New energy vehicles bask in May report card: Tesla stopped falling and rebounded, Xiaomi started double-shift production

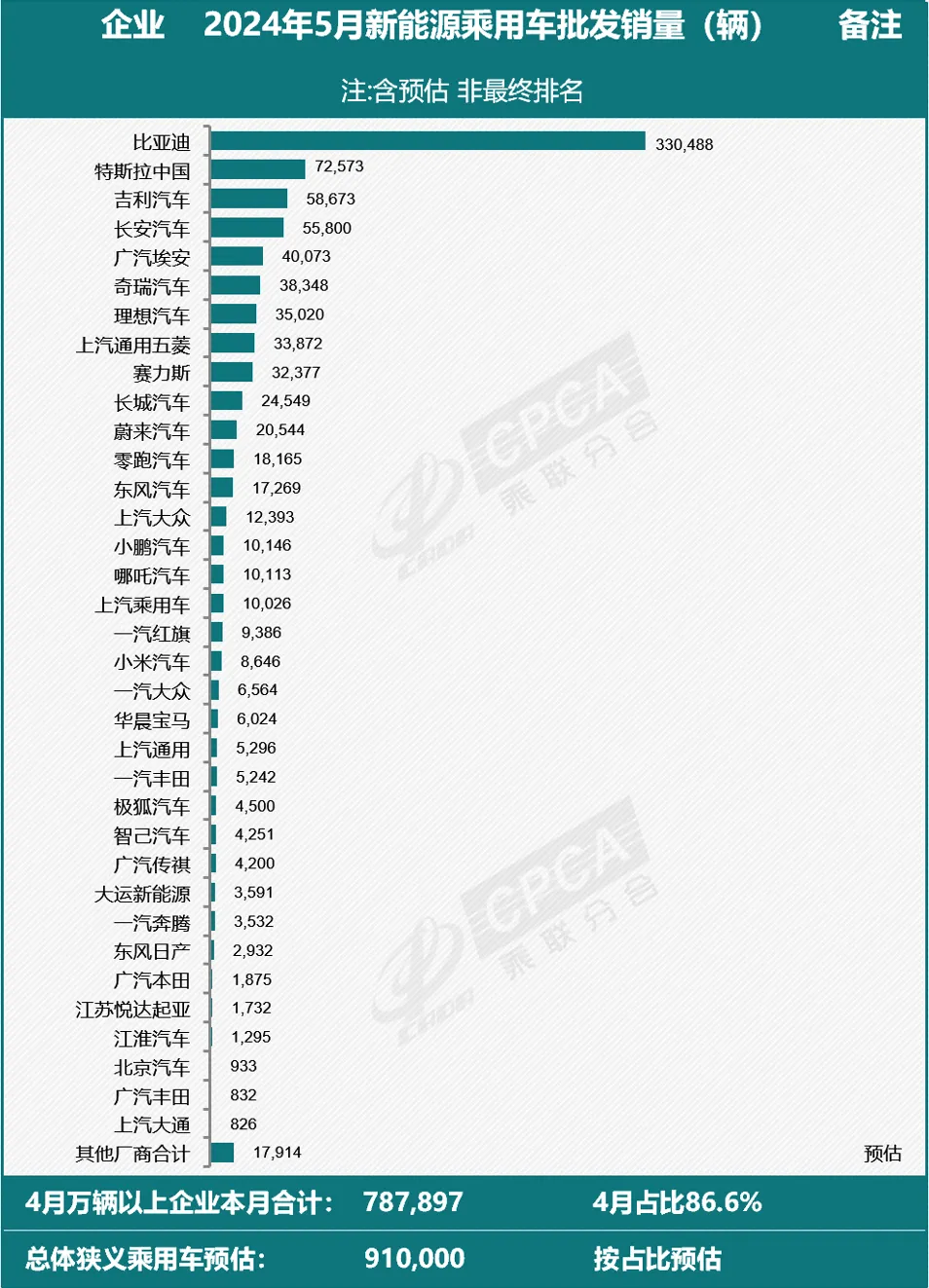

According to CPCA's comprehensive estimate of monthly preliminary data, wholesale sales of new energy passenger vehicle manufacturers in China reached 910,000 units in May, a year-on-year increase of 35% and a month on month increase of 16%.

According to CPCA's comprehensive estimate of monthly preliminary data, wholesale sales of new energy passenger vehicle manufacturers in China reached 910,000 units in May, a year-on-year increase of 35% and a month on month increase of 16%.

CPCA stated that the national economy operated steadily in May, despite being affected by factors such as holidays and a higher base compared to the same period last year. However, with the implementation of the national "trade in" policy, the introduction and follow-up of corresponding policy measures in various regions, and the phased cooling of the price war for new products in the car market, the consumer enthusiasm of the market's wait-and-see group was stimulated, and the national new energy passenger car market entered a relatively good development stage in May.

