The first brother of the new energy vehicle company deserves it! BYD's Q3 gross profit rose instead of falling has surpassed Tesla for the third consecutive quarter

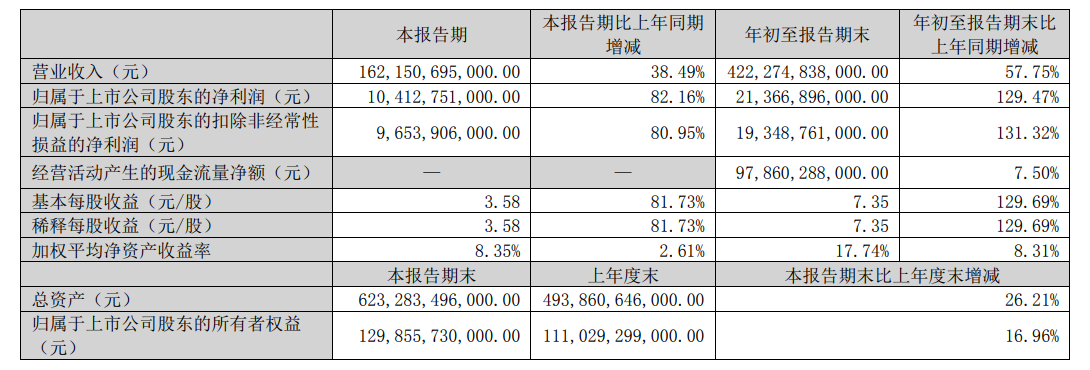

On October 30, "Car King" BYD released its third-quarter earnings report。BYD achieved revenue of 1,621 in the third quarter, data show.RMB 5.1 billion, up 38% YoY.49%; net profit of 104.1.3 billion yuan, up 82.16%, with an average daily profit of 1.1.3 billion yuan。

On October 30, BYD, the most high-profile "car king" among new energy car companies, released its third-quarter earnings report.。

BYD achieved revenue of 1,621 in the third quarter, performance data show.5.1 billion yuan (RMB, the same below), up 38.49%。Net profit attributable to shareholders of listed companies was 104.1.3 billion yuan, up 82.16%, with an average daily profit of 1.1.3 billion yuan。

In the first three quarters of this year, BYD achieved operating income of 4,222.7.5 billion yuan, up 58% year-on-year; net profit was 213.6.7 billion yuan, up 130% year-on-year。

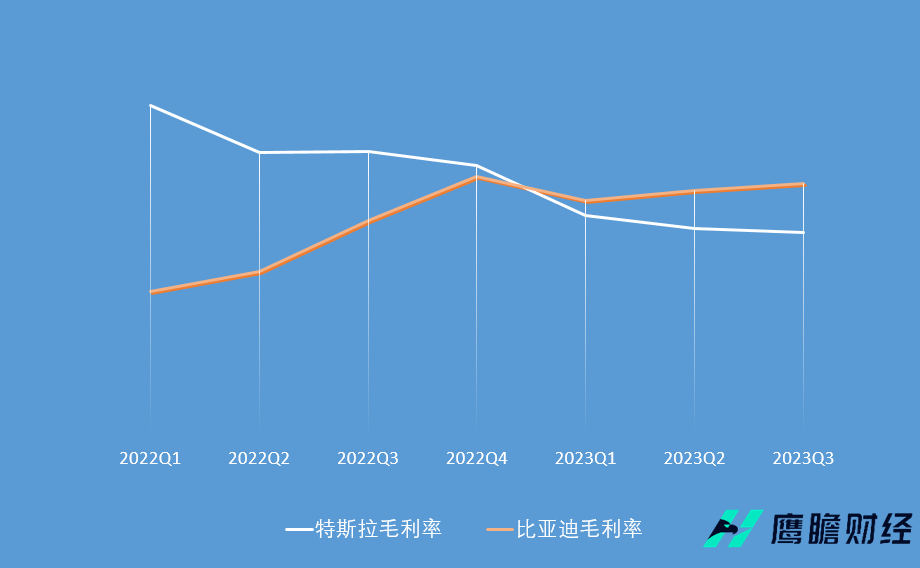

Not afraid of price war! BYD Q3 gross margin rose instead of falling

In this financial report, BYD's most eye-catching is its gross margin.。BYD's Gross Margin Reached 19 in Q3.79%, has exceeded Tesla for three consecutive quarters。

