TSMC's Q2 Financial Report Shows Strong Performance, Robust Demand Heralds a "Chip Spring"

"He who has Nvidia, conquers the world" has become an unspoken truth in the semiconductor industry.

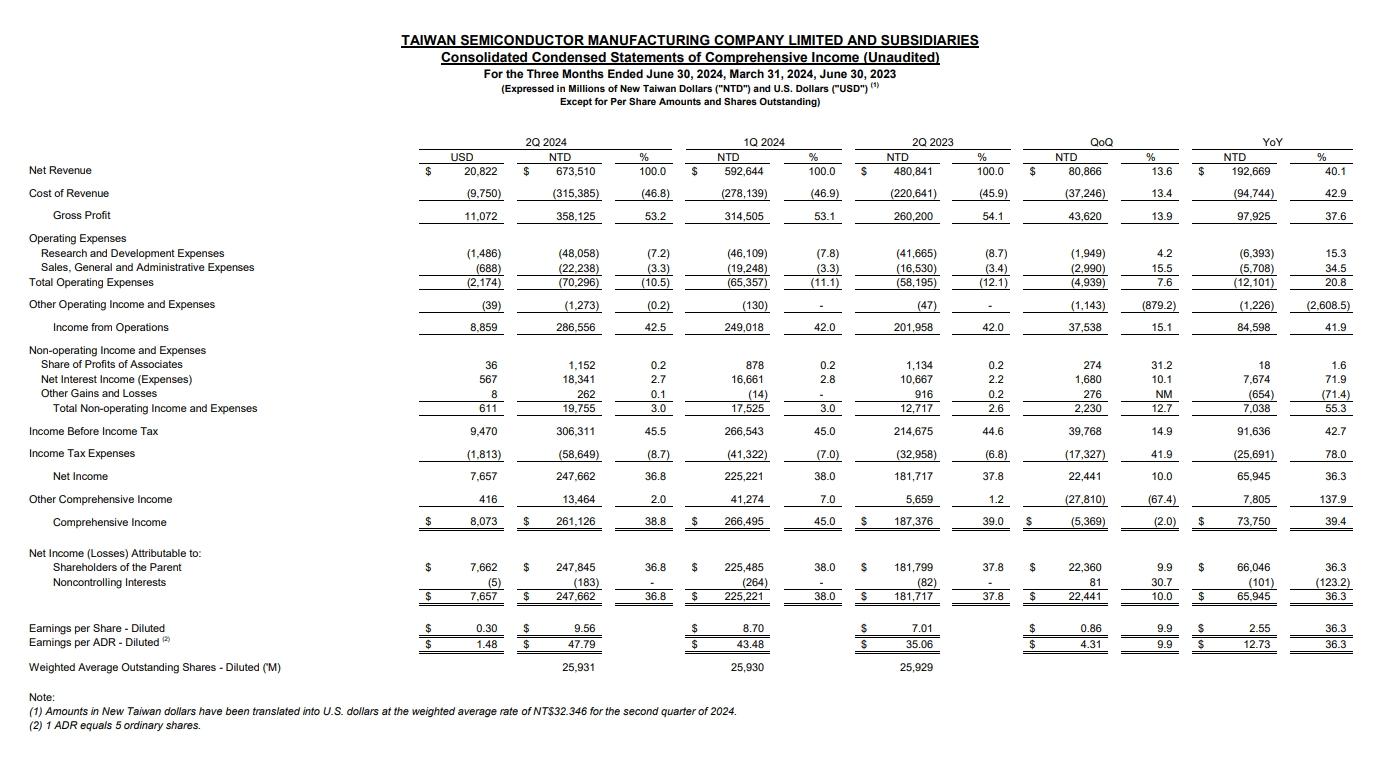

On July 18, global chip manufacturing giant TSMC announced its Q2 2024 financial report. During the reporting period, TSMC’s main financial metrics showed outstanding performance. Net revenue reached NT$673.51 billion, a year-on-year increase of 40.1%. Net profit was NT$247.85 billion, exceeding the market expectation of NT$235 billion and showing a year-on-year growth of 36.3%. Operating profit reached NT$286.56 billion, estimated at NT$274 billion, representing a year-on-year growth of 42%. The gross profit margin was 53.2%, an increase of 0.1 percentage points from the previous quarter, with an expectation of 52.6%, and the first quarter forecast was between 51% and 53%.