BYD sales steady, Tesla ring-up

BYD sold 331817 new energy vehicles in May, a year-on-year increase of 38.1% and a month on month increase of 5.9%. The sales of passenger cars reached 330,488 units, a year-on-year increase of 38.2%. Among them, BYD's plug-in hybrid electric vehicle (PHEV) sales reached 184,093 units, a year-on-year increase of 54.07%; There were 146,395 pure electric vehicles (BEVs), a year-on-year increase of 22.4%. This indicates that plug-in hybrid is still the main driver of BYD's growth.

According to CPCA data, BYD's sales account for about 36% of the estimated national sales, which has decreased compared to the previous quarter, but it remains the industry leader and has formed a cliff like lead over other car companies.

In terms of overseas exports, BYD exported a total of 37,499 passenger cars in May, a year-on-year increase of 267.5%, and an unexpected decrease of 8.6% compared to the previous month.

Specifically, let's take a look at the sales situation of BYD's various brands. The Dynasty and Ocean series remain BYD's main sales force, with a total of 315,227 units sold in May, a year-on-year increase of 38.2%. The joint venture brand between BYD and Mercedes Benz, DENZA, sold a total of 12,223 vehicles in May, a year-on-year increase of 11% and a month on month increase of 10%. In the high-end series, FangChengBao sold 2,430 units in May, a 15% increase compared to the previous month; The Yangwang brand performed slightly worse, selling 608 units in a single month, a 36% decrease compared to the previous month. Among them, the Looking Up U8 delivered 5,082 vehicles between January and May.

On May 28th, BYD released its fifth generation hybrid system - the fifth generation DM technology. According to official reports, the engine thermal efficiency of the fifth generation DM technology is 46.06%, the highest in the world; The fuel consumption per 100 kilometers is 2.9L, the lowest in the world; The comprehensive range reaches up to 2,100 kilometers, which is the longest in the world!

At the same time, BYD also announced the launch of the first model of the fifth generation DM technology: the Qin LDM-i and the Seal 06DM-i. That is to say, these two cars can travel 2,100 kilometers or more with just one charge or one tank of fuel. According to data from multiple media outlets, both vehicles have a comprehensive range of over 2,300 kilometers when fully charged and fueled, with a record high of 2,547 kilometers. Moreover, the starting price of both cars is only 99,800 yuan.

The ultra long range of BYD's latest model has ignited the entire car industry, and there is also a high level of discussion online, which should help boost BYD's sales in June.

Shanghai Securities stated that BYD sold a total of 501,900 plug-in hybrid passenger cars in the first four months of this year, accounting for over 45% of the domestic plug-in hybrid market. The release of the fifth generation DM technology and the launch of new models are expected to further boost BYD's sales of plug-in hybrid cars and consolidate its leading position in the domestic plug-in hybrid market.

On the Tesla side, according to CPCA data, Tesla China sold a total of 72,573 electric vehicles in May, a year-on-year decrease of 6.59%, narrowing the double-digit year-on-year decline from last month. On a month on month basis, it stopped falling and rebounded, increasing by 16.74%.

In the first five months of this year, Tesla China sold a total of 355616 vehicles, a decrease of 7.12% from 382,859 vehicles in the same period last year.

On May 24th, media reported that Tesla's Shanghai factory reduced Model Y production by at least 20% between March and June. This is not a good omen for Tesla, which has been questioned by the outside world for its weak sales growth. It is currently unclear whether the scope of production reduction will cover the Model 3 or continue into the second half of this year. Furthermore, it is unclear whether Tesla's factories in the United States and Germany have also taken similar production reduction measures.

In May, Tesla increased its marketing efforts in the China region. The company stated that Chinese customers who completed the delivery between May 25th and June 30th have the opportunity to win a sightseeing tour to the company's factory in Fremont, USA.

In terms of FSD's entry into China, on June 3rd, Baidu Maps released a video of Tesla's tested V20 version, announcing that Baidu Maps lane level navigation will soon be launched on Tesla. Baidu Maps official stated, "It will soon be launched and looks forward to meeting everyone as soon as possible."

Geely surpasses Changan and once again enters the top 3

Behind BYD and Tesla is Geely Auto. According to CPCA data, Geely Auto's sales surpassed that of Changan Auto in May, once again squeezing into the top three.

