Bilibili Q2 Net Loss Narrows by Over 70%, Gross Margin Improves for 8 Consecutive Quarters

In the second quarter, total revenue at Station B reached 61.300 million yuan, up 16% year-on-year, slightly higher than the 60% that analysts had expected..9 billion yuan。Adjusted net loss 2.7.1 billion yuan, down 72% year-on-year, also better than analysts expected。

On August 22, Bilibili released its unaudited financial report for the second quarter ending June 30.

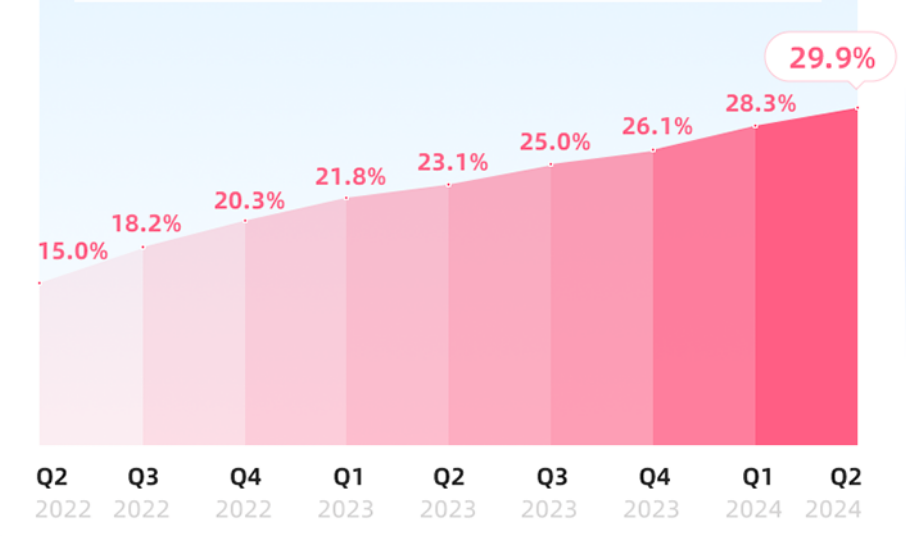

Gross Profit Margin Improves for 8 Consecutive Quarters

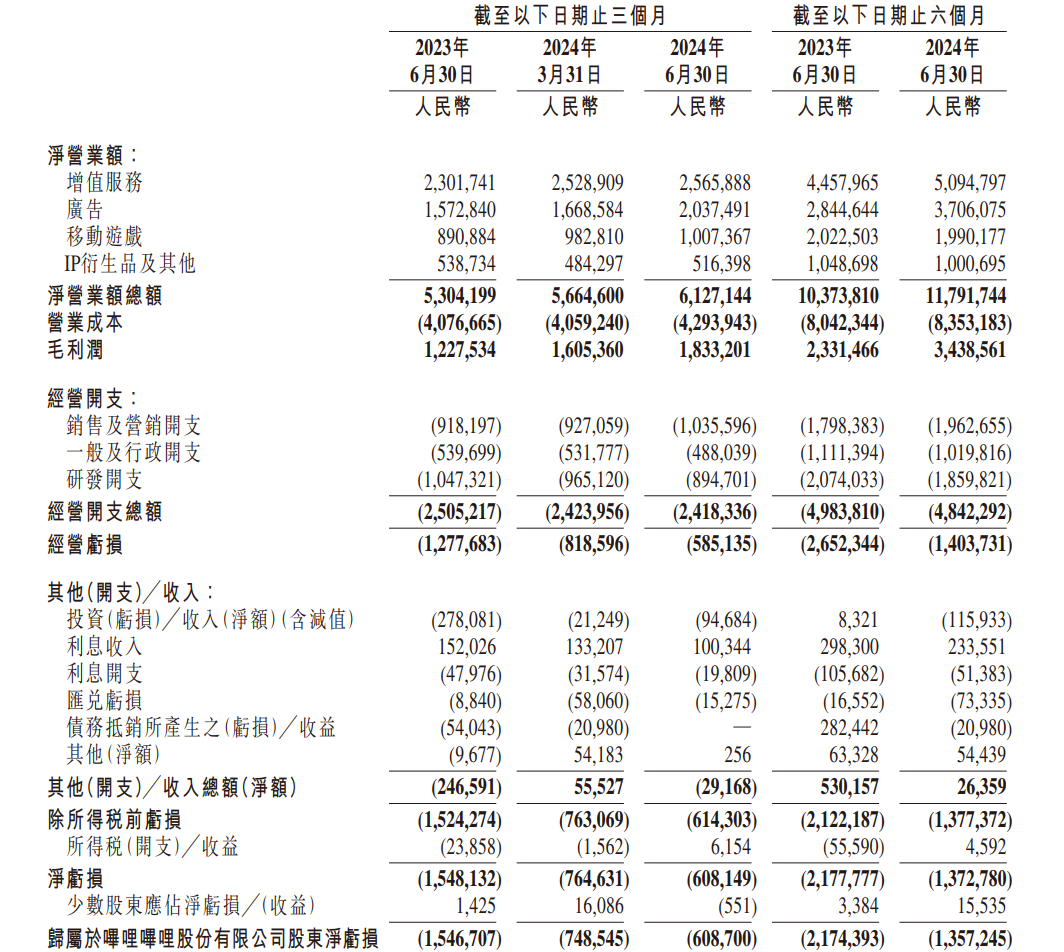

The performance data shows that in the second quarter, Bilibili's total revenue reached 6.13 billion RMB, representing a 16% year-over-year increase, slightly surpassing analysts' expectations of 6.09 billion RMB. Net loss narrowed by 61% year-over-year to 608 million RMB, and adjusted net loss decreased by 72% year-over-year to 271 million RMB, also beating analysts' expectations.

Bilibili's gross profit for Q2 was 1.833 billion RMB, a 49% increase year-over-year. The gross profit margin reached 29.9%, marking the eighth consecutive quarter of sequential improvement.

Bilibili's CFO, Fan Xin, attributed the sustained improvement in gross profit margin to the company's ability to control costs and achieve rapid revenue growth.

Looking ahead to Q3 financial performance, Fan Xin believes that the deferred revenue balance increased by more than 770 million RMB quarter-over-quarter, laying a solid foundation for revenue growth in Q3. It is expected that Bilibili's gaming and advertising revenue will continue to grow strongly in Q3, with gross profit margin expected to achieve significant sequential growth.

