Looking back at 2024, artificial intelligence infrastructure continues, and many large Internet companies, including Google and Amazon, have officially announced infrastructure plans for next year.Goldman Sachs even predicted that the development radius of artificial intelligence has not yet passed 50%.

With the large-scale laying of artificial intelligence infrastructure, new productivity has penetrated into all aspects of people's work and life.

The following article Hawk Insight provides you with an inventory of what breakthroughs will be made in artificial intelligence in 2024?

In terms of interactive models, OpenAI has launched a research-level version of its main artificial intelligence model for the first time.After users subscribe to ChatGPT Pro for $200 a month, the services they can enjoy include unlimited access to the company's smartest model, OpenAI o1, as well as o1-mini, GPT-4o and advanced voice.

ChatGPT Pro also includes the o1 pro mode, a version of o1 that uses more calculations to do more difficult thinking and provides better answers to the most difficult questions.OpenAI also hopes to add more powerful compute-intensive productivity features to the program in the future.In addition, the company also announced that 10 sets of ChatGPT Pro will be donated to medical researchers at top institutions in the United States to help drive meaningful progress in areas that benefit mankind.

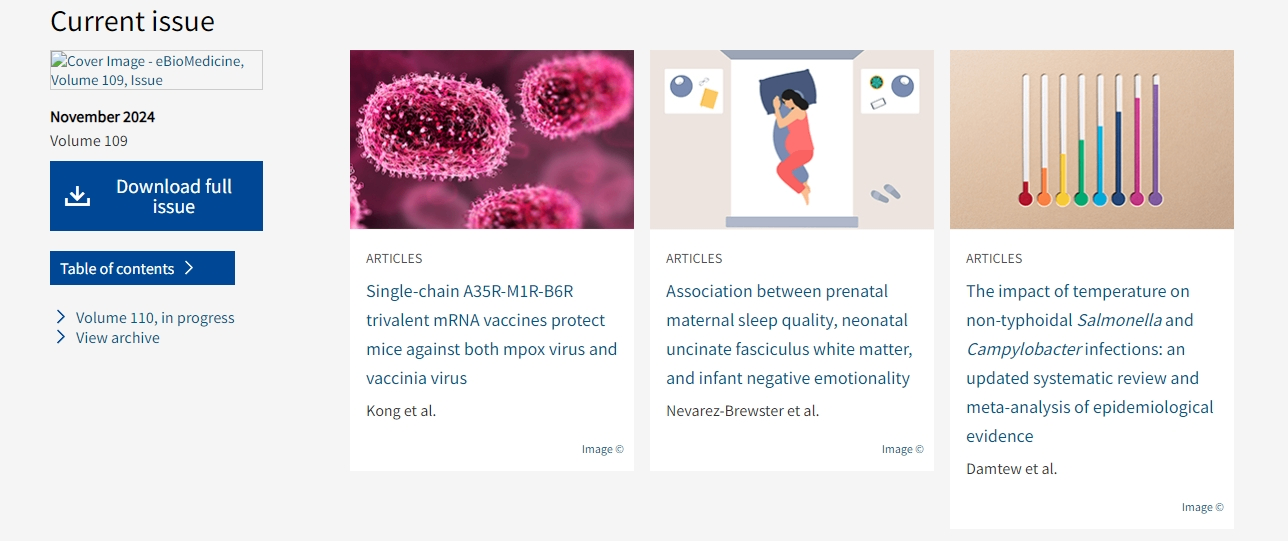

In the health care industry, artificial intelligence is also injecting new impetus into it.The latest news shows that researchers from Germany and the United States have developed a deep learning framework for automated volumetric body composition analysis using whole-body magnetic resonance imaging.The study, published in eBioMedicine, validated this approach and demonstrated its potential to predict all-cause mortality in a large Western population.

On December 3, Lantern Pharma, an artificial intelligence oncology precision therapy company, announced that the U.S. Food and Drug Administration (FDA) has approved its research drug LP-184 for the treatment of triple negative breast cancer (TNBC) to enter the fast track.This is the company's second fast-track designation in 2024 after LP-184 was first approved for the treatment of glioblastoma in October.

