Tencent Q1 profit surge exceeds market expectations, local gaming revenue returned to growth

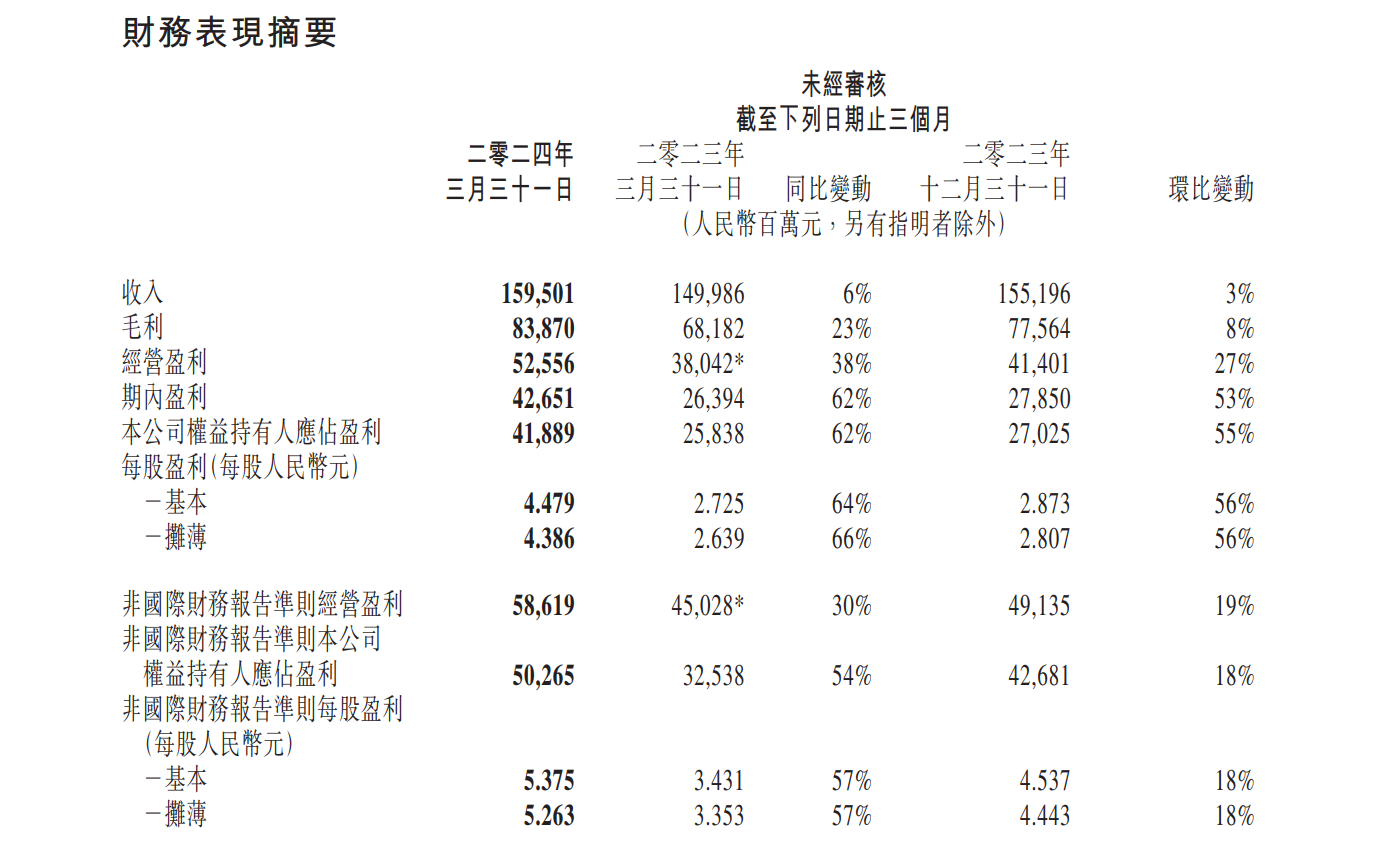

In the first quarter, Tencent's revenue reached RMB 159.501 billion, a year-on-year increase of 6%. After adjustment, the net profit was RMB 50.265 billion, a year-on-year increase of 54%, and the gross profit margin increased from 45% in the same period last year to 53%.