In terms of user data, Bilibili's daily active users (DAUs) in Q2 grew by 6% year-over-year to 102 million, with average daily usage time increasing from 94 minutes in the same period last year to 99 minutes. The average daily video views increased by 18% year-over-year to over 4.8 billion. Monthly active users (MAUs) reached 336 million, and monthly interactions reached 16.5 billion.

Additionally, Bilibili achieved a positive operating cash flow of 1.75 billion RMB in Q2, with a cumulative positive operating cash flow of 2.4 billion RMB in the first half of the year. As of June 30, 2024, Bilibili's cash and cash equivalents, time deposits, and short-term investments amounted to 13.912 billion RMB.

Bilibili's business is divided into several segments: value-added services, advertising, mobile games, IP derivatives, and others. Let's take a closer look at the performance of each business segment in Q2.

Increasing Live Streaming E-commerce

In Q2, Bilibili's value-added services revenue reached 2.566 billion RMB, an 11% increase year-over-year, driven primarily by the increase in paying users for premium memberships, live streaming, and other value-added services. Value-added services accounted for 42% of the company's total revenue.

In Q2, Bilibili's premium membership reached 22.3 million, with over 80% of them being annual or auto-renewal members.

Regarding live streaming, Bilibili's Chairman and CEO, Chen Rui, introduced the platform's e-commerce and transaction performance during the 618 shopping festival. He noted that sales generated by e-commerce customers on Bilibili during 618 grew by over 140% year-over-year. During this period, Bilibili also brought a 50% new customer rate to industry merchants, with the mother and child sector bringing in over 70% of new customers.

