Core CPI rose 3.2% year-on-year, lower than the expected 3.3%, compared with the previous value of 3.3%.

On January 15, a CPI data that boosted the market was released.Data from the U.S. Bureau of Labor Statistics showed that the consumer price index (CPI) rose 2.9% year-on-year in December, in line with market expectations, with a previous value of 2.7%; core CPI rose 3.2% year-on-year, lower than the expected 3.3%, with the previous value of 3.3%.

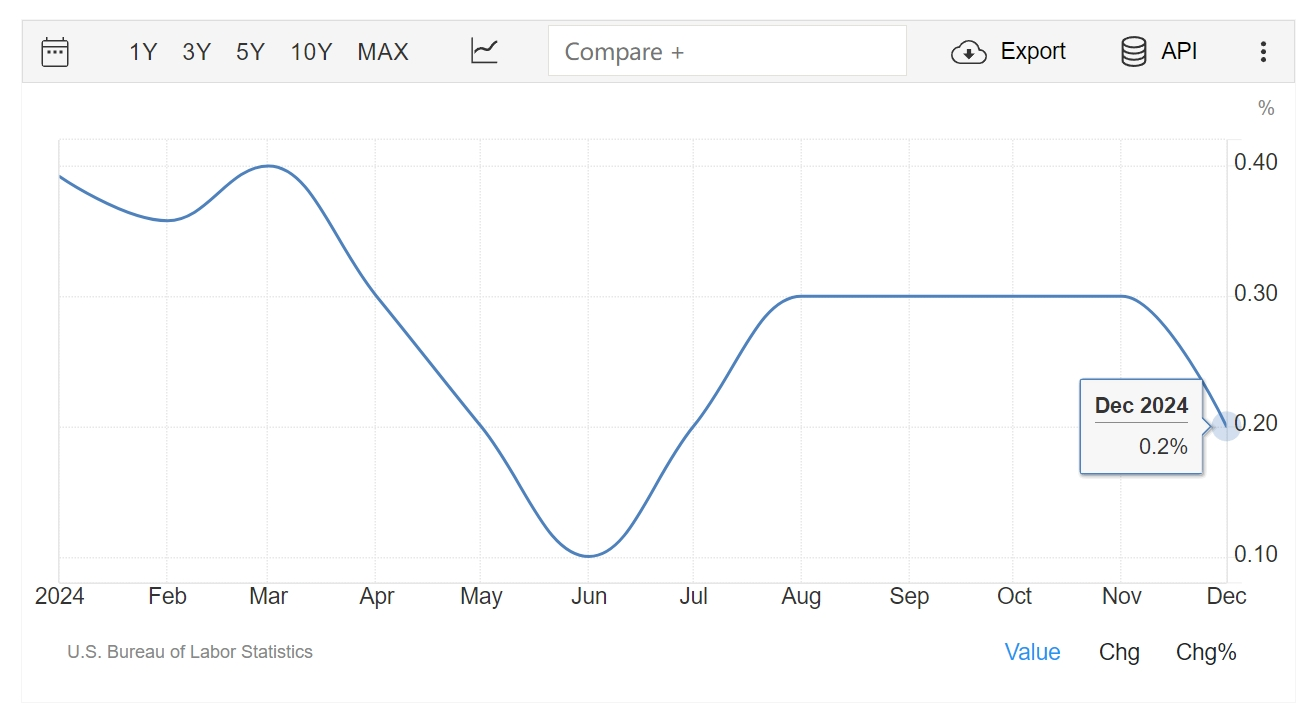

In December, the CPI rose 0.4% month-on-month, in line with expectations. The previous value was 0.3%, of which more than 40% of the increase came from energy.Core CPI rose 0.2% month-on-month, lower than expectations and previous values of 0.3%.The Federal Reserve's favorite CPI indicator, the super core CPI, rose 0.28% month-on-month, slowing annual inflation to 4.17%.

