The speed of light changes! Goldman Sachs urgently withdraws "U.S. recession" forecast after Trump suspends tariffs

Wall Street has witnessed perhaps the most dramatic reversal of forecasts in history.

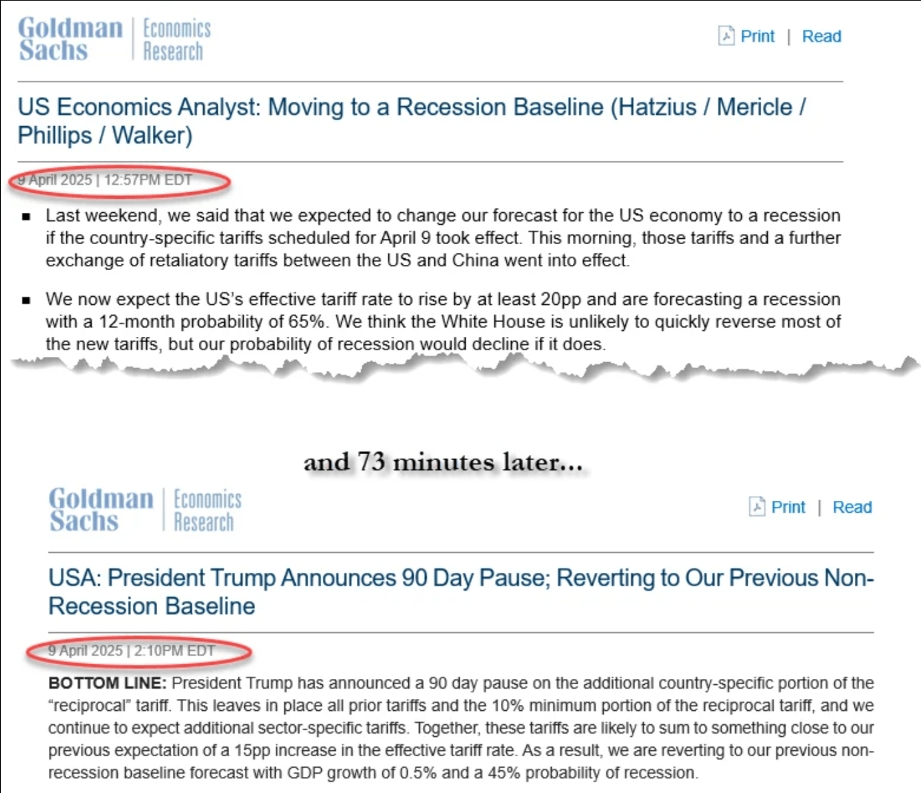

On April 9, Wall Street witnessed perhaps the most dramatic reversal of forecasts in history.Goldman Sachs Group issued a report early that day, raising the probability of a recession in the United States in the next 12 months to 65%. However, just an hour later, as the Trump administration announced a 90-day moratorium on most new tariffs, Goldman Sachs quickly withdrew this forecast, reducing the probability of recession to 45%.This lightning-like "face change" not only exposes the impact of policy uncertainty on market expectations, but also reveals the vulnerability of the current global economy in the trade game.

The wild swings in Goldman's forecast essentially reflect the Trump administration's erratic trade policy.On April 2, Trump announced the implementation of "reciprocal tariffs", planning to impose a benchmark tariff of 10% on all trading partners and impose higher tax rates on specific countries. This move directly led Goldman Sachs to increase the probability of recession from 35% to 45%, and lowered its forecast for U.S. GDP growth in 2025 from 1.5% to 1.3%.However, just a few hours after some of the new tariffs took effect on April 9, Trump announced a 90-day suspension of implementation through social media, retaining only the 10% benchmark tax rate.This policy style of "changing orders every day" forced Goldman Sachs to reassess the economic outlook in a short period of time. The originally expected comprehensive tariff impact was partially postponed, combined with the potential room for the Federal Reserve to cut interest rates, temporarily alleviating the risk of a hard landing.

