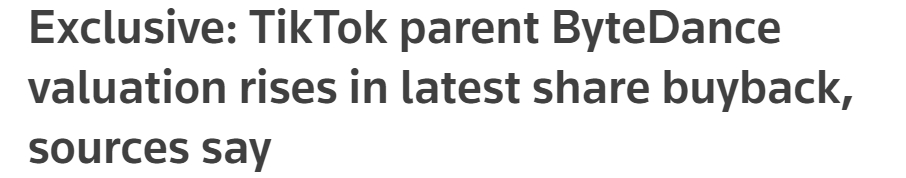

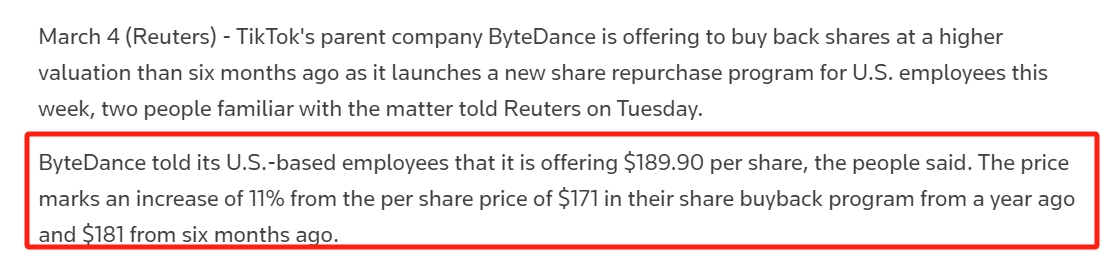

In March 2025, Byte was suspected to be working for an IPO.

Intelligence details

The company launched a new round of share repurchase program, offering U.S. employees a repurchase price of $189.90 per share-an increase of 11% from $171 a year ago and an increase of 5% from $181 six months ago., corresponding to a company valuation of US$315 billion (approximately RMB 2.3 trillion).

If the timeline is lengthened, since 2022, ByteDance has adjusted its valuation through stock repurchases many times, from US$155/share in 2022 (corresponding to a valuation of US$300 billion) to US$171/share at the end of 2023, and then to US$189.9/share today. Its valuation has increased by about 5% in more than two years, which makes people have to imagine.

