Despite Consuming Downturn, Meituan Q2 Earnings Beats Expectations!

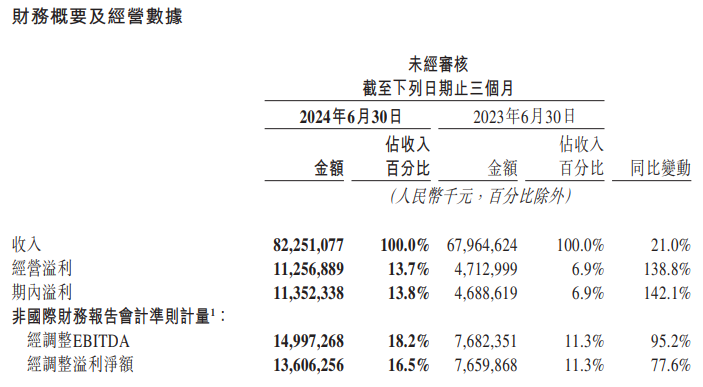

In the second quarter of this year, Meituan achieved revenue of 82.3 billion yuan, a year-on-year increase of 21.0%; net profit was 11.352 billion yuan, a year-on-year increase of 142.1%.

On August 28, Meituan disclosed its second quarter 2024 performance report on the Hong Kong Stock Exchange.

The financial report shows that in the second quarter of this year, Meituan achieved revenue of 82.3 billion yuan (RMB, the same below), a year-on-year increase of 21.0%; net profit was 11.352 billion yuan, a year-on-year increase of 142.1%; adjusted net profit was 13.6 billion yuan, a year-on-year increase of 77.6%.

Although the company was dragged down by low prices due to the economic downturn, the company's catering delivery business remained strong and the overall performance was better than expected. Morgan Stanley upgraded Meituan's rating to "overweight" and raised its target price from HK$120 to HK$125.

Meituan CEO Wang Xing believes that the company has adapted to the current domestic consumption environment. Compared with other fields, the local consumer market still has significant growth potential in terms of digitalization. Although this answer is almost perfect, he also warned investors not to be too optimistic: "In the second half of the year, we will continue to optimize operational efficiency. How much the loss can be reduced depends on the total scale of the business, so don't be too excited."

Meituan's shares are up about 25% so far this year, and in 2023, the company lost more than half of its market value.

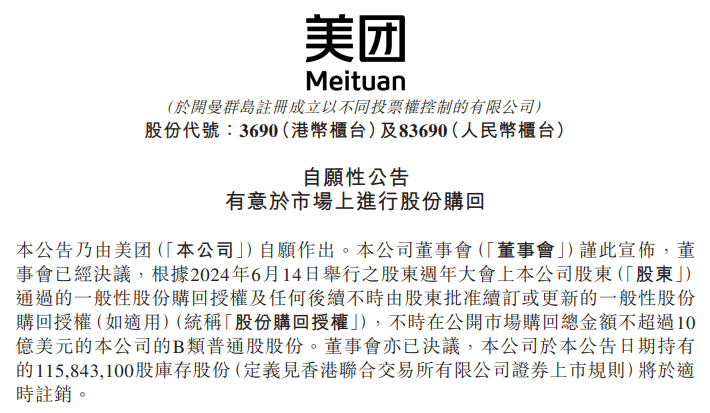

Subsequently, Meituan issued another announcement, announcing that it plans to spend no more than US$1 billion to repurchase the company's Class B common stock. In addition, the company will cancel the 115.8 million treasury shares it holds in due course. Meituan CFO Chen Shaohui said: "In the future, we will further develop new businesses, improve efficiency, reduce losses, seize new opportunities to achieve more growth, and achieve a better balance between growth and profitability."