LP-184 is currently undergoing Phase 1A clinical trials to assess the safety and tolerability of this candidate in a variety of solid tumors, including TNBC.In addition, LP-184 was developed in conjunction with Lantern's artificial intelligence platform RADR® to help validate mechanisms that can be utilized in clinical settings to target refractory cancers and improve treatment outcomes for specific patient groups.

According to a recent Accenture study, AI-driven health care could save the United States up to $150 billion annually by 2026.This can be achieved by reducing administrative costs, automating patient education and improving compliance with care plans.In particular, AI-powered assistants can provide essential 24/7 support.

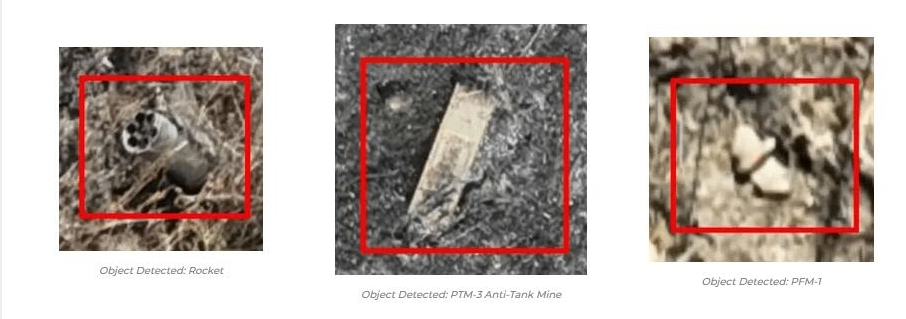

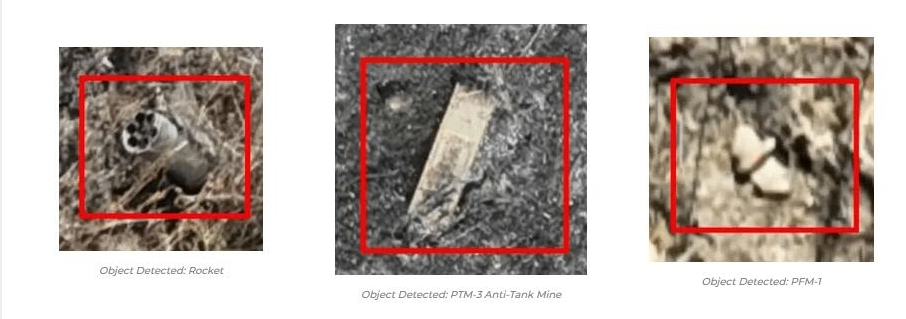

In the image analysis industry, artificial intelligence-driven drone image analysis has also made major breakthroughs.On December 4th, Safe Pro Group announced a major achievement: After leveraging images taken by daily drones and the Spotlight AI ™ software ecosystem, Safe Pro detected more than 16,500 pieces of deadly explosives alone without anyone participating in image analysis, making a significant contribution to humanitarian assistance on the battlefield.As technology advances, SpotlightAI™ has been able to quickly detect hundreds of explosives, including newly approved anti-personnel mines and cluster munitions.

