Weilai Q4 Losses Expand Again Under Price War Forced to Lower First Quarter Guidance

In the fourth quarter, Weilai's adjusted net loss was $4.8 billion, down 5.2%, month-on-month expansion 21.5%, exceeding market expectations。

On March 5, the electric car brand Weilai announced its fourth quarter and full-year results for 2023。

Losses are still widening

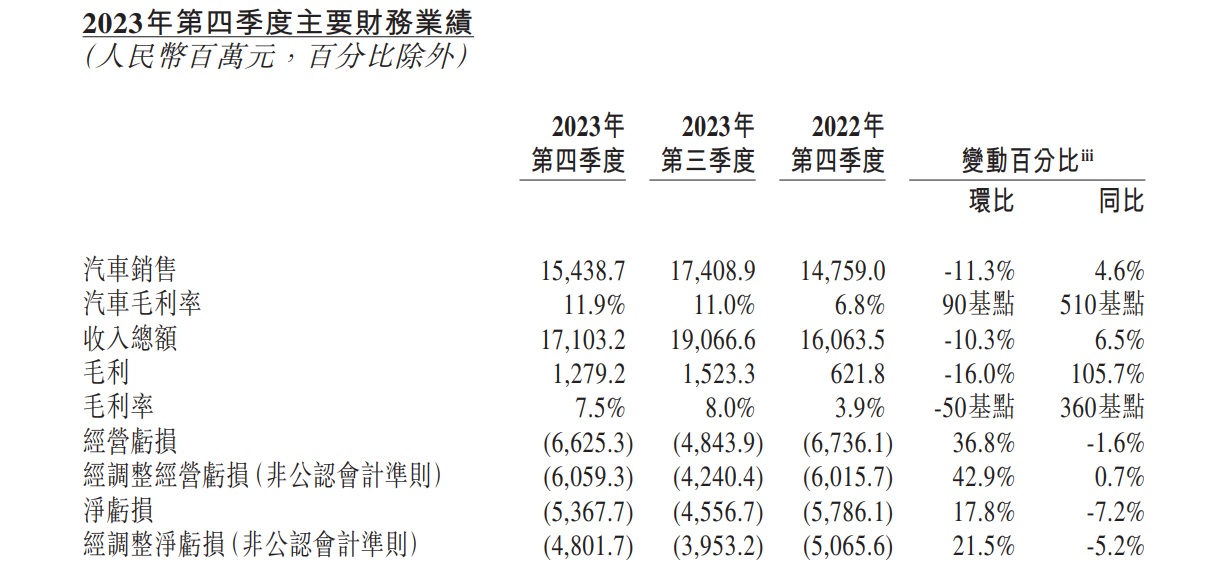

According to the data, Weilai's revenue in the fourth quarter of last year totaled 17.1 billion yuan (RMB, the same below), up 6.5%, down 10.3%, better than market expectations of $16.8 billion。Among them, automobile sales were 15.4 billion yuan, up 4.6%, down 11.3%。

In the fourth quarter, Weilai's adjusted net loss was $4.8 billion, down 5.2%, month-on-month expansion 21.5%, exceeding market expectations。Gross profit was $1.3 billion, up 105.7%, down 16.0%。Gross margin of 7.5%, below market expectations of 10.2%, compared to 3.9%, compared to 8 in the previous quarter.0%。

In addition, Weilai's R & D expenses in the fourth quarter of 2023 were 39.700 million yuan, a decrease of 0.2%, month-on-month growth of 30.7%, which is the fifth consecutive quarter of research and development spending exceeded 3 billion yuan.。

In terms of delivery data, NIO delivered 50,045 vehicles in the fourth quarter of last year, including 33,679 high-end smart electric SUVs and 16,366 high-end smart electric cars, up 25% year-on-year..0%, down 9.7%。

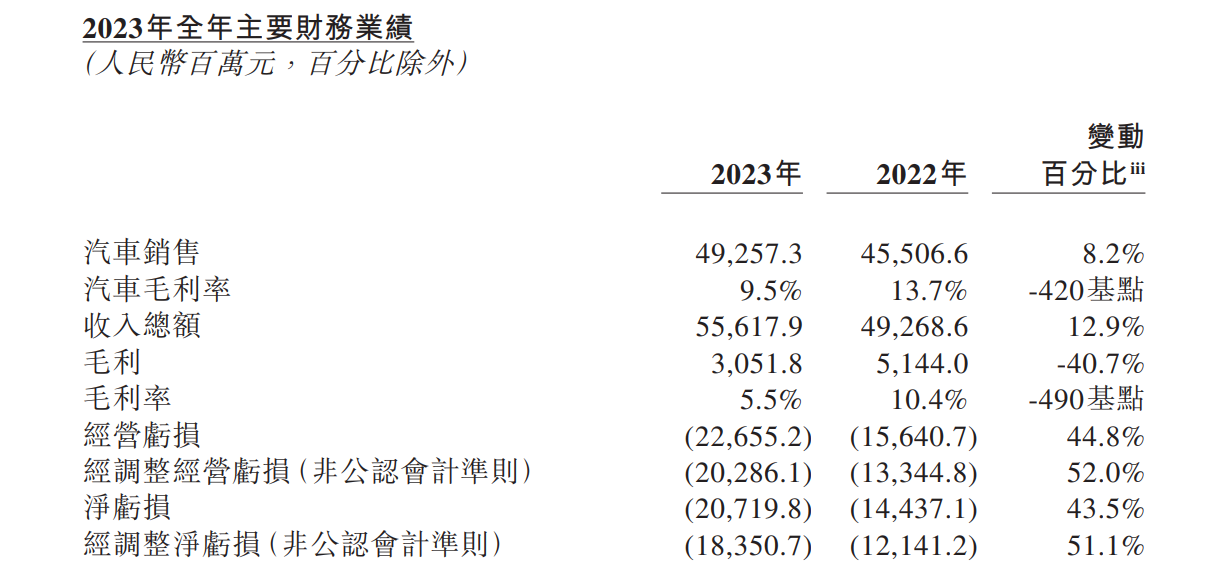

For the full year, Weilai's total revenue in 2023 was $55.6 billion, up 12 percent from the previous year..9%。Adjusted net loss for the full year 2023 was $18.4 billion, an increase of 51% over the previous year..1%。Gross profit for the year was $3.1 billion, down 40% year-on-year..7%。Gross margin for the full year was 5.5%, compared to 10 in the previous year.4%。

