On the Melbourne Stock Exchange, the financial technology sector has gained 47% in the past 12 months.

The global era of digital payments has accelerated.

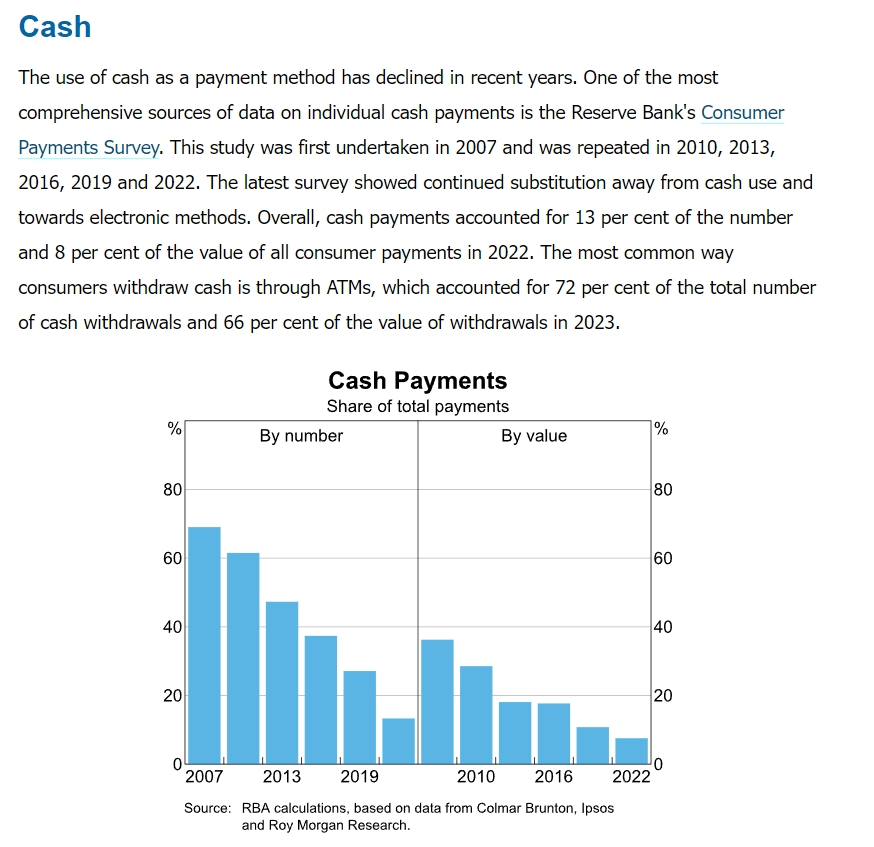

Australia's daily trading cash utilization fell precipitously, and the financial technology cluster contributed

