This week, the Trump deal completely ignited the market.

Starting from Sunday, the currency circle was the first to usher in a carnival. Bitcoin exceeded US$81,000, and the market value of Ethereum exceeded that of Bank of America.On Monday, Bitcoin surged more than 6%, and the Asian market surged directly above $81,000 in early trading, setting a record high.Ethereum, the second-largest cryptocurrency by market value, followed suit, with a price exceeding US$3,200 and a market value reaching approximately US$383 billion.

On the other hand, U.S. stocks have also stepped out of strength in the near future.In the two trading days after Trump was elected last week, the Nasdaq Index and the S & P rose nearly 5% respectively.As of last night's close, the three major U.S. stock indexes continued to rise across the board. The S & P 500 index closed above 6,000 points for the first time, setting a record high, and the financial sector continued to perform strongly.

Tesla, which is the most concerned by the market, rose nearly 9% last night, the largest five-day gain in four years. Its latest total market value reached US$1.12 trillion, surpassing TSMC to rise to seventh place in the U.S. stock market.Traders in the options market expect Tesla shares to rise further, with many call options set at target prices above $450.

What is the Trump Deal?What is the logic of the Trump deal?Can investors still add positions?

In short, as long as it is a transaction that provides good news after Trump takes office, it can be called a Trump transaction.

