Anta's first half earnings year-on-year double-digit growth DTC reform gains gradually cashed in!

After the Hong Kong stock market on August 22, Anta Sports released its interim results announcement for 2023.。Financial data show that during the reporting period, Anta Sports revenue reached 296.500 million yuan (RMB, the same below), up 14.2%, on a high base, doubling from the same period in 2019。

2022 is a landmark year for Anta。In this year, Anta's revenue increased by 8.8%, breaking the 50 billion mark for the first time, reaching 536.500 million yuan, this achievement also made it surpass Nike China in the same period, on the top of China's sports shoes and clothing market.。

Return and risk parallel Anta on the road to mergers and acquisitions drifting away

Anta's thick and thin hair is not without omens.。Just a year ago, in 2021, Anta had just completed its anti-overtaking of Adidas China.。From 2015 revenue exceeded 10 billion, to 2022 officially crossed the 50 billion mark, Anta only took 7 years。

Anta's ability to quickly change the business landscape in a short period of time is inseparable from its long-standing commercial M & A strategy.。In 2009, Anta spent 3.300 million to buy FILA China business from Belle。Data show that in 2020, FILA contributed 50% of Anta Group's revenue, and the profit margin of a single brand was as high as 70%, which has become an important pillar of Anta's revenue.。

In 2022, Anta's main brand and FILA will remain the two cores of the group's revenue.。Data show that in 2022, Anta's main brand revenue increased by 15% year-on-year, creating 27.7 billion yuan of revenue;.4%, but still stable at more than 20 billion。

The success of the acquisition of FILA has greatly boosted Anta's confidence in sticking to its M & A strategy, and the group has slowly begun its global M & A journey.。According to media statistics, since 2016, Anta has acquired nearly ten sports brands from all over the world, such as Japan's Disante DESCENTE, South Korea's Kolon Sports KOLON SPORT, and of course, Amafen Sports, which has spent huge sums of money, including Archaeopteryx, which consumers call "outdoor Hermes," professional tennis brand Wilson, ski brand Salomon, etc.。

After the plate became bigger, Anta gradually discovered that this M & A model, which focuses on the main business, is not without risk.。First, when Anta bets on important performance growth points in mergers and acquisitions, Anta may have no time to take into account the development of its own main brand.。Second, when the acquired company encounters growth difficulties, Anta's main brand will also be dragged down by it.。This concern can be seen from Anta's 2022 earnings report - although Anta completed its overtaking of Nike China during the reporting period, Anta's net profit fell by 1% in 2022..68%, while the company's net profit growth in 2021 was 49.55%, the difference between the two。

The so-called easy to hit the country, the difficult to keep the country, when Anta will slowly expand the layout of mergers and acquisitions at home and abroad, the market is looking forward to, Anta in 2023, can hand over what is not the same report card?

First-half earnings of 296.500 million yuan main brand and FILA are still the mainstay

After the Hong Kong stock market on August 22, Anta Sports released its interim results announcement for 2023.。Financial data show that during the reporting period, Anta Sports revenue reached 296.500 million yuan (RMB, the same below), up 14.2%, on a high base, doubling from the same period in 2019; gross profit of 187.600 million yuan, up 16.4%; profit attributable to shareholders of the company 56.2.7 billion yuan, up 32.33%; gross margin of 63.3%, up 1.3 percentage points; underlying earnings per share 1.74 yuan, 1 year earlier.33 yuan, the interim dividend of HK $82 per ordinary share.。

Judging from this interim report alone, Anta's report card is gorgeous。

Ding Shizhong, chairman of the board of directors of Anta Sports, said excitedly in the financial report that Anta has always adhered to the formation of multi-brand and all-round synergy from product design, R & D and manufacturing to brand marketing and brand retail, so as to be able to quickly respond to the market's changing differentiated needs.。In this financial period, relying on "dare to create" and "dare to break," the brands have delivered brilliant results.。

In terms of revenue, by segment, Anta's main brand and FILA brand remain the mainstay of Anta's revenue, which together contributed 89% to Anta's revenue during the reporting period..1%。It is worth noting that during the reporting period, the contribution of Anta's other brands to revenue increased significantly, with a year-on-year increase of 77.6%, helping Anta's financial results record a bright performance.。

Anta said in its earnings report that the growth of Anta's earnings benefited from the continued positive policies to stimulate domestic demand in mainland China.。In the same period in 2022, Anta's sales were dragged down by the overall retail market, with sales of the Anta brand, FILA brand and other brands rebounding from the same period in 2022 due to the base effect.。

Among them, the revenue growth of Anta's main brand was mainly due to the resumption of the retail market and the continuous transformation of Anta's DTC model in mainland China, resulting in an increase in DTC revenue; the revenue growth of the FILA brand was driven by the resumption of the retail market and the strong e-commerce business.。In addition, the strong earnings growth of all other brands was mainly driven by the DESCENTE and KOLONSPORT businesses, which, according to Anta, have outperformed management's internal targets significantly.

