Does Alibaba FY2025 Q1 Earnings Miss Market Expectations?

Thanks to the expansion of business scale and improved operational efficiency, Alibaba's core business achieved steady growth this quarter, with revenue in the first quarter increasing 4% year-on-year, but net profit falling 27% year-on-year.

On August 15, Alibaba released its first quarter performance report for the 2025 fiscal year ending June 30.

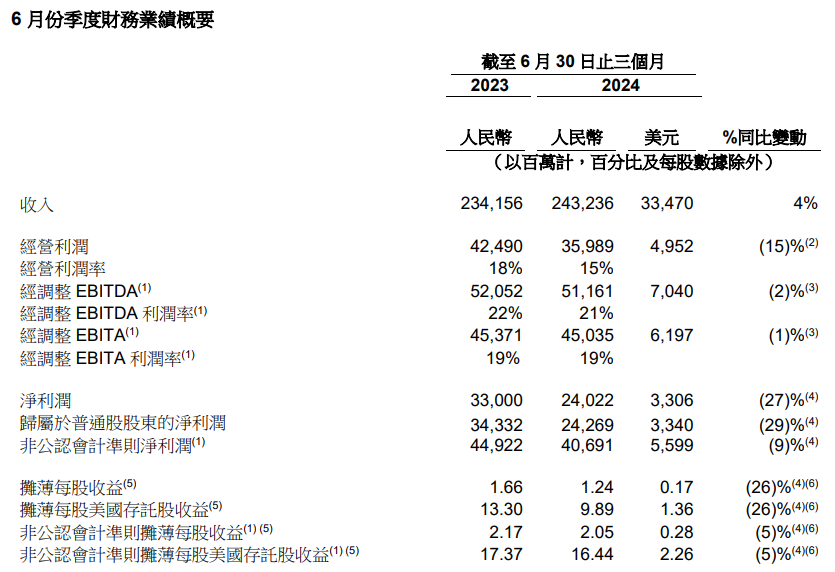

According to the financial report data, in the first quarter, Alibaba achieved revenue of 243.236 billion yuan (RMB, the same below), a year-on-year increase of 4%; net profit was 24.022 billion yuan, a year-on-year decrease of 27%; operating profit was 35.989 billion yuan, a year-on-year decrease of 15%, and operating profit margin was 15%; diluted earnings per share was 1.24 yuan, a year-on-year decrease of 26%.

Thanks to the increase in business scale and operational efficiency, Alibaba's core business achieved steady growth this quarter. Alibaba Group CEO Eddie Wu believes that this performance proves the effectiveness of the group's strategy and puts the business back on track for growth.

In addition, as of the end of the quarter, Alibaba repurchased a total of 613 million common shares at a total price of 5.8 billion dollars, including approximately 1.2 billion dollars of ADRs repurchased through non-public market transactions at the same time as the convertible note issuance on May 23. Therefore, the number of common shares outstanding is 19.024 billion.

Alibaba Group CFO Toby Xu revealed in a conference call that if approved by the shareholders' meeting, the company will complete the dual primary listing in New York and Hong Kong by the end of August.

Taotian Holds its Status

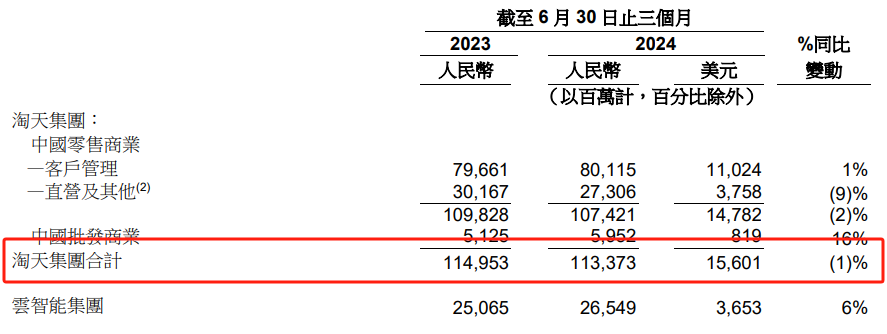

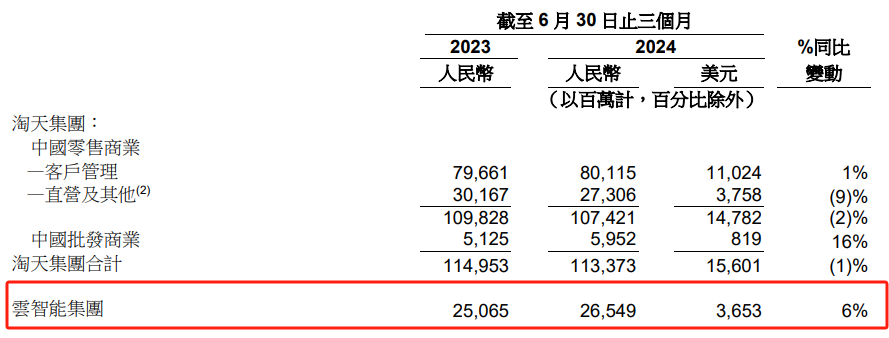

As Alibaba's core e-commerce business, Taotian Group's revenue this quarter fell 1% year-on-year to 113.373 billion yuan.

During the period, the Group provided users with "good products, good prices and good services" by increasing strategic investment in commodities, customer service, membership system and technology, and improved consumer retention rate and purchase frequency. It is worth mentioning that the GMV and order volume of this year's "618 Big Promotion" achieved high single-digit and double-digit year-on-year growth respectively.