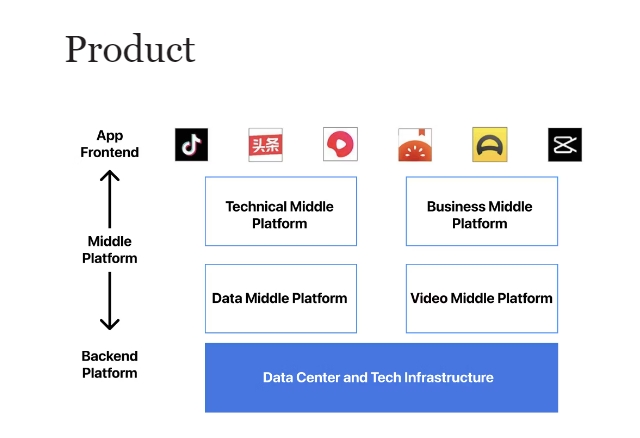

company profile

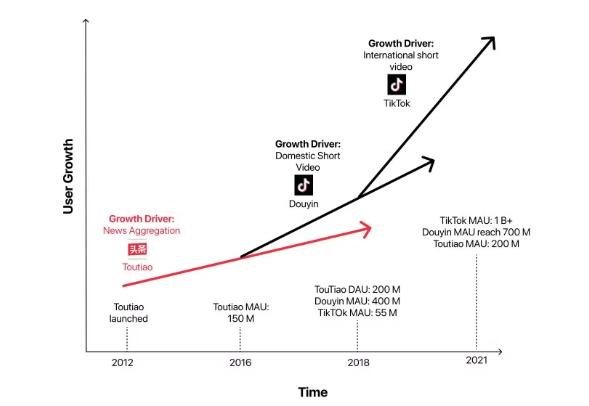

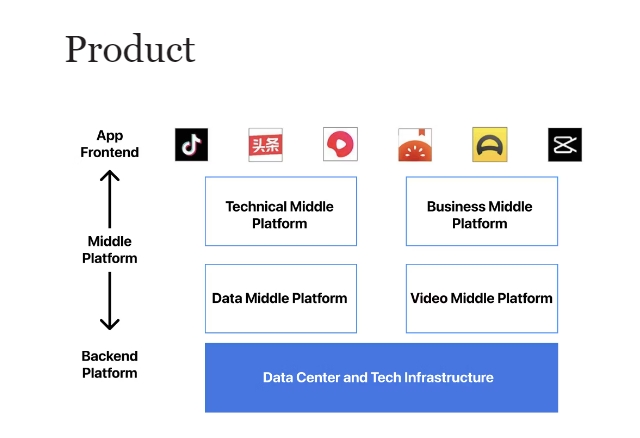

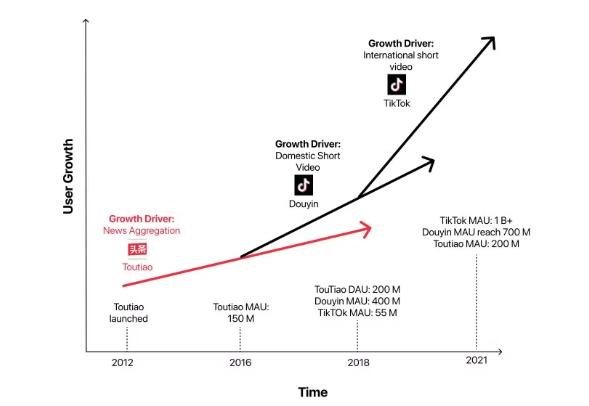

Founded in 2012, ByteDance uses an algorithmic recommendation engine to subvert the traditional content distribution model. Its three core products, Douyin, Today's Headline, and TikTok, occupy the strategic heights of Chinese information flow, Short Video and global social media respectively.

The brand upgrade of "Douyin Group" launched in 2022 marks the division of its domestic business (covering Douyin, Watermelon Video, Flying Book, etc.) from overseas TikTok, clearing regulatory obstacles for independent listing.

In terms of equity structure, Zhang Yiming retains control through AB share design. Sequoia Capital, SoftBank Vision Fund, Transatlantic Investment and other institutions collectively hold more than 60%, and the latest employee stock ownership platform has covered 110,000 employees.

It is worth noting that the joining of the new CFO Gao Zhun is seen as a signal to accelerate the listing. This "Chinese Stock Queen" who once operated Jingdong and Pinduoduo's U.S. stock listings is leading the construction of a financial system that complies with Hong Kong stock rules.InvalidParameterValue

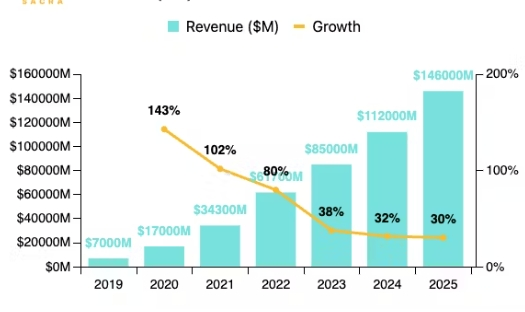

financial position

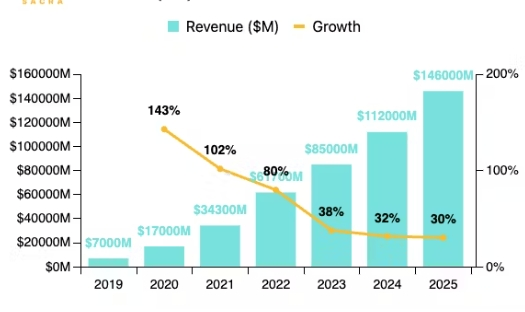

Financial report data for 2024 shows that the total revenue of ByteDance H1 exceeded US$73 billion, of which domestic advertising and e-commerce business contributed more than US$50 billion, a year-on-year increase of 35%; overseas TikTok e-commerce GMV surged 300% year-on-year, pushing the proportion of international revenue to 23%.

In the core product matrix, Douyin's daily activity is stable at 680 million yuan, and the average daily usage time of a single user is 122 minutes, far exceeding the average user's and WeChat video accounts;TikTok's global monthly activity exceeds 1.5 billion yuan, and the ARPU value in the North American market reaches 12.3 US dollars. Commercial efficiency approaches Meta.

What is more worth looking forward to is the second growth curve: Feishu's corporate customers exceed one million, the annual revenue of Volcano Engine cloud service exceeds US$3 billion, and the game business has built a closed loop of self-research + distribution through the acquisition of Mutong Technology and Youai Mutual Entertainment.InvalidParameterValue

issuance structure

Byte was rumored to have gone public once in 2022. At that time, due to the good cooperative relationship Goldman Sachs has maintained with ByteDance and Zhang Yiming in the past few years, Goldman Sachs would become the lead underwriter of Douyin IPO, while underwriters who had previously participated in the fast-hand IPO were expected to be excluded (the co-sponsors of the fast-hand IPO at that time included Morgan Stanley, Bank of America and Huaxing Capital).

Based on the direct competition between Douyin and Kuaidi, Morgan Stanley will not serve as the underwriter of Byte's IPO, and Byte may choose CICC or CITIC Construction Investment as the underwriter of Chinese securities firms.

Because three years have passed, and the fast hand of 1.8 trillion yuan has almost lost 1.6 trillion yuan, the above issuance structure is for your reference only.

the new strategy

If Byte is listed, there will be no doubt that it will be a super meat lot.