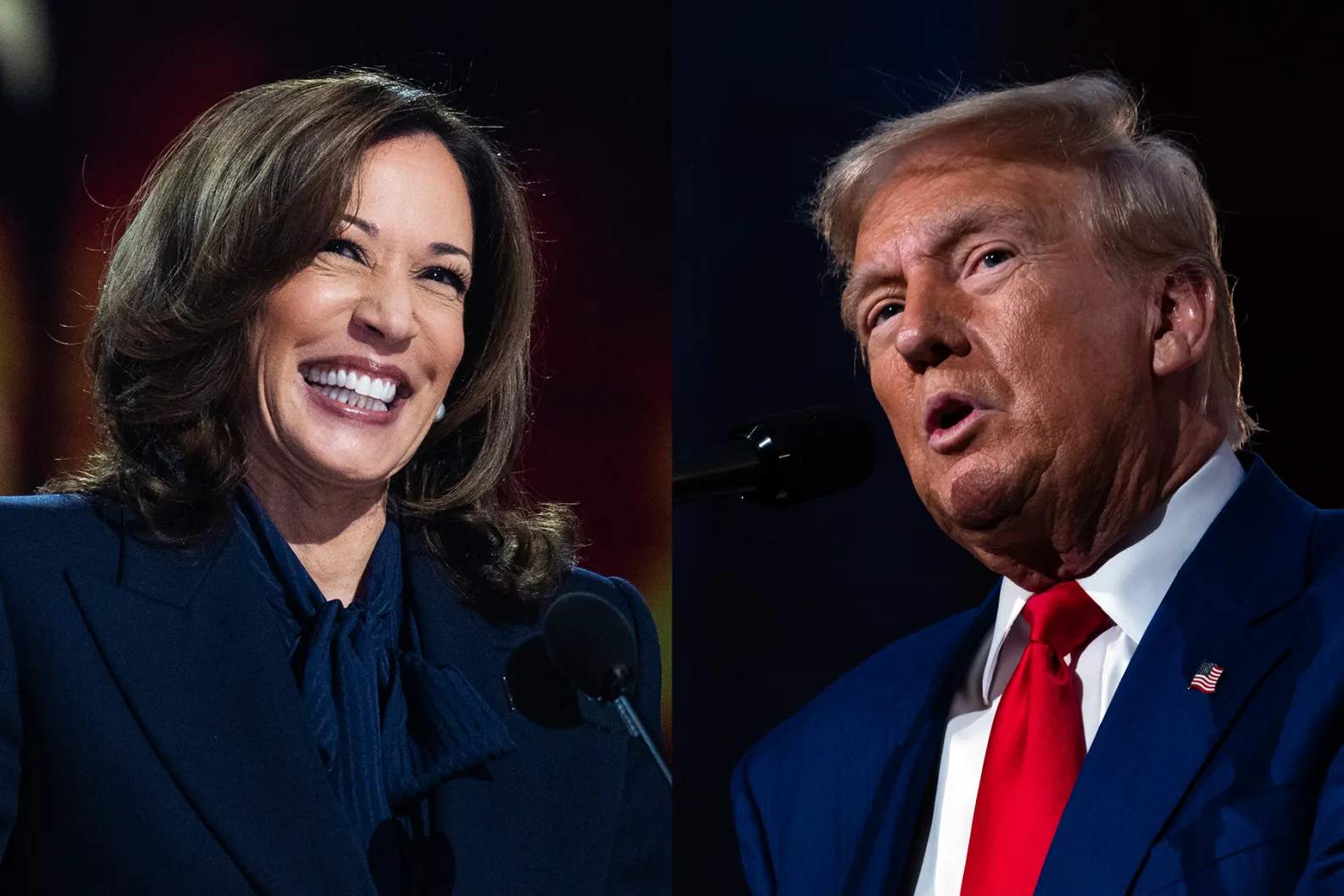

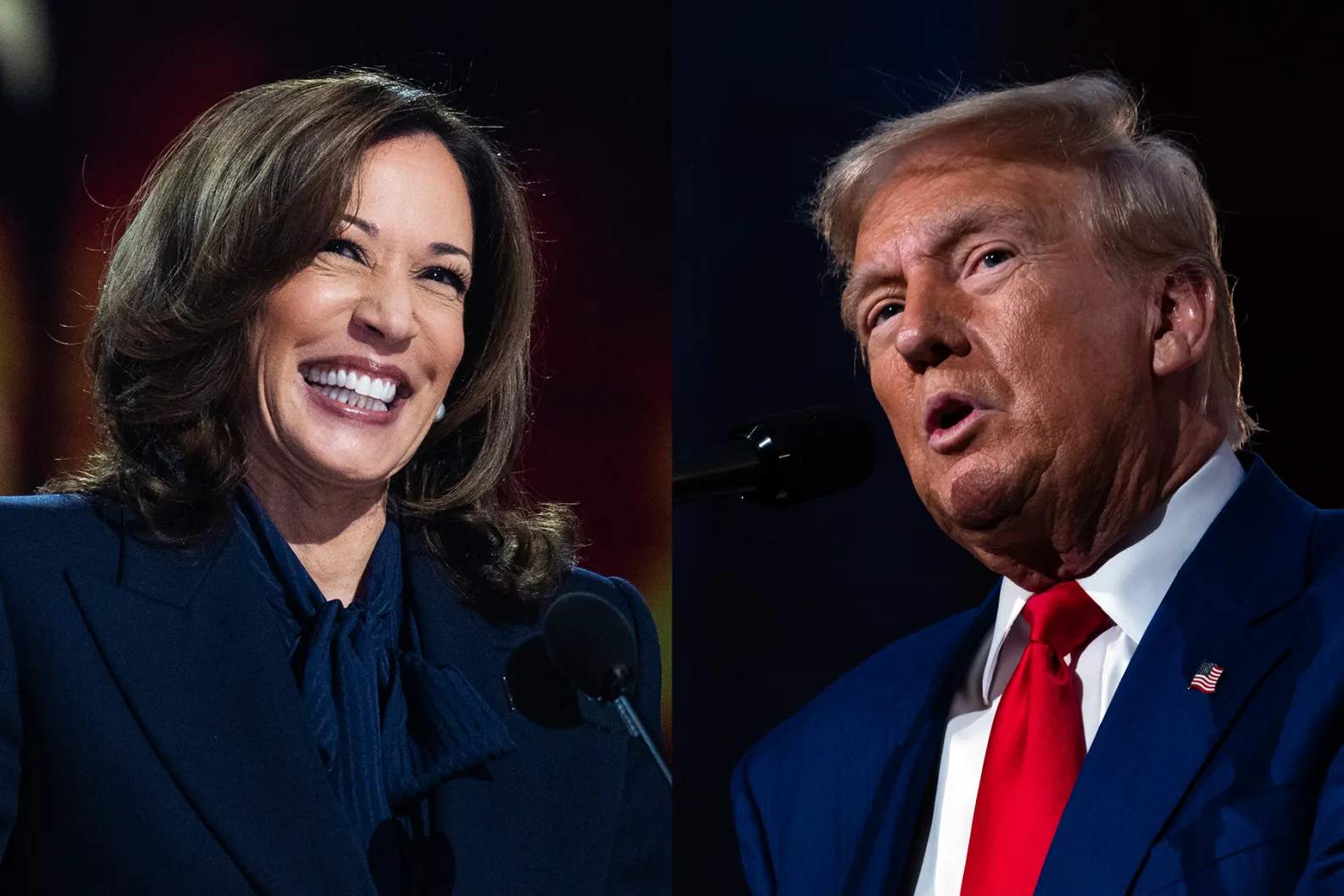

Judging from previous TV debates, the market has basically formed a main line.In the first debate between Trump and Biden held on June 27, U.S. Eastern Time, Trump clearly prevailed. The market performance was as follows: the S & P 500 index and the Nasdaq index rose sharply, and the US dollar index strengthened. The yield on U.S. bonds rose, LME copper rose rapidly, Bitcoin rose, Brent crude oil prices rose slightly, and COMEX gold was obviously under pressure.

On September 10, Trump and Harris held another debate. In this debate, Trump was at a disadvantage. The market performance was that the S & P 500 index and the Nasdaq index weakened rapidly after the opening, the US dollar index weakened, and the US bond yield fell, copper and oil prices rose in resonance, Bitcoin fell, and gold prices rose slightly.From this perspective, investors can get a glimpse of the trading ideas of the U.S. election.

It can be seen from this that the main lines of Trump's transactions are: bullish on cryptocurrencies, U.S. dollars, U.S. stocks (especially Tesla and banking stocks), bearish on gold, and U.S. bonds.

Let's first look at cryptocurrencies and gold.

In this round of rise, cryptocurrencies mainly benefited from Trump's policy propositions.He strongly advocated cryptocurrencies during the campaign, promising to protect and enhance the U.S. cryptocurrency industry and end the SEC's crackdown on cryptocurrencies, which is a big plus for the industry.

So, after Trump was elected, funds acted quickly.BlackRock's iShares Bitcoin Trust ETF (IBIT) recorded a single-day net inflow record of nearly $1.4 billion on Thursday.The options market offered a higher premium, and on the Deribit derivatives exchange, open interest on Bitcoin prices of more than $90,000 increased to more than $2.8 billion, a record high.

Standard Chartered Bank expects that Bitcoin will hit US$100,000 by the end of the year, and expects that by the end of 2026, the total market value of the cryptocurrency market will increase from the current US$2.5 trillion to US$10 trillion.

As a commodity with limited supply, the rise of cryptocurrencies will inevitably lead to the decline of gold.In addition, Trump may come to power with a more liberal "small government" idea, and a government that no longer "takes care of everything" will benefit Bitcoin, a "decentralized" asset.The prudent expansion of the scale of government debt will also help maintain the inherent credit of the US dollar. Since gold is priced in the US dollar, it is expected that it will continue to be under pressure in the future.