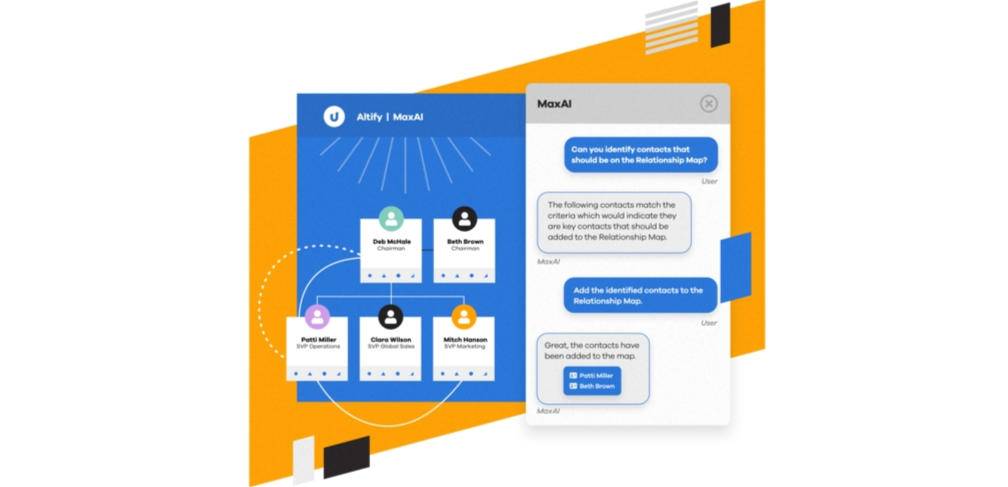

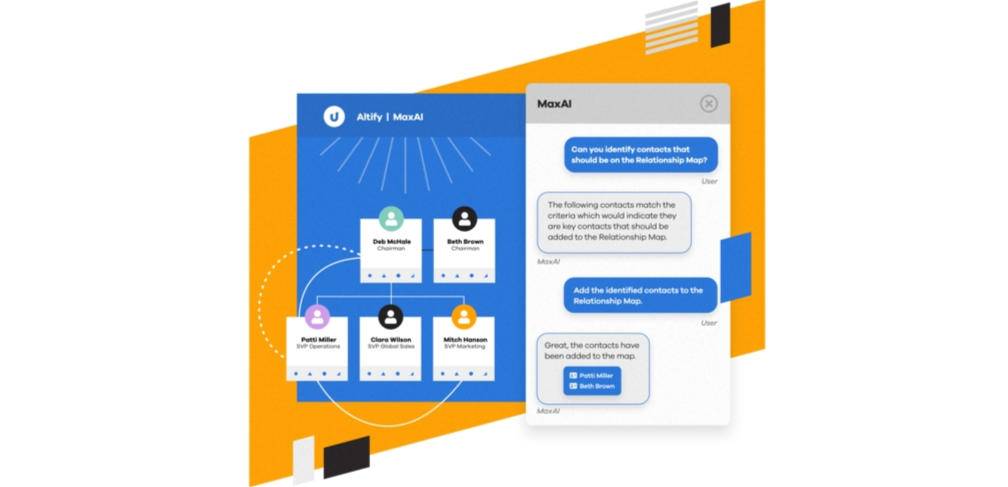

In the field of sales, artificial intelligence also shines.Upland Software is a leader in artificial intelligence cloud software for digital transformation.On December 4, the company announced that sales optimization software Upland Altify is now backed by Altify MaxAI, Upland's artificial intelligence tool used to manage account planning and transaction management, providing actionable insights to sales people to drive performance.Sales professionals can maximize efficiency and performance with these AI-driven solutions.

In addition, artificial intelligence marketing cloud company Zeta Global Holdings Corp. has also made breakthroughs in this field.Using artificial intelligence analysis and customer big data modeling, Zeta's marketing platform Zeta Marketing Platform shines during the Black Five period: platform usage surged 108% year-on-year, and more and more brands rely on Zeta to send personalized information during the shorter holiday season for better results.

Although the Thanksgiving shopping season is over, a Zeta survey shows that the holiday shopping season has just begun for many consumers.The survey of 6,000 consumers found that 53% of shoppers plan to start their holiday shopping in December-an increase of 8% from last year.As a result, Zeta expects strong demand for its tools, which will help marketers achieve ROI driven digital marketing throughout the holiday season.