It is understood that this year's "618 Big Promotion" cancelled the pre-sale system, and issued large coupons for 88VIP, beauty products and other products in advance, opening up the discounts of Taobao and Tmall merchants. As of 24:00 on June 18, 365 brands had a turnover of more than 100 million yuan on Tmall, and more than 36,000 brands doubled their turnover. As an important crowd asset of Taotian Group, after the improvement of membership rights and service quality, the number of 88VIP members once again increased by double digits year-on-year, exceeding 42 million.

Not only that, on July 26, Taobao took the lead in optimizing the "refund only" service, and officially launched it to all merchants on August 9. Statistics show that in the first week of the launch, the intervention of Taobao and Tmall in the "refund only for goods received" scenario has been reduced by 20%, and the number of unreasonable "refund only" has dropped sharply.

It is worth noting that Taotian Group will adjust the business rules for merchants from September 1 this year. From that day, "basic software service fee" will be charged to merchants on Taobao and Tmall platforms, specifically 0.6% of the order transaction amount, and the annual fee charged only to Tmall merchants will be cancelled; Xianyu will also charge sellers the same proportion of service fees from that day, with a maximum of 60 yuan per transaction. Analysts expect that this new measure will increase the group's core revenue in the next few quarters.

AliCloud Empowers Productivity

Cloud Intelligence Group is one of Alibaba's most important growth engines. This quarter, Alibaba Cloud focused on the "AI-driven + public cloud priority" strategy, continued to expand its technology and scale advantages, and recorded 26.549 billion yuan in revenue during the period, a year-on-year increase of 6%. Among them, the public cloud business achieved double-digit growth, and AI-related product revenue continued to grow by triple digits.

At the same time, Alibaba Cloud's profitability continued to rise, with adjusted EBITA surging 155% year-on-year to 2.337 billion yuan. The company said the growth was due to improved operational efficiency, but the profit growth was partially offset by continued investment in customers and technology.

In the first quarter, Alibaba Cloud released the open source model Qwen2-72B, which has been downloaded more than 20 million times. In addition, the company also significantly reduced the price of 9 main models of Tongyi Qianwen, and the main model Qwen-Long of GPT-4 level was reduced to 0.25% of the price of GPT-4. As a result, the usage of Alibaba Cloud AI products has doubled. According to statistics, the number of paying users of Alibaba Cloud AI platform Bailian increased by more than 200% month-on-month.

Eddie Wu said that the company will continue to invest in customers and technologies in AI infrastructure and other aspects to increase cloud adoption in the AI field. "We are confident that Alibaba Cloud's revenue from customers outside the Alibaba Group will resume double-digit growth in the second half of the fiscal year and gradually accelerate. With high-intensity R&D investment, it will maintain sustained profitable growth and become an AI cloud service provider with healthy profitability and leading market share." He said.

Cross-Border E-Commerce Benefits Cainiao

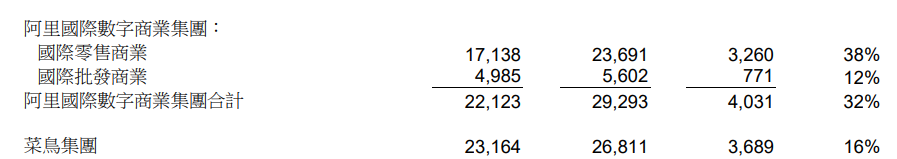

In terms of overseas e-commerce, AIDC's revenue increased by 32% year-on-year to 29.293 billion yuan in the first quarter, driven by the growth of cross-border businesses such as AliExpress Choice and Lazada.

The financial report shows that AliExpress has expanded its service scope with projects such as "10 billion subsidies for brands going overseas" and "major items"; it has also begun to expand the scope of suppliers and launched the "overseas hosting" model in cooperation with three major overseas warehouses. The platform takes care of sales, marketing and after-sales, and merchants only need to be responsible for delivery. As for Lazada, it achieved monthly profitability for the first time in July this year due to the improvement of monetization rate and operational efficiency.

Jiang Fan, CEO of AIDC, emphasized that in the next few quarters, the company will continue to optimize efficiency while pursuing a healthier growth model.

Cainiao is another beneficiary of this business. The growth of cross-border logistics fulfillment services has driven the group's revenue this quarter to increase by 16 percentage points year-on-year.

Today, Cainiao has become the world's largest logistics service company, and the time efficiency of "Global 5-Day Delivery" is still improving. Cainiao's smart logistics services such as automation, digitalization and IoT products are accelerating overseas.

Life Service's Deficit Narrows

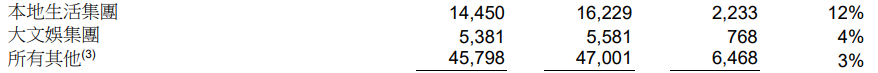

In addition to the above businesses, local life was driven by the growth of orders from Ele.me and AutoNavi, with revenue increasing by 12% year-on-year to 16.229 billion yuan, while improved operating efficiency and increased business scale also led to a significant narrowing of adjusted EBITA losses beyond expectations.

Alibaba expects that most of the group's businesses will break even within 1-2 years and gradually start to make profits on a large scale. Eddie Wu also said: "We will improve investment efficiency and monetization capabilities. Increasing the number of orders for local services is the key, and we also need to improve unit economic benefits. The online car-hailing business also needs to improve unit economic benefits."

In addition, the quarterly operating performance of Sun Art Retail, Freshippo, Alibaba Health and Lingxi Games also improved mildly.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.