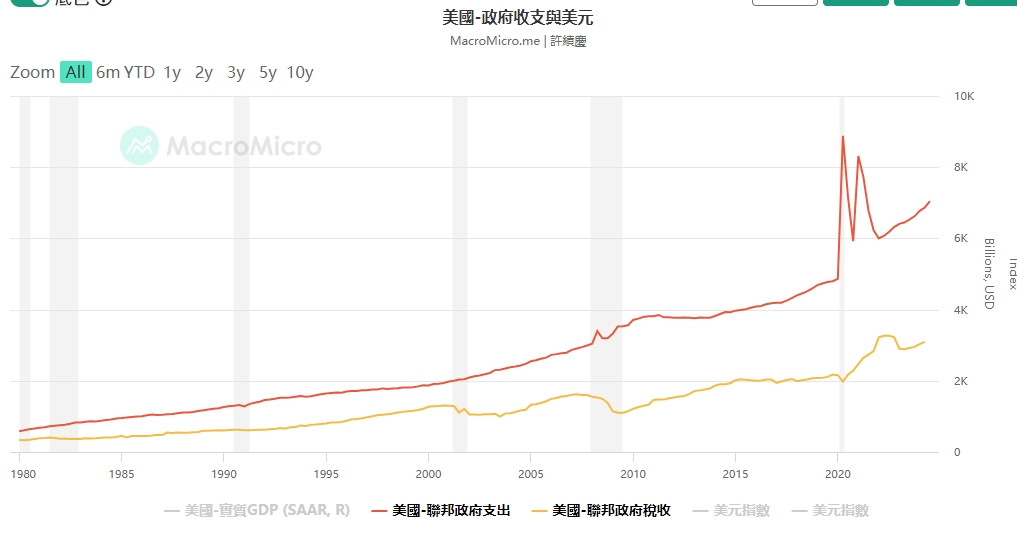

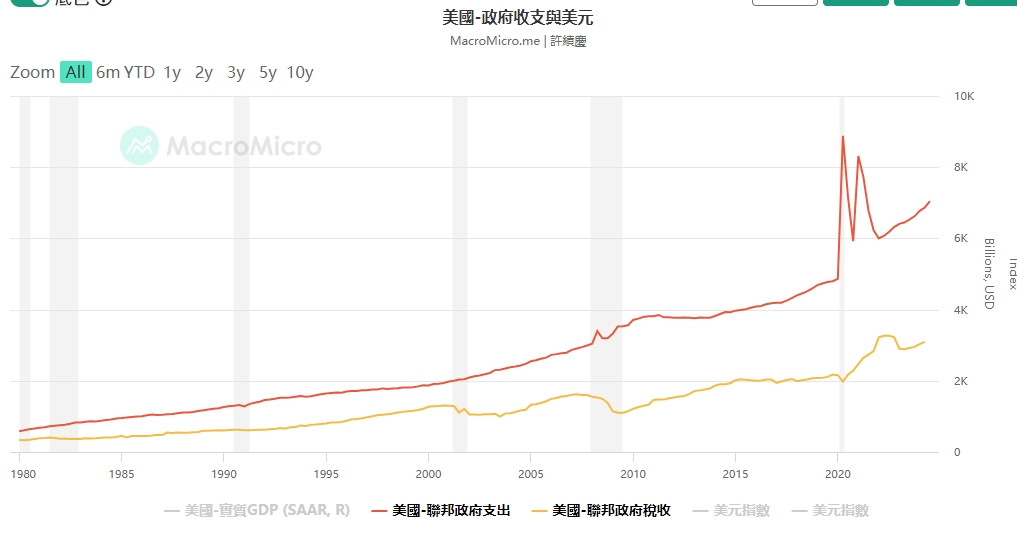

However, this "small government" model also has hidden concerns.The measures Trump promised before taking office to drive out immigrants, increase oil exploration, and tax cuts on businesses are all "burning money" and are expected to be under financial pressure.

Analysts said that if tariff revenue falls short of expectations, the Republican government may still introduce major fiscal changes.Under U.S. law, major fiscal policy changes require control of both houses of Congress. Even if the Republican Party wins a big victory, legislation will take time, and the Trump administration may still be stretched.

If the fiscal scale expands beyond expectations, the logic may reverse, the credit of the US dollar will be weakened, and gold will strengthen again.

In terms of U.S. stocks, the brightest one is naturally Tesla.

Since the November 5 election, the stock has risen more than 39%, increasing its market value by more than $300 billion.Although Trump, who advocates "boosting traditional energy", will pose a negative impact on the entire electric vehicle industry after taking office, Tesla's share price will not be affected.Analysts said that Trump's victory will help speed up regulatory approval of Tesla's autonomous driving technology, which is simply a long drought for Tesla, which is suppressed by Democratic governments everywhere.

_576280704_893.jpg)