According to historical data, if the overpurchase exceeds 200 times, the basic share will be allocated 1:1 between Group A (less than HK$5 million) and Group B.The winning rate of Group A is expected to be in the range of 5%-8%, of which the "Group A"(subscription of HK$4.9 million) may be over-allotted due to being close to the threshold of Group B; the winning rate of Group B is approximately 1.2%-2%, but it needs to bear higher capital costs.For investors with different capital levels, it is recommended to adopt tiered tactics.

Risk balancing and exit mechanism

Despite the strong fundamentals of ByteDance, there are three major risks to be wary of: First, the U.S. ban on TikTok is pending, and if Congress passes a mandatory divestiture bill, it may trigger a valuation revaluation; Second, the growth of domestic advertising has slowed down, with Q4 in 2024 falling by 7% month-on-month; Third, the liquidity of Hong Kong stocks has contracted, with the recent first-day break rate of large-scale IPOs reaching 45%.It is recommended that the winning bidder activate the "conditional order" function: set up batch profit stop and automatic stop loss.For highly leveraged users, volatility risks can be hedged by subscribing short rounds or CBBCs.InvalidParameterValue

Why must we seize ByteDance to create new ones?InvalidParameterValue

This may be the last opportunity to participate in the trillion-dollar unicorns in the past five years-Ant Group's listing has been stranded and Didi's delisting lessons are ahead, and regulators will not open the window for platform economy IPOs for a long time.The timing of ByteDance is very strategic: the Federal Reserve's interest rate cut cycle has started to ease the pressure on foreign capital outflows, and the expansion of Hong Kong Stock Connect has increased the demand for capital allocation in the south. Its weight in the Hang Seng Technology Index is expected to exceed 8%.

How to make new ones?

1. Before subscribing for new shares, you need to open a Wealth Broker account.Wealth Broker provides convenient online account opening service, and users can register through the official website or App.

Click on the exclusive discount account opening link: p.wealthbr.com/0qBSODM? lan=zh

2. New operating procedures for Hong Kong stocks

login account

Open the Wealth Broker App and log in using your account information.

Enter the new share subscription page

In the navigation bar at the bottom of the App, click [Market], and then select [New Share Subscription].

Select new shares

Browse the list of new shares currently available for subscription, click the new shares you are interested in, and enter the details page.

Submit subscription application

Choose the subscription method: Wealth Broker provides cash subscription and financing subscription methods.Financing subscriptions can provide leverage of up to 10 times, depending on the new shares.

Confirm subscription quantity: Enter the subscription number based on your funds.Please note that the number of shares per lot for each new issue may vary and needs to be selected based on specific circumstances.

Submit the application: After confirming that there is no error, click [Confirm Subscription], and the system will prompt you to verify the information again and submit it after confirmation.

3. Deduction time

Ordinary subscription

Subscription funds will be frozen in real time after the application is initiated and will be deducted on the subscription deadline.

Bank financing subscription

Deduction time for principal part: The principal part of bank financing subscriptions is frozen in real time after the subscription application is submitted, and deducted on the subscription deadline date. Bank financing subscriptions are usually one trading day in advance.

Deduction time for partial bank financing: When you submit a subscription, the bank financing amount will be recorded first, and the payment will be uniformly deducted on the winning date.

Bank financing interest must be paid regardless of whether the winning bid is won or not and will be deducted on the date of announcement of the winning bid.If the listing of new shares is postponed or cancelled, the interest-bearing period will increase accordingly.

The subscription fee must be paid regardless of whether the bid is won or not, and will be deducted together with the subscription principal on the subscription deadline.In case of postponement, cancellation of listing, etc. of new shares, subscription handling fees will need to be paid.

Return of funds

Ordinary subscription-after announcement of winning results

If there is no winning bid, the deducted subscription amount and principal will be returned to the user's account on the day when the winning bid is announced.

If a partial winning bid is awarded, the winning bid will increase the user's position, and part of the excess amount deducted from the principal that has not been awarded will be returned to the user's account after the winning bid result is announced.

Bank Financing Subscription-After announcement of winning results

If there is no winning bid, the deducted subscription amount and principal will be returned to the user's account on the day when the winning bid is announced.

If a partial winning bid is awarded, the winning bid will increase the user's position, and part of the excess amount deducted from the principal that has not been awarded will be returned to the user's account after the winning bid result is announced.

I wish everyone a smooth investment ~

Recently, if there are new Hong Kong stocks, or if you want to exchange accounts for Hong Kong and U.S. stocks, you can add a small WeChat exchange.

Introduction to Wealth Broker:

Wealth Broker is a licensed and compliant global investment platform established in 2017 and headquartered in Singapore. It holds Australia ASIC and New Zealand FSPR licenses. It is regulated by the Hong Kong Securities and Futures Commission (SFC) and SIPC to ensure transaction security and compliance.The platform supports investment in multiple categories of assets such as Hong Kong stocks, U.S. stocks, ETFs, new share subscriptions, and options. The funds are managed by third-party banks and provide AI intelligent investment, low-cost transactions, and round-the-clock customer service support.There is no need to go to Hong Kong and open an account online in 10 minutes, helping investors easily enter the global market, making it safe, compliant, convenient and efficient.