New energy car companies release sales figures in March, BYD sales are more than five times Tesla's!

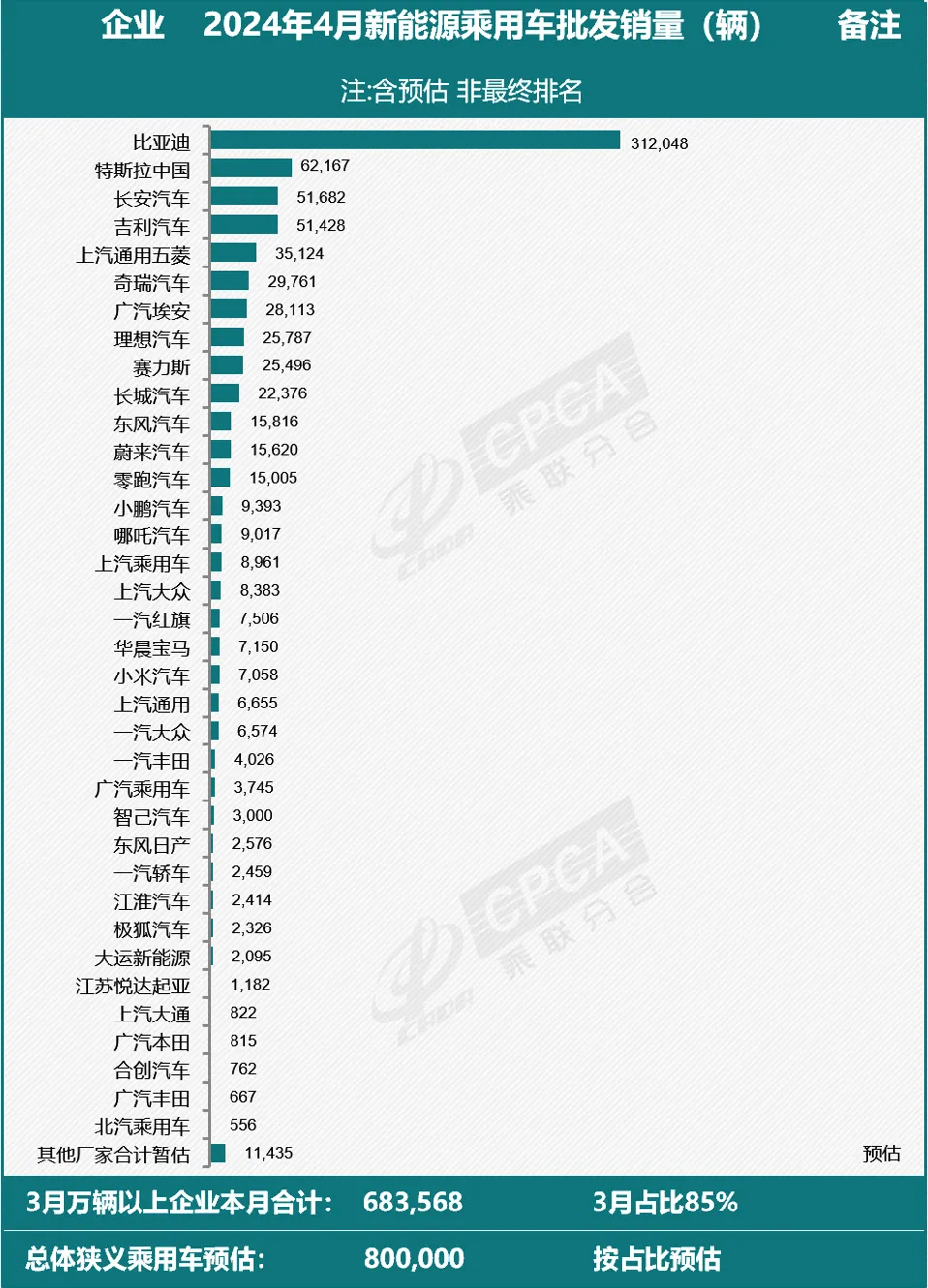

According to data from CPCA, wholesale sales of new energy passenger vehicles in China reached 800,000 units in April, a year-on-year increase of 33% and a slight decrease of 2% compared to the previous month.