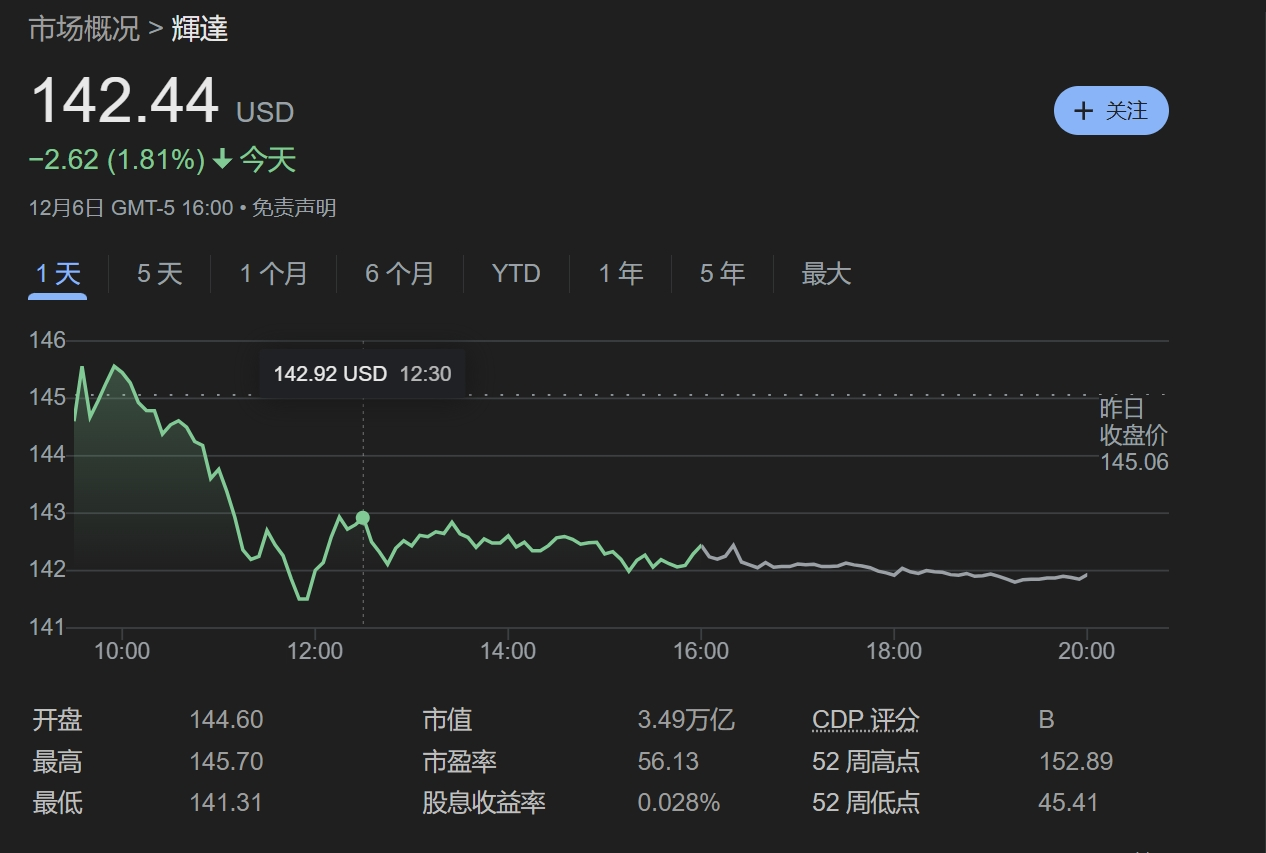

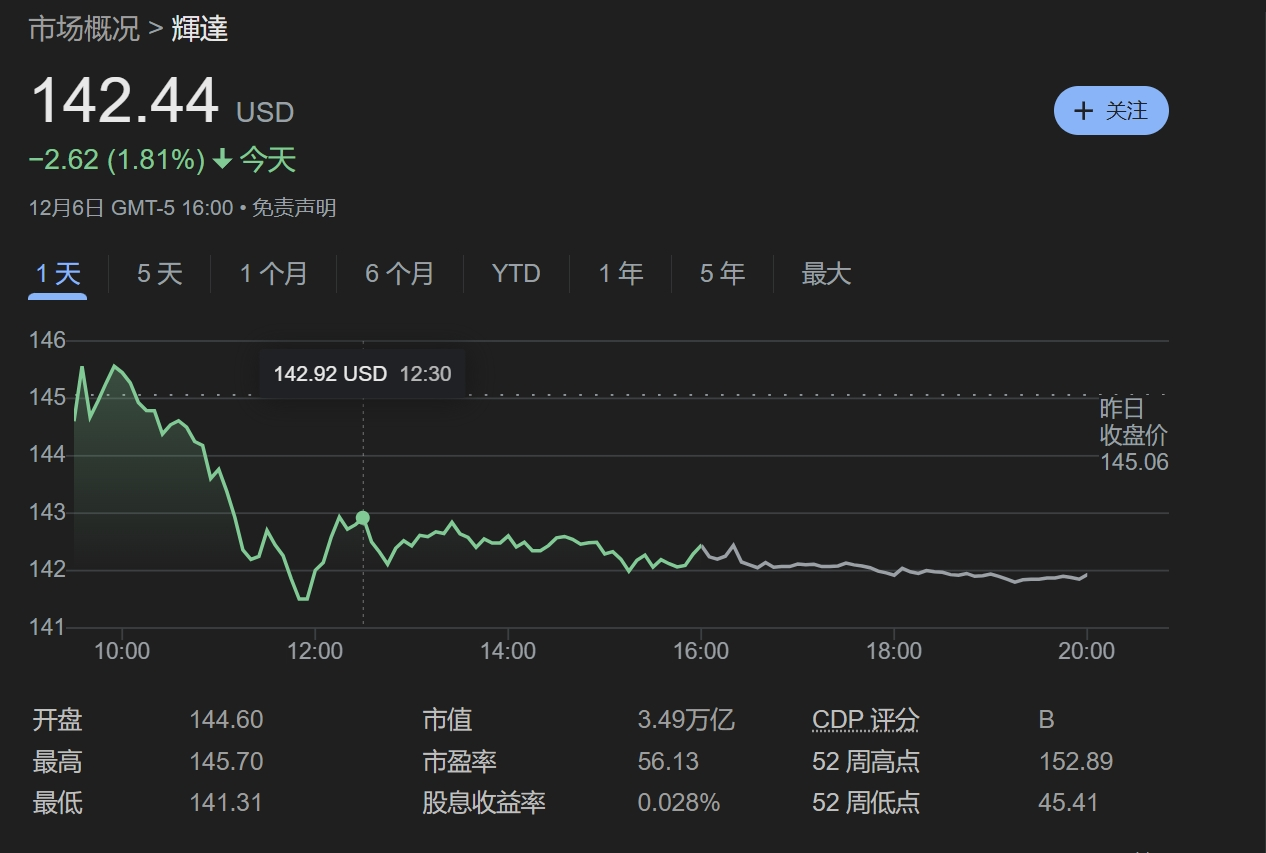

Finally, artificial intelligence chips have also erupted this year.A typical company is Marvell Technology, Inc, which is mainly engaged in the development and production of semiconductors, focusing on data centers.On December 4, JPMorgan analyst Harlan Sur raised his price target for Marvell Technology from $90.00 to $130.00 and maintained an "overweight" rating.

It is understood that the rating was made after Marvell's October quarterly results exceeded Wall Street expectations.The company reported fiscal third-quarter sales of $1.52 billion, exceeding the consensus forecast of $1.46 billion.CEO Matt Murphy revealed that the quarter's growth was driven mainly by sales of new custom artificial intelligence accelerator chips for Amazon and other so-called builders of hyperscale data centers that run today's vast artificial intelligence software models.

It can be observed that after two years of large-scale model arms race, in 2024, the implementation of artificial intelligence will continue to erupt, and applications have penetrated into all aspects of our lives.

It is reported that after Trump officially takes office in January 2025, he will appoint David Sacks, former chief operating officer of Pay Pal, as the "White House artificial intelligence and cryptocurrency czar."It is foreseeable that under the Trump administration, a storm of comprehensive reform without policy is about to begin.

