New energy vehicle company H1 closing report: BYD firmly ranks first, Geely raises its annual sales target

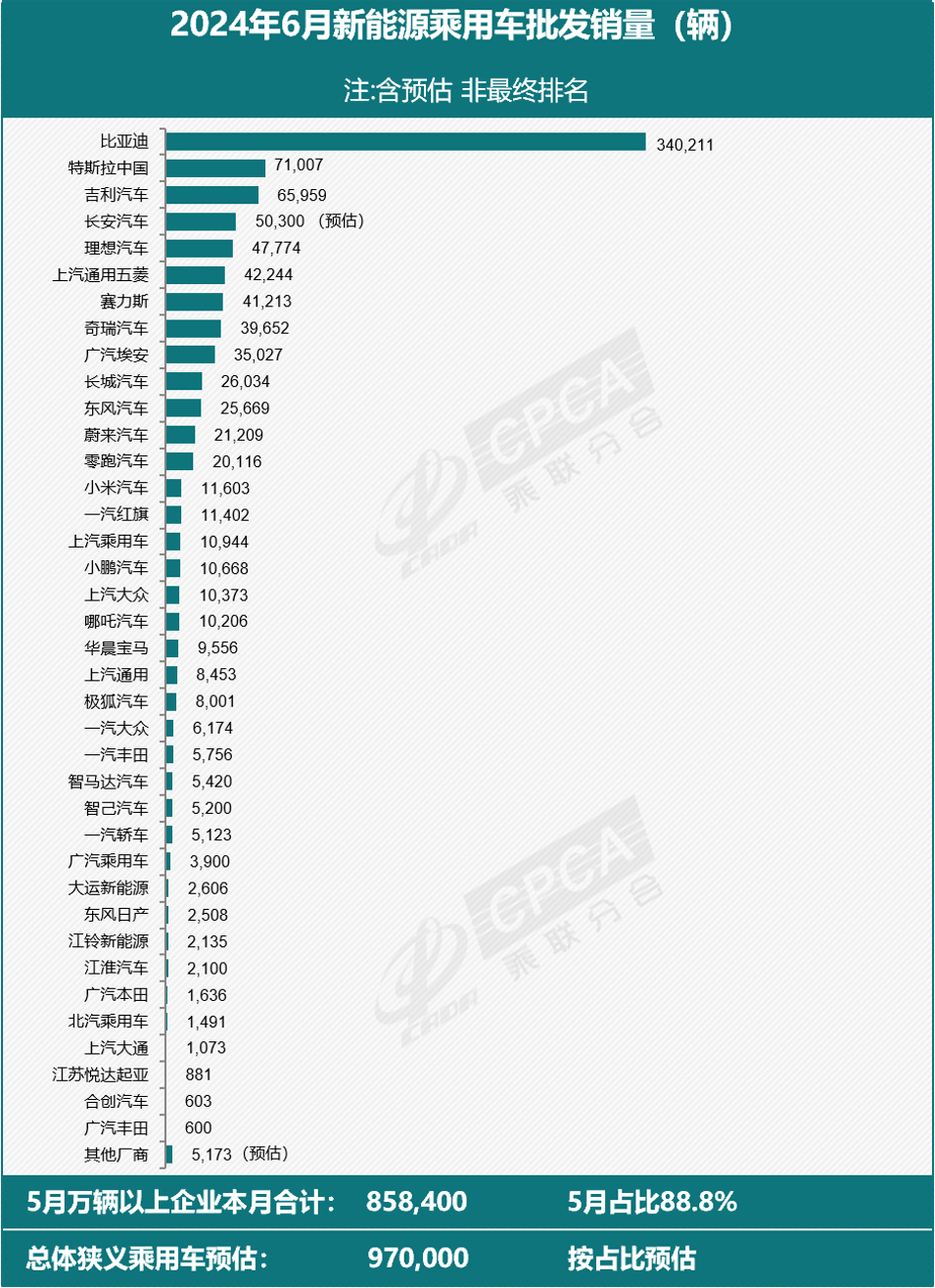

According to CPCA's comprehensive estimate of preliminary monthly data, wholesale sales of new energy passenger vehicle manufacturers in China reached 970,000 units in June, a year-on-year increase of 28% and an 8% increase compared to the previous month.

