Stop it! Google and Broadcom, in fact, who can not do without who.

Google's "incentive method" has played a role, successfully resolved the chip pricing crisis。

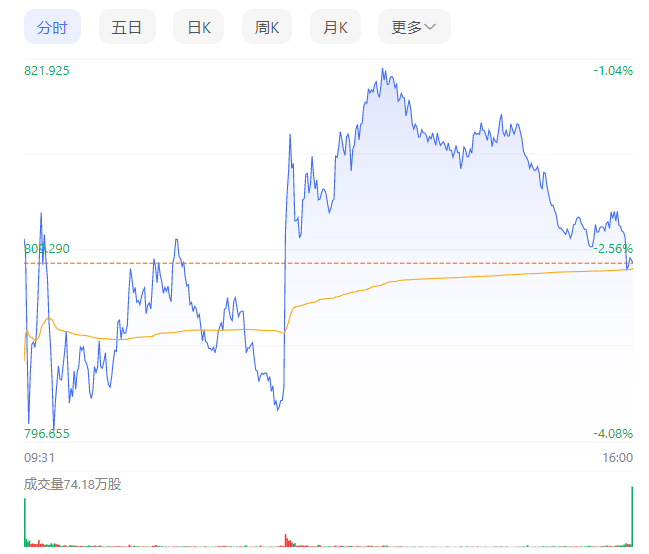

On September 21, local time, affected by Google's "break-up rumors," chipmaker Broadcom's shares fell, falling more than 4% during the session.。Partial losses followed, closing down 2.67% at 808.36美元。The reason why Broadcom was able to narrow its decline in the second half was because Google released the news that "the relationship between the two remains unchanged," boosting market sentiment.。

Google andBroadcom's "break-up" rumors

Earlier media reports said Google was considering abandoning its partnership with Broadcom as early as 2027.。

Broadcom has long been a stable supplier of Google's AI chips。However, it seems that the honeymoon between Google and Broadcom is coming to an end: Google executives have had extensive discussions about abandoning Broadcom's supplier status, while Google is exploring the possibility of designing its own related chips (tensor processing units).。

The main reason Google is doing this is to reduce costs.。

Google has been ramping up chip investment this year to catch up with Microsoft, hoping to gain a strong position in the booming AI application market.。But because AI development is particularly expensive compared to other types of R & D。

As one of the first Internet companies to enter artificial intelligence, Google has spent a lot of money in the field, and the heavy R & D costs are gradually becoming a burden on Google, which is why Google wants to find another way out.。According to media reports, if Google can switch to self-research in the manufacturing process of artificial intelligence chips, it can help it save billions of dollars in costs every year.。

In addition to cost reasons, the relationship between Google and Broadcom has not been very good since this year.。

According to the news, due to the global chip shortage last year, Broadcom raised the price of network interface chips by 30%, causing dissatisfaction from Google, and the two companies have been locked in a months-long stalemate over the pricing of Broadcom's TPU chips.。Finally, earlier this year, Google executives set the goal of abandoning Broadcom, unwilling to be "stuck" by outside vendors.。

The news also said that as a stopgap measure, Google has launched a partnership with Marvell Technology, another chip supplier, hoping to transfer the supply of network interface chips to the company.。Not only that, according to Google and Marvell's plan, the two will launch a new network interface chip by next year, internally codenamed Granite Redux。If the news is true, it will seriously shake Broadcom's position in Google's supply chain。

For this news, the market believes that it may be Google in the price negotiation process of the use of "incitement"。In a note to clients, Jordan Klein, Mizuho Securities' managing director for trading in the technology, media and telecommunications sectors, said the news story looks like a negotiating tactic by Google to expose Broadcom to indirect threats to win better pricing.。

As the market expected, when Google threw out rumors of cooperation with Marvell Technology, Broadcom, which felt the crisis, quickly made up with Google:This Thursday,A Google spokesperson told the media publicly that there has been no change in the company's relationship with Broadcom.。

Google also said: "In the long run, we have a fruitful cooperation with Broadcom and a number of other suppliers."。Our work to meet internal and external cloud needs has benefited from our collaboration with Broadcom; they have been excellent partners and we feel our engagement has not changed。"

It seems that Google's "provocation" has played a role in successfully resolving the chip pricing crisis.。

Google wants to "shake off" Broadcom?It's not that easy!

In any case, the cooperation between Google and Broadcom continues, which is good for both sides。

From Google's point of view, it's never easy to get your hands on your own chips in the short term, and it's more likely to disrupt the entire product chip supply chain。In addition, Nvidia, although a dominant player in the chip industry, is unable to meet the unusually strong market demand, and sometimes Google has to turn its attention to other chip suppliers, such as Broadcom.。

Evercore ISI analyst Matthew Prisco also corroborated this view in a note to clients.。Prisco said it would not be easy for Google to move from Broadcom's AI chips to in-house design because "there is meaningful collaboration and use [of Broadcom's intellectual property] in these designs, so any shift [from Google] at this point in time would have to involve considerable effort."。"

From Broadcom's point of view, in today's fierce competition in the chip industry, it is very important to retain Google as a big customer.。Broadcom needs to continue to expand its chain of high-quality customers and enrich its open source channels in order to expect to be able to break hands with Nvidia in the future。

In May, JPMorgan analyst Harlan Sur estimated that Broadcom's revenue from Google could reach $3 billion this year.。It has also been reported that orders for Broadcom's TPU processor are accelerating, and Google is the largest of its orders, with orders approaching $2 billion.。

Taken together, the partnership between Google and Broadcom is not just about chip buyers and sellers。Over the years, the relationship between the two has long been upgraded from trading to cooperation, the two sides in the chip research and development on the road to help each other, hand in hand to the peak, which is also an important reason why Google is difficult to "shake off" Broadcom。

It is understood that Google and Broadcom in a number of areas of artificial intelligence cooperation。For example, while Broadcom's fifth-generation TPU is currently being reused by Google, the two have begun to collaborate on future sixth-generation processors.。In addition, in the design of artificial intelligence chips, the two sides also have cooperation。

However, Google's desire to shift AI chips to self-research is understandable and inevitable.。

On the one hand, Google's other competitors such as Microsoft and Amazon are scrambling to develop custom chips to help the company save costs while also meeting specific workload requirements within the company.。

On the other hand, the surge in chip prices this year has also allowed Internet companies such as Google to see huge earnings prospects in the industry.。For example, driven by this year's AI boom, Nvidia's H100 price has skyrocketed, selling for almost twice its initial cost (about $20,000).。In today's rapid development of artificial intelligence, the demand for computing power in the future will only be even greater.。For Google and other technology companies, this is a very broad blue ocean - the sooner self-research, the sooner to make money, the sooner to enjoy。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.