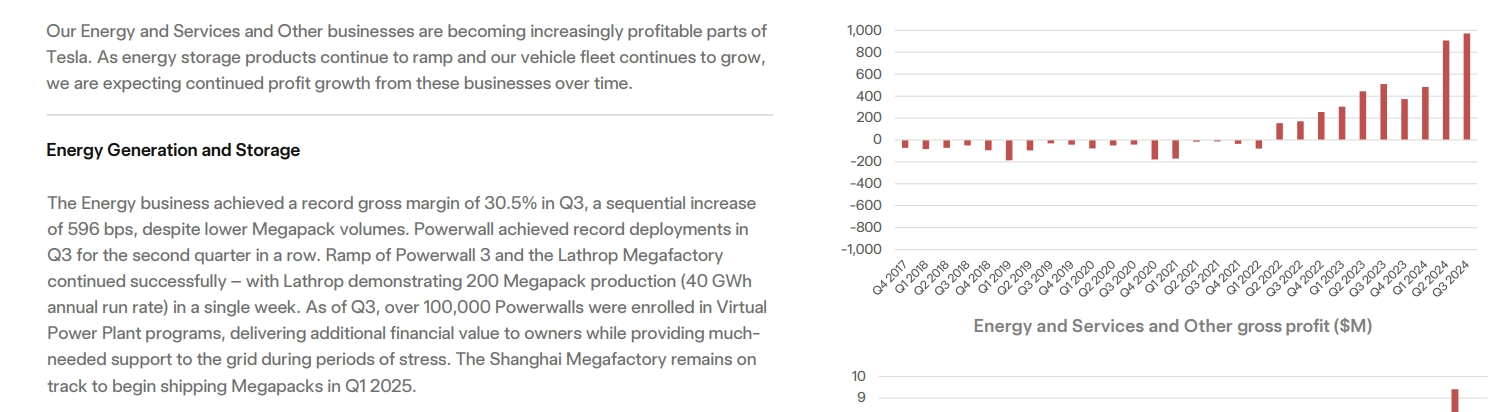

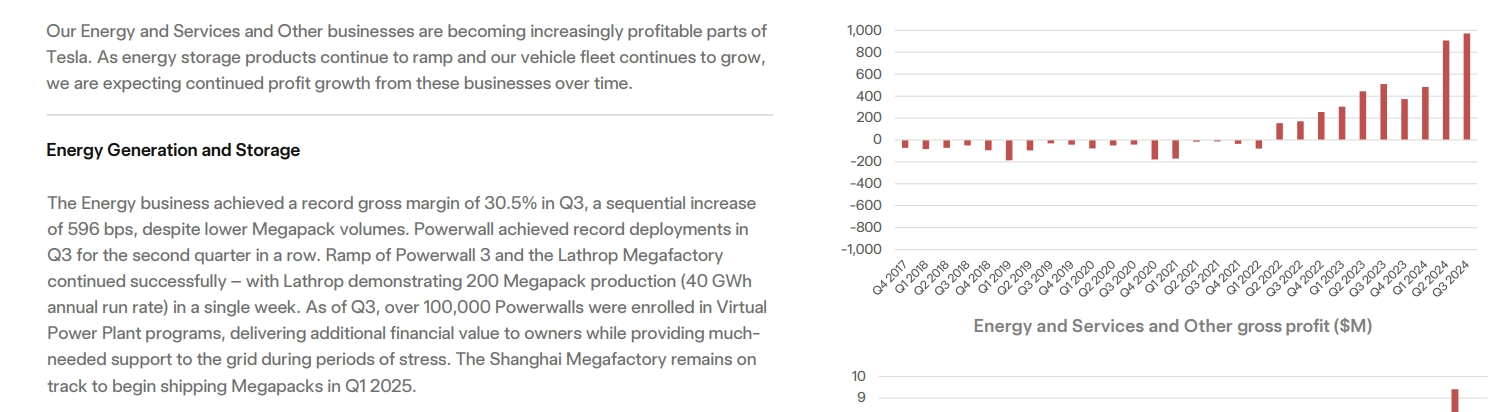

In addition, judging from Tesla's third quarterly report, the American star car company seems to have found a new business growth point-the energy storage business.Data shows that Tesla's energy power generation and energy storage business revenue in the third quarter was US$2.376 billion, a year-on-year increase of 52.4%, and a year-on-year increase of 100% in the second quarter.In the third quarter, the gross profit margin of the energy storage business reached 30.5%, setting a record for the highest gross profit margin of the business in a single quarter.

According to the financial report, Tesla's energy storage business mainly includes two types of products: Powerwall and Megapack. The former is for domestic use and the latter is for commercial use.As a car manufacturer, Tesla's energy storage business was initially not attracted by the market.However, as AI data centers are built across the United States, these "power-swallowing behemoths" are putting huge loads on the U.S. power grid, and Tesla's energy storage business is beginning to have the opportunity to show its muscles.

Morgan Stanley said that in the future, the power demand brought by the AI boom will make Tesla a key player in the U.S. energy market.By 2030, the electricity consumption of U.S. data centers may be equivalent to the electricity consumption of 150 million electric vehicles-a sign that Tesla will continue to realize the dividends of its energy storage business for at least the next five years.

Therefore, forging iron requires one's own strength. Tesla's recent surge is not entirely due to Trump's election.The solid fundamentals demonstrated by the third-quarter financial report also brought confidence to investors.

Finally, there is U.S. Treasury bonds.

