Kuaishou Q2: Cost Saving Failed to Increase Profit, Stock Price Once Fell by 12%

According to the report, Kuaishou's revenue in the second quarter was 30.975 billion yuan, with gross profit margin and adjusted net profit both exceeding expectations, but the growth rate of e-commerce GMV slowed down during the period, hitting market confidence.

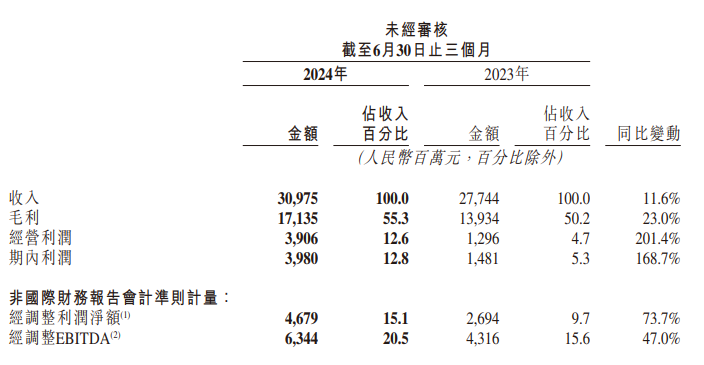

According to the financial report, Kuaishou's revenue in the second quarter was 30.975 billion yuan (RMB, the same below), an increase of 11.6% year-on-year; gross profit was 17.135 billion yuan, an increase of 23.0% year-on-year; adjusted net profit was 4.68 billion yuan, a surge of 73.7% year-on-year; gross profit margin and adjusted net profit margin both reached a single quarter high of 55.3% and 15.1% respectively.

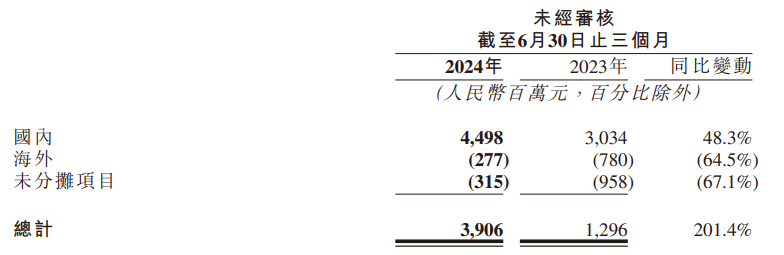

During the period, the operating profit of the domestic division increased by 9.5% year-on-year to 4.5 billion yuan; at the same time, the overseas division was affected by the rapid growth of overseas revenue, and the loss narrowed from 780 million yuan in the same period last year to 277 million yuan.

Kuaishou said in its financial report: “In the second quarter of 2024, in a highly competitive environment, our revenue and profits continued to grow, with industry-leading AI technology, dynamic content and business ecosystem, and efficient organizational collaboration. This progress has laid the foundation for our platform to thrive in a dynamic market.”

After the financial report was released, Kuaishou once fell more than 12% to HK$39 on August 21, and its stock price hit a new low since early February.

Progress of 3 Main Businesses

In terms of main business, revenue from online marketing services, live broadcasts and other services (including e-commerce) made a major contribution. Revenues were recorded at 17.515 billion yuan, 9.302 billion yuan and 4.158 billion yuan respectively, accounting for 5.65% of the revenue respectively. %, 30.0% and 13.5%.

Online Marketing Solutions Intelligentized

Data shows that thanks to the optimization of intelligent marketing solutions and algorithms, Kuaishou's online marketing business is still growing rapidly, with an increase of 22.1% compared with the same period last year.

Among them, Outer Loop has achieved significant growth in industries such as media information, e-commerce platforms and local life, and the average daily marketing consumption of paid short dramas has more than doubled year-on-year. Under the mining and reasoning of large models, accurate matching of users and advertisers was achieved. In the second quarter, customers' consumption of marketing delivery using UAX accounted for more than 30% of the total consumption of external circulation.

In the field of internal circulation, Kuaishou has continued to optimize its strategies and capabilities for intelligent product placement, allowing merchants to use full-site promotion or smart hosting to reach 40% of the total consumption of internal circulation. The consumption of small and medium-sized merchants increased by 60% year-on-year this quarter. %.

"Live-Broadcast+" Ecosystem Refined

Thanks to the refined adjustment of the operating model, live broadcast business revenue decreased by 6.7% year-on-year in this quarter.

