Alibaba Return to its Growth Track in Q4

Alibaba Group reported its fiscal 2024 fourth quarter and full year results and declared a 4 billion dollars dividend for fiscal 2024.

On May 14, Alibaba Group released its financial report for the fourth quarter and full year of the 2024 fiscal year.

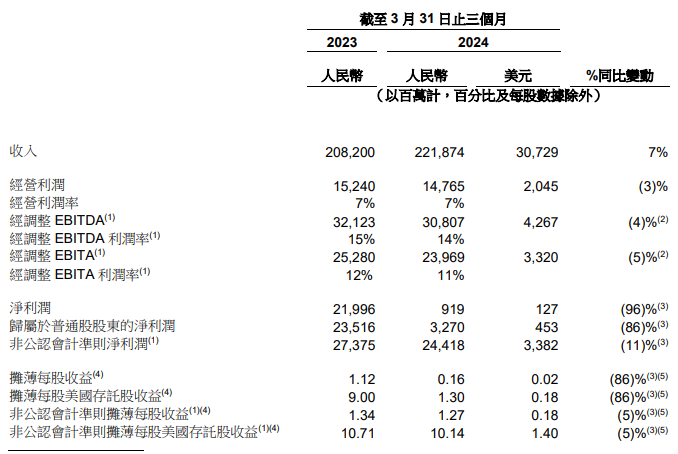

According to the financial data, Alibaba's total revenue for the fourth quarter was 2,218.74 billion yuan, a 7% year-on-year increase, surpassing market expectations. Adjusted net profit was 24.42 billion yuan, down 11% year-on-year, while net profit attributable to shareholders plummeted by 86% to 3.27 billion yuan. Diluted earnings per share were 0.16 yuan, compared to 1.12 yuan for the same period last year.

On the night of the financial report release, Alibaba announced that its board of directors had approved the distribution of dividends for the fiscal year 2024, including regular annual cash dividends and a one-time special cash dividend, with a total payout of 4 billion dollars. This marks the second time the group has announced annual dividends, with the total annual dividends for the previous fiscal year being approximately 2.5 billion dollars.

Additionally, Alibaba continues to execute its share repurchase plan, continuously enhancing shareholder returns. In the past year, it repurchased a total of 1.249 billion ordinary shares (equivalent to 156 million ADS) for a total amount of 12.5 billion dollars, resulting in a net decrease of 5.1% in Alibaba's outstanding shares after considering shares issued under employee stock plans.

Alibaba Group CFO Toby Xu stated, "The performance this quarter demonstrates that Alibaba's strategic adjustments are yielding results, with the group returning to a growth trajectory. We will continue to fulfill our commitment to enhancing shareholder returns."

Furthermore, Alibaba expects to complete its primary listing conversion in Hong Kong by the end of this August. Following the conversion, Alibaba will have dual primary listings on the main boards of the HKEX and the NYSE, which will help expand its investor base and bring new liquidity to Alibaba.

"1+6+N" Works

Starting from March 28, 2023, Alibaba initiated a restructuring of its "1+6+N framework adjustment", dividing its business into six departments, each with its own board of directors and CEO, with the authority to introduce external capital or conduct public listings to maximize shareholder value.

In last September, Joseph Tsai and Eddie Wu respectively assumed the roles of chairman and CEO of the Alibaba Group's board of directors. Subsequently, Wu Yongming, through the strategy of concurrently developing Taobao and Alibaba Cloud, facilitated Alibaba's current focus on the development of strategic core businesses. He revealed that over the next decade, Alibaba's priority will be on technology-driven internet platform businesses, AI-driven technology businesses, and globalized commercial networks.

Amidst this transformation, Alibaba intensified its investment in three major areas: core user experience on Taotian Group (TTG), core public cloud products, and AI infrastructure in overseas e-commerce. Consequently, while accelerating business development, quarterly profits have declined due to increased investment expenses.

"Users Come First" Brings Surprise

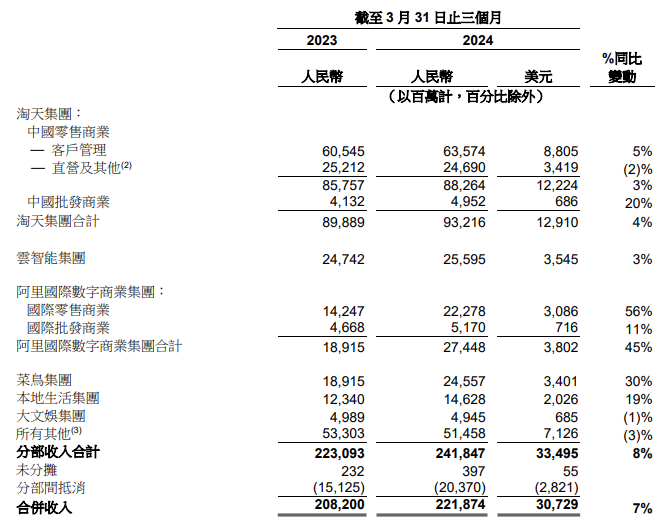

During this quarter, TTG achieved a revenue of 93.216 billion yuan, a year-on-year increase of 4%. Moreover, due to a significant increase in the number of buyers and purchase frequency during the quarter, online GMV and order volume experienced double-digit growth. It is worth noting that revenue from search and recommendations showed strong momentum, driving a 5% year-on-year growth in CMR. Additionally, benefiting from the increased consumption willingness and trust of multi-level consumers on the platform, the number of 88VIP members also achieved double-digit growth, surpassing 35 million.

