"Commodity bull market flag bearer" Goldman Sachs refused to bow: optimistic about the next year's oil price trend

Goldman Sachs commodity researchers recently said that the main factor driving up oil prices over the past year was demand in China, not triggered by the Russia-Ukraine conflict, and that Chinese manufacturing activity is now rising。

Goldman Sachs commodity researchers recently said that the main factor driving up oil prices over the past year was demand in China, not triggered by the Russia-Ukraine conflict, and that Chinese manufacturing activity is now rising。As a result, Goldman Sachs expects Brent, the global benchmark for crude oil prices, to surge again over the next 12 to 18 months, which could mean that crude oil prices are targeting $100 or more per barrel in the fourth quarter of this year.。

Jeff Currie, global head of commodities research at Goldman Sachs, said in an interview with the media on Wednesday that the current supply situation is "more tense."。Currie said the agency still expects crude prices to hit $100 a barrel in the fourth quarter as oil inventories fall and the money supply stabilizes。

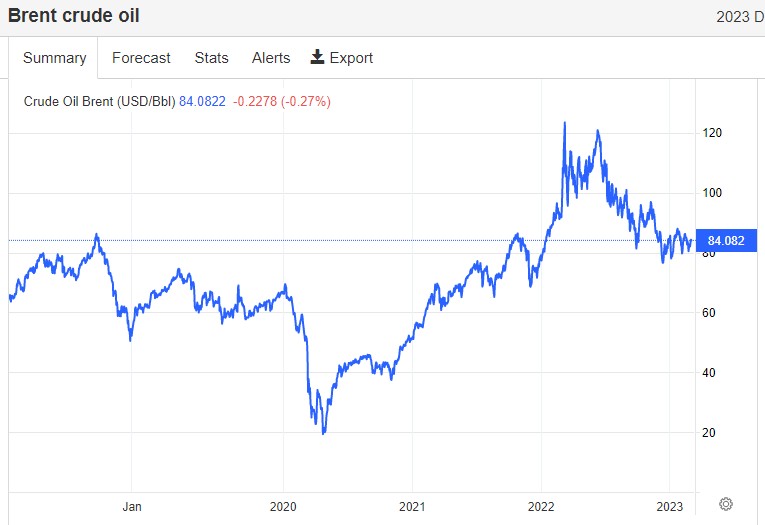

Goldman Sachs, known as the "standard bearer of the commodity bull market," is still one of the most bullish financial institutions on Wall Street on commodities, and although commodity prices such as crude oil have fallen sharply from their all-time highs, Goldman Sachs remains firm in its belief that the commodity market has entered a super-cycle.。Currie said investors may be less interested in the commodities sector at the moment, but China's latest manufacturing PMI data shows a pick-up in demand, which will put pressure on idle global capacity.。Brent crude futures are currently trading near $84 a barrel.。

Mr Currie said: "In the fourth quarter of last year, global oil demand contracted by about 2 per cent, which in my view was a recession.。Currie said the recession had created some spare capacity for oil and other commodities, but recent manufacturing data from China showed that was reversing.。"Now, as Chinese demand returns to the market, we will lose spare capacity and we will return to our previous problems," Currie said.。

The real focus is on supply scarcity, according to a research paper released by Goldman Sachs。"At this point, given that supply is still so scarce, supply capacity from one year to the next is really the focus."。The market has been trading this way。He pointed out that the commodity supercycle is not an "uptrend" in the general sense, but rather a "sequence of different peaks."。

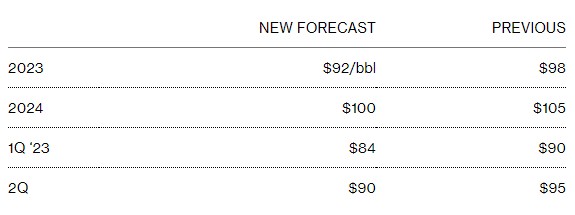

Prior to the media interview, Goldman Sachs analyst Jeff Curry and others predicted in a report that Brent crude oil futures prices would rise to $100 per barrel by December, implying an increase of about 20 percent from current levels.。However, Goldman Sachs has also lowered its forecast for oil prices, predicting that Brent crude could average $92 per barrel this year, down from their previous forecast of $98 per barrel, and that Brent crude is expected to reach $100 per barrel in December (previously expected around the middle of the year), compared with an earlier forecast of $105.。

Goldman Sachs said in the report that the economic recovery triggered by China's reopening will push the crude oil market into deficit by June this year and "expose structural underinvestment."。

Goldman's peer Morgan Stanley also recently lowered its forecast for Brent crude oil prices in the second half of this year and 2024, but remains bullish on oil price trends in the coming year.。The agency lowered its fourth-quarter and 2024 cloth price forecasts to $95 a barrel from $110, and third-quarter prices to $95 from $100.。The agency now expects an oversupply of crude oil in the first quarter, a balanced market in the second quarter and a supply shortage in the second half, citing China's economic recovery and rising demand for air travel, but to a lesser extent than previously expected.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.