According to official data, Geely Auto sold a total of 160,658 new cars in May, a year-on-year increase of about 38% and a month on month increase of about 5%. Among them, the sales of new energy vehicles reached 58,673 units, a year-on-year increase of 146% and a month on month increase of 14%. Overseas export sales of 36,890 vehicles increased by approximately 68% year-on-year. In the first five months of this year, Geely Auto's cumulative total sales increased by over 45% year-on-year, and the cumulative sales of new energy increased by about 126% year-on-year.

As a highly regarded mid to high end brand under Geely Auto, ZEEKR's sales have reached a new historical high. In May, ZEEKR delivered a total of 18616 vehicles, a year-on-year increase of 114.5% and a month on month increase of 15.7%. In the first five months of this year, ZEEKR delivered over 260,000 vehicles.

Moreover, Geely Auto plans to continue using strong drugs in June to further increase sales. On May 31st, Geely Auto announced the launch of the Geely Car Festival, which will take place from June 1st to June 30th. During the Car Purchase Festival, the entire series can enjoy a maximum cash discount of 23,000 yuan, and the government enterprise dual exchange subsidy can reach a maximum of 22,000 yuan.

In May, the sales of new energy vehicles under the independent brand of Changan Auto reached 55,800 units, a year-on-year increase of over 90%, and the growth rate slowed down from 129.7% last month.

Among several major sub brands, Changan Qiyuan delivered a total of 13,557 new cars in May, a month on month increase of 15%. DEEPAL's delivery volume in May reached 14,371 vehicles, a year-on-year increase of 104.7% and a month on month increase of 12.8%. Officially revealed, DEEPAL G318 will be launched and delivered in June, with direct volume increase upon launch. In addition, the delivery volume of Avatar in May was 4,569 vehicles, a year-on-year increase of 163% and a month on month decrease of 27%.

GAC Aion did not perform well in May compared to Li Auto, delivering a total of 40,073 vehicles, a month on month increase of 60%, but recorded a year-on-year decline of 11%. From January to May this year, its sales were 142,339 units, a year-on-year decrease of 14%.

Affected by the year-on-year decline in sales, GAC Aion's sales have also dropped from third place in new energy last month to fifth place.

In terms of SAIC, a total of 81,000 new energy vehicles were sold in May, and 365,000 new energy vehicles were sold from January to May this year, a year-on-year increase of over 27%. SAIC General Motors delivered a total of 7443 new energy vehicle models (Buick, Chevrolet, Cadillac) under three brands in May, a year-on-year increase of 214%.

"New car-building forces" competition intensified

● Li Auto

In May, Li Auto once again defended its position as the top "new force".

According to official sources, Li Auto sold a total of 35020 electric vehicles in May, a month on month increase of 35.8% and a year-on-year increase of 23.85%.

The steady increase in sales of Li Auto in May was mainly boosted by the price reduction in late April. On April 22nd, Li Auto officially announced a price reduction, with 2024 Li L7/L8/L9 and MEGA models priced at 18,000 to 30,000 yuan. Due to the launch of Li Auto's price reduction in late April, the driving effect on sales was more evident in May.

It is worth noting that previously, Li Auto provided delivery guidance for the second quarter in its financial report, ranging from 105,000 to 110,000 vehicles. In April and May, Li Auto delivered a total of 60,700 vehicles, which means that Li Auto needs to complete 44,300 vehicles in June to reach the lower limit of delivery guidelines. This is a considerable pressure for frontline sales personnel.

● AITO

After the AITO M7 Plus Shanxi Yuncheng accident, the AITO official official account has not disclosed the monthly delivery data since last month.

However, AITO is a brand jointly launched by SERES and Huawei, and holds an absolute share in SERES sales, so we can also glimpse AITO's sales situation from SERES delivery data.

According to official data, SERES sold 34,130 new energy vehicles in May, a year-on-year increase of 298.62%. From January to May this year, the cumulative sales of SERES new energy vehicles reached 156,823 units, a year-on-year increase of 342.35%.

On May 31st, AITO's new M7 Ultra was refreshed and launched. The official stated that the new M7 Ultra from Wenjie will be delivered as soon as it is launched, with a target of delivering 4,000 units in the first week. It is expected that the delivery volume will reach 20,000 units in June, achieving instant delivery and quantity increase upon launch.

At the press conference of AITO's new M7 Ultra, Yu Chengdong released the latest data on several AITO products: the AITO new M5 had a large order of over 20,000 vehicles in one month, the AITO M9 had a large order of over 90,000 vehicles in five months, and the AITO new M7 had a large order of over 180,000 vehicles in eight months.

●NIO

In May, NIO's performance was very impressive.

NIO stated that a total of 20,544 electric vehicles were delivered in May, a month on month increase of 31.5% and a year-on-year increase of 233.8%. Meanwhile, this data also exceeded its sales record set in July 2023. Since the beginning of this year, NIO has delivered a total of 66,217 new cars, a year-on-year increase of about 51%.