According to CPCA's comprehensive estimate of preliminary monthly data, wholesale sales of new energy passenger vehicle manufacturers in China reached 970,000 units in June, a year-on-year increase of 28% and an 8% increase compared to the previous month.

CPCA stated that the national economy operated steadily in June. With the implementation of the national policy of "exchanging old for new" and the follow-up of corresponding policy measures in various regions, the bottlenecks were cleared and a continuous increase in the exchange of old for new was achieved, dispelling doubts and concerns about the exchange of old for new. The cancellation of vehicle purchase tax exemption for micro electric vehicles below 200 kilometers in June has had a negative impact on the consumption of entry-level consumer groups. But after the temporary cooling of the price war for new products in the car market, the consumer enthusiasm of the market's wait-and-see group has been stimulated.

CPCA also mentioned that the issuance of licenses for gasoline and new energy vehicles in Beijing was the most important increment in June, and the release of new energy purchasing power was effective. The national new energy passenger vehicle market achieved a relatively good sprint performance in June at the end of the first half of the year.

BYD's H1 sales exceeded 1.61 million units, while Tesla's Q2 delivery exceeded expectations

BYD sold 341,658 vehicles in June, a year-on-year increase of 35% and a slight increase of 3% compared to the previous month. Among them, 340,211 passenger cars were sold, a year-on-year increase of 35.2%.

Among passenger cars, the sales of plug-in hybrid electric vehicles (PHEVs) reached 195,032 units, a year-on-year increase of 58%; There were 145,179 pure electric vehicles (BEVs), a year-on-year increase of 13%. Plug in hybrid remains the main driver of BYD's growth.

In terms of overseas exports, BYD exported a total of 26,995 passenger cars in June, a year-on-year increase of 156.2% and a month on month decrease of 28%.

Specifically, let's take a look at the sales situation of BYD's various brands. The Dynasty and Ocean series remain BYD's main sales force, with a total of 324,838 units sold in June, a year-on-year increase of 35%. The joint venture brand between BYD and Mercedes Benz, DENZA, sold a total of 12,223 vehicles in June, a year-on-year increase of 11%. In the high-end series, FangChengBao sold 2680 units in June, a 10% increase compared to the previous month; The Yangwang brand performed slightly worse, selling 418 units in a single month, a 31% decrease compared to the previous month.

In the first half of 2024, BYD's cumulative sales reached 1.613 million vehicles, a year-on-year increase of 28%.

On the noon of July 2nd, BYD announced on its official Weibo account that it will hold the completion ceremony of its Thailand factory and the offline ceremony of its 8th million new energy vehicles on July 4th. At that time, BYD's official Weibo account will broadcast the ceremony live. On March 25th of this year, BYD announced the discontinuation of its 7th million new energy vehicles. This means that the company produced 1 million new energy vehicles in less than four months.

After the Thai factory is put into operation, BYD's production capacity is expected to further accelerate.

As early as September 2022, BYD signed a land purchase agreement with Thai industrial real estate developer WHA Industrial Development PLC to build an electric vehicle factory there. On March 10, 2023, BYD held a groundbreaking ceremony for its factory in Thailand. At that time, BYD stated that it expected the factory to start production in 2024, with an annual production capacity of approximately 150,000 vehicles.

In addition to its factory in Thailand, BYD's factory in Uzbekistan also welcomed the first batch of production vehicles on June 27th. BYD is also building passenger car factories in Hungary and Brazil.