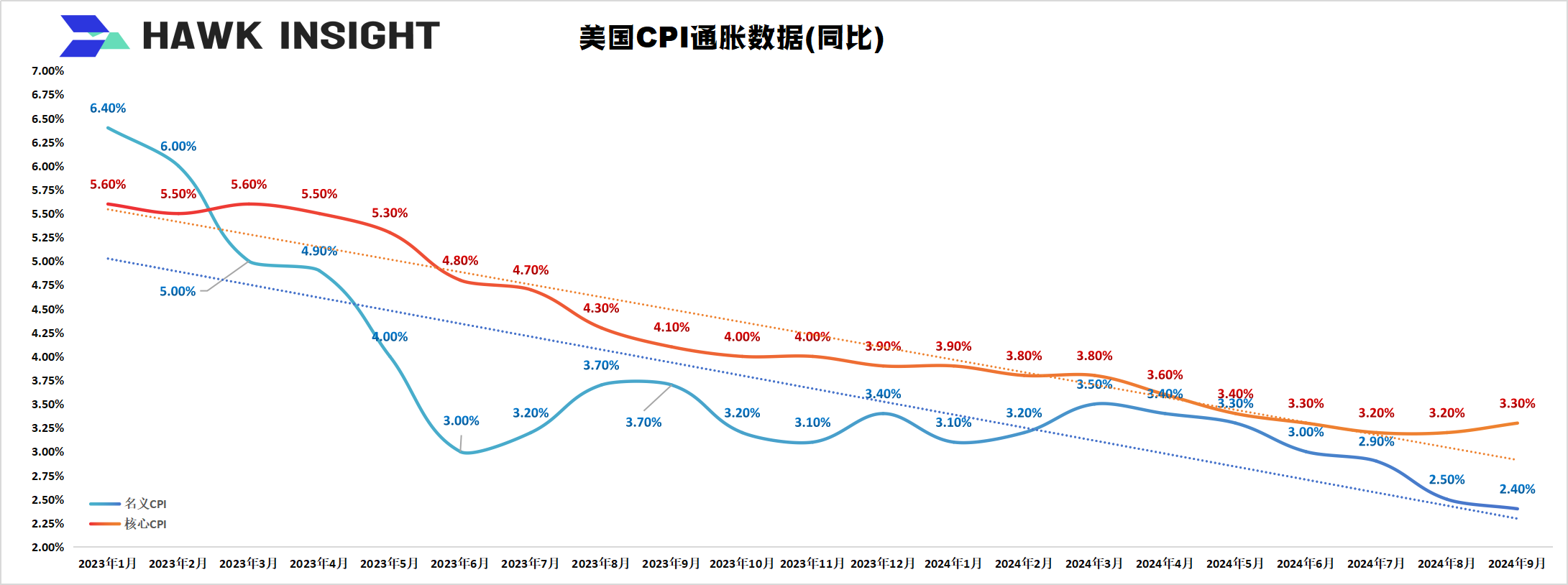

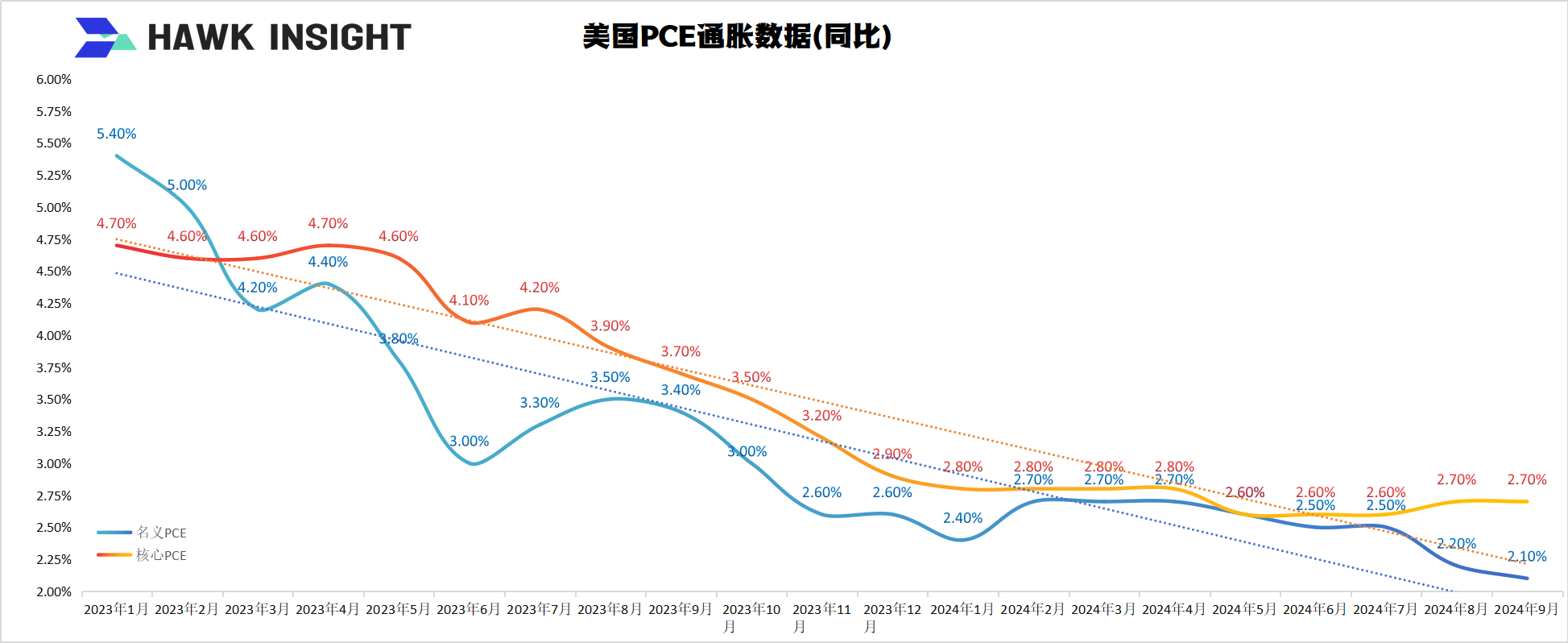

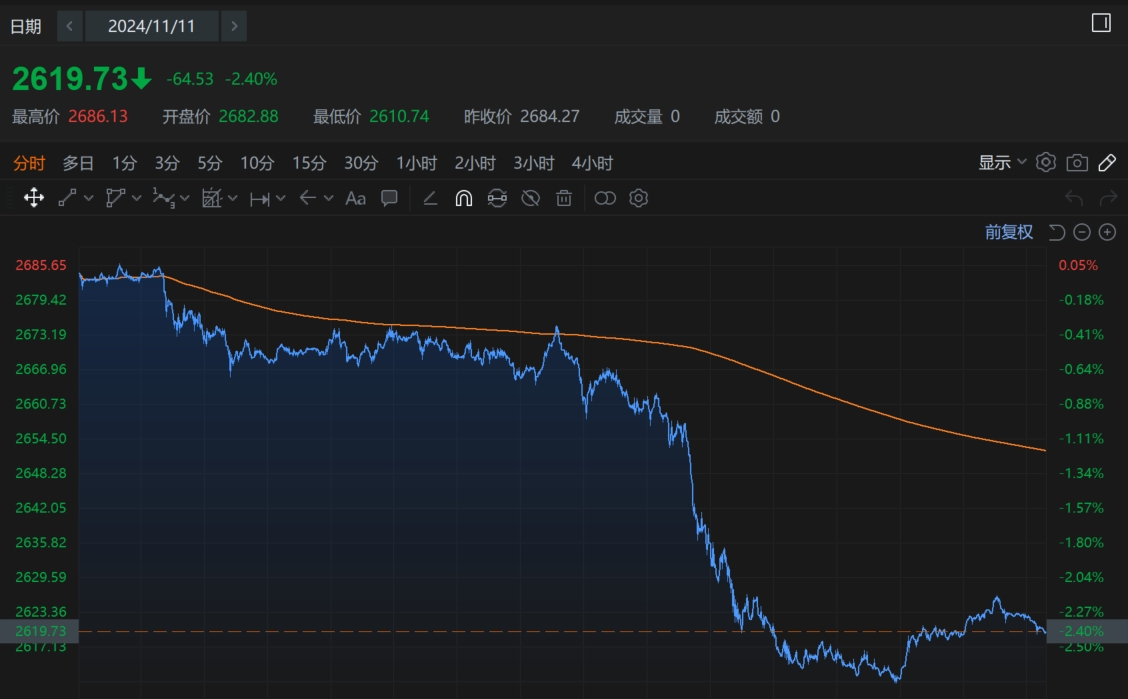

The recent sell-off in U.S. Treasuries is related to strong inflation expectations.The Federal Reserve has entered a cycle of interest rate cuts, compounded by the aggressive fiscal policies that Trump may launch after taking office, causing market concerns that the Federal Reserve will maintain high interest rates for a longer period of time, and even the overall interest rate center may move upward.

Swap pricing shows that traders expect the Federal Reserve to reduce its benchmark interest rate to 4% by mid-2025, compared with the market's original forecast of 3%.The new interest rate is a full percentage point higher than the old interest rate.

