Baidu Q4 Revenue Net Profit Record Growth Robin Li Reiterates Company's "No Lack of Core"

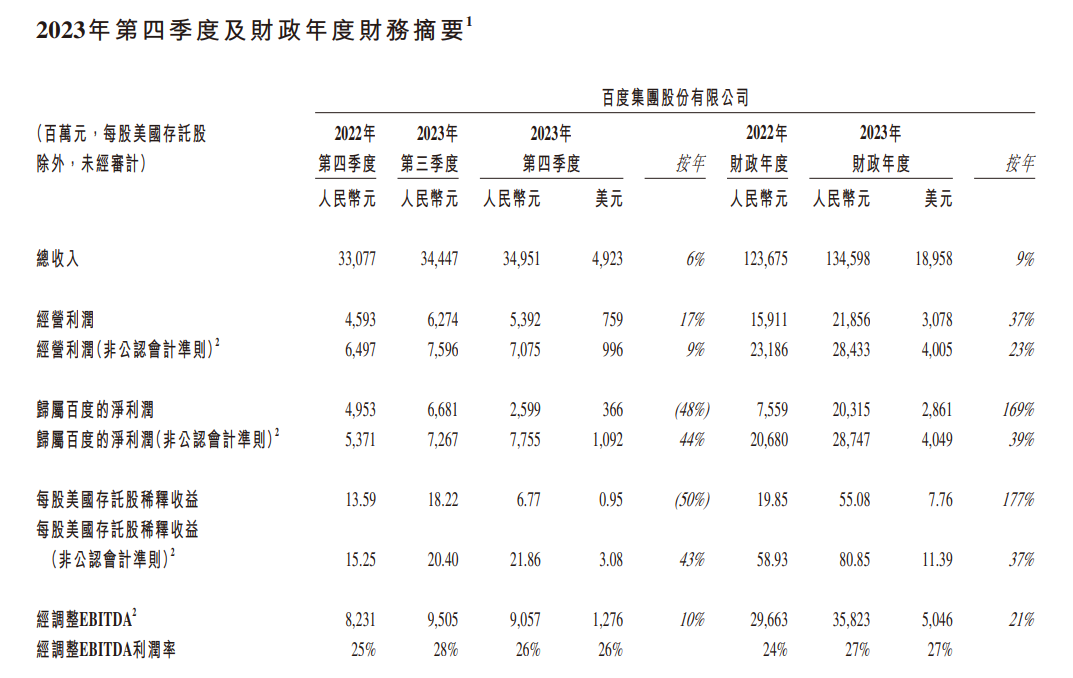

On February 28, Baidu Group announced its fourth quarter and full year 2023 financial results。According to the data, Baidu's total revenue in the fourth quarter was 35 billion yuan, up 6% year-on-year; net profit attributable to Baidu was 2.6 billion yuan, down 48% year-on-year, close to half.。

On February 28, Baidu Group ("Baidu") announced its financial results for the fourth quarter and full year ended December 31, 2023.。

Revenue net profit recorded growth

According to the data, Baidu's total revenue in the fourth quarter was 35 billion yuan (RMB, the same below), up 6% year-on-year and 1.7%。Baidu's core revenue, excluding iQiyi, was $27.5 billion, up 7 percent year-on-year, slightly exceeding market expectations of $273..100 million yuan。Among them, online marketing revenue was 19.2 billion yuan, up 6% year-on-year, while non-online marketing revenue was 8.3 billion yuan, up 9% year-on-year, mainly due to the intelligent cloud business.。

In terms of earnings, adjusted net profit attributable to Baidu was $7.8 billion, up 44% year-on-year, of which net profit attributable to Baidu Core was $7.5 billion.。

As of December 31, 2023, cash, cash equivalents, restricted funds and short-term investments were $205.4 billion and free cash flow was $7 billion.。

For the year, Baidu's total revenue reached $134.6 billion, up 9% from the previous year.。Adjusted net profit was 28.7 billion yuan, up 39% year-on-year。

Baidu also disclosed some of its business data:

● In terms of intelligent cloud, Baidu disclosed that by the end of 2023, Baidu's flying paddle platform had condensed 10.7 million developers, and has served 235,000 enterprises and institutions。By the end of 2023, developers had created 860,000 models on the paddle.。

● In terms of intelligent driving, Baidu's automatic ride-hailing service Radish Fast Run provided a total of 839 thousand rides in the fourth quarter of 2023, up 49% year-on-year。As of January 2, 2024, the cumulative single volume provided by Radish Fast on open roads exceeded 5 million.。In the fourth quarter of 2023, driverless orders accounted for 45% of Wuhan's overall order portfolio, up 5 percentage points from the previous quarter.。