Earlier this year, Tesla opened the new energy vehicle price war with a wave of price cuts。A number of car companies have followed up, opening the price reduction mode。The advantage is that it can attract consumers quickly, but the disadvantage is also obvious, that is, profits have been severely eroded.。

The first thing that can't be suffered is the new car-building forces, in Xiaopeng Automobile, for example, the second quarter net loss increased by about 20% to 2.8 billion yuan.。Gross profit and gross profit margin are both negative, gross profit from 0 in the first quarter..$700 million fell directly to -200 million; gross margin also fell from $1 billion in the first quarter..7% to -3.9%, compared with 10% in the same period last year..9%。Among them, the gross margin of automobiles fell to -8..6 per cent, down more than threefold from 9 per cent in the same period last year..1%。The situation of gross profit is so severe, which also leads to Xiaopeng's "absence" of a new round of price war.。

And the power of price cuts, even the new energy "big factory" Tesla is a bit unbearable。Multiple price cuts this year have pushed Tesla's gross margin directly below the 20% mark, with gross margins trending downward in the first three quarters.。In the third quarter, Tesla's automotive gross margin fell more than expected to 16.3%。

In contrast, BYD's gross margin is exceptionally good。As a big-name car company, it is not easy to maintain gross margin growth in the new energy vehicle price war.。

As for the performance of profitability, BYD said: "In the third quarter of 2023, the new energy vehicle industry continued its good growth momentum, and the company's new energy vehicle sales continued to hit record highs, ranking first in global new energy vehicle sales.。Despite the continuation of intensified competition in the industry in the third quarter, the company's earnings continued to improve, demonstrating strong resilience by virtue of its increasing brand power, continued expansion of scale advantages and strong industry chain cost control capabilities.。"

Market at home and abroad "two hands"

As BYD mentioned, its steady rise in profitability is inseparable from the scale effect of its record car sales.。

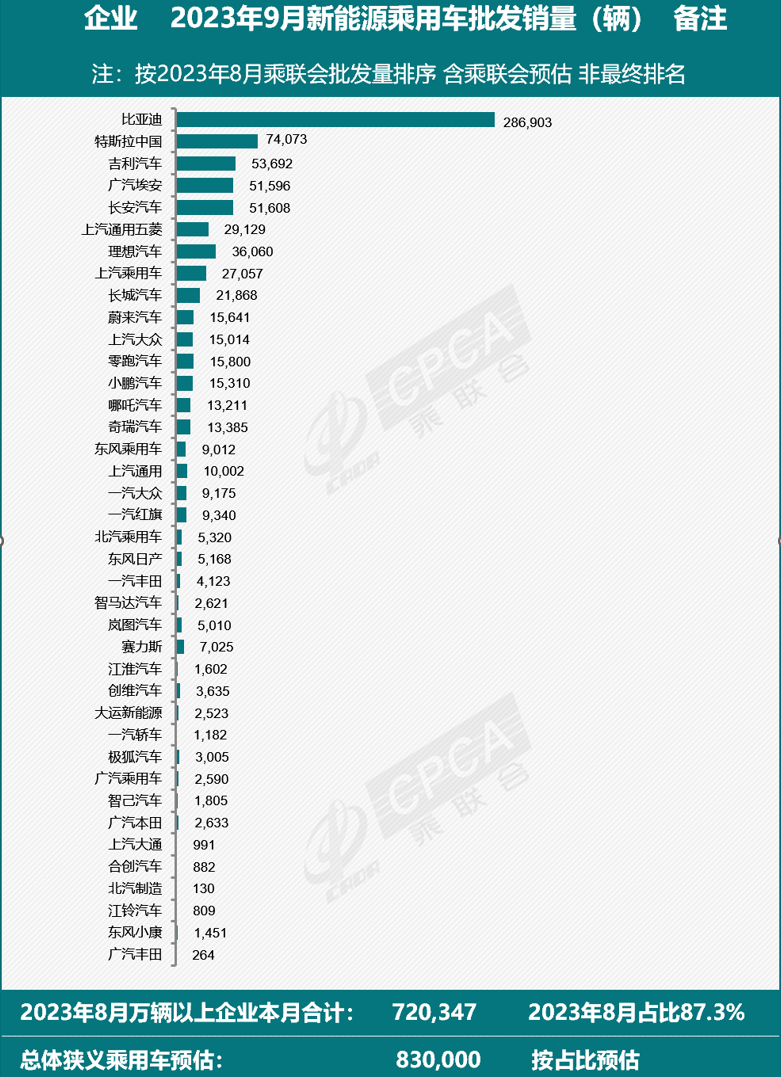

According to BYD's production and sales report, BYD sold 286,903 new energy passenger vehicles in September, up 42.8%, ranking first in China's domestic new energy vehicle market。In the third quarter, new energy vehicle sales reached 82.210,000 vehicles, another single-season high。