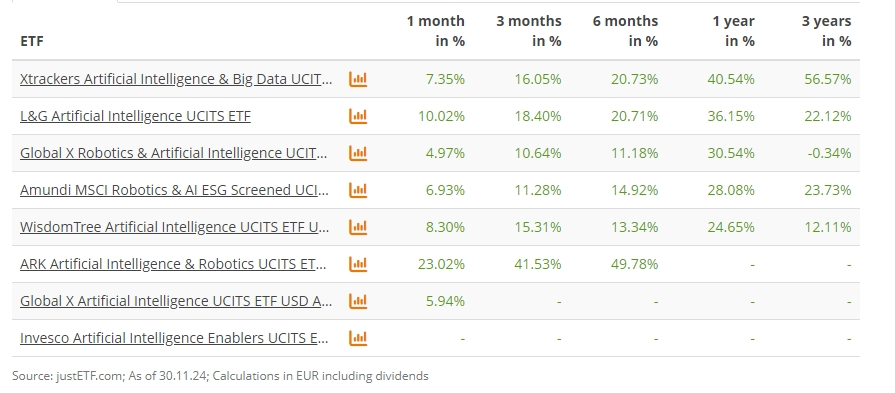

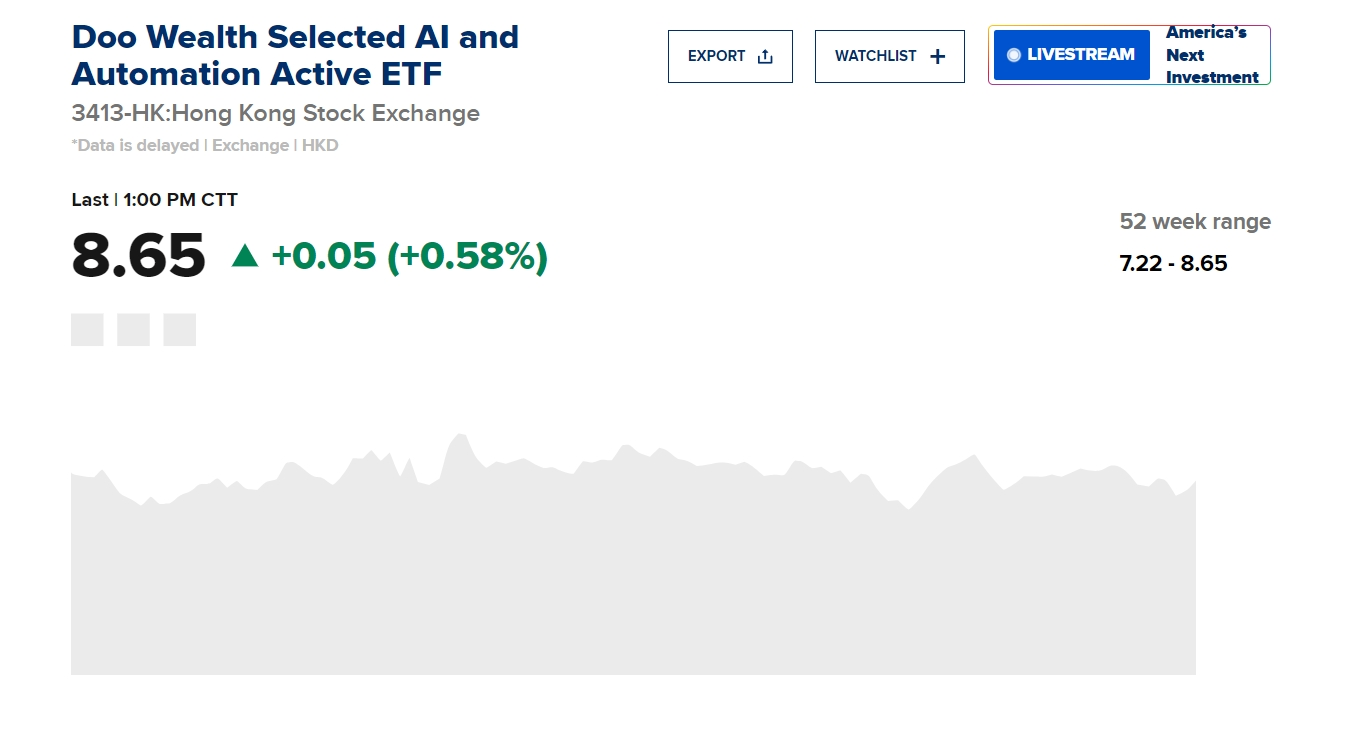

So, in the face of this wave of artificial intelligence dividends, how should ordinary people participate?Since the stock price of the artificial intelligence concept is relatively high, buying an ETF may be a good choice.

Take Nvidia as an example. Buying a share of Nvidia costs US$140; Oracle and Google share prices are both above US$150; Microsoft's share price is around US$400; and Meta's share price is as high as nearly US$600.For many people, buying a share of each of these companies will cost a lot of their savings.