However, the policy suspension did not eliminate the deep anxiety in the market.Goldman Sachs 'latest forecast shows that the U.S. economic growth rate in 2025 will be only 0.5%, and the probability of a recession in the next 12 months will still be as high as 45%.This contradiction stems from the limitations of the policy toolbox: even if some tariffs are suspended, the benchmark rate of 10% will still be higher than previous levels, while additional tariffs of 25% in specific industries (such as on China goods) may continue to push up corporate costs and consumer prices.According to estimates, if comprehensive tariffs are implemented, core PCE inflation in the United States may rise from the current 2.8% to 3.1%, while GDP growth may be dragged down by another 0.7 percentage points.This "boiled frog in warm water" policy environment has caused corporate capital expenditures to remain sluggish. JP Morgan data shows that the U.S. manufacturing PMI has been in a contraction range for three consecutive months, indicating that economic activity may shrink in the third quarter.

The market's reaction to other institutions is equally intriguing.After Trump announced the suspension of tariffs, most institutions maintained a cautious stance despite a brief surge in U.S. stocks.Renaissance Macro pointed out that policy changes have only turned "non-linear risks" into "linear risks" and have not changed the trend of economic slowdown; Citigroup emphasized that the tariff suspension cannot offset the impact of measures in effect on inflation and growth, maintaining its forecast of 0.8% GDP growth throughout the year; JPMorgan warned that even if the probability of a recession declines, actual economic activity may still contract before the end of the year, and postponed the Federal Reserve's first interest rate cut from June to September.Behind this collective prudence lies the long-term growth of policy uncertainty-as the Goldman Sachs report stated, trade policies "may change every hour," making it difficult for companies to formulate medium-and long-term plans, thereby inhibiting investment and employment.

The direction of the Federal Reserve's monetary policy has become a key variable in balancing risks.Goldman Sachs predicts that if economic data continues to be weak, the Federal Reserve may start cutting interest rates in June, with a cumulative rate of 2 percentage points during the year.However, this path faces dual challenges: on the one hand, the short-term market easing brought by the suspension of tariffs may reduce the urgency of interest rates; on the other hand, structural inflationary pressures (such as housing and services costs) may limit policy space.The data shows that even if core PCE inflation falls from its peak, its absolute value is still higher than the 2% target, while wage growth remains high at 4.5%, creating a potential risk of a "wage-price spiral".This dilemma explains why institutions such as Morgan Stanley are divided over when to cut interest rates-some believe faster action is needed to hedge against a recession, while others advocate maintaining interest rates to anchor inflation expectations.

The interconnectedness of the global economy is particularly prominent in this incident.U.S. policy fluctuations have had spillover effects through trade and financial channels: the euro zone's growth forecast for 2025 has been lowered to 0.8%, while China's growth forecast has dropped to 4.5% due to an average export tariff of 20%.What is more noteworthy is that the Policy Uncertainty Index (TPU) rose far more in the euro zone than in the United States, indicating that European companies are more anxious about supply chain restructuring.This divergence could exacerbate the strength of the dollar and further suppress capital inflows into emerging markets.At the same time, risk aversion pushed gold prices above US$3100 per ounce, and Goldman Sachs even set an extremely bullish target of US$4000, reflecting the market's need for hedging against "de-dollarization" and geopolitical risks.

Looking at this game between policy and market, the core contradiction lies in the failure of "expectation management".The Trump administration is trying to reshape trade order through tariff leverage, but its frequent adjustment strategy has instead amplified volatility.Data shows that since the tariff announcement on April 2, the S & P 500 index has fallen by 17%, and its market value has evaporated by more than US$5 trillion. The policy suspension only brought about a one-day rebound and failed to reverse the technical bear market pattern.This "policy market" feature exposes the structural problems of economic governance in the post-epidemic era-when political decisions are deeply bound to market rules, any short-term intervention may generate more complex long-term risks.

In the next three months, the market's focus will be on two levels: one is whether the April 9 "window period" to suspend tariffs can lead to a breakthrough in trade negotiations, and the other is how the Federal Reserve can balance inflation stickiness and recession risks.Historical experience shows that repeated policies may temporarily delay the crisis, but cannot eliminate the fundamental contradiction.As the meaningful conclusion of the Goldman Sachs report: "The financial environment is becoming more sensitive to tariff escalation, and the cost of a collapse of confidence is far more expensive than the tariffs themselves.”

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.