The "Disappearing" Factory?U.S. judge rules Weilai investors can file class action lawsuit against it

On August 8, local time, a judge in the United States ruled that investors in Weilai Automobile could file a class action lawsuit.。Earlier, investors accused the company of lying during its 2018 initial public offering (IPO) that it was building its own factory in Shanghai.。

On August 8, local time, a US judge ruled that investors in Chinese electric car manufacturer NIO can file a lawsuit in a class.。Earlier, investors accused the company of lying during its 2018 initial public offering (IPO) that it was building its own factory in Shanghai.。

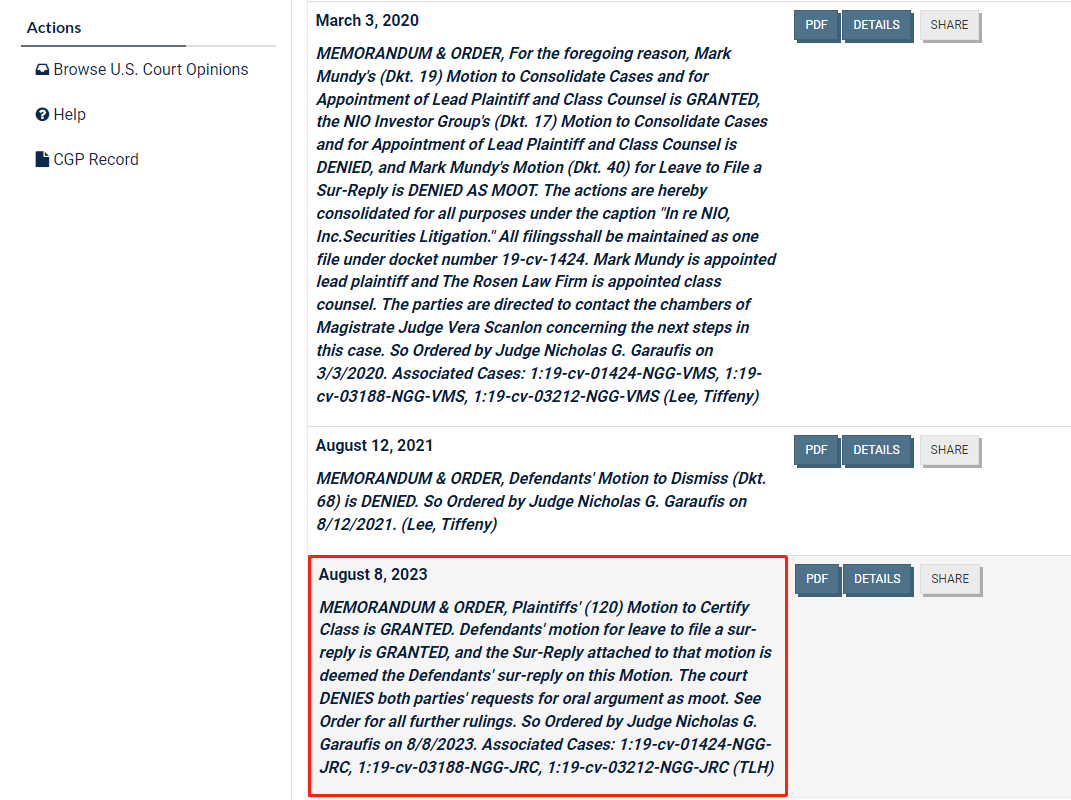

U.S. District Judge Nicholas Garaufis of Brooklyn issued an order certifying all investors who purchased the company's American Depositary Shares (ADSs) in the September 2018 IPO and those who purchased the company's ADSs between October 8, 2018 and March 5, 2019.。

The ruling by the U.S. District Judge is one of the last hurdles investors face before the case goes to trial.。Securities class actions are rarely heard in court, and those that are not dismissed usually enter the settlement phase.。The company can also ask a judge to rule in its favor without trial.。

The lawsuit, filed in federal court in New York, alleges that NIO, NIO CEO Li Bin, and other managers and directors misled investors in IPO documents about the Shanghai plant, making them think that construction was already under way at the time.。

NIO said in March 2019 that it had abandoned plans to build a new factory in Shanghai mentioned during the IPO.。But according to the lawsuit, there are former employees who claim that construction never began and that the necessary construction permits were never issued.。

Weilai's move made investors feel cheated.。Investors believe the plant is important to them because its completion means that NIO will have the ability to build its own cars, which can help NIO reduce its dependence on other automakers。At present, Weilai's cars are basically made by JAC。

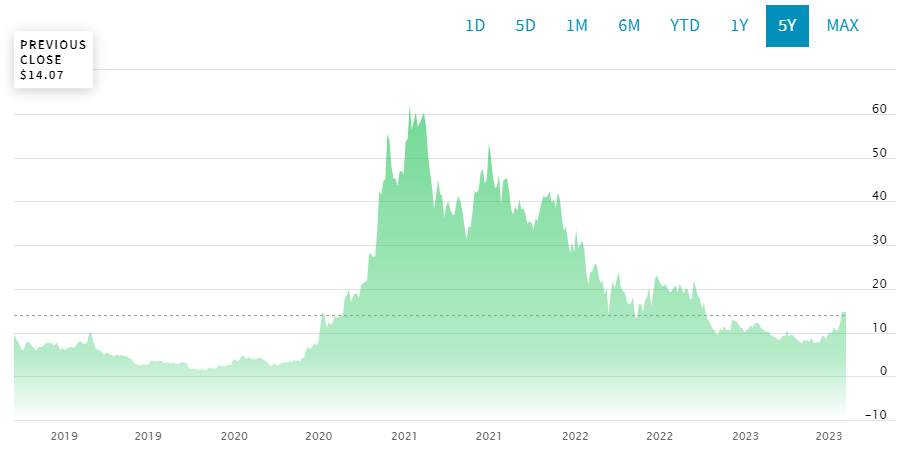

Investors expect NIO to compensate for falling ADS prices。Investors said that when NIO revealed it would not build a new plant in Shanghai, its ADS price fell 30%, from around $10 per share to $7。

Investors also accused the underwriters responsible for the NIO IPO of failing to do due diligence before going public.。As the first Chinese electric car to go public in the U.S., the IPO has an ultra-luxury underwriter lineup, including Morgan Stanley, Goldman Sachs, JPMorgan Chase, Bank of America Merrill Lynch, Deutsche Bank, Citibank, Credit Suisse, UBS Securities and WR Securities, including a number of investment banks and financial institutions.。

In the lawsuit, in addition to the Shanghai factory, the plaintiffs also argued that NIO had made false or misleading statements about the quality and design of electric vehicles and the impact of reduced government subsidies for electric vehicles on the company's competitive advantage.。However, both sides denied the allegations and considered them baseless.。Weilai believes that the plaintiff's accusations are based on post-IPO developments that were non-existent and unpredictable before the company's IPO。

Weilai had filed a motion to withdraw the case with the District Court in December 2020, but the motion was rejected by the court in August 2021.。

As of press time, NIO's ADS is trading at 13 per share today (August 10)..$67, up about 1 percent from yesterday's close.56%。According to Nasdaq official website data, after the listing, NIO's ADS all the way down, as low as 1.around $4, and then began to rise sharply in the second half of 2020, as high as around $60。In 2022, the company's ADS began to decline, hovering around $14 in recent days.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.