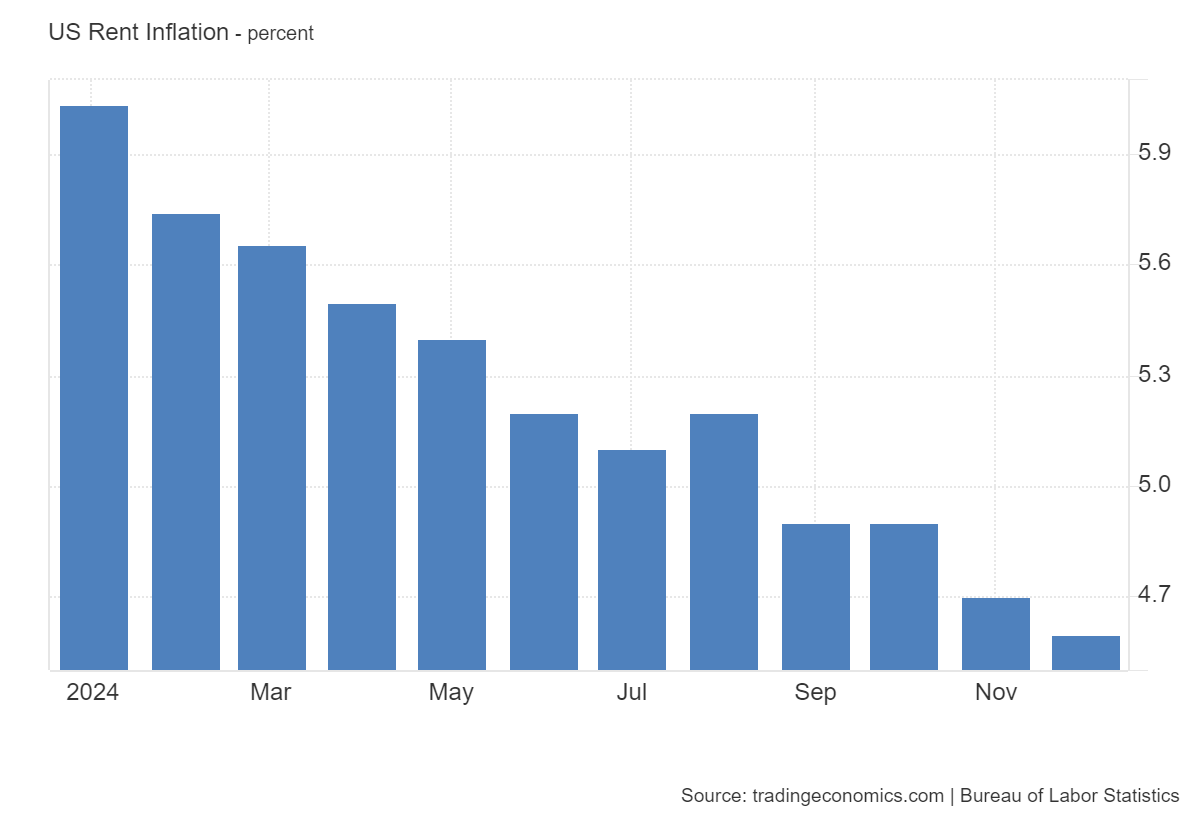

In December, hotel accommodation prices fell, medical services grew less, and rent increases were relatively moderate in December, which helped curb inflation data for the month.Food prices, air tickets, new and used cars, auto insurance, etc. have driven the rise in CPI.The cost of goods excluding food and energy rose slightly by 0.1% in December after rising 0.3% in November.If used cars are no longer included, commodity prices fall.

