After the reform of the first financial report released a number of business performance! Ali this move is right

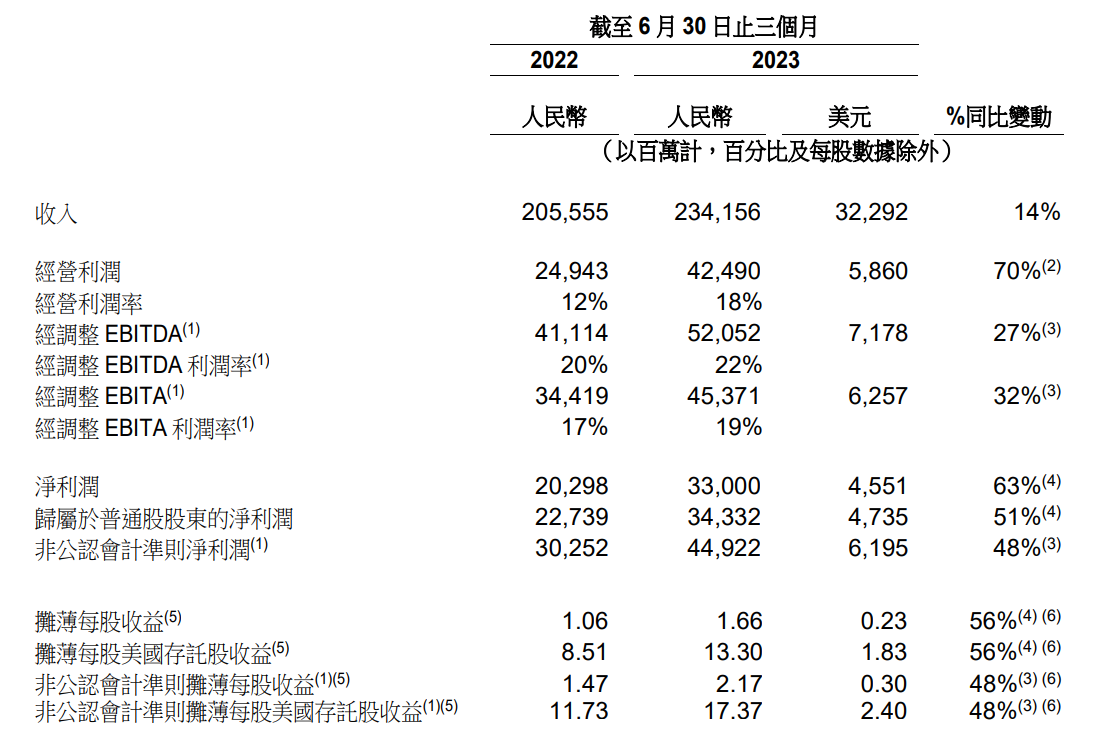

On August 10, Alibaba released its first financial report after launching the "1 + 6 + N" organizational change.。Performance data show that in the second quarter, Alibaba Group's revenue was 2,341.5.6 billion yuan, up 14% year-on-year, the first time Alibaba's revenue growth has returned to double digits since the first quarter of last year.。

On August 10, Alibaba released its second-quarter 2023 financial report, which is also Alibaba's first financial report after launching the "1 + 6 + N" organizational change.。

Performance data show that in the second quarter, Alibaba Group's revenue was 2,341.5.6 billion yuan (RMB, the same below), up 14% year-on-year, exceeding market expectations of 2,237.500 million yuan。This is also Alibaba since the first quarter of last year, revenue growth back to double digits。Operating profit was 424.9 billion yuan, up 70% year-on-year。Adjusted EBITA up 32% YoY to 453.7.1 billion yuan。

Net profit under non-GAAP was 449.2.2bn, up 48% YoY; EPS was RMB2.17 yuan, up 48%。Free cash flow is 390.8.9 billion yuan, compared with 221 in the same period last year..7.3 billion yuan up 76%。

E-commerce business performs well: Amoy Group stops falling and recovers, international digital business group losses narrow