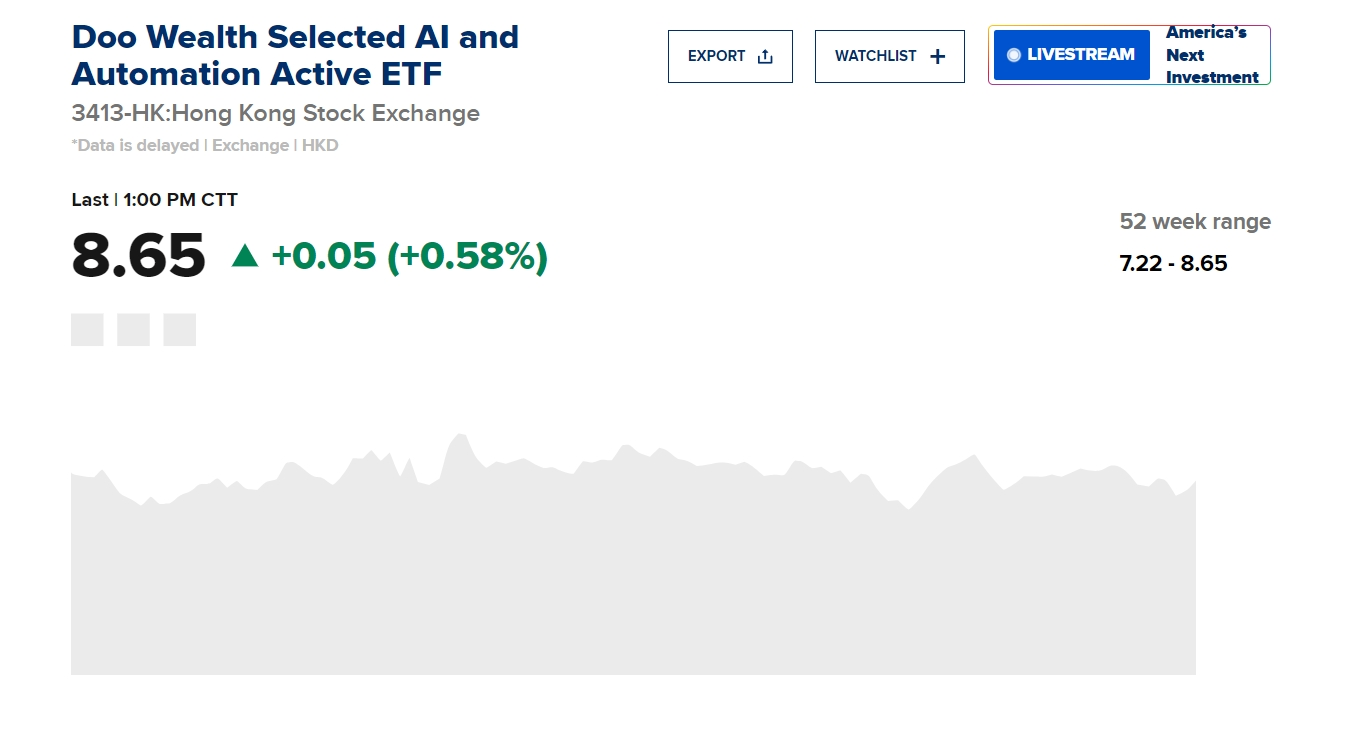

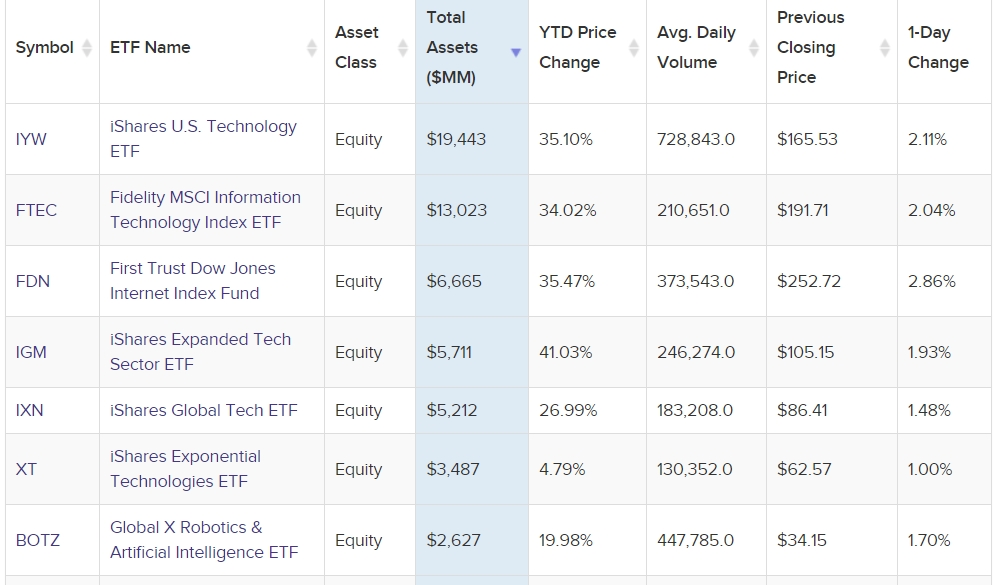

In contrast, artificial intelligence-related ETFs have become a good choice, because buying an ETF is equivalent to buying a basket of stocks, which can achieve the above-mentioned "package and buy effect", but there is no such high buying threshold.