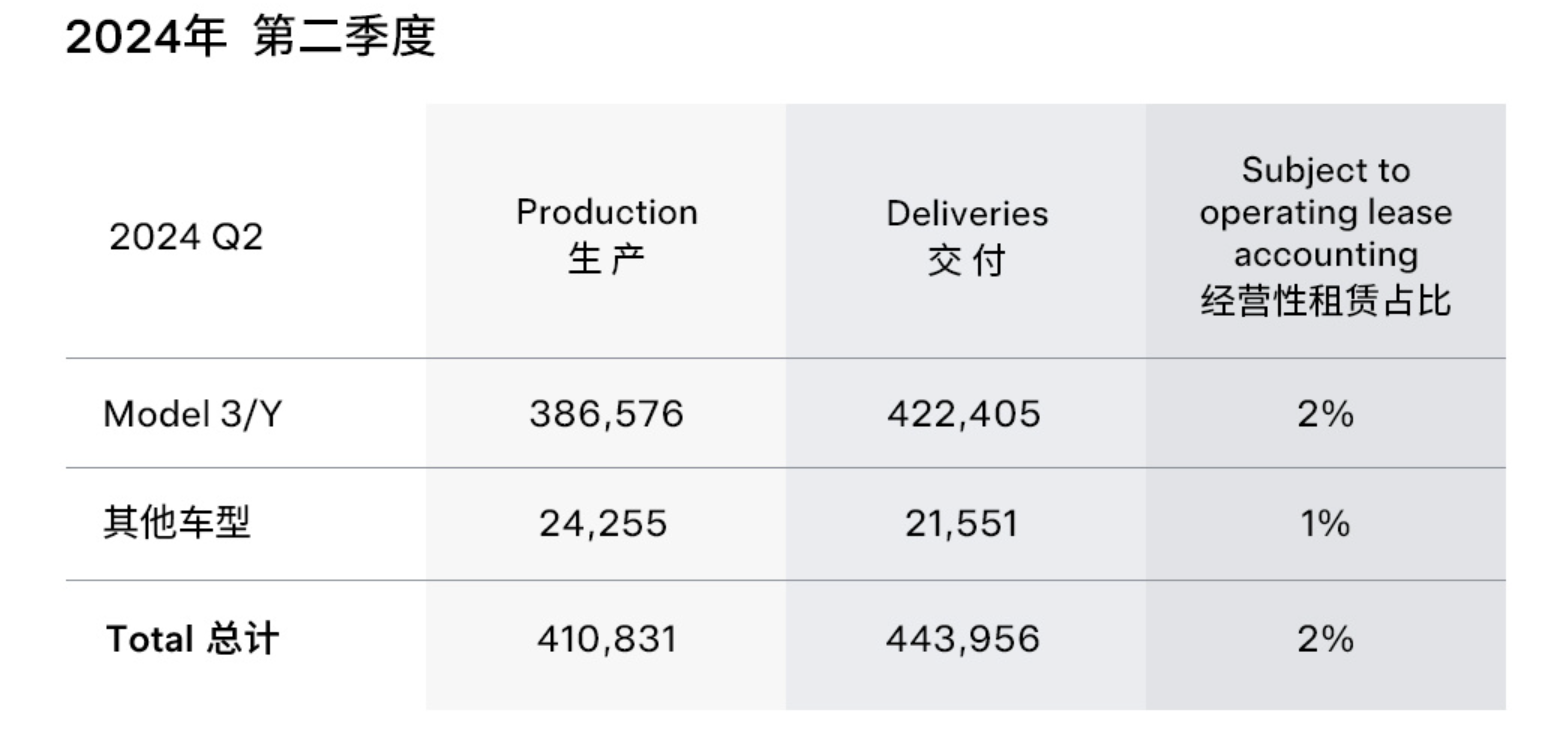

On the Tesla side, in the second quarter of this year, Tesla produced approximately 411,000 electric vehicles globally, a year-on-year decrease of 14%; Approximately 444,000 vehicles were delivered, a year-on-year decrease of nearly 5%, but a month on month increase of 14%, higher than market expectations.

According to data from the CPCA, Tesla China sold a total of 71,007 electric vehicles in June, a year-on-year decrease of 24%, and the decline has once again expanded to double-digit numbers; On a month on month basis, it also returned to the downward range, falling slightly by 2%.

According to Tesla China's official Weibo account, from July 1st to July 31st, orders for both the Standard Range and Long Range All Wheel Drive versions of the Model 3/Y will enjoy a 5-year interest free or low interest car purchase benefit.

