Driven by Strong Data Centre Business, AMD Q2 Surpasses Expectations

AMD released its second-quarter 2024 earnings report, in which net profit surged 881% year-on-year and data center revenue doubled, becoming the focus of the market.

On July 30, AMD released its second quarter of 2024 earnings report. The data showed significant performance growth for the company, with both revenue and net profit far exceeding market expectations, leading to a substantial rise in the stock price during after-hours trading.

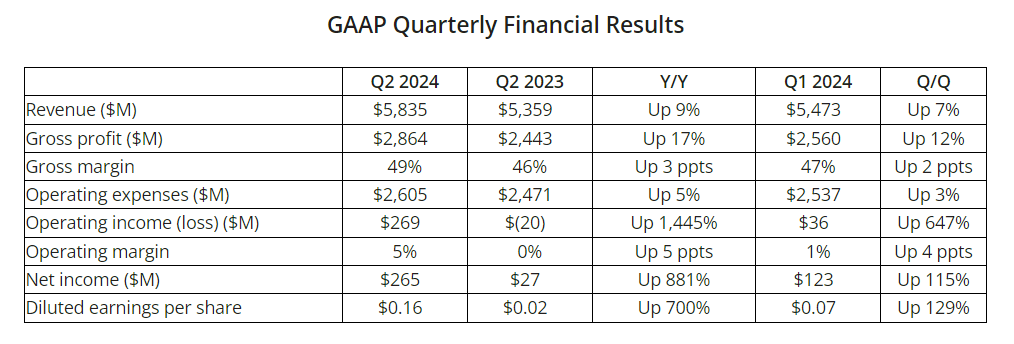

According to the financial report, AMD's total revenue for the second quarter reached $5.835 billion, a 9% year-on-year increase and a 7% quarter-on-quarter increase. Net profit recorded $265 million, an 881% year-on-year surge and a 115% quarter-on-quarter increase. The gross margin was 49%, and earnings per share were $0.16, up 700% year-on-year and 129% quarter-on-quarter. Notably, the data center business showed remarkable growth, doubling within a year and significantly boosting investor confidence.

For the ongoing third quarter, AMD holds an optimistic outlook, forecasting revenue to reach $6.7 billion, with a possible variance of about $300 million, and expected double-digit year-on-year and quarter-on-quarter growth. The adjusted gross margin is projected to be around 53.5%. Overnight, AMD's stock price surged nearly 8% in after-hours trading, though it has declined by about 6% year-to-date.

Segment Business Data

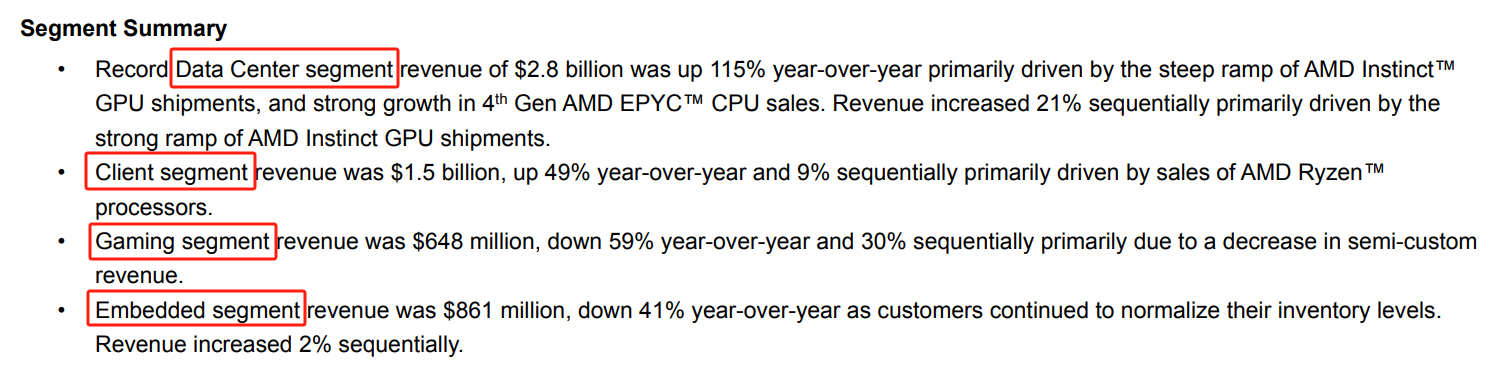

The data center division was the main driver of quarterly performance growth, with revenue reaching a record high of $2.8 billion, a 115% year-on-year increase and a 21% quarter-on-quarter increase, alongside a significant rise in operating profit. Remarkably, this division's revenue has set new records for two consecutive quarters, with an 80% year-on-year increase last quarter.

