Ali Disassembles Jingdong?Its Jingdong Production and Development and Jingdong Industry have been submitted to the Hong Kong Stock Exchange.

On the evening of March 30, Jingdong Group successively disclosed the announcement documents on the Hong Kong Stock Exchange.。The announcement said that Jingdong Group intends to spin off its Jingdong Production and Development and Jingdong Industrial to be listed independently on the main board of the Hong Kong Stock Exchange.。Subsequently, JD and JD Industrial immediately submitted their listing application documents to the HKEx, disclosing their business composition and operating data for the first time.。

Ali recently announced the adjustment of the group's organizational structure to "1 + 6 + N," and claimed that all subsidiaries will have the opportunity to go public when they mature.。The move drew cheers from the market and its share price rose in response, as the market believed that Ali's value had finally been unleashed。Last night, another Internet giant followed suit, showing the market what speed of action is。

Jingdong also dismantled and went public after dismantling.

On the evening of March 30, Jingdong Group successively disclosed the announcement documents on the Hong Kong Stock Exchange.。The announcement said that Jingdong Group intends to spin off its Jingdong Production and Development and Jingdong Industrial to be listed independently on the main board of the Hong Kong Stock Exchange.。Subsequently, JD and JD Industrial immediately submitted their listing application documents to the HKEx, disclosing their business composition and operating data for the first time.。

It is reported that Jingdong Production and Development is the only storage and logistics facilities development and operation management sub-group under Jingdong Group, holding all self-built storage and logistics facilities projects under Jingdong Group.。As of the date of the announcement, JD Group, through a wholly-owned subsidiary, held approximately 74% of the total issued share capital of JD..96%。After the completion of the spin-off, JD Group will continue to indirectly hold more than 50% of JD's equity, therefore, JD will remain a subsidiary of JD Group。Jingdong Group will continue to operate (including) online retail and e-commerce platform businesses.。

Jingdong Industrial mainly provides customers with industrial supply chain technology and related services, aiming to help customers improve supply chain reliability, reduce costs and improve efficiency.。To date, Jingdong, through its wholly-owned subsidiary, holds 77% of the total issued share capital of Jingdong Industrial.About 95%。After the completion of the spin-off, Jingdong Group will continue to indirectly hold more than 50% of Jingdong Production and Development, therefore, Jingdong Industry will also remain a subsidiary of Jingdong Group.。

Like Ali in the previous two days, Jingdong was boosted by the news and its share price surged in response。Last night, U.S. stocks, Jingdong opened high, and finally closed up nearly 8%, today's Hong Kong stocks, Jingdong Group-SW also rose more than 8% in the session, but the afternoon gains narrowed, and finally closed up 5.39%, now HK $172。

Jingdong Production and Development: The Cornerstone of Jingdong Group's Supply Chain Ecosystem

According to HKEx disclosure documents, JD Productivity (JD Intelligent Productivity Co., Ltd.; JINGDONG Property, Inc..) Formal submission of A1 application documents to the Hong Kong Stock Exchange, co-sponsors of Bank of America Securities, Goldman Sachs and Haitong International, and financial adviser to UBS Group.。The company was incorporated in the Cayman Islands in January 2012 and received two rounds of funding in 2021 and 2022.。

According to public information, JD is the leading and fastest-growing modern infrastructure development and management platform in China and Asia, focusing on logistics infrastructure and laying out diversified industrial parks.。As an important part of JD Group's supply chain ecosystem, JD takes "intelligent industry empowering urban development" as its mission, and provides comprehensive solutions for the construction and operation of modern standard warehouses, integrated intelligent industrial parks, data centers, photovoltaic new energy and other infrastructure for the whole industry through investment and development, asset management and diversified value-added services.。And in the third party logistics, e-commerce, manufacturing, retail and other new economic industries continue to cultivate。

According to the Jones Lang LaSalle report, from the beginning of 2018 to the end of 2022, the average compound annual growth rate of JD's total floor area expansion exceeded 40%。As of December 31, 2022, JD had accumulated a large portfolio of modern infrastructure assets with a total asset management scale of RMB 93.7 billion and a total floor area of RMB 23 billion..3 million square meters, covering 29 provincial administrative regions in China and 4 overseas countries。In terms of floor space, JD is currently ranked third in Asia and second in China.。

And JD has been actively expanding markets outside of China.。As of December 31, 2022, JD had 25 infrastructure projects in 4 overseas countries.。The first overseas market the company selected and entered was Southeast Asia, which was actively developed through the acquisition and management of a portfolio of assets in Indonesia and projects in Vietnam.。Another successful overseas market for JD is Europe, where the company has acquired stock projects in the UK and the Netherlands with the aim of improving operational efficiency through refurbishment and upgrading of the stock.。