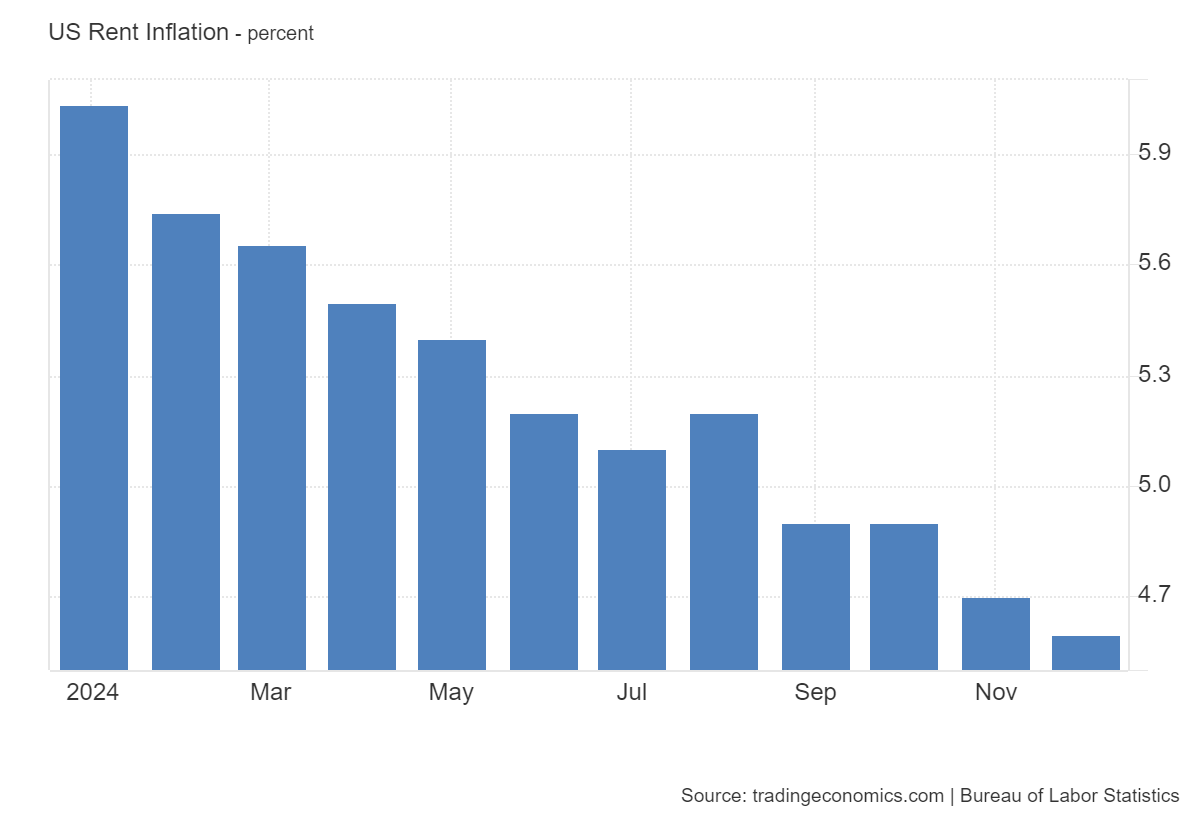

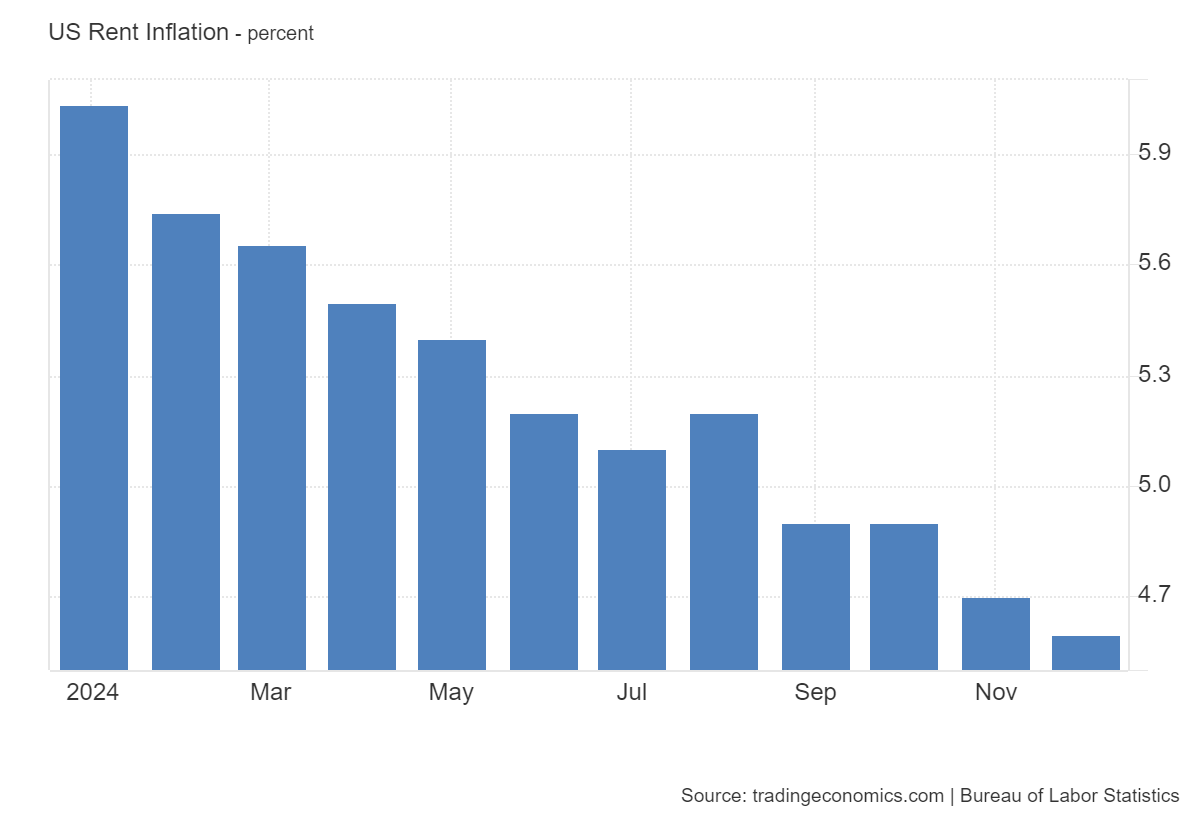

Housing prices, the largest category in the services industry, rose 0.3% for the second consecutive month in December.Owner's equivalent rent and main residential rents both rose, growth after the smallest increase since 2021.Excluding housing and energy, service prices rose 0.2%, the smallest increase since July last year, according to agency calculations.

Affected by lower-than-expected inflation, the three major U.S. stock indexes rose across the board.At the close, the Dow Jones index rose 1.65% to 43,221.55 points; the S & P 500 index rose 1.83% to 5,949.81 points; and the Nasdaq index rose 2.45% to 19,511.23 points.

The yield on the 10-year Treasury note fell sharply, falling about 13 basis points to around 4.65%.As U.S. bond yields fell, growth stocks such as Tesla and Nvidia rose.Tesla rose 8%, and Nvidia rose more than 3%.

The performance of a number of large banks generally exceeded market expectations, and stock prices collectively rose. JPMorgan Chase rose nearly 2%, Citigroup and Wells Fargo both rose more than 6%, and Goldman Sachs rose 6%.

Regarding expectations for future interest rate cuts, some analysts believe that after months of rising inflation data in the United States, the latest CPI data is lower than expected will help restart discussions about progress in inflation.But Fed officials need to see a series of depressed data to be convinced of this.lingering inflationary pressures led to a sharp sell-off in global bond markets and raised concerns that the Federal Reserve relaxed policy too quickly late last year.

Currently, it is widely expected that the Federal Reserve will still leave interest rates unchanged at its meeting later this month.But more economists said that better than expected CPI data in December made it possible for the Federal Reserve to cut interest rates in March this year.Prior to the release of this CPI report, traders generally expected that interest rates would not be cut again until the second half of this year.

Nick Timiraos, a well-known journalist known as the "New Federal Reserve News Agency", said that the U.S. CPI report released on Wednesday had little impact on the prospects of the Fed suspending interest rate cuts. The mixed data could not point to the direction of inflation. It is expected that the Fed will continue to remain inactive this month, and more data is needed to determine the next step.