According to data from CPCA, wholesale sales of new energy passenger vehicles in China reached 800,000 units in April, a year-on-year increase of 33% and a slight decrease of 2% compared to the previous month.

CPCA believes that since the beginning of the year, there has been a surge in new product price reductions in the car market, and consumers are still very wait-and-see. The sales recovery momentum in the passenger car market is insufficient. Recently, some companies have actively taken measures to reduce prices for new cars, and the increase brought about by the price decline has been reflected. In the first half of April, the penetration rate of new energy reached 50%.

CPCA further stated that with the successful opening of the Beijing Auto Show in late April, consumer attention to the car market has significantly increased. In addition, the nationwide policy of replacing old cars with new ones will be launched at the end of the month, which is expected to stimulate the early wait-and-see demand for car purchases and accelerate its release. It is expected that the overall car market will improve in May.

BYD's April sales were more than five times Tesla's

In April, BYD sold a total of 313,245 cars, a year-on-year increase of 48.96%. Among them, the sales of passenger cars reached 312,048 units, a year-on-year increase of 49%. According to the estimated data from the China Association of Automobile Manufacturers, BYD's sales account for about 40% of the country's estimated sales, ranking first in the industry.

Specifically, let's take a look at the sales situation of BYD's various brands. The Dynasty and Ocean series sold a total of 297,864 units in April, a year-on-year increase of 49.7% and a month on month increase of about 4%. The Qin, Song series, and Seagull series were the main sales drivers. BYD and Mercedes Benz's joint venture brand, DENZA, once again crossed the 10,000 vehicle mark, selling a total of 11,122 vehicles in April, a month on month increase of 8%. The high-end series performed worse, with FANGCHENGBAO selling 2,110 units in April, a 40.6% decrease compared to the previous month; Yangwang brand sold 952 units, a decrease of 12.7% compared to the previous month.

At the recently opened Beijing Auto Show, Yangwang unveiled its flagship sedan Yangwang U8, Yangwang U9, and Yangwang U7, making its offline debut as a million dollar new energy vehicle.

In terms of overseas exports, BYD exported a total of 41,011 passenger cars in April, a year-on-year increase of 176.6% and a month on month increase of 6.7%.

On the Tesla side, according to data from CPCA, Tesla China sold 62,167 electric vehicles in April, a year-on-year decrease of 18% and a month on month decrease of 30.2%. As Tesla's sales decline, its gap with BYD has further widened. In April, BYD's sales were more than five times that of Tesla.

Perhaps due to poor performance in the Chinese market, Tom Zhu, Senior Vice President of Tesla's automotive business, will resign from his management positions in Europe and the Americas and return to Tesla China as Vice President of the China region, responsible for production and sales in the Greater China region, with the intention of boosting sales again.

In addition, with Tesla's full auto drive system (FSD) expected to enter China, it is speculated that another important task for Zhu's return is to lead the landing of Tesla's FSD in China.

Previously, Zhu had been a core executive of Tesla's business in China and had also led the successful construction of the Shanghai super factory. It is reported that Zhu was appointed in early 2023 to be responsible for Tesla's North American sales and became the de facto head of Tesla's automotive business, equivalent to Tesla's "second in command", second only to Musk.

"National team" brand overall performance is good

Changan Auto ranks behind BYD and Tesla.

In April, the sales of Changan Auto reached 210,133 units. Among them, the sales of Changan Auto's independent brand new energy increased by 129.7% year-on-year to 51,682 vehicles, and the overseas sales of Changan Auto's independent brand increased by 93.2% year-on-year to 31,649 vehicles. From January to April this year, Changan Auto's independent brand new energy sales reached 180,500 units, a year-on-year increase of over 68%.