Core Local Business Beats Expectations

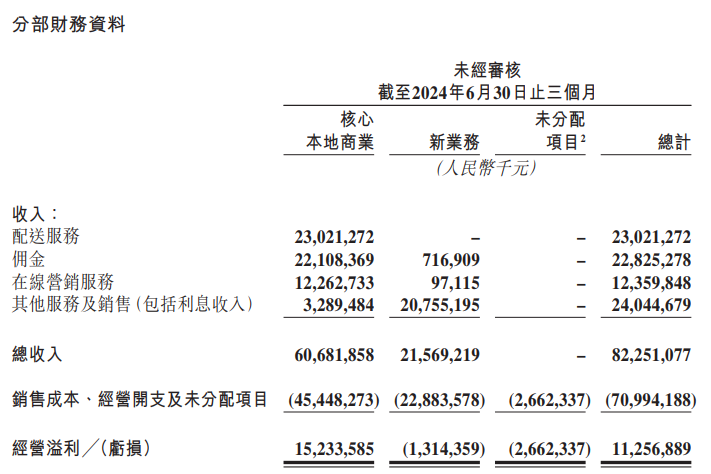

In terms of divisions, Meituan's core local business grew by 18.5% year-on-year to 60.7 billion yuan; operating profit increased by 36.8% year-on-year to 15.2 billion yuan; profit margin rose to 25.1%, a new high since 2022.

It is not difficult to see that Meituan's revenue growth this quarter mainly comes from the strong development of core local businesses. The instant delivery business continues to grow steadily, operational efficiency is further improved, and the flash sales and in-store hotel and travel businesses are expanding strongly.

In the second quarter, Meituan's annual active users and merchants hit a new record high, and the average annual transaction frequency of annual transaction users has achieved continuous growth for 15 quarters since mid-2020. The number of instant delivery transactions reached 6.167 billion, suggesting a new trend of mass consumption of "instant retail"; the number of transaction users and order frequency of flash sales business continued to grow; the number of in-store hotel and travel orders during the period increased by more than 60% year-on-year.

Since the beginning of this year, Meituan has made many adjustments to the company's organizational structure: on the one hand, it has integrated the instant delivery and in-store hotel and travel businesses, and on the other hand, it has also optimized the supply side, attracting more traditional merchants to "join the game", further improving operational efficiency.

During the period, Meituan launched a pilot of the "God Member" that connects the food, drink and entertainment services, and completed full-scene coverage in July. As of the beginning of the month, the business has attracted 5 million merchants. "Pinhaofan" also became a new growth factor for many small and medium-sized businesses during the period, attracting a large number of young consumers.

Takeaway "brand satellite stores" also welcomed brands such as Lao Xiang Ji and Haidilao to join this quarter, providing more merchants with commission rebates, traffic support, operational guidance and other services. As of the end of June, 120 brands have opened more than 800 satellite stores across the country.

Meituan Flash Purchase has cooperated with more retail physical brands such as fast-moving consumer goods, clothing, alcohol and beverages, and the number of annual transaction users and the average annual transaction frequency have once again achieved steady growth. Among them, "Wai Ma Send Wine" achieved strong GTV growth this quarter.

Not only that, thanks to the arrival of the traditional consumption peak season, the in-store hotel and travel business has once again achieved steady growth, with order volume increasing by more than 60% year-on-year, the number of annual transaction users increasing by nearly 35% year-on-year, and the number of annual active merchants also reaching a new high.

New Business Loss Narrowed Significantly

For the new business, mainly benefiting from the revenue growth of the commodity retail business and the improvement of Meituan's operational efficiency, this segment has also made great progress, with revenue increasing by 28.7% year-on-year to 21.6 billion yuan, the highest growth rate in the past four quarters. At the same time, operating losses narrowed 74.7% year-on-year to 1.3 billion yuan, and the operating loss rate improved 8.7 percentage points month-on-month to 6.1%.

In the second quarter, by improving product quality and strengthening supplier cooperation, Meituan Youxuan's operational efficiency was improved, thereby increasing the average unit price and product markup rate. This was supplemented by strengthening contract fulfillment capabilities, improving marketing efficiency, optimizing resource allocation, and reducing losses. Both month-on-month and year-on-year rates narrowed significantly. Xiaoxiang Supermarket has also made significant progress in terms of products, operations and contract fulfillment, leading its peers in growth and continuously improving efficiency.

At other business levels, B2B catering supply chain services, catering management systems, shared bicycles and power banks have all entered a healthy growth trajectory.

After the financial report was released, Meituan also made a new round of adjustments to its business: it will integrate SaaS, shared bicycles and power bank rental businesses into a new software and hardware department, and rename its overseas business Keeta.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.