After the Hong Kong stock market closed on Tuesday, Tencent Holdings released its financial report for the first quarter of 2024 as of March 31.

According to performance data, Tencent's revenue in the first quarter reached 159.501 billion yuan, a year-on-year increase of 6%. The net profit was 41.889 billion yuan, a year-on-year increase of 62% and a month on month increase of 55%; After adjustment, the net profit was 50.265 billion yuan, a year-on-year increase of 54% and a month on month increase of 18%. The gross profit increased by 23% year-on-year to 83.9 billion yuan, and the gross profit margin increased from 45% in the same period last year to 53%.

The impressive profit growth rate immediately attracted the attention of investment banks.

Jeffrey stated that Tencent's first quarter revenue met expectations and its net profit under non international accounting standards exceeded expectations. I believe Tencent has demonstrated strong execution power in its high-quality growth strategy, maintaining its buy rating and raising its target price to HKD 475.

It is worth noting that Tencent Holdings' stock price has risen by over 27% since the beginning of this year. If calculated from the low point of this year's stock price (i.e. January 22), Tencent's increase exceeds 44%.

Specifically, let's take a look at the various business situations.

Channels Grows Rapidly, Game Flow Records YoY Growth

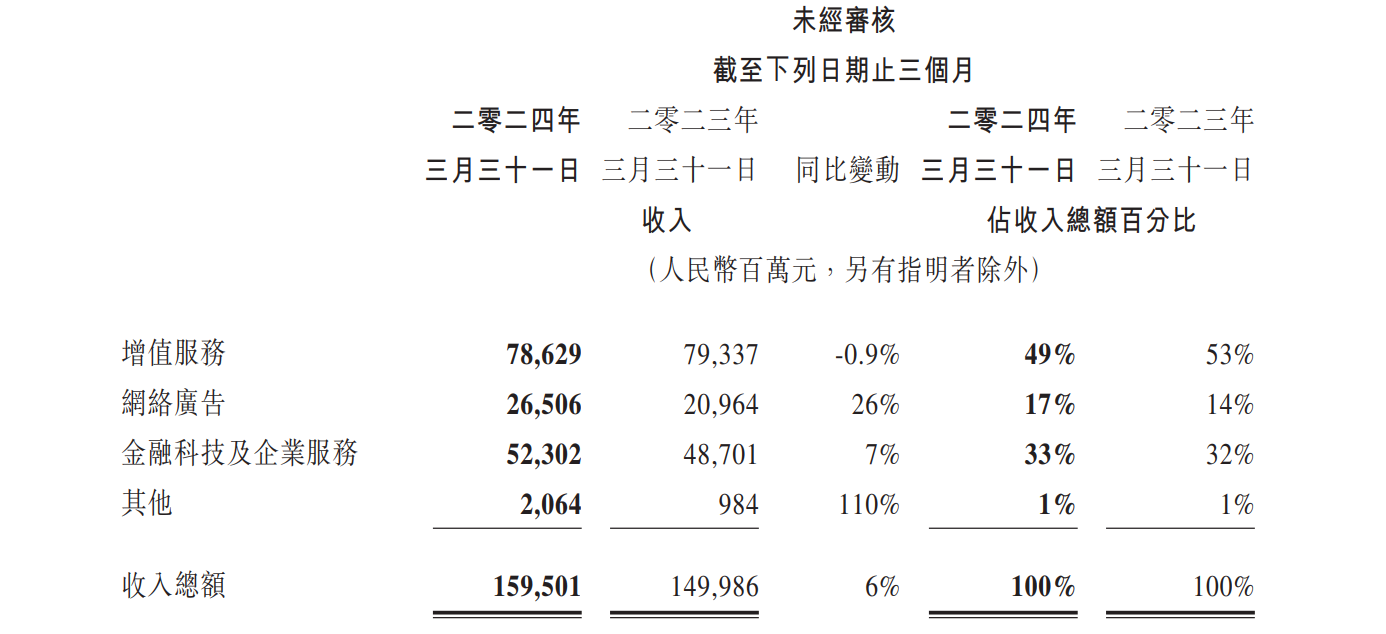

Tencent's value-added services business recorded a revenue of 78.6 billion yuan in the first quarter of this year, a year-on-year decrease of 0.9% and a month on month increase of 14%. The gross profit of this business segment increased by 5% year-on-year to 45 billion yuan, and the gross profit margin increased from 54% in the same period last year to 57%. Tencent's value-added services include two major sectors: social networking and gaming.

● Social networks

In the first quarter, Tencent's social network revenue decreased by 2% year-on-year to 30.5 billion yuan. Among them, revenue from music and long video paid members, Channels live streaming services, and small game platform service fees increased, while revenue from music live streaming and game live streaming services decreased.

Tencent also disclosed some social network operation data for the first quarter: as of March 31, 2024, the combined monthly active accounts of WeChat and WeChat were 1.359 billion, a year-on-year increase of 3%; The monthly active accounts of QQ mobile terminals were 553 million, a year-on-year decrease of 7%; The number of registered accounts for fee based value-added services was 260 million, a year-on-year increase of 12%; The number of paid video members reached 116 million, a year-on-year increase of 8%; The number of paid music members reached 114 million, a year-on-year increase of 20%.