Changan Auto's independent new energy brands include Changan Qiyuan, DEEPAL, and Avatar.

As the main pure electric brand under Changan Auto, DEEPAL delivered a total of 12,744 vehicles in April, a decrease from 13,048 vehicles in March. The official statement from DEEPAL also stated that the DEEPAL S7 topped the sales chart of all Thai brand BEVs in April, achieving a significant month on month growth of 90.9%.

The other two brands, Changan Qiyuan, delivered 11,833 vehicles in April and Avita delivered 5,247 vehicles.

According to official data, Geely Auto's passenger car sales in April were 153,267 units, a year-on-year increase of 39% and a month on month increase of 2%. Among them, the sales of new energy vehicles (including Geely, LYNK&CO, ZEEKR and other brands) were 51,428 units, a year-on-year increase of 75% and a month on month increase of 15%.

According to data from CPCA, Geely Auto's sales were surpassed by Changan Auto in March, falling out of the top three. Although Geely Auto was unable to achieve a comeback in April, the gap between the two has been narrowed to about 200 vehicles, and the "battle situation" between the two sides has become increasingly anxious.

As a highly regarded mid to high end brand under Geely, ZEEKR delivered a total of 16,089 units in April, a year-on-year increase of 99% and a month on month increase of 24%, setting a new historical high. From January to April, there was a year-on-year increase of 111%, consistently ranking first in sales of Chinese pure electric brands with over 200,000 yuan.

ZEEKR is also actively enriching its product price matrix and entering the high-end automotive field. On April 19th, the four seater ultra luxury flagship MPV model ZEEKR 009 Glory was officially launched, with an official retail price starting from 789,000 yuan. It will officially start nationwide delivery on May 19th.

ZEEKR 009 Glory adopts a full stack 800V high-voltage system, with a CLTC comprehensive operating range of 702 kilometers and a 0-100 km/h acceleration of 3.9 seconds. It is equipped with a 108 degree 5C Kirin battery, with a peak power of 580 kilowatts.

According to official disclosure, SAIC Group sold 285,000 new energy vehicles from January to April, a year-on-year increase of over 35%. Among them, SAIC Volkswagen's new energy sales exceeded 10,000 units in April, a year-on-year increase of 56%; SAIC General Motors delivered a total of 8,762 new energy vehicles in April, a year-on-year increase of 93.1%.

GAC Aion's global sales in April reached 28,113 vehicles, ranking among the top three in new energy. According to official reports, GAC Aion ranked first in the automotive industry on the 2024 Hurun Global Unicorn List, becoming the highest valuation of over 100 billion yuan for domestic unlisted new energy vehicle companies, and also the fastest car company to break through one million in the world, taking only 4 years and 8 months.

On April 7th, GAC Aion and DiDi Intelligence announced that their joint venture, Guangzhou Andi Technology Co., Ltd., had been granted a business license. This is the first joint venture established by L4 autonomous driving company and car companies in China to create Robotaxi mass-produced vehicles.

The L4 autonomous production vehicle developed by both parties will be based on GAC Aion's pure electric exclusive vehicle platform and vehicle electrical architecture, combined with Didi's unique L4 autonomous driving technology solution for travel services.

It is reported that the first Robotaxi has completed product definition and is currently undergoing joint design review. It is planned to achieve mass production next year. The mass-produced Robotaxi will fully adapt to the Didi autonomous driving and unmanned intelligent operation system, Huiju Port, and connect to the Didi travel network in a hybrid dispatching form, providing users with safe, comfortable, and cost-effective autonomous travel services.

"New car-building forces" competition intensified

●Li Auto

Li Auto surpassed AITO in April, regaining its position as the best-selling new force. In April,Li Auto delivered 25787 vehicles, a slight increase of 0.4% year-on-year and a decrease of 11.03% month on month.

On April 22nd, Li Auto officially announced a price reduction. The 2024 Li L7, Li L8, Li L9, and MEGA will adopt a new pricing system, and new and undelivered users can enjoy the new prices.