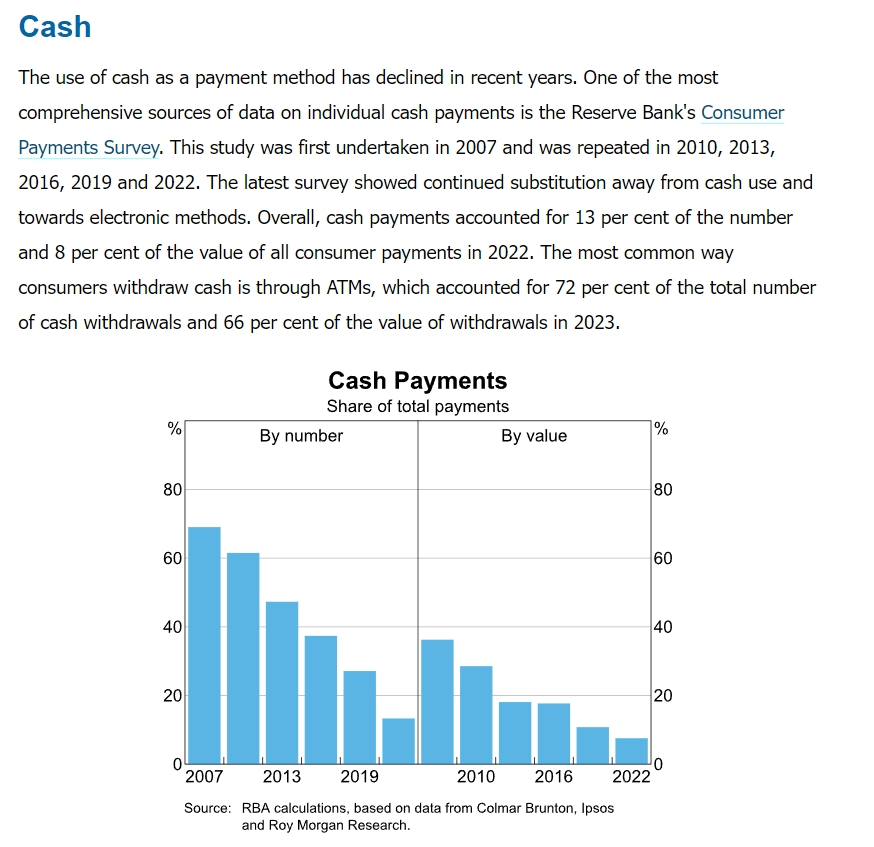

According to the latest data from the Reserve Bank of Australia (RBA), the cash utilization rate for daily transactions has dropped precipitously from 70% in 2007 to 13% in 2022, and this trend is still deepening after the epidemic.

This significant change is due to the financial technology cluster with Melbourne as its hub: HuePay, a subsidiary of Remittance World, has integrated innovative tools such as bank card receipts and BNPL (Buy First and Pay Later), its service network covered 85% of chain merchants in Australia and New Zealand within six months; the digital transaction volume of the four major banks continues to rise. The annual increase of Federal Bank (CBA) digital wallets exceeded 29 million, and the mobile payment scale of National Bank (NAB) has doubled in two years.

This change not only stems from the universal popularization of "Tap and Go" technology, but also benefits from the strategic layout at the policy level. The Victoria government has used a combination of tax exemptions and talent introduction to compress the registration cycle of financial technology companies to 3 working days, attracting global payment giants to set up regional headquarters here and accelerating digital payment to break through the critical point of technological penetration.

When we turn our attention to the world, the fission effect of digital payments is even more shocking.