However, AI products and services are not the only focus for AMD. Its client business division, with revenue of $1.5 billion, saw year-on-year and quarter-on-quarter growth of 49% and 9%, respectively. This division, which includes PC chip sales, remains a crucial part of AMD's operations. The growth was primarily driven by the sales of AMD Ryzen™ processors (up 49% year-on-year), and Radeon 6000 GPU sales also saw a year-on-year increase.

In contrast, net revenue for the gaming and embedded business divisions declined. The gaming division, affected by reduced semi-custom income, saw a 59% year-on-year decline in revenue to $648 million. The embedded division, impacted by customers' ongoing inventory adjustments, experienced a 41% year-on-year revenue decline to $861 million. Nonetheless, both divisions maintained a certain level of operating profit.

Robust AI Chip Sales

Analysts attribute the strong quarterly performance mainly to AMD's competitive AI chips. Like its competitor NVIDIA, AMD is leveraging the current AI boom to drive sales of its data center GPUs and CPUs.

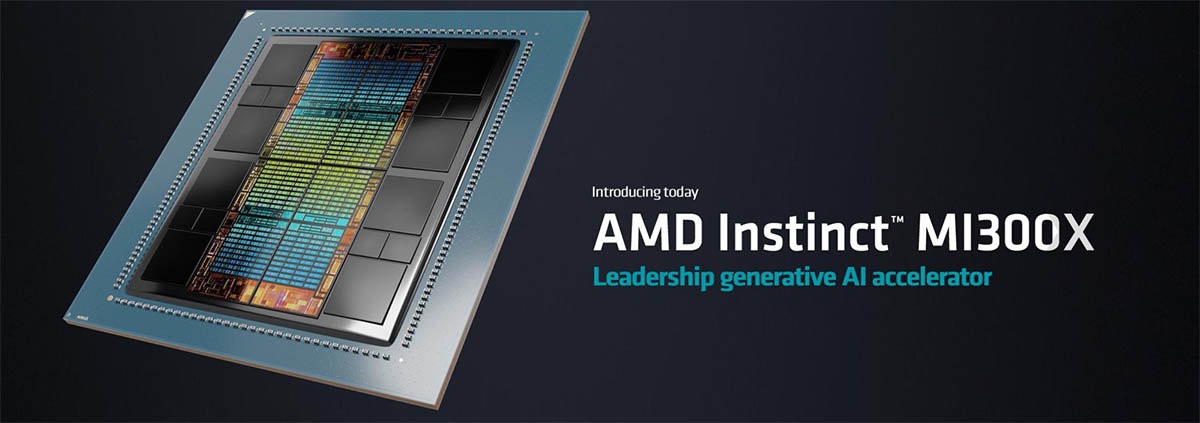

The highlight of this earnings report is that nearly half of AMD's sales came from data center products, particularly the MI300 chips. The MI300X, AMD's most advanced GPU chip, was showcased at COMPUTEX 2024 in June, with companies like Microsoft, Meta, Dell, HPE, and Lenovo already adopting this series of chips.

AMD CEO Lisa Su stated during the conference call that the sales of the company's AI chips were "above expectations." The flagship AMD MI300, competing with NVIDIA's H100, achieved over $1 billion in sales within a single quarter, significantly boosting the data center division's revenue. She anticipates that AMD's data center GPU revenue will exceed $4.5 billion for the full year 2024, higher than the previous April forecast of $4 billion.

Furthermore, Su revealed AMD's future product iteration roadmap, indicating plans to release new AI chips annually: the MI325X in Q4 this year, the MI350 in 2025, and the MI400 in 2026, to maintain market competitiveness. She also mentioned that the MI350 would be "very competitive" compared to NVIDIA's Blackwell.

However, regarding supply chain constraints, Su noted that although the situation has improved, supply tightness will persist until 2025.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.