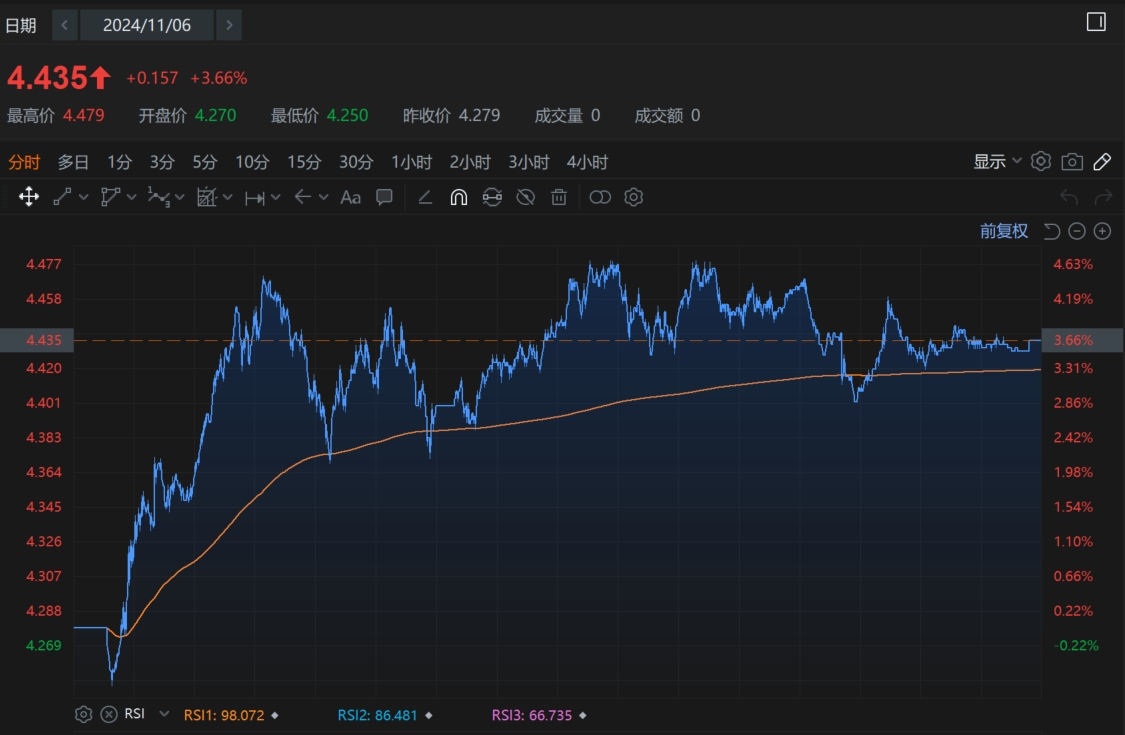

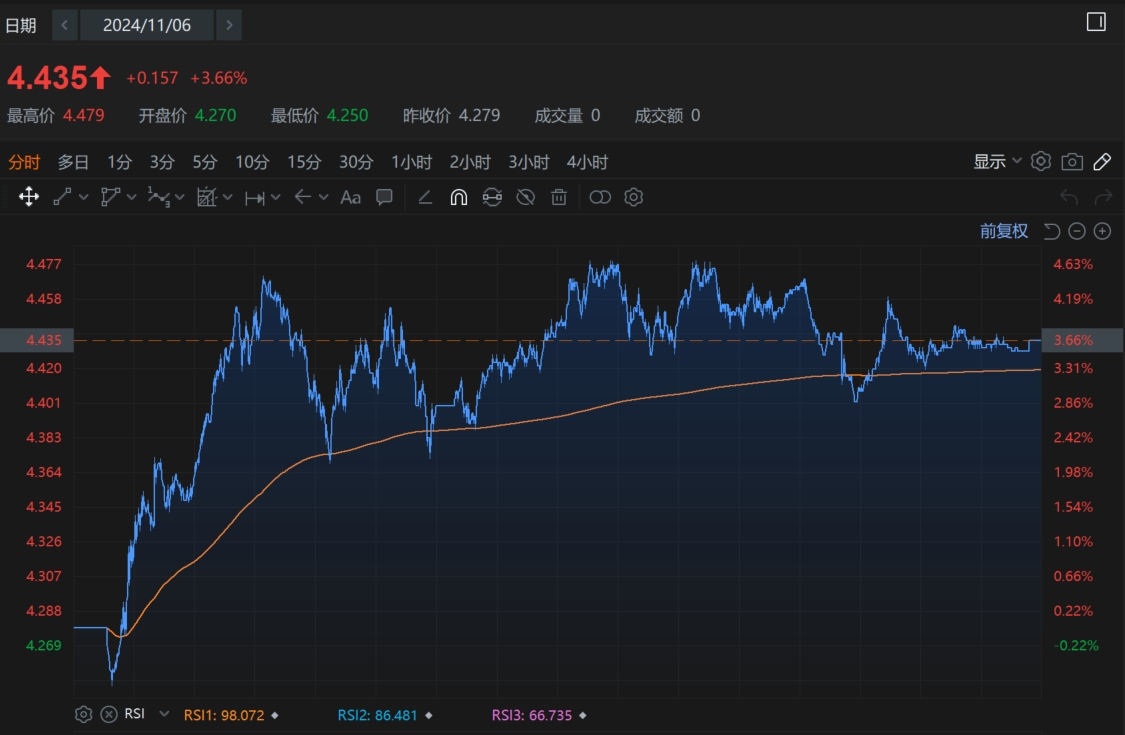

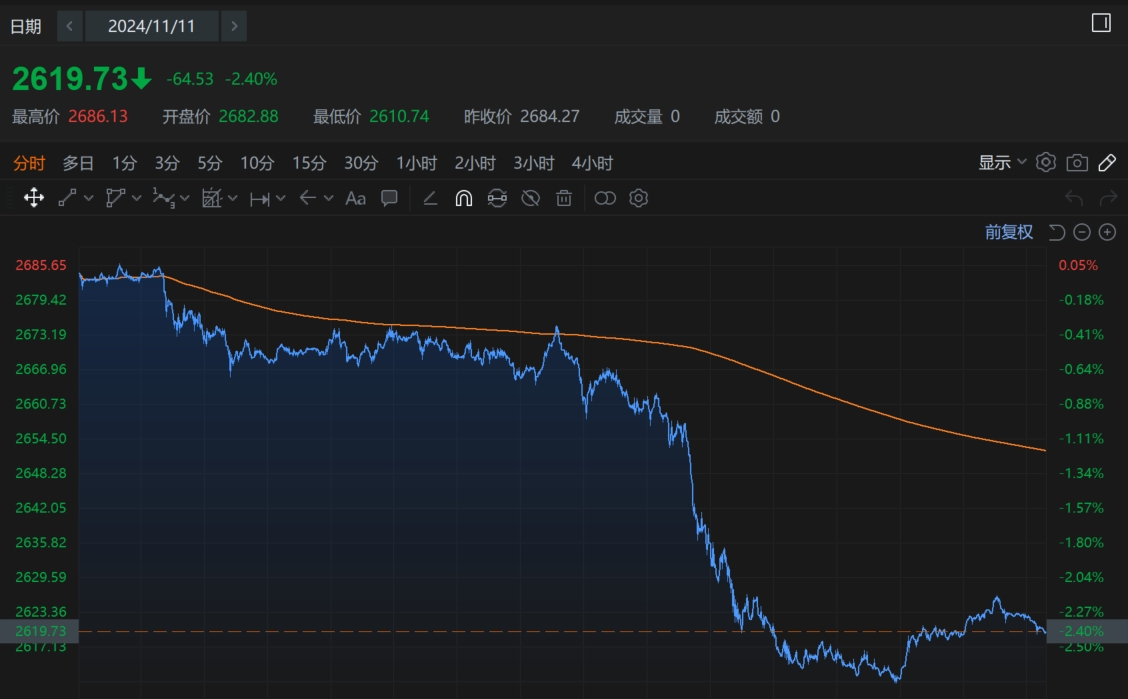

Amid fierce expectations, U.S. bonds were sold sharply after Trump's election victory, and the yield on the 10-year Treasury bond soared to more than 4.47%.

Now, the trend seems to be reversing. The Federal Reserve cut interest rates by 25 basis points in November, demonstrating its determination to advance the interest rate cut cycle.Coupled with factors such as strong auctions of 10-year U.S. bonds, the yield on 10-year U.S. bonds fell by more than 8 basis points a week, indicating that market demand's ability to absorb government bonds is still there.

Funds are also coming in one after another to bargain.

Data compiled by Bloomberg showed that last week, Direxion's TMF (triple long Treasury bonds with more than 20 years) received a record inflow of US$625 million.BlackRock's TLT (ETF for U.S. Treasury bonds over 20 years) also received a $1.4 billion inflow.Since the beginning of this year, capital inflows from the two products have reached US$3.3 billion and US$14 billion respectively, and many funds are betting that the interest rate cut cycle will continue.