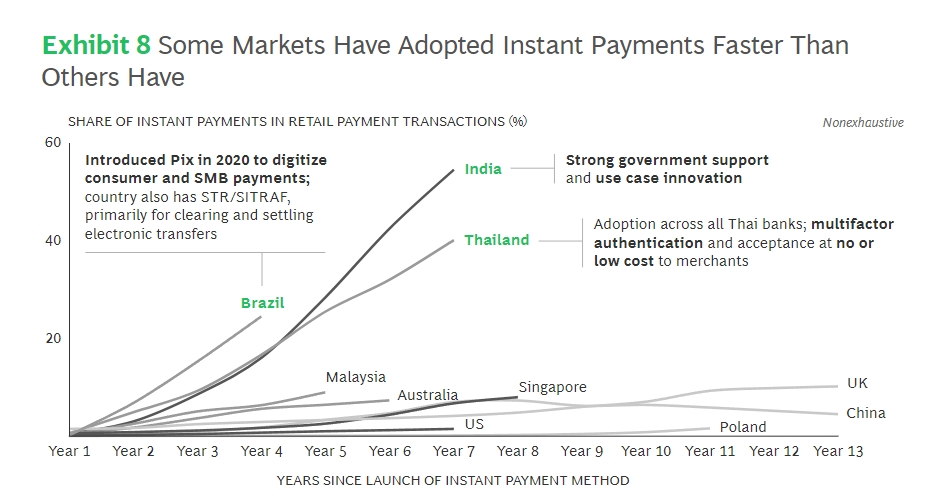

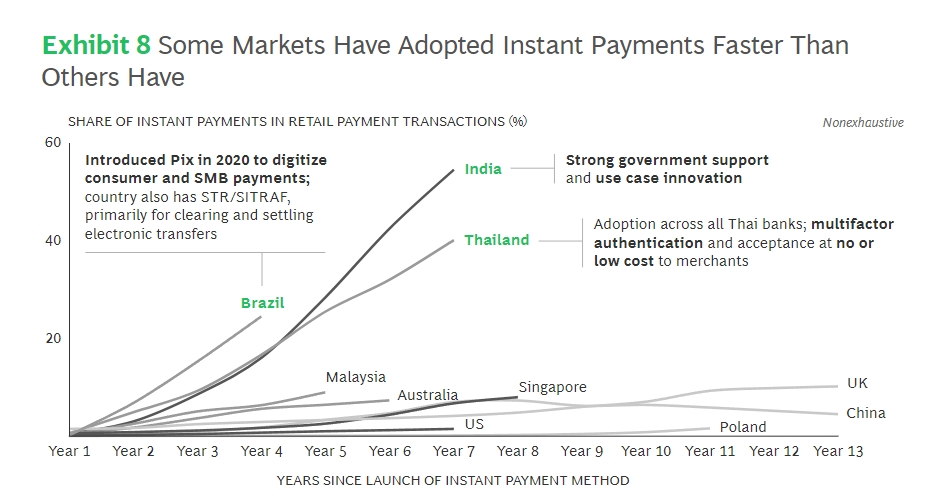

The super payment platform built by Egyptian financial technology company Fawry handles more than 2.1 million transactions per day, allowing this traditional cash society to achieve 85% digital migration in just three years; the PIX instant payment system led by the Central Bank of Brazil gained 110 million users in one year after its launch, and the transaction scale exceeds the sum of traditional channels such as checks and transfers; Through the SGQR Unified Payment Code project, Singapore has pushed the penetration rate of electronic payments to 92% of retail scenarios, and the annual transaction growth rate of the government-led PayNow system has remained above 40%.

In this silent monetary revolution, technological iteration and policy catalysis resonate: China's digital RMB pilot cities have expanded to 50, and targeted red envelopes have exceeded 8 billion yuan; India's UPI unified payment interface has exceeded 10 billion monthly transactions, reducing costs to 1/10 of traditional systems; the EU's Instant Payment Regulation (IPR) mandates euro zone banks to provide round-the-clock second-level transfer services, completely breaking down barriers to cross-border payments.Boston Consulting predicts that global digital payment revenue will exceed US$2.9 trillion by 2030, which is equivalent to recreating a British economy.

Capital markets and digital payments explode at the same frequency

Capital markets are always one step ahead of the curve.

On the Melbourne Stock Exchange, the financial technology sector has risen by 47% in the past 12 months. The share price of HuePay's parent company, HuePay, soared 14% on the same day when the news of the establishment of the Australian subsidiary was announced; Brazilian digital bank Nubank's market value exceeded US$52 billion on its first day on the New York Stock Exchange. Its dynamic credit model based on AI algorithms dwarfs traditional banks; Although Ant Group has suspended its IPO, its hard power ranks first in the world in underlying technology patents still supports the valuation level of more than US$150 billion.

More implicit changes occur in the capillaries of the capital market: the annual circulation of "buy first and pay later" securitization products launched by PayPal exceeded US$30 billion, converting consumer credit into tradable assets; the payment data index jointly developed by Visa and JPMorgan Chase has become a core indicator for hedge funds to predict consumption trends; Singapore's DBS Bank even incorporated payment flow data into the SME credit model, shortening the loan approval time limit from 7 days to 15 minutes.

This payments revolution is rewriting the underlying logic of capital pricing.When every coffee consumption can be transformed into an analyzable data stream in real time, when the cost of cross-border remittances drops from 7% to 0.5%, and when small and micro enterprises no longer rely on fixed asset mortgages for financing, the efficiency of capital allocation has been exponentially improved.The Commonwealth Bank of Australia developed a business district heat prediction system through payment data to help retail real estate REITs accurately adjust rental strategies; Alipay's "green payment" labeling system guides 200 billion ESG funds to flow to low-carbon merchants;SWIFT's newly launched ISO 20022 message standard has expanded the number of payment information fields from 168 to 9000, providing an unprecedented data dimension for smart investors.

Digital payment ETFs: An excellent combination of multi-dimensional efficiency reconstruction

In this market environment, if investors want to seize the growth dividends of the digital payment market, purchasing a digital payment ETF may be a good choice.Compared with individual stock investment, the competitive advantages of digital payment ETFs are reflected in multi-dimensional efficiency reconstruction.