It is worth noting that if you look at pure electric vehicles alone, BYD's sales of pure electric vehicles reached 43 in the third quarter..160,000 units, up 23% from the second quarter。Tesla, which sells only pure electric cars, delivered a total of 43 in the third quarter of this year..50,000 vehicles, recording the first month-on-month decline of 6% this year。In other words, from BYD "winning" pure electric car market has been close at hand。

Now BYD, like a "general" in his youth, is attacking cities and territories around the world.。

In the third quarter, BYD not only "new" models in Brazil, Chile, Colombia and many European countries, but also continued to enter new markets such as Turkey.。Recently, BYD also carried a number of its cars to major international auto shows。Germany's Munich Motor Show, Japan's Tokyo Motor Show, Belgium World Bus Expo, etc. have all left traces of BYD。BYD's new energy vehicle industry is quite popular in the local area, and this year, sales of some of BYD's models in Brazil, Thailand, Sweden and other places have reached record highs.。

As of September 2023, BYD's cumulative sales of new energy vehicles have exceeded 5.4 million, covering more than 70 countries and regions on six continents and more than 400 cities.。

In addition, BYD now has three overseas plants under construction, three in Brazil, Thailand and Uzbekistan.。

Achieve full coverage of low, medium and high-end products

In September, BYD's high-end brand - look at the U8 deluxe version announced the listing, the price of 109.80,000 yuan, expected to be delivered from October。

The launch of high-end brands marks BYD's full coverage of low, medium and high-end products in electric vehicles。BYD now has dynasty series, ocean series, and Mercedes-Benz cooperation "Dengshi" brand, equation leopard, etc., plus look, these brands cover the price range of 5-1.5 million yuan, can be said to meet the low and high-end all market demand.。

For BYD, if you want to go global, you must lay out product lines at different prices.。This allows the company to improve its pricing structure, further expand its customer base, and create brand awareness that matches its status.。

In addition, the layout of mid-to-high-end product lines can help BYD share the profit pressure of low-end automotive products。Especially in China, the competition in the low-end and mid-end auto market is extremely fierce.。The low-end models are still BYD's main sales force, in order to allow the company to maintain a better level of profitability and cash flow, in the high-end products is essential.。

The layout of the mid-range and even high-end automotive product lines requires strong technical support.。In order to constantly attack new technology peaks, BYD is also spending money on research and development。In the first three quarters of this year, BYD disclosed research and development expenses as high as 249.400 million yuan, up 129% year-on-year。Among them, BYD's single-quarter research and development expenses reached 11.1 billion yuan in the third quarter, up 46.2%, which is the first time the company's single-quarter R & D expenses have exceeded the $10 billion mark.。

Among the high-end brands looking up to the U8, BYD is using two new technologies that the company launched in the first half of this year.。One is the world's first new energy exclusive intelligent hydraulic body control system "cloud"。The system can achieve 300,000 lifts of the vehicle without failure, and has three levels of adjustable stiffness, continuous adaptive damping adjustment, and 150mm ultra-high adjustment stroke。The other is the four-wheel independent torque vector control "easy quartet"。Yi Sifang technology takes the four-motor independent drive as the core, and comprehensively reconstructs the characteristics of new energy vehicles from the three dimensions of perception, control and execution.。

In addition, Yi Sifang also has 1,200 super horsepower, which can perform in-situ U-turns, emergency floating water, and stable driving after a puncture。With new technology, look up to U8 can achieve full coverage of off-road scenes, including the desert, wading, ice and snow, rugged road sections。

At present, the first batch of stores of Yangwang Automobile has been put into trial operation, covering 21 cities such as Shanghai, Hangzhou and Shenzhen in China.。BYD said that by the end of this year, Yangwang Auto will open more than 90 direct stores in more than 40 cities across the country, achieving coverage in first-tier and new first-tier cities and bringing the ultimate products and sincere services to more users.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.