● In terms of mobile ecology, Baidu APP had 6 monthly active users in December 2023..6.7 billion, up 3% year-on-year。Hosted pages accounted for 51% of Baidu's core online marketing revenue in the fourth quarter of 2023。

● For iQiyi, Baidu disclosed that the average daily total subscription membership of iQiyi reached 100 million in the fourth quarter, compared to 1 in the fourth quarter of 2022..100 million, up from 1 in the previous quarter.08 million。More importantly, the average monthly membership service revenue (average monthly membership revenue per member) contributed by iQiyi in the fourth quarter was 15.98, compared to 14 in the fourth quarter of 2022 and the third quarter of 2023, respectively..$17 and $15.54 yuan。

"Baidu Core once again showed solid quarterly results。Robin Li, co-founder and CEO of Baidu, said, "In 2023, we made a major breakthrough in Wenxin and Wenxin's one-word model, product reinvention and commercialization.。At the same time, our core business remains resilient and healthy.。Going forward, we will continue to invest strongly in generative AI and foundational models to lay the foundation for the gradual creation of new growth engines.。"

Increase investment in AI

In the fourth quarter, Baidu spent $6.3 billion on research and development, up 11% from a year earlier.。Baidu said the increase in R & D spending was mainly due to depreciation expenses and increased server rack fees for servers supporting generative AI R & D。For the full year 2023, Baidu's capex increased 38% YoY。

And those investments are paying off well.。

At present, an important application direction of Baidu to AI is in advertising。Li revealed on the phone that generative AI can help Baidu improve the eCPM (effective thousand display cost) of advertising.。And with the introduction of generative artificial intelligence tools, the accuracy of advertising matches has increased, helping companies achieve more targeted and relevant advertising.。He said that in the past four quarters, generative AI has brought hundreds of millions of incremental revenue to Baidu, and he believes that in 2024, the related incremental revenue will also rise to billions.。

Shen Shake, president of Baidu Intelligent Cloud Business Group, also gave positive comments on AI's help in generating revenue.。He mentioned that in the fourth quarter just past, Baidu's total revenue from its generative AI and underlying model-related business (including internal and external revenue) exceeded $600 million.。

On the other hand, Baidu has also achieved some success in reducing related costs。Baidu said that the current Wen Xin Yiyan 3.The cost of reasoning for version 5 is only 3.1% of version 0。

Shen said he believes Baidu's cloud business revenue will accelerate in 2024 compared to the same period last year。He said: "In terms of enterprise cloud, we will continue to increase the gross margin of traditional cloud business.。At present, Baidu's generative artificial intelligence and large language model business is still in the early stages, in the future we will dynamically adjust business pricing to achieve rapid market coverage and improve product penetration for more enterprise users.。In the long run, we believe that the profit margin of AI cloud business will be higher than that of traditional cloud business.。"

When asked about Wenxin Yiyan's corporate adoption rate, Baidu said that in December last year, about 26,000 enterprises of different sizes and types chose to use Wenxin Yiyan API interface, a quarter-on-quarter increase of 150%。Shen said: "We believe that no company in China can receive such a large number of API requirements as we do.。"

For the chip, Baidu is still the same as last quarter, said they are not "lack of core"。Li Yanhong said Baidu's current artificial intelligence chip reserves are enough to support Wenxin's iterative upgrade in the next one to two years.。For model reasoning, the required chip functions do not need to be too powerful, and the chips on Baidu's hands and the existing chips on the market are enough to support its needs.。

Baidu Entry Wensheng Video Model?

In addition, Robin Li also expressed his views on the recent hot Wensheng video model。He believes that multimodal generative artificial intelligence, or the transformation and fusion between multimodal, such as text, audio, video, etc., is the general trend of future basic model development.。He said that Baidu has already invested in this area and will continue to do so in the future.。

Li emphasized that the potential market for large language models is huge and that development is still at a very early stage.。"In today's world, even the most powerful large language models still cannot adapt to all application scenarios, and there is still a lot of room for improvement.。"

In addition, he also mentioned that a huge potential application market for visual basic models is autonomous driving.。"All along, we are constantly training video generative models to apply to autonomous driving technology.。"We are also constantly learning to detect, classify and detect objects in order to better understand and understand the real world and its laws, so as to help us transform the captured road images and videos into driving tasks, so as to achieve more intelligent, safe and adaptable autonomous driving technology."。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.