In terms of shipments, the 5nm process accounted for the largest share, representing about 35% of the total wafer sales for the quarter. The 7nm process shipments accounted for about 17%, and the most advanced 3nm shipments accounted for only 15% of the total wafer sales. Overall, revenue from TSMC's advanced processes (including 7nm and more advanced processes) accounted for 67% of the total wafer sales for the quarter, up from 65% in the previous quarter. The 3nm and 5nm processes combined contributed to half of TSMC's Q2 revenue.

TSMC Senior Vice President and Chief Financial Officer Wendell Huang stated, "In the second quarter, the strong growth of our business benefited from robust demand for our 3nm and 5nm technologies, but the ongoing seasonal factors for mobile phones partially offset this growth. As we move into the third quarter of 2024, we expect strong demand for advanced process products from mobile phones and AI-related products to support our performance."

From a business perspective, HPC (high-performance computing) has now firmly replaced mobile business as the core performance driver for TSMC. In the second quarter, HPC revenue increased by 28% quarter-on-quarter, followed by DCE business, which includes digital consumer electronics such as T-Con, PMIC, and WiFi chips, aimed at applications like set-top boxes and smart TVs. This business saw a quarter-on-quarter revenue increase of 20%.

Analysts say the cyclical recovery of PCs and the strong momentum of AI development have driven chip sales growth. Additionally, the global smartphone market experienced a revival in the first quarter, bringing many new orders from companies like AMD, Apple, and Broadcom (AVGO) to TSMC, contributing to its better-than-expected performance in the second quarter.

TSMC's "chip spring" owes much to the strong demand from Nvidia. As the underlying computational power support for artificial intelligence, Nvidia's chips have been in short supply for over two years, with the saying "those who have Nvidia, conquer the world" becoming an unspoken truth in the semiconductor industry. On July 15, TSMC and Nvidia reached an agreement, with the latter increasing its chip orders to TSMC by 25% to start producing its latest Blackwell platform GPUs.

Nvidia has stated that the Blackwell architecture GPU is equipped with 208 billion transistors, manufactured using TSMC's 4nm process. Currently, major international companies such as Amazon, Dell, Google, Meta, and Microsoft plan to integrate Nvidia's Blackwell architecture GPUs to build AI servers. Unsurprisingly, Blackwell is expected to become another highly sought-after AI chip.

Reports suggest that following the agreement to increase production, TSMC may significantly raise the price of chips supplied to Nvidia, considering the ongoing demand and supply constraints. Given the open attitude of other AI companies, Nvidia is also expected to accept TSMC's price increase. Analysts believe that by selling more expensive chips, TSMC can significantly improve its profit margins in the coming quarters.

For the third quarter, TSMC continues to provide positive performance guidance. Chairman and President Mark Liu stated that TSMC has raised its 2024 revenue growth guidance in USD to over 20%. The company expects third-quarter revenue to be between $22.4 billion and $23.2 billion, with a gross margin of 53.5% to 55.5%, compared to the market estimate of 52.5%. The operating profit margin is expected to be between 42.5% and 44.5%.

Liu also stated that TSMC's capital expenditure for 2024 will be between $30 billion and $32 billion. The previous guidance for capital expenditure was $28 billion to $32 billion, with a market estimate of $29.55 billion. Additionally, more resources will continue to be directed towards the production capacity of advanced processes and AI-related products in high demand.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.