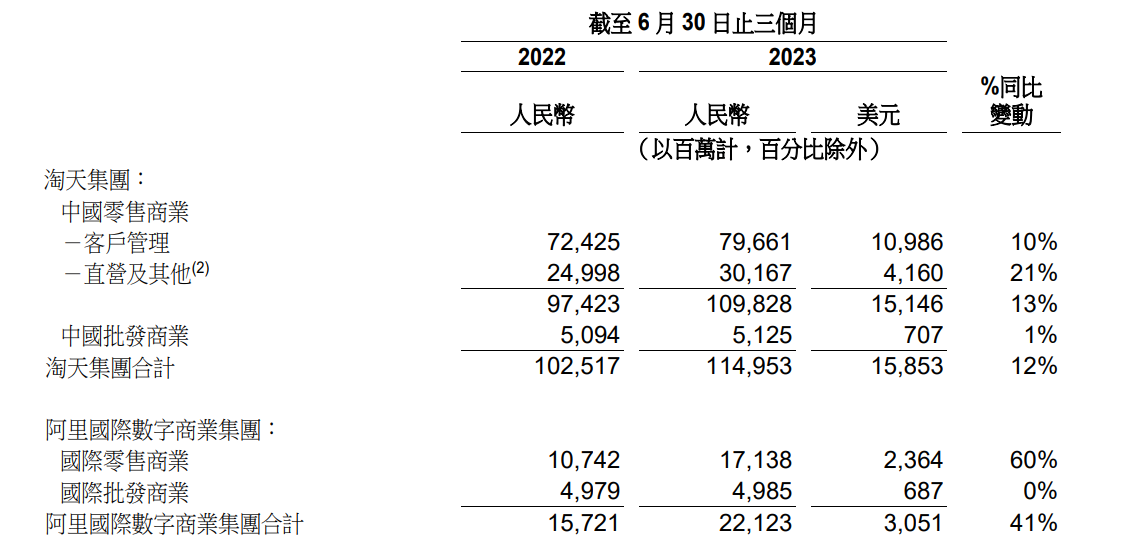

In the second quarter, Taotian Group (including Taobao, Tmall, Idle Fish and 1688.Com, etc.) revenue reached 1,149.5.3 billion yuan, accounting for half of Alibaba Group's revenue。It is worth noting that revenue from this business grew 12% year-on-year in the second quarter, reversing the previous four consecutive quarters of decline and laying a good foundation for the group's revenue as a whole.。

Specifically, in the second quarter, China retail commercial revenue in this business group was 1,098.2.8 billion yuan, up 13% year-on-year, and this revenue fell 3% year-on-year in the first quarter of this year.。While China's wholesale business revenue in the second quarter was 51.$2.5 billion, up 1% year-on-year, with this revenue recording an 8% year-on-year decline in the last quarter。

In the second quarter, Amoy Group's adjusted EBITA was 493.1.9 billion yuan, up 9% year-on-year。The increase was mainly due to an increase in customer management profits and a narrowing of certain business losses.。

Revenue growth is inseparable from the support of users。In June, the average daily active user (DAU) of Taobao app increased by 6.5%, benefiting from an effective user acquisition program and an increase in Taobao app user retention during the quarter。Importantly, the improvement in user acquisition and retention supported the success of the 618 Shopping Festival, resulting in solid growth in order volume and average order amount.。

CICC believes that the change of Amoy Group has begun to bear fruit, the company is expected to further adhere to the current strategy on the existing line of change, even taking into account the macro uncertainty and base volatility, the bank believes that the future of the company's core e-commerce business revenue stabilization, profit margin stability are high probability events;。

In addition to the Chinese market, Ali's e-commerce also performed well in overseas markets.。Ali International Digital Business Group (including AliExpress, Lazada, Trendyol, its international retail business revenue was 171 in the second quarter..3.8 billion yuan, up 60% year-on-year。International wholesale business achieved revenue of 49.8.5 billion yuan, steady year-on-year。

In the second quarter, Ali International Digital Business Group's adjusted EBITA was a loss of 4.200 million yuan, a loss of 1.3.800 million yuan。The sharp year-on-year narrowing of losses was mainly due to improved earnings levels in Trendyol and Lazada.。AliExpress achieved strong order growth in the quarter, Trendyol's operating results were positive for the first time, and Lazada's losses narrowed due to higher liquidity.。

AliExpress is Ali's earliest e-commerce brand, known as the "overseas version of Taobao," currently covering more than 100 countries around the world.。Trendyol is the largest e-commerce brand in Turkey, and Alibaba, after many investments, currently holds 87% of its shares.。Lazada is one of the largest online shopping sites in Southeast Asia, with users in Southeast Asian countries such as Indonesia, Malaysia, the Philippines and Thailand.。

Local living losses narrow, Cainiao and Big Entertainment Group turn losses into profits

In the second quarter, local life group revenue increased 30% year-on-year to RMB 144.$5 billion, driven by strong revenue growth from Ele.me and Gode businesses。Adjusted EBITA for loss 19.8.2 billion yuan, a loss of 2.8 billion yuan in the same period last year..3.4 billion yuan, the narrowing of the loss was mainly due to the growth of hungry orders and the positive economic performance of each order, as well as the rapid growth of Golder orders driven by market demand.。

Cainiao Group and Big Entertainment Group both turned losses into profits in Q2.。

Specifically, Cainiao Group's revenue in the second quarter rose 34% year-on-year to 231.6.4 billion yuan, mainly driven by increased revenue from international logistics fulfillment solution services and domestic consumer logistics services.。Adjusted EBITA loss from prior year 1.8.5 billion yuan turned into profit of 8.7.7 billion yuan。

In June 2023, Cainiao had three new international sorting centers in service, bringing the total number of overseas sorting centers in operation to 18.。