By introducing a number of high-quality new guilds, Kuaishou successfully built a regional team during the live broadcast period. By the end of the quarter, the number of signed guild institutions had increased by nearly 50% year-on-year, and the number of signed guild anchors had increased by 60% year-on-year, becoming the core growth point of this business.

In addition, with the help of the "short video + live broadcast + community" ecosystem, Kuaishou has expanded its audience size in terms of content, supply, and interaction. The daily average number of resume submissions for the Quick Jobs business increased by more than 130% year-on-year, and the matching rate increased by more than 150% year-on-year; the daily average size of the Ideal Home business also reached 10 times that of the previous quarter.

E-Commerce Operations Diversified

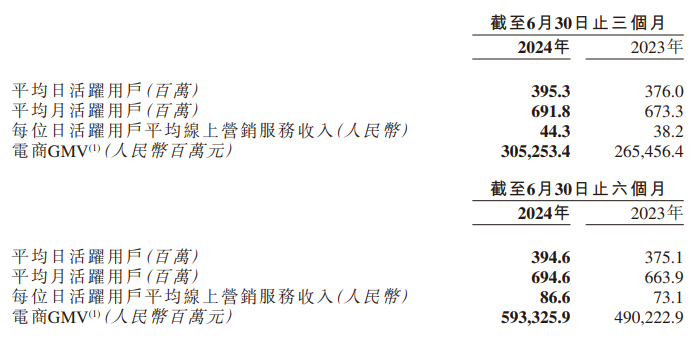

Despite weak demand in the domestic consumer environment, thanks to the company's diversified global operations, Kuaishou e-commerce still recorded a GMV of 305.3 billion yuan in the second quarter, a year-on-year increase of 15%, and promoted a 21.3% year-on-year growth in other service revenue.

On the demand side, the average number of monthly buyers during the period increased by 14.1% year-on-year to 131 million, and the monthly active user penetration rate reached a record high of 18.9%. The company adheres to the "user first" strategy, accurately captures and responds to consumer preferences, further expands the user base through product and subsidy strategies, and encourages repeat purchases.

On the supply side, Kuaishou vigorously promoted the cold start, growth and long-term operation of new merchants in the second quarter of this year, and at the same time empowered the global operations of existing merchants, driving the average monthly number of merchants to increase by more than 50% year-on-year. Not only that, in the e-commerce sector, the GMV of the pan-shelf sector also accounted for more than 25% of the total GMV in the second quarter.

For the second half of 2024, the company's management pointed out in the earnings call that both merchants and e-commerce platforms are still facing a slowdown in short-term consumer demand. Coupled with the weakening of traffic dividends, e-commerce needs to achieve content and business efficiency. Better balance.

Full-Scenario AI Matrix Activates Users

It is reported that Kuaishou has launched a comprehensive layout in the field of AI and built a set of advanced infrastructure to support the training and reasoning of large models with trillions of parameters, so that the AI matrix can be seamlessly embedded in multiple business scenarios to support content creation, understanding and recommendation and user interactions. Interaction greatly enhances business competitiveness.

At the user level, Kuaishou’s average daily active users and average monthly active users increased by 5.1% and 2.7% year-on-year respectively in this quarter, to 395 million and 692 million; on the traffic side, it also achieved large-scale growth, and the total usage time of Kuaishou applications increased year-on-year. 9.5%.

In terms of search business, the user penetration rate of Kuaishou search has further increased. In the second quarter, nearly 500 million monthly active users used Kuaishou search, and the number of searches in a single day increased by more than 20% year-on-year. In addition, Kuaishou also supports high-quality content creators through differentiated operating strategies and optimized algorithms, making the content creation ecosystem healthier and the content more distinctive.

Kuaishou co-founder, chairman and CEO Cheng Yixiao revealed in a conference call that the company has launched a self-developed large-scale video generation model "Keling" and a large-scale language model "Ruyi", and launched a membership system to global users to further iterate model functions. , the Vincent graph model "Ketu" is also officially open source.

According to statistics, in the first half of this year, nearly 20,000 merchants used the AI matrix to optimize their operations on the Kuaishou platform. In June, AIGC’s average daily consumption of marketing materials peaked at 20 million yuan.

Talking about the next strategic development direction, Cheng Yixiao added: "Kuaishou will firmly implement the AI strategy and strive to create new business monetization models while empowering existing business scenarios."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.