Last year, the Middle East capital CYVN Holdings's total strategic investment in Weilai was $2.2 billion (about 15.8 billion yuan), at this rate of burning money, CYVN's capital injection Weilai can be consumed in less than a year.。

Weilai said that as of December 31, 2023, the Company's cash and cash equivalents, restricted cash, short-term investments and long-term term deposits amounted to $57.3 billion。

For the full year 2023, NIO delivered 160,038 vehicles, an increase of 30% over 2022..7%。It is worth noting that the original delivery target set by NIO in 2023 was 24.50,000, and realistic deliveries are less than two-thirds of the target。As a result, NIO has set itself a full-year delivery target of 230,000 vehicles in 2024 (monthly average of 1.90,000), a brand that is one of the few new car-building forces to target down.。

R & D expenses for the full year 2023 were 134.300 million yuan, an increase of 23% over the previous year..9%, breaking through 10 billion for two consecutive years。

unusually conservative first quarter guidance

In addition, to the surprise of the market, NIO's first quarter 2024 guidance is unusually conservative.。

NIO said that in the first quarter of 2024, vehicle deliveries will be between 31,000 and 33,000 units, a decrease of about 0% year-on-year..1% to an increase of about 6.3%, significantly lower than the 50,045 in the previous quarter, and also lower than market expectations of 4.40,000 vehicles。Total revenue in the first quarter is expected to be between $10.5 billion and $11.1 billion, down about 1% year-on-year..7% to an increase of about 3.8%, also significantly lower than market expectations。

Currently, NIO's January and February delivery data have been disclosed。According to official data from Weilai, a total of 10,055 new cars were delivered in January, up 18 from a year earlier..2%, down 44.2%。In February, 8,132 new vehicles were delivered, down 33 from a year earlier..1%, down 19.1%。

In other words, NIO expects its March delivery data to be between 12,813 and 14,813, which is more than the monthly average of 1 set by NIO this year..The target of 90,000 vehicles is still far away.。

At the earnings call, Li Bin, founder, chairman and CEO of Weilai, said: "I believe that after March, as the weather warms up, the market will get better and better, and I am confident that I can return to the level of 20,000 units per month, and I hope to reach this level as soon as possible.。"

Sub-brand Alps released in the second quarter

In the case of increasingly fierce competition, in order to increase the market share, Weilai had to step down from the high-end "altar" to cover the mid-market.。

At the time of the layoffs in November last year, it was reported that as part of the layoff plan, Ulysses' new brand, Alpes, would no longer operate as a separate project for the company, and that personnel would be assigned to various departments of Ulysses, with some of the positions also being cut.。After the merger, the positions of former Alpine employees will continue to be adjusted on a small scale, and the process will continue until June 2024.。

Although the team was dismantled and scattered, Weilai did not give up the Alps sub-brand.。At yesterday's fourth-quarter call, Li Bin said: "Our current plan is to release the Alpine mass market brand in the second quarter, and then release the first product in the third quarter, starting with mass delivery in the fourth quarter.。"

During the call, Li Bin also revealed that Alps has developed three products。

Li Bin said that in the fourth quarter of last year, the first trial prototype of the Alps had already been off the assembly line, and the company was "very satisfied" with this product.。It also says that the first product is a Tesla Model Y, but a replacement version of the Model Y.。"At present, our cost and performance are very competitive, and I believe our cost is about 10% lower than Tesla, which also gives us a good space for pricing."。"

The second car is an SUV for the extended family. The research and development is progressing very smoothly. It has entered the mold opening stage and will be ready for market next year.。The third car is also in the process of development, but "it's too early to talk about this product, we will choose the right time to talk to you。"

A new round of price war, Wei Lai also intends to "watch the fire from the shore."?

Last year, China's new energy vehicle market has had many price wars, although most car companies are actively or passively involved, but there are also some car companies choose to "watch the fire from the shore," Weilai is one of them.。

During the conference call, when asked again about pricing, Li Bin said that starting in the second half of this year, Weilai will sell both brands of products at the same time.。

"From a strategic point of view, under the NIO brand, we will not launch cars that are cheaper than the ET5, including models that are in the pipeline.。We are certainly still focused on the brand premium, in order to increase gross margin as the orientation, in terms of price and volume will pay more attention to maintain the level of gross margin, will not use price war in exchange for sales promotion.。"

At the same time, Li Bin also added that from the perspective of the second brand, Alps is indeed aimed at the home market, and the competition in this market will certainly be more intense, but Alps can use the company's research and development in smart and electric, As well as investment in infrastructure, it has a greater advantage than starting from scratch。He also mentioned that second brands will prioritize sales over gross margin growth。"In general, the two brands will have different strategies, and I believe this combination is a better strategy for the company's long-term operations."。"

For the competition in the market, Li Bin believes that "China is a very open auto market, competition is definitely good for users, of course, it will be a little harder for enterprises, but I believe that in the end can win the market competition, are more comprehensive ability, more from the user experience of the enterprise, we are sure to win the long-term market competition is confident。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.