For large entertainment groups (including Youku, Barley and Ali Pictures), second-quarter revenue was 53.8.1 billion yuan, up 36% year-on-year, reflecting the growth of online entertainment business and the strong recovery of offline entertainment business.。Among them, this quarter, Youku's total subscription revenue increased by 5% year-on-year, and the revenue of Fa Mai and Ali Pictures recovered strongly, growing rapidly compared to the same period last year.。The business group's adjusted EBITA for the second quarter was a profit of $63 million, compared to a loss of $9 million in the same period last year..$0.7 billion, mainly driven by increased revenue from Ali Pictures and Barley。

All other businesses (including Gaoxin Retail, Box Horse, Ali Health, Lingxi Mutual Entertainment, Yintai, Smart Information, Feizhu and other businesses) achieved revenue of 455 in the second quarter..4.1 billion yuan, up 1% year-on-year, mainly contributed by revenue growth from Ali Health, Flying Pig, Box Horse and Smart Information。Adjusted EBITA for loss 12.04 billion yuan, a loss of 22 in the same period last year..7.5 billion yuan。

It is worth mentioning that this Q2 financial report does not mention the relevant financial information of the box horse.。Some analysts believe that the box horse independent listing, performance or has been out of the table。Alibaba mentioned in its first-quarter earnings report that the board of directors has approved the start of the listing process for the executive box horse and expects the listing to be completed within the next six to 12 months。

Cloud intelligence group has attracted much attention

In the second quarter, the total revenue of the Cloud Intelligence Group (including Alibaba Cloud and DingTalk) (including revenue from customers inside and outside the ecosystem) was 251.2.3 billion yuan, up 4% year-on-year。Adjusted EBITA to 3.8.7 billion yuan, up 106% year-on-year, mainly due to lower hosting and bandwidth costs due to the return to normal usage of nailing compared to the same period last year.。

In terms of the AI community, on August 3, Alibaba Cloud's open-source platform, Model Scope, launched two open-source models, Qwen-7B and Qwen-7B-Chat, which the company said Alibaba Cloud calls a generic model and a dialogue model with 7 billion parameters, both of which are open-source, free and commercially available.。

As of July 2023, Magic had hosted more than 1,000 AI models, with a cumulative total of more than 45 million model downloads, according to the financial report.。The platform is one of the leading online communities of open source model resources in China. Developers can use Alibaba Cloud's AI computing capabilities to train and experiment with models.。

As soon as the news of "open source" came out, Alibaba Cloud directly brushed the "good impression" in front of the public.。

On the earnings call, CEO Zhang Yong said of the ecosystem: "Entering a new era of AI, a new ecosystem is incubating, and we want to develop this community so that it includes all the good models and can further provide developers with application tools to help upgrade models.。He added that he will make good use of open source resources, adhere to the open source strategy, and let more and more users use models and resources.。

He said: "As a cloud service provider, our goal is to allow agent companies to use the low-cost, high-performance infrastructure provided by Alibaba Cloud, including using our basic models or deploying large models on Alibaba Cloud.。He sees this as a huge opportunity for Alibaba Cloud, and the company will use these models to develop a new generation of AI applications.。

Cloud Intelligence Group also mentioned other AI-related developments in the company's earnings report.。

In terms of generative AI, Alibaba Cloud has released a series of new features for generative AI models.。Since the release of "Tongyi Thousand Questions" in April, Alibaba Cloud has upgraded its audio transcription platform "Listening" to equip it with AI-driven conference analysis capabilities.。In July, Alibaba Cloud launched the Generative AI Wensheng Graph Model "Tongyi Wanxiang"。Nail also connected to the "Tongyi Thousand Questions" in the second quarter and opened the test to enterprise customers.。

In terms of AI science cooperation, in the second quarter, Fudan University and Alibaba Cloud jointly released one of China's largest on-cloud research intelligence platforms for universities, and Alibaba Cloud uses its AI infrastructure and services to support scientific research to improve efficiency and reduce costs, and to promote the development and adoption of large language models in scientific research.。

In addition, in June, consulting firm Forrester released its second quarter 2023 FaaS platform report.。Alibaba Cloud scored the highest score in 26 out of 40 scoring criteria by virtue of its "function computing" product capability, and was selected as the "leader" quadrant of global service providers.。

During the call, an analyst mentioned an interesting topic, that is, asking Alibaba Cloud which vertical industries it will give priority to developing applications.。Alibaba Cloud said that in terms of priority, the first is the Internet company.。Many of these Internet companies in China are so-called digital native companies, and they basically rely on the cloud to empower their businesses.。"But every company's level of digitalization is different, and we can further use our cloud infrastructure, our products, including our AI services to further penetrate the Internet industry."。"

Also related to financial services.。"There are a lot of sub-industries in financial services, so we are investing a lot of resources in developing this area of the business.。"

Another is the automotive industry.。The company believes that electric vehicle companies, whether they are mature or start-ups, will basically become data-driven companies.。The company is also developing products and services for the industry.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.