Generally speaking, the capital threshold of ETFs is between individual stocks and over-the-counter funds. Buying a lot (100 shares) may only cost more than 100 yuan, and the lower one is even less than 100 yuan, which is much lower than the threshold of individual stocks.

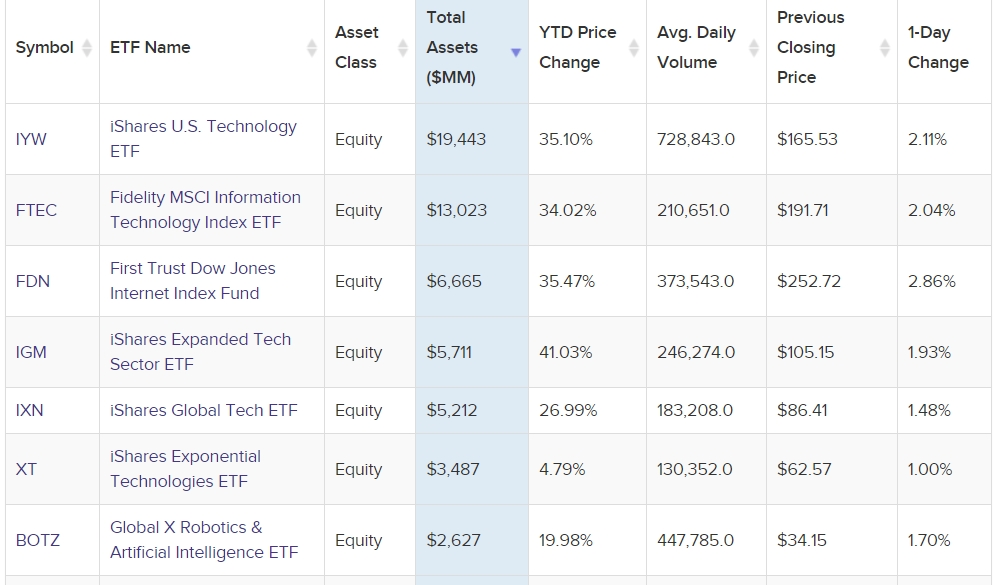

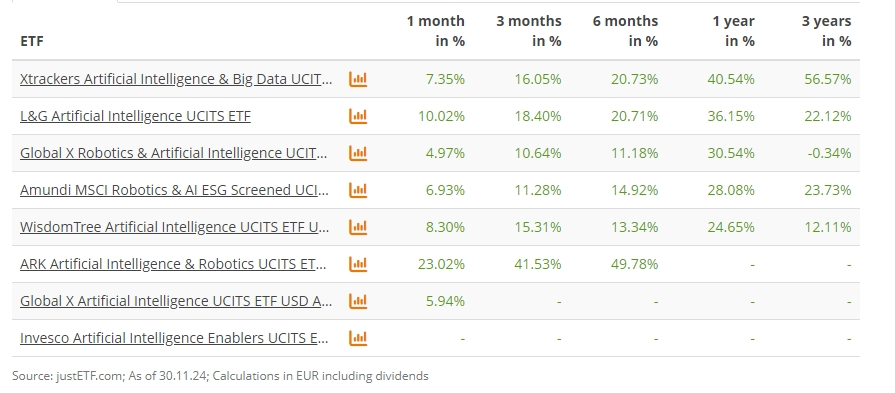

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

Moreover, ETFs have a rich selection of individual stocks.For investors unfamiliar with individual stock analysis, ETFs provide a simple way to invest without having to delve into each company.

There is also no risk of trading or delisting in ETFs.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.

With low thresholds, transparent transactions, rich options, no thunder, and support on-site trading, ETFs are the best choice for ordinary investors or novice investors to participate in the artificial intelligence market.