In addition, the total usage time of Channel srecorded a year-on-year increase of over 80%. Tencent claims that by expanding product categories and incentivizing more content creators to participate in live streaming sales, it has strengthened the Channels live streaming sales ecosystem.

The total user usage time of the mini program increased by over 20% year-on-year. Among them, the daily usage of non gaming mini programs achieved a double-digit percentage increase year-on-year, and the revenue of mini games increased by 30% year-on-year.

● Games

In terms of gaming, it can be divided into international and local markets.

In the first quarter, the international market gaming revenue increased by 3% year-on-year to 13.6 billion yuan. The total revenue of the game increased by 34% year-on-year and decreased by 3% month on month.

Among them, Brawl Stars performed particularly well, with the number of daily active accounts (DAUs) in the international market more than doubling year-on-year and total revenue increasing by more than four times year-on-year. In addition, PUBG Mobile's DAU and revenue recorded double-digit year-on-year growth rates in the first quarter. The total revenue of the first quarter of Warframe reached a new high.

In the local market, game revenue decreased by 2% year-on-year to 34.5 billion yuan, with a month on month increase of 28%. Tencent explained that the year-on-year decline in gaming revenue was due to delayed revenue. In terms of individual games, "Honor Of Kings" experienced a year-on-year decrease in revenue due to the high base during last year's Spring Festival, while Game For Peace experienced a year-on-year decrease in revenue due to weak commercial content in the second half of last year.

But the good news is that the total gaming revenue in the local market has resumed growth, with a year-on-year increase of about 3%.

Tencent stated that Honor Of Kings and Game For Peace have begun to benefit from new commercial rhythms and improved game content design, achieving year-on-year growth in revenue in March 2024.

In addition, the revenue of multiple local market games also reached a historic high in the quarter. The DAU of Teamfight Tactics has reached a historic high, ranking third among all mobile games in China in terms of total revenue this quarter. CrossFire: Legends achieved a historic high in total revenue for paid users this quarter. The number of users and total revenue of Arena Breakout have reached new milestones.

"Looking ahead, our focus will be on implementing new strategies for existing games and driving the successful release of backup new games," said James Mitchell, Chief Strategy Officer, during a conference call. It is understood that Tencent will gradually launch several large-scale games this year, including DNF, Tarisland, Need for Speed and so on.

The gaming business is an important business of Tencent, so the outside world is very curious about how Tencent will integrate AI technology into its gaming business.