At the rate level, the management fee of head digital payment ETFs has been reduced to 0.15%-0.35%, which is more than 60% lower than that of actively managed funds. This cost advantage can save more than 40% of revenue losses over ten years under the compound interest effect.In terms of liquidity mechanism, ETFs 'secondary market trading characteristics allow them to maintain an exit channel in extreme market environments. When a failure of the Southeast Asian payment system triggered sector shocks in 2024, the single-day turnover of relevant ETFs surged by 300%, providing investors with a liquidity buffer during the crisis.More critical is its risk diversification ability-when India's UPI payment interface fluctuates due to regulatory tightening, the ETF portfolio holding Latin American digital bank Nubank and African mobile wallet M-Pesa during the same period can still maintain positive returns. This cross-regional, cross-technology path asset allocation is a moat that is difficult for individual investors to replicate.

For ordinary investors, digital payment ETFs are rewriting the threshold for participation in wealth management.Private equity funds of traditional financial institutions usually require million-dollar starting investments, while the unit price of mainstream digital payment ETFs has dropped to the $50 range and supports fragmented transactions.This inclusiveness is particularly significant in the ASEAN market. The number of retail investors in Singapore accessing the ETF trading platform through the SGQR unified payment code will increase by 210% year-on-year in 2024.

What is more noteworthy is the evolution of intelligent fixed investment tools: the AI-driven ETF fixed investment system launched by Morgan Stanley can dynamically adjust the proportion of positions based on user consumption data-when the system detects an increase in the frequency of cross-border payments by users, it will automatically add the weight of cross-border payment service providers such as Worldpay and Adyen to achieve resonance between investment portfolios and personal digital footprints.InvalidParameterValue