Specifically, the Pro version of the 2024 Li L7 was reduced by 18,000 yuan, the Max version was reduced by 20,000 yuan, and the Ultra version was reduced by 20,000 yuan. The price reduction of the Pro, Max, and Ultra versions of the 2024 Li L8 is the same as that of the 2024 Li L7. The Pro version of the 2024 Li L9 will be reduced by 20,000 yuan, while the Ultra version will be reduced by 20,000 yuan. The 2024 Li MEGA model was priced at 559,800 yuan before the price adjustment and 529,800 yuan after the adjustment, with a price reduction of 30,000 yuan.

At the same time, in order to avoid being accused of "backstabbing old car owners", Li announced that it will provide cash rewards to owners of the 2024 Li L7, Li L8, Li L9, and MEGA who have already picked up their cars.

Due to the launch of the ideal round of price reductions in late April, the driving effect on sales may become more apparent in May.

●AITO

From the same month on month growth rate, Li's performance in April was average. In this situation, the Li still returns to being the top new force, mainly because the rapid momentum of AITO in the past few months was hit by negative public opinion.

Due to the recent major public opinion crisis, the AITO official official account did not disclose the delivery data of April.However, AITO is a brand jointly launched by Seres and Huawei, and holds an absolute share in Seres' sales. Therefore, we can also glimpse the sales situation of AITO in April from Seres' delivery data.

According to the data from CPCA, the wholesale sales volume of new energy passenger vehicles in April was 25,496. Even assuming all AITO brand cars are being sold, there has been a significant month on month decline of over 20%.