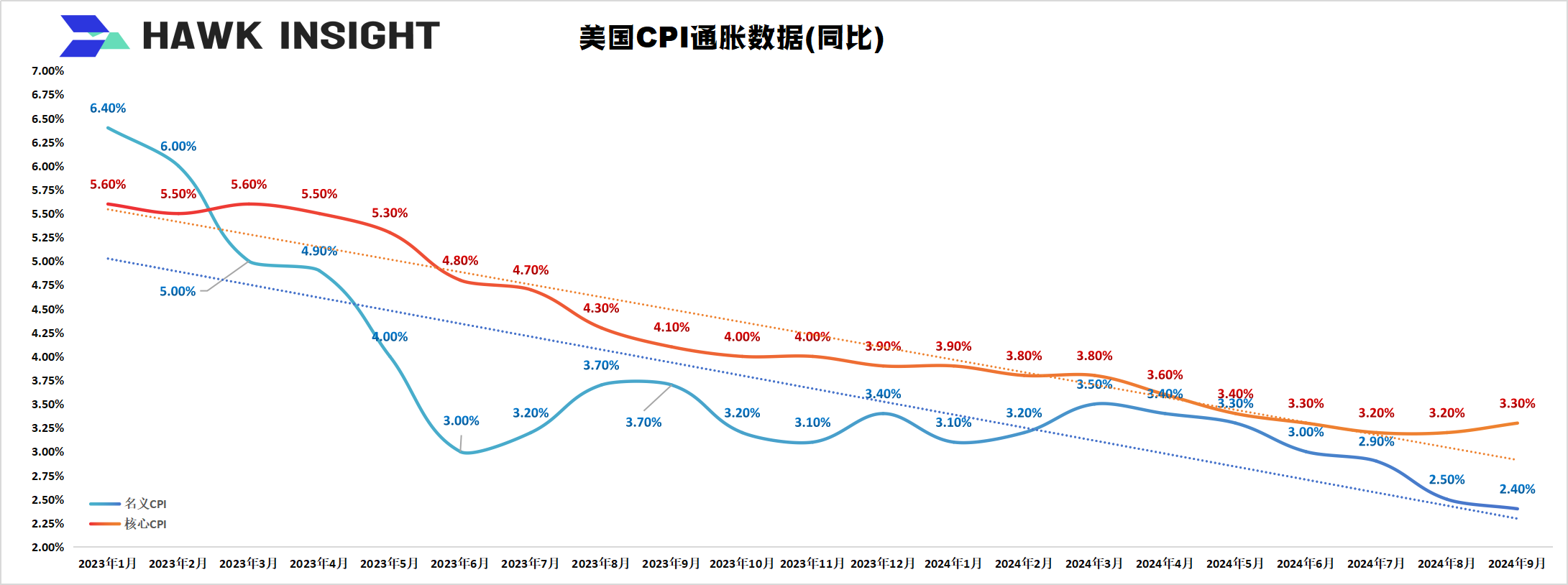

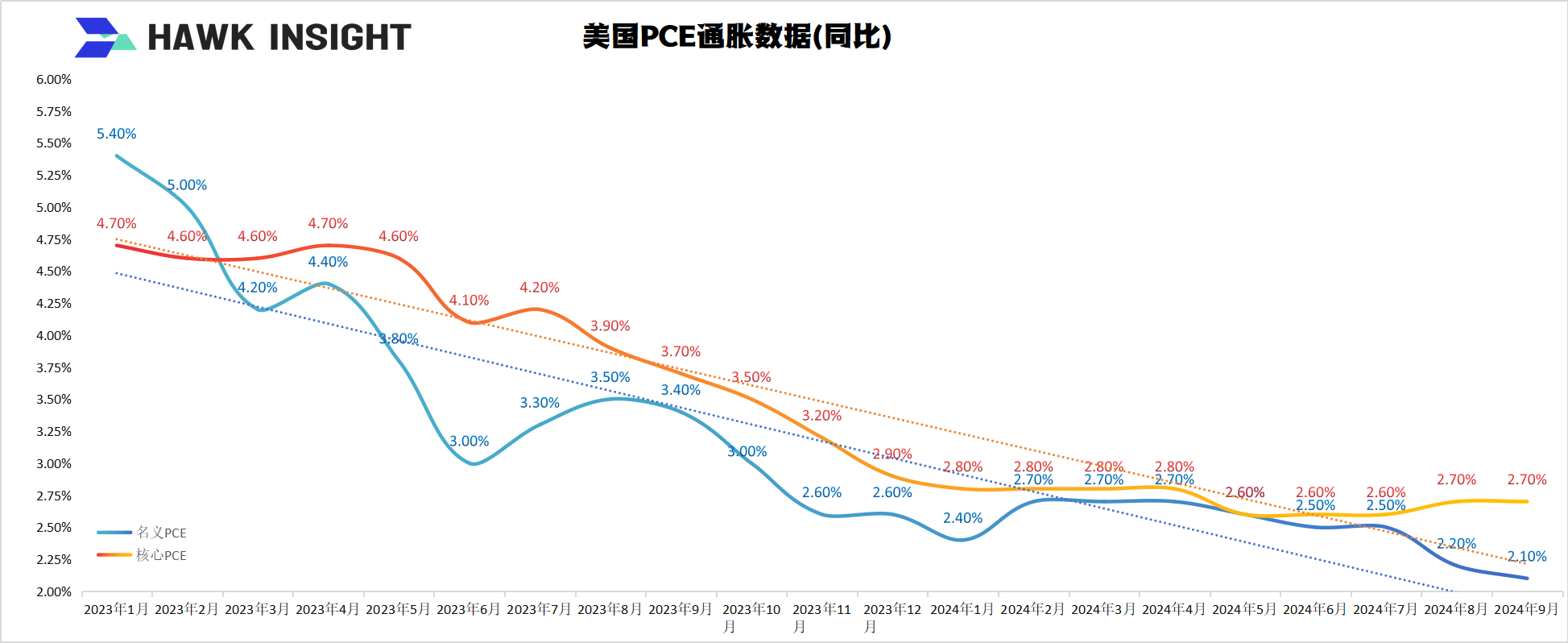

Investors are currently keeping a close eye on inflation because inflation data is closely related to the pace of the Federal Reserve's interest rate cuts.If inflation unexpectedly rises, the Federal Reserve may have to slow down the pace of interest rate cuts, and the decline in U.S. debt may continue.However, based on the movements of the above two funds, the decline in US debt may have bottomed out.

In addition, imposing additional tariffs will also raise inflation.According to Shen Wanhongyuan's calculations, the trade balance between China and the United States will increase by US$12.98 billion, and the domestic price level in the United States will rise slightly by 0.1%.Goldman Sachs predicts that if the United States fully implements Trump's tariff plan, the U.S. inflation rate will rise by 1.1%. Whether this rate is within the Federal Reserve's tolerance, we still need to find an answer from Powell's expected management.

The Federal Reserve's interest rate decision in December is crucial, when the FOMC Committee will release SEP economic forecasts, including important indicators such as interest rate path, expected inflation, expected unemployment rate, and expected economic growth.

_576280704_893.jpg)