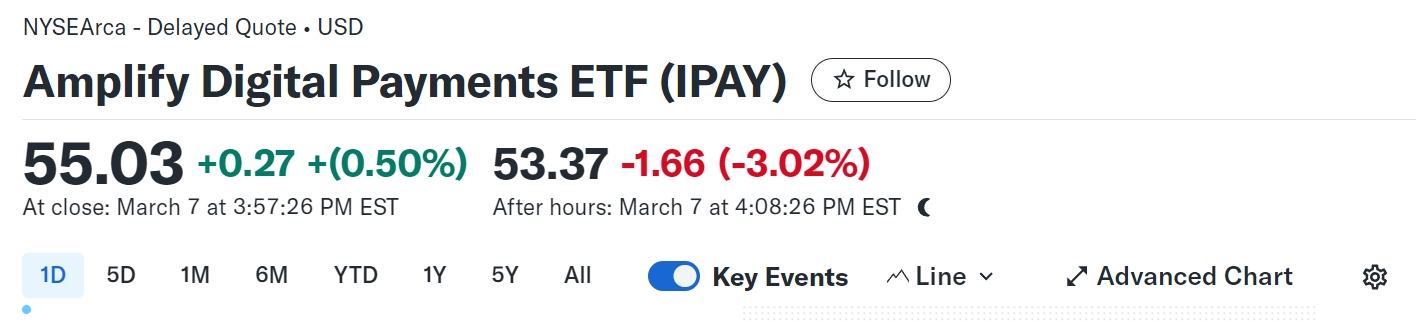

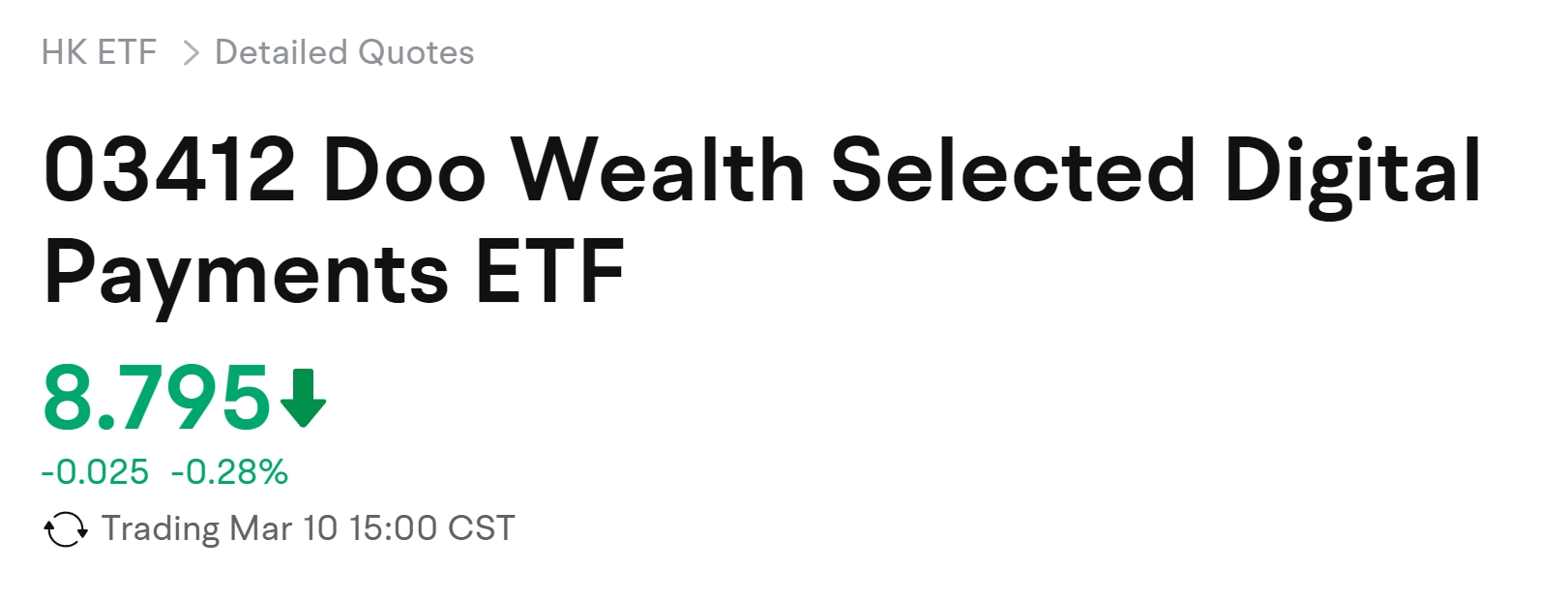

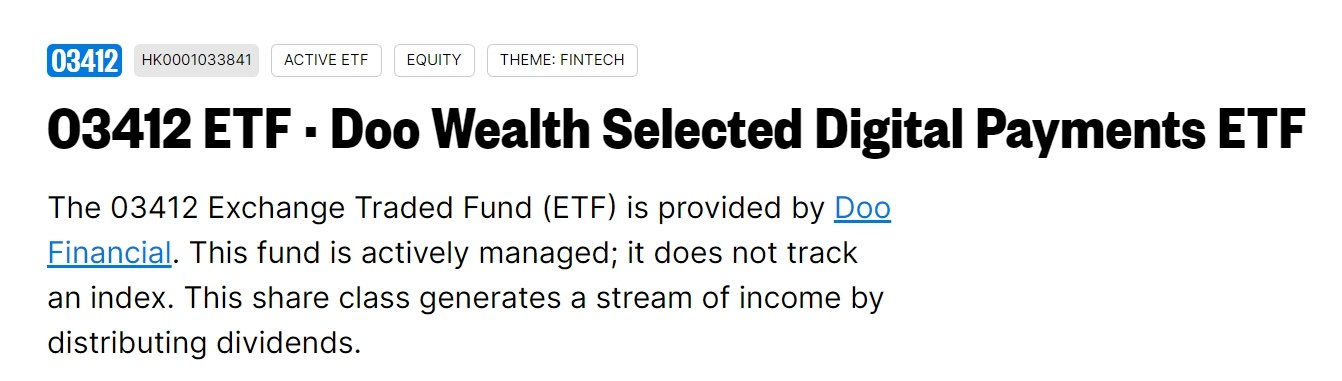

The following are some of the more representative electronic payment ETFs & indexes on the market. They are not recommended for investment but are for reference only:

Looking back at the time and space node of 2025, the exit of cash is no longer a simple change in payment methods.From the aggregated payment terminal in the Melbourne cafe to the blockchain settlement center in Lujiazui, Shanghai, this wave of digitalization sweeping the world is reshaping the DNA of commercial civilization.

Perhaps as Goldman Sachs 'latest report said: "Payment data flow has become the new crude oil of the digital age, and the ability to refine this resource will determine the capital landscape in the next decade."