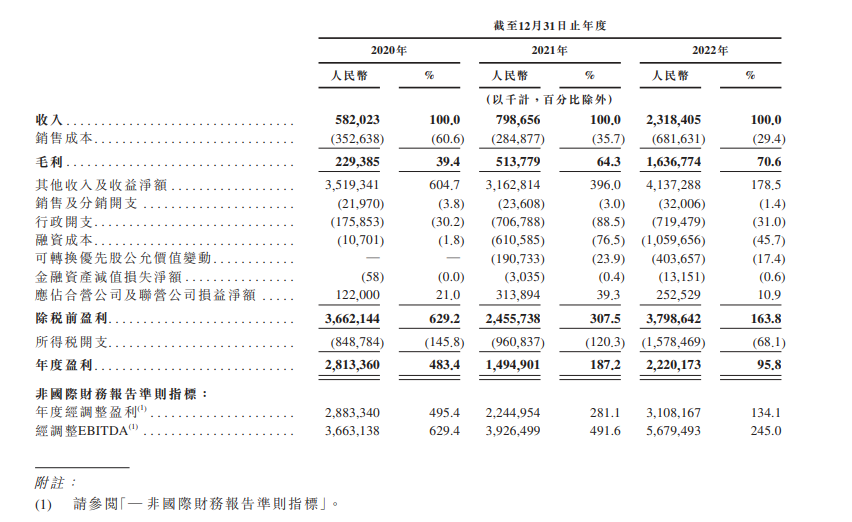

In terms of performance, according to public data, JD's revenue in 2020 was 5.8.2 billion yuan (RMB, the same below), in 2021 to 37..2% growth to 7.9.9 billion yuan, a further 190 in 2022.3% growth to 23.1.8 billion yuan。Due to the impact of the annual gain on changes in the fair value of completed and under construction investment properties during the performance period, JD's net profit was higher than revenue, and adjusted net profit during the performance period 28.8.3 billion yuan, 22.4.5 billion yuan and 31.08 million yuan。

In order to strengthen its unique position as a "super node" in the supply chain, JD has formulated relevant strategies for its future business development.。According to the report, the company will continue to focus on core distribution nodes across China and further strengthen the density and quality of its infrastructure asset network; continue to be located in strategic regions around the world and leverage business synergies through our cross-border modern infrastructure network; continue to recycle capital by selectively applying funds and investment vehicles and working with reputable long-term capital partners; continue to expand and diversify the company's customer base by improving service capabilities; and continue to capture opportunities in the modern infrastructure industry。

With regard to risk factors, although JD said in the report that the company does not currently have any material adverse changes, there are still risks to note: the success of the company's business depends on its ability to meet the growing snowball of modern infrastructure and whether the demand for change will continue to grow in the international community in which it operates; and the company may subsequently have a conflict of interest with JD Group;。

Finally, in terms of fund-raising purposes, JD said it will be used to further expand the domestic infrastructure asset network, focusing on core geographic locations and strategic logistics nodes; at the same time, to further expand its influence in overseas markets; in addition, it will be used for customer solutions and service capabilities, and continue to build rooftop photovoltaic power generation systems and other aspects of renewable energy management.。

Jingdong Industry: China MRO procurement services market ranked first

According to HKEx disclosure documents, JD Industries (JD Industries Co..) formally submitted A1 application documents to the Hong Kong Stock Exchange, whose co-sponsors are Bank of America Securities, Goldman Sachs and Haitong International.。Financial Advisors are UBS and CITIC Securities。It is reported that Jingdong Industrial completed the renaming in July 2021 and officially became an independent business unit of Jingdong Group.。Prior to this, its predecessor, "Jingdong Industrial Products," as a first-class category of Jingdong, won 2 in 2020..$300 million Series A funding round, valued at more than $2 billion。

According to the disclosure documents, JD Industry, as an independent business unit of JD Group, is positioned as an industrial supply chain technology and service provider, focusing on building digital infrastructure and creating value for the entire industry through the digitalization of the full-link industrial supply chain to ensure supply, reduce costs and increase efficiency for customers.。

According to the Insight Consulting report, JD Industries will have a turnover of RMB 22.3 billion in 2022, with a compound growth rate of 38.4%。In terms of 2022 transactions, JD Industries ranks first in China's MRO procurement services market and is the largest service provider in China's industrial supply chain technology and services market.。

According to the same data, as of December 31, 2022, as part of JD Industrial Services, the company's platform provided the widest supply of industrial products in China by SKU volume.。As of the same period, the platform has provided 48 product categories and approximately 42.5 million SKUs.。And in 2022, the platform will have partnered with about 30,000 manufacturers, distributors and agents at the same time.。