Since the second half of last year, TTG has been enhancing user experience throughout the entire chain, focusing on three key areas: improving product supply, offering competitive prices, and providing high-quality services, aiming to increase user retention and purchase frequency.

According to data from the National Bureau of Statistics of China, in the first quarter of 2024, the total retail sales of consumer goods in China exceeded 12 trillion yuan, a year-on-year increase of 4.6%. The core CPI rose by 0.7% year-on-year, and the role of consumption in driving economic growth became more prominent. Online consumption maintained double-digit growth, with the online retail sales of physical goods in the first quarter increasing by 11.6% year-on-year, a 3.2% acceleration compared to the previous year.

During this period, TTG focused on upgrading its services around the core consumer experience through multiple rounds of enhancements. Taking 88VIP as an example, unlimited returns subsidized by the platform with free shipping lowered the threshold for consumers to safeguard their rights and interests, ensuring reasonable benefits. Member-exclusive benefits such as points redemption for vouchers, exclusive prices, and daily vouchers also brought more benefits to consumers.

For the fiscal year 2025, Alibaba expects to launch monetization products as planned and introduce new monetization mechanisms in the second half of the year that align with the new platform algorithms and product features, further enhancing income centered around CMR.

Alibaba Cloud's AI Dominance

Following the strategy of "cloud first, AI-driven," Alibaba Cloud's revenue in the fourth quarter increased by 3% year-on-year to 25.595 billion yuan. Core public cloud product revenue achieved double-digit year-on-year growth, with accelerated growth in AI-related revenue, maintaining triple-digit year-on-year growth, and continuous improvement in revenue quality.

Demand for cloud computing and AI-related products has surged across industries for some time. Therefore, Alibaba Cloud has actively invested in a cloud computing product matrix centered around AI infrastructure and simultaneously promoted the comprehensive application of AI large models. Currently, Alibaba Cloud has established strategic cooperation with many domestic large model giants. On the other hand, to create a technological and scale competitive advantage for Alibaba Cloud, Alibaba recently lowered the pricing of its global public cloud products.

At the end of this April, Alibaba launched the 110 billion parameter model Qwen1.5-110B, topping the HuggingFace open-source large model leaderboard, comparable to the world's top open-source models. Last week, Tongyi Qianwen 2.5 appeared on the authoritative benchmark OpenCompass, with scores matching those of GPT-4 Turbo.

Alibaba Group CEO Wu Yongming said, "Given the accelerated growth of AI product customers and related cloud computing revenue, we will continue to firmly execute our strategic focus, seizing growth opportunities for the future."

AliExpress Boosts AIDC

According to financial data, the total revenue of Alibaba International Digital Commerce Group (AIDC) was 27.448 billion yuan, a year-on-year increase of 45%, and the overall order volume of its retail platforms increased by 20% year-on-year.

In fact, the strong performance of Alibaba's overseas e-commerce is mainly due to the growth of its cross-border business, especially led by AliExpress Choice. With competitively priced products and efficient services, coupled with enhanced synergies with Cainiao, in April 2024, Choice accounted for about 70% of the overall order volume of AliExpress. In addition, Global AliExpress has also reserved millions of euros in discounts and promotions as part of its global exclusive sponsorship of this summer's European Cup.

At the local level, Trendyol continued to maintain double-digit growth in orders. In addition to Turkey, Trendyol further expanded its business to the Gulf region and became one of the most downloaded e-commerce apps in the Gulf region this quarter. Lazada also continued to focus on improving operational efficiency, with a significant narrowing of losses per order compared to the same period last year as monetization rates further improved and operations optimized.

Cainiao Leads the "Other" Growth

In terms of Cainiao, revenue increased by 30% year-on-year to 24.557 billion yuan. To enhance synergy with Alibaba's domestic and international e-commerce businesses, Cainiao withdrew its IPO plan on the HKSE in this March.

In the domestic express delivery field, Cainiao Express accelerated the construction of its "standard express" products this quarter and focused on creating delivery solutions for characteristic businesses such as spring tea and books. It has become the logistics partner for the core production area of West Lake Longjing and the third National Reading Conference.

In the cross-border express delivery field, Cainiao continued to maintain close cooperation with AliExpress. Within the fourth quarter, Cainiao's 5-to-10-day delivery service expanded to an additional four countries, covering a total of 14 countries, significantly enhancing the delivery success rate of AliExpress services.

In the global supply chain field, Cainiao continued to create one-stop, differentiated solutions for global customers based on different vertical industries, leading key indicators such as delivery speed, product damage rate, and courier service satisfaction.

This quarter, Cainiao also officially entered the US consolidation market, offering both air and sea freight products, with the fastest delivery time for air freight products being 5 days after dispatch from the consolidation warehouse. In the future, Cainiao will continue to invest in the construction of a globalized and digitized logistics network, enhancing global competitiveness and serving more global customers.

In other business areas, the latest quarterly revenue of the local life group increased by 19% year-on-year to 14.628 billion yuan, while the revenue of the big entertainment group was 4.945 billion yuan, a year-on-year decrease of 1%, but the loss narrowed year-on-year. Among them, Fresh Hippo's revenue continued to grow. Data shows that since this January, Fresh Hippo has opened approximately 10 new stores in various cities across the country. Previously, Fresh Hippo announced plans to increase its presence in the Yangtze River Delta region this year, with the number of stores nationwide expected to exceed 400 by the end of the year.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.