Specifically, with a down payment of 79,900 yuan and zero interest for 5 years, the daily supply for Model 3/Y standard range version owners can be as low as 85 yuan, while the daily supply for long range all wheel drive version can be as low as 107 yuan. If you want a lower down payment, you can enjoy low interest car purchase benefits. The standard range version and long range all wheel drive version of Model 3/Y can both choose lower down payments - starting at 45,900 yuan, in which case the annual rate can be as low as 0.5% (equivalent to an annualized rate of 0.92%).

Geely raises full-year sales target, GAC A arranges to drop to ninth place

According to Geely Auto's official data, a total of 166,085 new cars were sold in June, a year-on-year increase of 24% and a month on month increase of approximately 3%. Among them, the sales of BEVs in June were 37,100 units, a year-on-year increase of 59%. PHEVs sold 28,859 units in June, a year-on-year increase of 147%. Overseas export sales of 35347 vehicles increased by approximately 61% year-on-year.

In the first half of this year, Geely Auto's cumulative total sales increased by 41% year-on-year, reaching 955,730 vehicles. Due to strong sales performance, Geely Auto announced that its management team has decided to increase its original annual sales target by approximately 5%, from 1.9 million vehicles to 2 million vehicles.

As a highly regarded mid to high end brand under Geely, ZEEKR's sales have reached a new historical high. In June, ZEEKR delivered a total of 20,106 vehicles, a year-on-year increase of 89% and a month on month increase of 8%. This is also the first time ZEEKR has delivered over 20,000 vehicles in a single month.

In the first six months of this year, ZEEKR delivered a total of 87870 vehicles, a year-on-year increase of 106%, and won the top spot in China's pure electric brand sales of over 200,000 yuan in 2024. Among them, ZEEKR 001 delivered over 10,000 yuan for three consecutive months and remained the best-selling pure electric vehicle model with a sales volume of over 250,000 yuan. As of the end of June, ZEEKR has delivered over 280,000 vehicles in total.

As the second half of the year begins, ZEEKR plans to continue launching promotional activities in July to further increase sales. On July 1st, ZEEKR announced the launch of a limited time discount for car purchases in July. From July 1st to 31st, purchasing ZEEKR X can enjoy up to 45,000 yuan of limited time car purchase rights; Purchase ZEEKR 007 and enjoy up to 36,000 yuan of limited time car purchase benefits; Purchase the new ZEEKR 001 and enjoy a limited time car purchase benefit of up to 35000 yuan.

In June, the sales of new energy vehicles under the independent brand of Changan Auto reached 64,000 units, a year-on-year increase of over 61%, and the growth rate slowed down from 90% last month.In the first half of this year, Changan Auto's independent brand sold 299,000 new energy vehicles, a year-on-year increase of over 69%.

As the most closely watched domestic brand under Changan Auto, DEEPAL performed well in June, delivering 16,659 vehicles in a single month, a year-on-year increase of 107.18% and a month on month increase of 15.92%.

It is worth noting that multiple new models of DEEPAL will be launched in the second half of the year, including DEEPAL S07, DEEPAL L07, and DEEPAL S05. Deng Chenghao, CEO of DEEPAL Auto, said, "DEEPAL Auto aims to achieve a monthly sales volume of 30,000 units in the fourth quarter and become the first new energy vehicle enterprise among state-owned enterprises to achieve both scale and profitability breakthroughs."

GAC Aion's performance in June was poor, making it one of the few car companies to record a month on month decline.

According to official data, the global sales of GAC Aion in June were 35,027 units, a year-on-year decrease of 22.2% and a month on month decrease of 12.6%.

Since the beginning of this year, the sales performance of GAC Aion has been poor. Since February, GAC Aion's monthly sales have started to decline year-on-year, and it has been five consecutive months so far.

Affected by the year-on-year decline in sales, GAC Aion's ranking of new energy passenger vehicle manufacturers in the CPCA in June dropped from fifth place in May to ninth place, while in April, GAC Aion's ranking was still third.

In the first half of 2024, the cumulative sales of GAC Aion were 177,366 units, a year-on-year decrease of 15.27%. GAC Aion had previously set a goal of challenging 700,000 vehicles and sprinting 800,000 vehicles in 2024, but its cumulative sales in the first half of this year only achieved a quarter of the annual target.