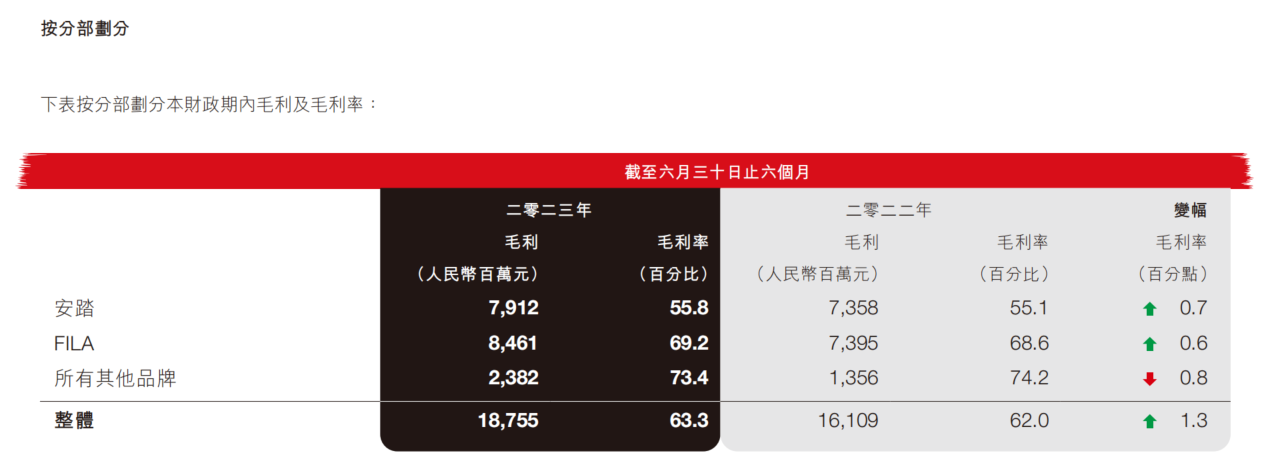

In terms of gross profit and gross margin, in the first half of this year, the gross profit of Anta's main brand reached 79.1.2 billion yuan, gross margin of 55.8%; FILA's gross profit reached 84.6.1 billion yuan, gross margin of 69.2%; all other brands have a gross profit of 23.8.2 billion yuan, gross margin of 73.4%。Among them, the gross margin of Anta's main brand and FILA increased by 0% respectively compared with last year..7 and 0.6 percentage points, but gross margins for all other brands fell by 0.8 percentage points, while overall gross margin increased by 1.3 percentage points to 63.3%。

Anta said that during the reporting period, the Group's overall gross margin increased compared to the same period last year.。There are two main reasons, one, Anta's main brand and FILA's gross margin increased during the reporting period;。

Among them, the year-on-year increase in gross margin of Anta's main brand was due to the relatively high gross margin due to the continued DTC transformation of the business segment, while the year-on-year increase in gross margin of the FILA segment was due to a decrease in the amount of inventory write-offs net of profit and loss during the reporting period.。

Proceeds from DTC reform materialize

It is not difficult to see that this Anta can hand over this satisfactory financial report, DTC transformation is its "invisible push" behind the scenes.。

In short, DTC represents an idea that is - to face the consumer。As a brand model that originated in North America, DTC is an independent operator that is rooted in the line, selling products directly to consumers without middlemen to make the difference.。Previously, the same as the service trade sports brand Nike is to take this model。In 2015, Gouzi officially adopted DTC's direct business as a corporate strategy, and in 2017, the company upgraded DTC to a CDO based on this, emphasizing closer proximity to consumer needs.。

Anta's DTC road dates back to August 2020, when Anta has begun to form an international M & A matrix, and its vision has gradually broadened, turning its counterparty from "Li Ning," which has been closely followed, to "Nike," and announcing that the main brand of Anta will be transformed into DTC, the main strategy is to transform the stores operated by the original offline dealers into direct stores.。

2021 is a key year for Anta's DTC reform, this year, Anta bet on the "double Olympic" resources, the release of "nitrogen technology" platform, DTC to point to specialization and high-end。Now, it is the third year of Anta's DTC transformation, and it can be seen that Anta's efforts over the years have gradually been reflected in the financial results.。

Ding Shizhong, chairman of the board of directors of Anta sports, once said that the positioning of Anta is: "do not do China's Nike, to do the world's Anta," will focus on the international market, this is undoubtedly a correct choice.。According to the global sports and fitness clothing market trends and analysis report published by Research And Markets website, the global sports clothing market is expected to reach 191.9 billion US dollars by 2026, with a compound annual growth rate of 4% compared with 2022..5%。The opportunity for the sporting goods market is that it has great potential for development in terms of both industry size and compound annual growth, while the challenge is that competition in the industry continues to intensify, and competition has shifted from quantity and price to new technologies and high value-added.。

However, Anta's internationalization path, relying solely on DTC reform and global business mergers and acquisitions may not be enough。From the internationalization of the enterprise, the internationalization of the brand and the internationalization of the market three angles to analyze, stepping on the business philosophy, the internationalization of the talent structure has done a good job.。But the market tends to focus on the latter two levels, especially the "market internationalization" that can be directly measured by numbers, which is Anta's current weakness.。

In addition, from the point of view of product research and development investment, although Anta has invested a lot in the field of professional sports in recent years, the gap is still large compared with international brands.。From 2019 to 2021, Anta's R & D expenses were 7.800 million yuan, 800 million yuan.8.8 billion yuan, 11.3.5 billion yuan, accounting for 2.3%, 2.5%, 2.3%。In contrast, Nike, Adi's annual R & D investment is as high as 5% -10%。

In 2022, Anta did not publish international business revenue data, compared to the same period Li Ning, 361 degrees international business were 1..77% and 1.Percentage of 8%。Although Anta has won the first place in China's sports footwear market, Anta also appears to be somewhat cash-strapped in the international market.。

The good news is that there is news that at present, Anta is continuing to increase investment in scientific research, strengthen professional attributes, and lead the promotion of commodity power with science and technology.。Through the joint Tsinghua, Donghua and other well-known universities and international research institutions, to build a global sports science research platform。At the same time, its globalization strategy is steadily advancing, expanding its market layout in Southeast Asia, and has launched direct retail business in Singapore, Malaysia, the Philippines and other countries.。

This shows that Anta is on the right track。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.