Alibaba continues to reduce its holdings. This time it's the turn to beep

In November 2023, Alibaba Group CEO Wu Yongming said that Ali would "invest more resolutely and choose more decisively."。

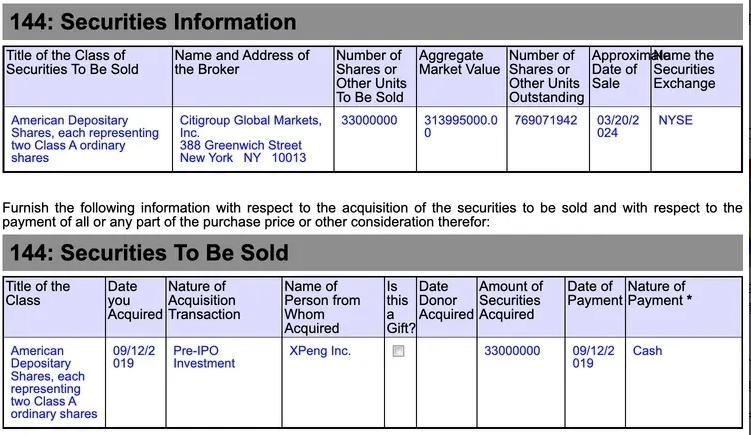

On March 22, foreign media reported that Chinese Internet giant Alibaba raised funds by selling 30.85 million Bilibili American depositary receipts..$57.8 billion。

Information shows that American depositary receipts (i.e., ADRs) are a specified number of negotiable certificates issued by American depositary banks that represent shares of foreign companies.。ADRs are listed on the New York Stock Exchange (NYSE) or Nasdaq, but are also sold over-the-counter (OTC)。

Alibaba inIn February 2019, it acquired 13.6 million common shares and 10 million American depositary shares of B Station through Taobao China, becoming one of the major shareholders of B StationIn addition to its direct stake in Station B, Alibaba is also a major advertiser of Station B.。According to the annual report of Station B, the two companies signed a business cooperation agreement in December 2018.。

In the wave of Alibaba's reduction, Bilibili became the third target to be sold off.。On Wednesday, Alibaba's holding subsidiary, Taobao China Holdings Ltd., sold the value of 3.$1.7 billion in Xiaopeng Auto shares。Previously, Ali also averaged 0 per share..The price of HK $5045 sold 83.840,000 shares of Fast Dog Taxi, with a transaction value of approximately 42.HK $30,000。

In the face of the strong impact of a number of e-commerce companies such as Pinduoduo, Ali has been seeking to improve its capital management structure.。

In November 2023, Alibaba Group CEO Wu Yongming said that Ali will have three important priority directions - technology-driven Internet platform business, AI-driven technology business, and global business network.。The company will be "more committed and more decisive in its trade-offs."。

According to the analysis, Alibaba's current and future focus is expected to be on core retail and cloud computing businesses.。

It is worth noting that Alibaba's "asset reduction" not only occurs in the capital secondary market, in its new retail system, Ali's territory is also constantly adjusting.。

According to reports, since December 2023, a number of physical retail listed companies associated with Ali have announced that Alibaba and Taobao have packaged and transferred their shares in retail companies to a Hangzhou Haoyue Enterprise Management Co.。

The analysis said that although the new retail business has contributed a lot of intangible value to Alibaba, but in recent years, e-commerce and other factors continue to impact the background of offline channels, the entity's return performance is not satisfactory.。With limited energy, Ali may have to make a trade-off。

At Alibaba's fiscal 2024 third quarter earnings call, Alibaba Group Chairman Cai Chongxin also said that the company's balance sheet still has some traditional physical retail business, they are not the core focus of the business, the company's exit is also reasonable.。

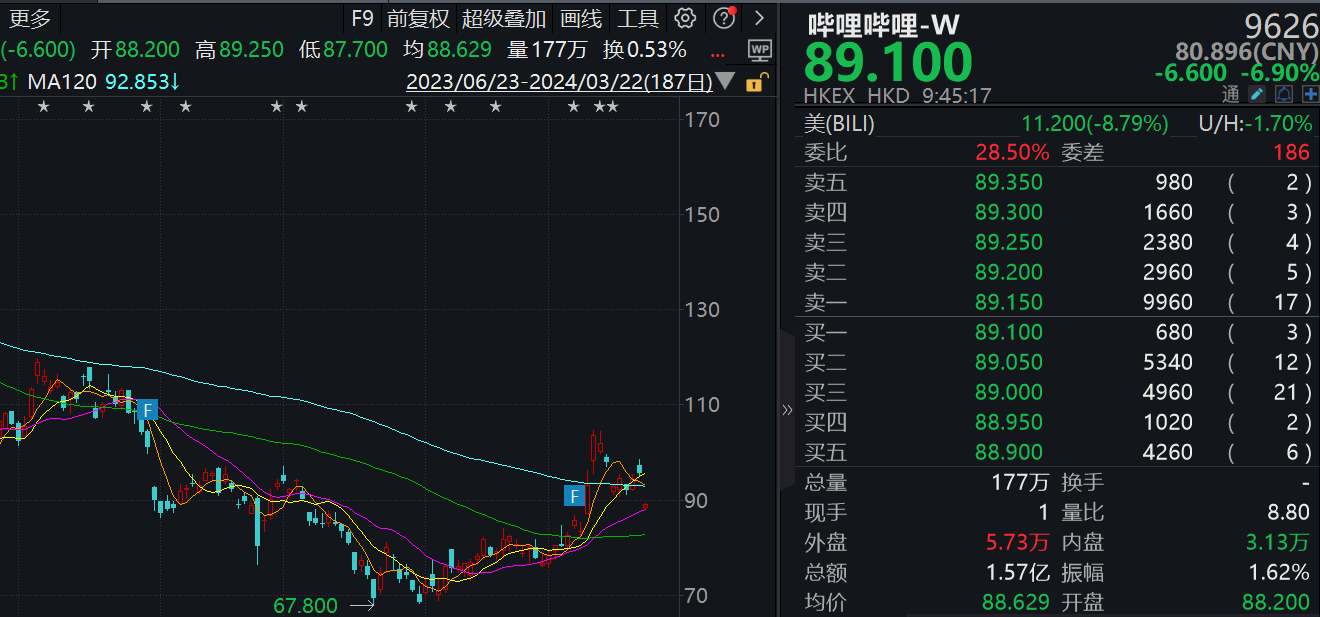

On the news, the U.S. stock market fell more than 8% overnight.。

For the sale, Ali related people said: "The sale is mainly based on Ali's own capital management objectives, will not affect the business cooperation between the two sides, Ali's related business will continue to strengthen cooperation with B station in various fields."。"

On March 21, Moody's issued a rating report and maintained a negative outlook for Alibaba Group。Moody's said: "The rating confirmation reflects the company's well-known brand in the e-commerce industry, leading market position, stable cash flow generation record and prudent financial policy.。These factors provide a strong buffer against increasing competition and regulatory challenges。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.