For GAC Aion, how to stimulate sales growth has become an urgent problem to be solved.

In terms of SAIC, in June, SAIC sold over 93,000 new energy vehicles, with a cumulative sales of over 460,000 new energy vehicles in the first half of the year, a year-on-year increase of 24%.

SAIC's high-end intelligent brand IM Motors sold 6,015 vehicles in June, a significant increase of 200% year-on-year and 41% month on month, ranking among the top ten new force brand sales in the Chinese market.

"New forces in car manufacturing" is highly competitive

●Li Auto

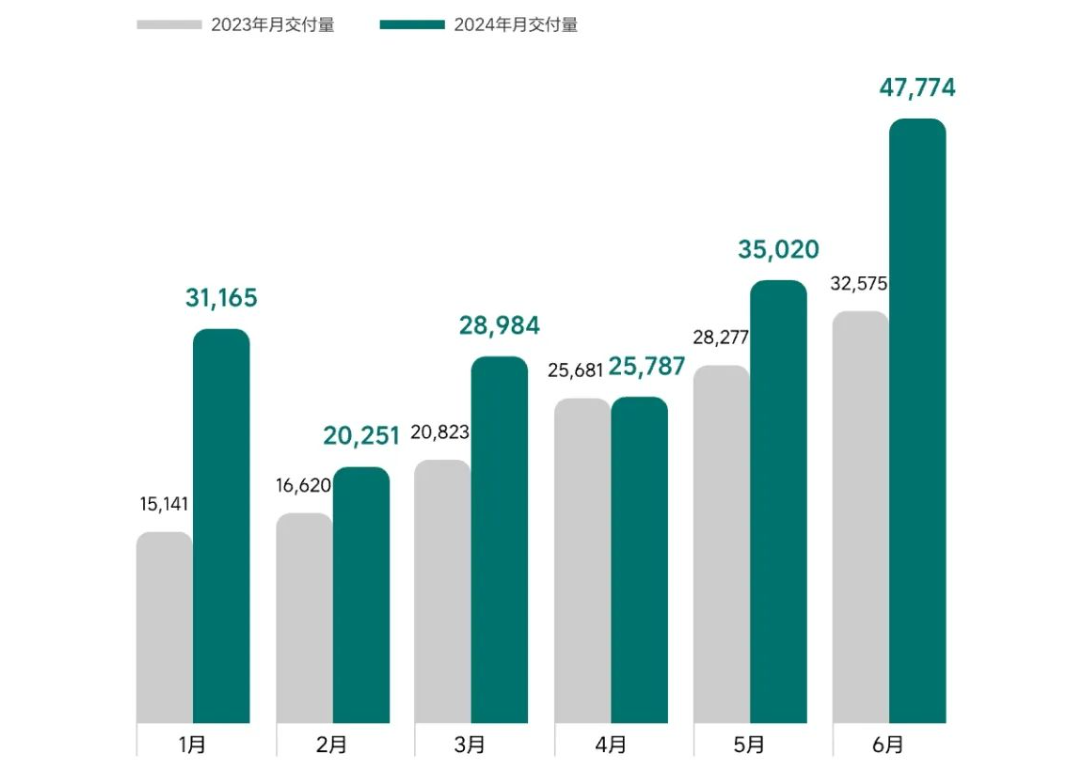

Li Auto will still firmly occupy the top position of the "new forces" in June. According to official sources, Li Auto delivered 47,774 new cars in June, a year-on-year increase of 46.7% and a month on month increase of 36%.

In the second quarter, 108,581 vehicles were delivered, a year-on-year increase of 25.5%, just exceeding the lower limit of the company's previously set delivery target (105,000 to 110,000 vehicles). In the first half of this year, Li Auto delivered nearly 190,000 new cars, ranking first in the total delivery volume of new Chinese brands.

●AITO

In June, the delivery volume of AITO was 43,146 vehicles, a 59% increase compared to the previous month. Among them, AITO M9 delivered 17,241 vehicles, AITO new M7 delivered 18,493 vehicles, and AITO new M5 delivered 7,046 vehicles. In the first half of this year, the cumulative delivery volume of AITO reached 181,197 vehicles throughout the year.