In terms of transactions, nearly 40 million users watched e-commerce content on Bilibili in Q2, a 70% year-over-year increase. The number of daily active UP hosts engaged in e-commerce grew by over 130% year-over-year, with the number of e-commerce videos increasing by more than 330%, and the number of live-streaming e-commerce sessions rising by 270%.

As Bilibili's average user age has increased to 25 years, its content ecosystem has also evolved. Chen Rui stated that Bilibili is not only a playground for young people's interests and hobbies but also a hub for their lifestyle consumption.

Chen Rui remarked, "The growth in content categories related to young people's consumption on Bilibili was the fastest in Q2, such as home, real estate, automobiles, and fashion & beauty, with video views in these categories increasing by 39%, 43%, and 30% year-over-year, respectively." He believes this is a natural outcome as the average user age reaches 25 years.

Advertising Revenue Sees Impressive Growth

The advertising business performance of Bilibili in the second quarter was very impressive, with a year-on-year growth of 30%, reaching 2.037 billion yuan, thanks to the optimization of advertising products and the improvement of advertising efficiency provided by the company. Advertising revenue accounts for 33% of the company's overall revenue.

In the first half of 2024, the revenue generated by Bilibili UP's master-slave advertising and value-added services increased by 30% year-on-year.

It is reported that the top five advertising clients of Bilibili in the second quarter came from five vertical industries: gaming, e-commerce, digital home appliances, food and beverage, and automotive. Among them, e-commerce and digital home appliances were the two largest drivers of advertising growth. During this year's 618 shopping festival, e-commerce customers' advertising on Bilibili increased by 300% year-on-year.

In addition, Bilibili stated that the company has been continuously improving the infrastructure of its advertising platform.

Chen Rui introduced that in the first half of the year, Bilibili upgraded its PC advertising platform and provided a one-stop professional advertising tool, resulting in a 50% year-on-year increase in the number of major clients for effective advertising in the first half of the year. In addition, the newly launched material and creative center of Bilibili has applied the latest artificial intelligence content generation technology to help advertising clients diagnose and optimize materials. After the upgrade of the creative center, the advertising placement materials achieved a CVR (click through conversion rate) increase of over 30%.

Chen Rui Emphasizes Long-Term Game Operations

Mobile gaming revenue amounted to 1.007 billion RMB in Q2, a 13% increase year-over-year, driven primarily by the release of new exclusive licensed games, including The Three Kingdoms: Strategy Edition. Gaming revenue accounted for 17% of the company's total revenue.

The Three Kingdoms: Strategy Edition quickly climbed to the top three of the iOS bestseller list upon release and remained in the top ten throughout its first month. It became the fastest game in Bilibili's history to reach 1 billion RMB in gross revenue. Chen Rui believes the game's success "fully demonstrates our operational capabilities beyond ACG games."

The Three Kingdoms: Strategy Edition is a simulation game (SLG), a genre known for its long life cycle.

Chen Rui stated that the internal goal set for The Three Kingdoms: Strategy Edition is to make it a high-quality game with a lifespan of over five years, emphasizing the importance of long-term operations.

"We must recognize that the gaming industry is no longer one where quick profits can be made, but rather an industry that requires long-term optimization and improved user experience," said Chen Rui. "We strive to be the company that listens to players the most and respects them the most in the industry, aiming to keep this game operating for the long term."

In addition to the three business segments mentioned above, Bilibili's IP derivatives and other businesses generated 516 million RMB in revenue in Q2, a 4% year-over-year decrease. This segment represents a smaller portion of the company's overall revenue, accounting for only 8%.

On Wednesday, Bilibili's stock opened lower and rose higher in the Hong Kong stock market. In the morning session, it fell sharply by more than 5%, but then rose all the way up, closing up more than 1%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.