During a conference call, when asked about the application prospects of the HunYuan model in the gaming business, President Liu Chiping stated that the HunYuan model can assist the gaming business in various ways. At present, the biggest contribution is still in customer service. Hunyuan has become a customer service robot for many games, achieving a very high level of customer satisfaction.

Liu Chiping believes that "over time, if we can achieve the application of mixed elements in various modes, especially in creating high-quality and high fidelity videos, its role will be very significant. Before this goal is achieved, mixed elements can be used to create non player characters and create certain interactive experiences, but they still cannot take over some relatively heavy tasks related to content creation in the game. I think it may require multiple iterations before mixed elements can be deployed for game production."

Advertising revenue gross profit both increased significantly

In the first quarter, Tencent's online advertising revenue was 26.5 billion yuan, a year-on-year increase of 26% and a month on month decrease of 11%.

Tencent said that the year-on-year growth of revenue was driven by the growth of WeChat Channels, applet, official account and Soyiso. The company revealed that in the first quarter, advertising spending in all major industries except the automobile industry increased, including the game, Internet services and consumer goods industries.

In terms of gross profit, the gross profit of online advertising business in the first quarter increased by 66% year-on-year to 14.5 billion yuan, and the gross profit margin significantly increased from 42% in the same period last year to 55%. The growth in gross profit is mainly due to the growth in advertising revenue from WeChat Channels and Soyi Search.

Tencent stated that the company has upgraded its advertising technology platform to assist advertisers in more effective advertising placement, and has launched a generative AI driven advertising material creative tool for all advertisers.

Michelle mentioned during a conference call that the company is still in a very early stage of increasing its advertising volume in Channels, currently only about a quarter of the advertising volume of its main short video competitors. Deploying advertisements through artificial intelligence to generate revenue is still in its early stages. He believes that overall, Tencent still has a significant advantage and can continue to seize market share at a faster pace in the future. "The application of artificial intelligence to Tencent's advertising technology has continuously benefited us, and these technologies have strong leverage."

When asked if he would like Meta to promote artificial intelligence services to all products, President Liu Chiping's answer was quite cautious and did not reveal any information about the direction of internal AI products.

Liu Chiping said, "I believe that as long as there are suitable products, WeChat platforms and other products with a large number of users can become excellent distribution channels for artificial intelligence products. However, currently, every company is trying different products to see which ones work. No company has truly created killer applications, except perhaps OpenAI's Q&A model."

He emphasized, "I think everyone should have confidence that Tencent has been developing technology, and the HunYuan model has first-class technology. We are also actively creating and testing different products to understand their significance for our existing products. When the time is ripe, these products will be launched on our platform."

Financial technology and corporate services business gross margin bright

In Tencent's first quarter financial report, the profitability performance of its fintech and enterprise services businesses was also a highlight.

In the first quarter, the gross profit of this business segment increased by 42% year-on-year to 23.9 billion yuan, and the gross profit margin significantly increased from 34% in the same period last year to 46%. Tencent stated that the growth in branch gross profit is due to the increased contribution of high gross profit margin financial services and Channels merchant technical service fees, increased commercialization of enterprise WeChat and other enterprise service businesses, and improved cost-effectiveness of cloud services.

However, the revenue of this division is still weak. In the first quarter, the revenue of this business segment increased by 7% year-on-year to 52.3 billion yuan, a decrease of 4% month on month.

The company stated that revenue from fintech services increased in single digit percentage year-on-year, mainly due to a slowdown in offline consumer spending growth and a decrease in withdrawal income, while revenue from wealth management services grew strongly.

In addition, the enterprise service business revenue achieved a year-on-year growth rate of more than ten points, benefiting from the increase in cloud service revenue and Channels merchant technical service fees.

In the first quarter, Tencent Cloud Audio and Video solutions attracted more local and international customers, especially those in the media, entertainment, and live streaming industries. International Data Corporation (IDC) has rated Tencent Cloud Audio and Video Solution as a leader in the Chinese market for six consecutive years.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.