On June 26th, AITO officially announced that the AITO M9 has been on the market for 6 months and has accumulated over 100,000 units. The AITO M9 remains the champion of luxury car sales with over 500,000 yuan, setting a new record for luxury brand model sales in the Chinese market.

AITO is a brand jointly launched by SERES and Huawei, accounting for the vast majority of SERES sales.

According to official data, SERES sold 44,126 new energy vehicles in June, a year-on-year increase of 372.04%. From January to June this year, the cumulative sales of SERES new energy vehicles reached 200,949 units, a year-on-year increase of 348.55%.

●NIO

NIO's performance in June is still good.

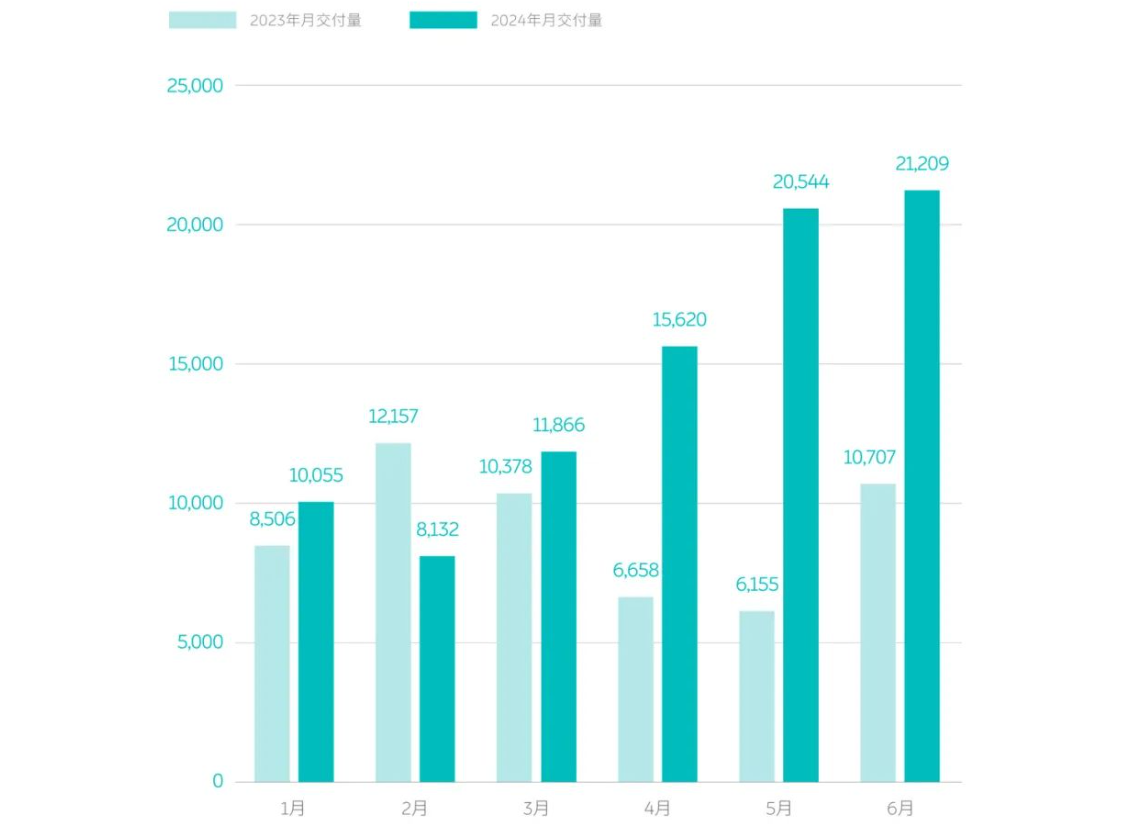

NIO Automobile stated that a total of 21,209 electric vehicles were delivered in June, a month on month increase of 3% and a year-on-year increase of 98%, setting a new historical high. In the second quarter, NIO delivered a total of 57,373 new vehicles, exceeding the delivery limit set by the company (54,000 to 56,000 vehicles), a year-on-year increase of 143.9%. In the first half of 2024, NIO delivered a total of 87,426 new cars, a year-on-year increase of 60.2%.