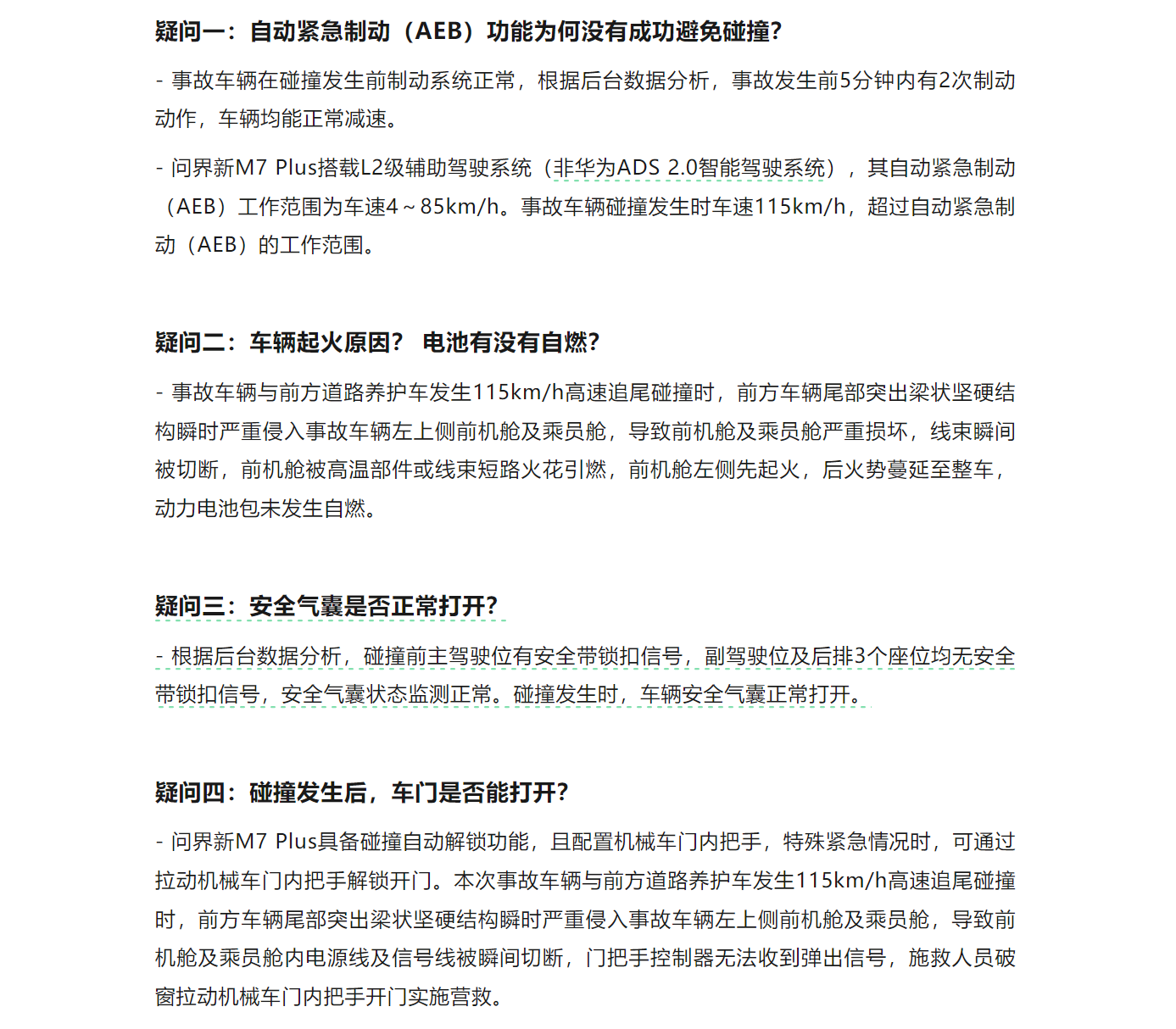

At the end of April, a serious traffic accident occurred in Yuncheng, Shanxi Province, China with a AITO M7 Plus. The car collided with a highway maintenance vehicle and caught fire, resulting in the unfortunate death of three people on board. Subsequently, there were some questioning voices online, believing that the above-mentioned vehicles did not trigger AEB and the doors could not be opened when encountering an accident, causing a major safety crisis for AITO.

On April 28th, AITO officially released a statement stating that according to the national platform data access management regulations, it was learned that the vehicle had a speed of 115km/h at the time of the accident, the airbags were opened normally, and the characteristics of the power battery pack were all normal.

On May 6th, AITO officially issued another statement in response to several technical issues that have been of utmost concern in the public opinion regarding the traffic accident in Shanxi Yuncheng of the AITO M7.

At present, the accident is still under investigation, and the truth of the accident still needs to wait for the police to collect evidence and make a final judgment.

It is worth noting that prior to the accident, the AITO M7 was the best-selling model in the AITO brand. In March of this year, the monthly delivery volume of AITO M7 was 24,598 vehicles, accounting for 77.5% of the AITO total delivery data (31,727 vehicles) during the same period. It is currently unknown how the subsequent sales of the AITO M7 will be affected after this accident.

