the first three quarters.064% and 0 of the cost.075%。

Citi believes there is still a risk of a downward revision to the company's earnings forecast as Dada's financial statements remain uncertain and believes the stock is subject to considerable uncertainty in the coming months。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.