●Leapmotor

Leapmotor's sales in June exceeded the 20,000 mark. According to official data, Leapmotor delivered a total of 20116 vehicles in June, a year-on-year increase of 52% and a month on month increase of 11%.

In the first half of this year, the cumulative delivery volume of Leapmotor cars was 86,696, a year-on-year increase of 95%.

On June 28th, the latest SUV model of Leapmotor, C16, was officially launched with a suggested retail price of 155,800 to 185,800 yuan. Officially, it received a large order of 5,208 vehicles within 48 hours of its launch. It is expected that there will be a delivery volume of over 2,000 vehicles in July, and large-scale deliveries will begin in August.

Previously, the model made its debut at the 2024 Beijing Auto Show and began pre-sales, with pre-sale orders exceeding 11,950 units within 24 hours.

●Xpeng

Xpeng delivered 10,668 vehicles in June, a year-on-year increase of 24% and a month on month increase of 5%, with sales exceeding 10,000 for the second consecutive month. Among them, the Xpeng X9 "Nine Crowned King" delivered 1,687 units, with a cumulative delivery of 13,143 units in the first half of the year, continuously leading the market in pure electric MPV and pure electric three row seat models.

In the first half of this year, Xpeng delivered a total of 52,028 new cars, a year-on-year increase of 26%.

In July, the first car of Xpeng MONA brand, M03, will make its debut. Previously, the official revealed that the price of the car should be around 150,000 yuan. Xpeng's sales growth momentum has been weak this year, and the company also hopes that the launch of the MONA brand can play a driving role in overall sales.

However, the competition for electric vehicles in the price range of 100,000 to 200,000 yuan is very fierce nowadays. Let's wait and see what highlights the MONA brand will have.

●NETA

Official data shows that in June, the entire NETA Auto series delivered 10,206 vehicles, a year-on-year decrease of 16% and a slight increase of 1% compared to the previous month. In the first six months of this year, the cumulative delivery volume of NETA was 53,770 vehicles, a year-on-year decrease of 14%.

On June 28th, the NETA L pure electric version was officially launched, with a starting price of 139,900 yuan. It is the only pure electric model within 300,000 yuan that comes with all three major components (refrigerator, color TV, large sofa). However, the official has not disclosed the current situation of the NETA L pure electric version, and the driving effect of this model on the company's overall sales remains to be observed.

●Xiaomi

Among the new forces in car manufacturing, Xiaomi Auto is the most unique presence. Other car companies are all worried about sales, only Xiaomi Auto is worried about production capacity.

According to official reports, Xiaomi Auto's delivery volume in June exceeded 10,000 vehicles, an increase of over 16% compared to the previous month. Since the beginning of this year, the cumulative delivery volume of Xiaomi Auto has exceeded 25,688 vehicles. According to Xiaomi Auto's previously announced order volume, there are still about 60,000 vehicles waiting to be delivered.

Starting from June, Xiaomi Auto factory officially started dual shift production to increase production capacity. The company stated that starting from July 1st, the delivery of the Xiaomi SU7 series will further accelerate, and it is expected that the delivery cycle can be shortened by up to 5 weeks after the order is locked.

In addition, Xiaomi Auto has also launched a limited time car purchase benefit for July. From July 1st to 31st, ordering all models of Xiaomi SU7 can enjoy a complimentary Nappa leather seat worth 8000 yuan; And benefits such as Xiaomi's enhanced intelligent driving function and lifetime free of charge.

CITIC Lyon stated in its latest research report that looking ahead to the second half of the year, the price war is expected to continue.

CITIC Lyon stated that due to the difficulty of competing with BYD's hybrid models for joint venture fuel vehicles, especially BYD's huge cost advantage, it is expected that the price war in the mass market (below 200,000 yuan) will ease, and the market share of joint venture OEMs will rapidly decline. In the high-end market (over 200,000 yuan), due to the launch of many competitive new models and the high recognition of foreign luxury brands, the price war will intensify in the second half of 2024 and the first half of 2025.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.