●NIO

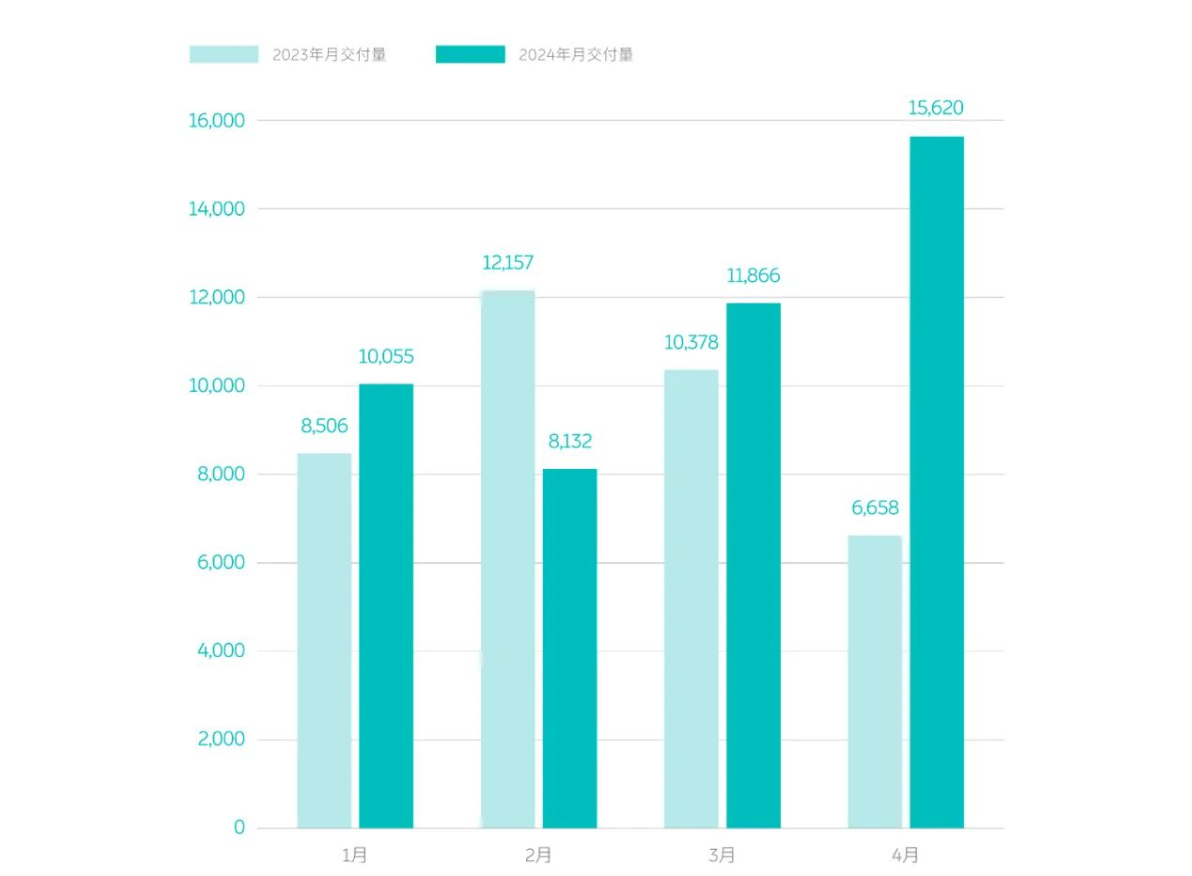

In April, the best performing new force was NIO.

According to official disclosure, NIO delivered a total of 15,620 new cars in April, a year-on-year increase of 134.6% and a month on month increase of 31.6%. As of the end of April, NIO has delivered a total of 495,267 new cars.

The good performance of NIO in April is related to the company's 1 billion yuan gasoline vehicle replacement subsidy. Starting from April 1st, gasoline vehicle users who replace NIO's 2024 new car will receive an additional 10,000 yuan subsidy from the optional installation fund. In May, NIO will also launch a "0 down payment" car purchase plan, with a maximum exclusive subsidy of 20,000 yuan for "trade in". This may further boost NIO's sales.

In addition, NIO's new brand "ONVO" is expected to debut in mid May, with the first model being the "ONVO L60". It is reported that the management team of Ledo brand will make a public appearance on May 9th, and it is expected to disclose information such as the responsible person, brand and logo meaning, and Ledo App.

It is understood that NIO's new brand will target the automotive market of 200,000 to 300,000 yuan, overlapping with Tesla's Model 3/Y price range. Although the competition for electric vehicles in this price range is fierce, it can enrich the company's price matrix for electric vehicles, which not only helps to increase the company's market share but also improves the company's profit margin.

●Leapmotor

Leapmotor, the new force behind NIO. Leapmotor also performed well in April, delivering a total of 15,005 vehicles, a year-on-year increase of 71.96% and a month on month increase of 3%. Leapmotor stated that the delivery of the two main models, C11 and C10, both exceeded 10,000 yuan.