It is worth noting that the new electric vehicle brand "ONVO" under NIO has officially made its debut in mid May. On May 15th, NIO held a launch event for the ONVO brand in Shanghai, officially releasing the brand's first car - the ONVO L60, with a pre-sale price of 219,900 yuan, 20,000 yuan lower than the starting price of the Tesla Model Y.

The ONVO brand is positioned in the mainstream home market, and the first product exhibition car is expected to arrive in stores in August and be launched and delivered in September. NIO stated that the ONVO brand supports battery swapping and is compatible with NIO brand battery swapping stations.

Although the launch of the ONVO brand can enrich NIO's price matrix and help the company improve profit margins, the price range targeted by ONVO is highly competitive, and it is unclear whether ONVO can carve out a path from it.

In addition, on May 31st, NIO Energy Investment (Hubei) Co., Ltd. received a strategic investment of 1.5 billion yuan. NIO said that this round of strategic investment will be used for technology research and development, manufacturing, operation and maintenance in the fields of charging, power exchange, energy storage, battery service, energy Internet, as well as the layout and development of NIO's energy charging and power exchange infrastructure, and support the investment in vehicle network interactive innovation business.

Previously, NIO Energy had reached a charging and swapping strategic partnership with Changan Auto, Geely Auto, Anhui Jianghuai Auto, Chery Auto, Lotus, GAC, and FAW.

● Leapmotor

The new force behind NIO is Leapmotor. Leapmotor also performed well in May, delivering a total of 18,165 vehicles, a year-on-year increase of 50.6% and a month on month increase of 21.1%. Among them, 11,992 units of C11 and CI0 were delivered.

In addition, the latest SUV model of Leapmotor - C16 will be launched and delivered in June. Previously, the model made its debut at the 2024 Beijing Auto Show and began pre-sales, with pre-sale orders exceeding 11,950 units within 24 hours. It is reported that the expected selling price for a fully equipped C16 will not exceed 200,000 yuan.

In May, Leapmotor further deepened its cooperation with Stellantis Group. On May 14th, Leapmotor Motors announced that Stellantis Group and Leapmotor Motors had established an international joint venture with Leapmotor Motors in a ratio of 51% to 49%.

The company stated that with the help of Stellantis Group's global distribution channels, Leapmotor International plans to launch Leapmotor cars in nine European markets starting from September this year, including France, Italy, Germany, the Netherlands, Spain, Portugal, Belgium, Greece, and Romania. At present, the company's management team is preparing to launch the C10 and T03 electric models first in Europe, and plans to expand its sales outlets in Europe to 200 by the end of this year.

Leapmotor International further stated that starting from the fourth quarter of this year, the company will enter the Indian and Asia Pacific, Middle East and Africa, and South American markets.The new car making forces behind Leapmotor are Xiaopeng Motors and Nezha Motors, both of which crossed the 10,000 vehicle mark in May.

● Xpeng

Xpeng delivered 10,146 electric vehicles in May, a year-on-year increase of 35.2% and a month on month increase of 8%. This is the first time this year that monthly sales have exceeded 10,000. In the first five months of this year, Xpeng delivered a total of 41,360 vehicles, a year-on-year increase of about 26%.

● NETA

Like Xpeng, NETA's sales in May were also worth over ten thousand. Official data shows that in May, the entire NETA series delivered 10,113 vehicles, a year-on-year decrease of 22.4% and a month on month increase of 12.2%.

On May 24th, the NETA L pure electric version began pre-sale, with a pre-sale price starting at 140,000 yuan. NETA previously stated that the higher than expected order volume of NETA L resulted in delayed delivery and will provide certain compensation to the car owner. The driving effect of this new car on the overall sales of the company remains to be observed.

● Xiaomi

Among the new forces in car manufacturing, Xiaomi Auto is the most unique presence. Other car companies are all worried about sales, only Xiaomi Motors is worried about production capacity.

According to official data, Xiaomi Auto delivered 8,630 new cars in May, an increase of 22.3% compared to the previous month. According to Xiaomi Auto's previously announced order volume, there are currently over 70,000 vehicles waiting to be delivered.

In order to increase production capacity, Xiaomi Auto stated that starting from June, the Xiaomi Auto factory will officially start dual shift production to increase production capacity, with a target of delivering over 10,000 units per month in June. Meanwhile, in order to accelerate the efficiency of matching orders with production, Xiaomi Auto has decided to shorten the hesitation period for large lock orders from 7 days to 3 days (72 hours) starting from 0:00 on June 5th.

Xiaomi Auto also promised to deliver a minimum of 100,000 units by 2024 and a sprint delivery of 120,000 units.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.