It is worth noting that in 2022, JD Industries has served 6,900 key corporate customers and more than 2.6 million SMEs, of which key corporate customers include about 50% of China's Fortune 500 companies and more than 40% of the global Fortune 500 companies in China.。

Public information shows that JD Industrial's business philosophy is to address the common pain points of the industry, through the construction of a full-link digital infrastructure, coupled with its services and operations, in order to achieve cost reduction and efficiency in the industrial supply chain.。And the company is the first to adopt a light model to build an efficient and scalable platform to provide customers of all industries and sizes with a comprehensive supply of industrial products and technologies and services across scenarios and categories.。

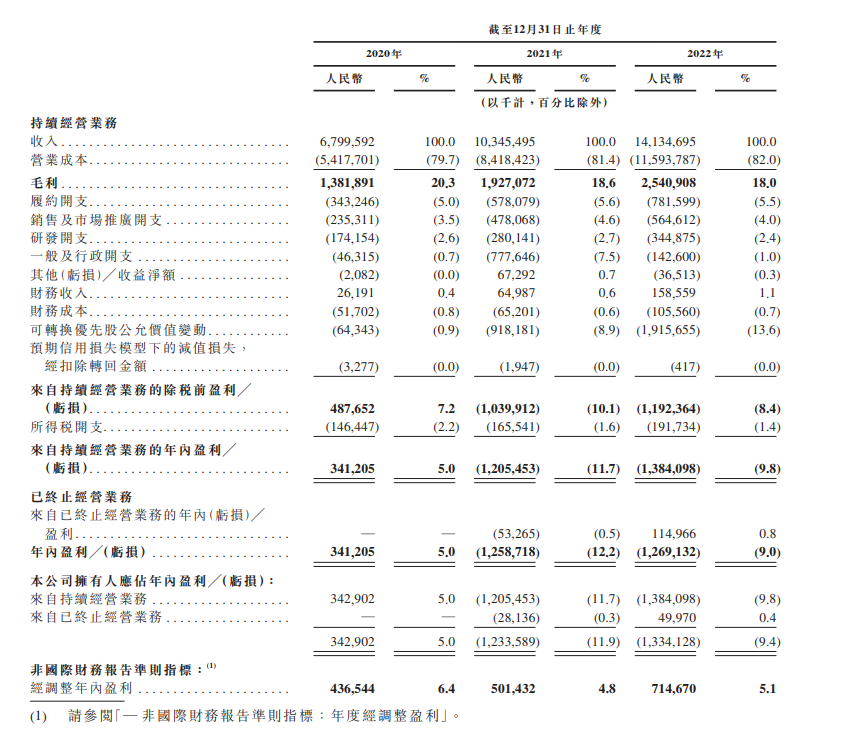

In terms of performance, according to public data, Jingdong Industry's total revenue from 2020 to 2022 was 6.8 billion yuan (RMB, the same below), 10.3 billion yuan and 14.1 billion yuan, respectively, with a compound annual growth rate of 44.2%; excluding the impact of discontinued operations, changes in the fair value of convertible preferred shares and share-based payment expenses, non-IFRS adjusted net earnings were 4.3.7 billion yuan, 5.01 billion yuan and 7.1.5 billion yuan。

Strategic direction and risks, JD Industries plans to adopt the following strategies: continue to improve the company's supply chain technology and operational capabilities; further expand the company's customer base and increase its pocket share of supply chain expenditures; continue to explore new market opportunities。In terms of risks, the Company's market and profitability are uncertain; there is a conflict of interest with JD Group; fluctuations and disruptions in supply and demand for industrial products and conditions related to them。

Finally, with regard to the purpose of the fund-raising, JD Industries said it intends to focus the funds raised from the global offering on enhancing industrial supply chain capabilities, further expanding its customer base and continuing to explore new market opportunities.。

More and more members of Jingdong Department

Regarding the spin-off arrangement, Jingdong said that the spin-off will allow investors to better evaluate the company, focus on Jingdong Group's business, and increase the value of Jingdong Production and Development and Jingdong Industrial, which will benefit Jingdong and its shareholders as a controlling shareholder as a whole.。At the same time, it will help the spin-off subsidiary to enter the equity and debt capital markets independently, improve its ability to obtain bank credit financing, and at the same time directly link the responsibility of management to its operating performance, improve the decision-making process, speed up the response to market changes and improve operational efficiency.。

Up to now, in addition to the main body of Jingdong Group, "Jingdong Department" enterprises have Jingdong Logistics, Jingdong Health, Dada Group successfully listed;。In the future, after the successful listing of Jingdong Production and Development and Jingdong Industry, Liu Qiangdong will become the biggest winner, and the number of "Jingdong" listed companies in his hand will reach 7 (including Debang shares).。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.