In addition, the latest SUV model of Leapmotor, C16, made its debut at the 2024 Beijing Auto Show and began pre-sales, with pre-sale orders exceeding 11,950 units within 24 hours. It is reported that the full price of the C16 is expected to not exceed 200,000 yuan, and the car will be launched and delivered in June.

Among the new forces in car manufacturing, both Xpeng Motors and Nezha Motors performed poorly in April, with both struggling to cross the 10,000 vehicle mark.

●Xpeng

In April, XPeng delivered a total of 9,393 new cars, a year-on-year increase of 33% and a month on month increase of 4%. Among them, the Xpeng X9 delivered 1,959 units, with a cumulative delivery of nearly 10,000 units in April, continuously leading the market in pure electric MPV and pure electric three row seat models. From January to April, Xpeng Motors delivered a total of 31,214 new cars, a year-on-year increase of 23%.

On April 9th, Xpeng Motors announced its official entry into the Hong Kong and Macau markets, bringing its key models including G9, X9, G6, and P7i to consumers in Hong Kong and Macau.

●NETA

NETA delivered 9,017 units of its entire lineup in April, a year-on-year decrease of 18.6% and a month on month increase of 8.4%. From January to April this year, NETA delivered a total of 33,451 new vehicles across the entire lineup, which is still a certain distance from the delivery volume of 37,256 vehicles in the same period last year and 38,965 vehicles in the same period in 2022.

On April 22nd, NETA officially announced the launch of a new model under its umbrella -NETA L.

NETA L is positioned as a family intelligent super extended range SUV, with an official guide price of 129,900 yuan to 159,900 yuan. Within 72 hours of its launch, the cumulative orders have exceeded 10,000 units. The driving effect of this new car on the overall sales of the company remains to be observed.

On April 22nd, NETA Motors officially launched its first Indonesian ecological smart factory in Jakarta, Indonesia, with the production of a new car. The Indonesian Ecological Smart Factory is Nezha Automobile's second overseas smart factory after its Thai factory, and is another milestone in NETA Automobile's globalization process.

NETA Motors is vigorously promoting localization development in the Southeast Asian market. At present, NETA Motors has established an ecological smart factory for large-scale production in Thailand and is actively preparing to build a third factory in Malaysia.

●Xiaomi

Starting from this month, Xiaomi Motors has also joined the team of car companies reporting monthly data and has begun to appear in the monthly wholesale sales list of new energy passenger vehicle manufacturers by the China Association of Automobile Manufacturers.

According to official data, since its first delivery on April 3rd, the Xiaomi SU7 has delivered 7058 units in April. As of 24:00 on April 30th, the number of lock orders for Xiaomi SU7 reached 88063, with female car buyers accounting for 28%, BBA owners accounting for 29%, and Apple users accounting for 52.5%.

As one of the few brands in the automotive industry that can reach a breaking level, Xiaomi's "sky shattering" traffic is envied by many car companies. During the recent Beijing Auto Show, Xiaomi Group's CEO Lei Jun personally attended the event, attracting many onlookers. Not only did Lei Jun arrive at the scene, but executives from multiple car companies including BYD's Wang Chuanfu and Li Auto Li Xiang also arrived at the scene. Netizens jokingly said that previous car shows were all models, but now they are all CEOs.

Xiaomi Motors officially stated that by the end of the Beijing Auto Show on May 4th, the Xiaomi booth had received over 150,000 people.

Regarding Xiaomi's production capacity, Lei Jun previously stated that he is making every effort to expand production capacity, accelerate delivery, and ensure the completion of the task of delivering 100,000 units this year.

Xiaomi is a force that cannot be ignored and has become a consensus in the industry. It is like a new "catfish" rushing into the original electric vehicle market, stirring up increasingly fierce market competition and accelerating the reshuffle of the electric vehicle market. Major car companies can only do their best to avoid being eliminated by maintaining a fighting state at all times.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.