AliCloud‘s Price-Cutting heats Cloud Computing up

AliCloud announced price reductions across the board in overseas markets, the average reduction is 23%, with a maximum reduction of 59%. After this, actual prices will be lower than any other international mainstream cloud vendors.

On April 8th, AliCloud announced a comprehensive price reduction in overseas markets, covering core cloud products deployed across 13 global regions and over 500 product specifications. The average reduction is 23%, with a maximum reduction of 59%. Following this price adjustment, AliCloud's overseas market cloud product prices are now lower than any other leading international cloud vendors.

It is reported that this price adjustment comes at a time when global demand for cloud computing is surging, and internal restructuring within the group is underway. Alibaba Group CEO Eddie Wu is attempting to rejuvenate Alibaba's entire business through the reform. Last November, against the backdrop of a shortage of high-end chip supplies and tense geopolitical situations, Alibaba announced the cancellation of its cloud business IPO plan. Since the large-scale price reductions in last April, AliCloud has introduced preferential policies multiple times.

In February this year, AliCloud announced "AI First" strategy in mainland China, adjusting prices for more than 100 products, with an average reduction of 20% and a maximum reduction of 55%. As part of the "AI First" strategy, this move aims to make it more convenient for customers of all scales to use core computing resources, thereby resisting competitors and attracting more AI software developers.

Is there any alternative?

Compared to the price reduction a month ago, this price adjustment mainly targets overseas markets, covering 13 regional nodes including Malaysia, Indonesia, Singapore, the Philippines, Japan, South Korea, Thailand, the United States (both East and West Coasts), Germany, the United Kingdom, the United Arab Emirates, and Hong Kong, China. It encompasses five core categories of public cloud products: computing, storage, networking, databases, and big data. The new prices take immediate effect and apply to new and existing customers who place orders through the AliCloud official website.

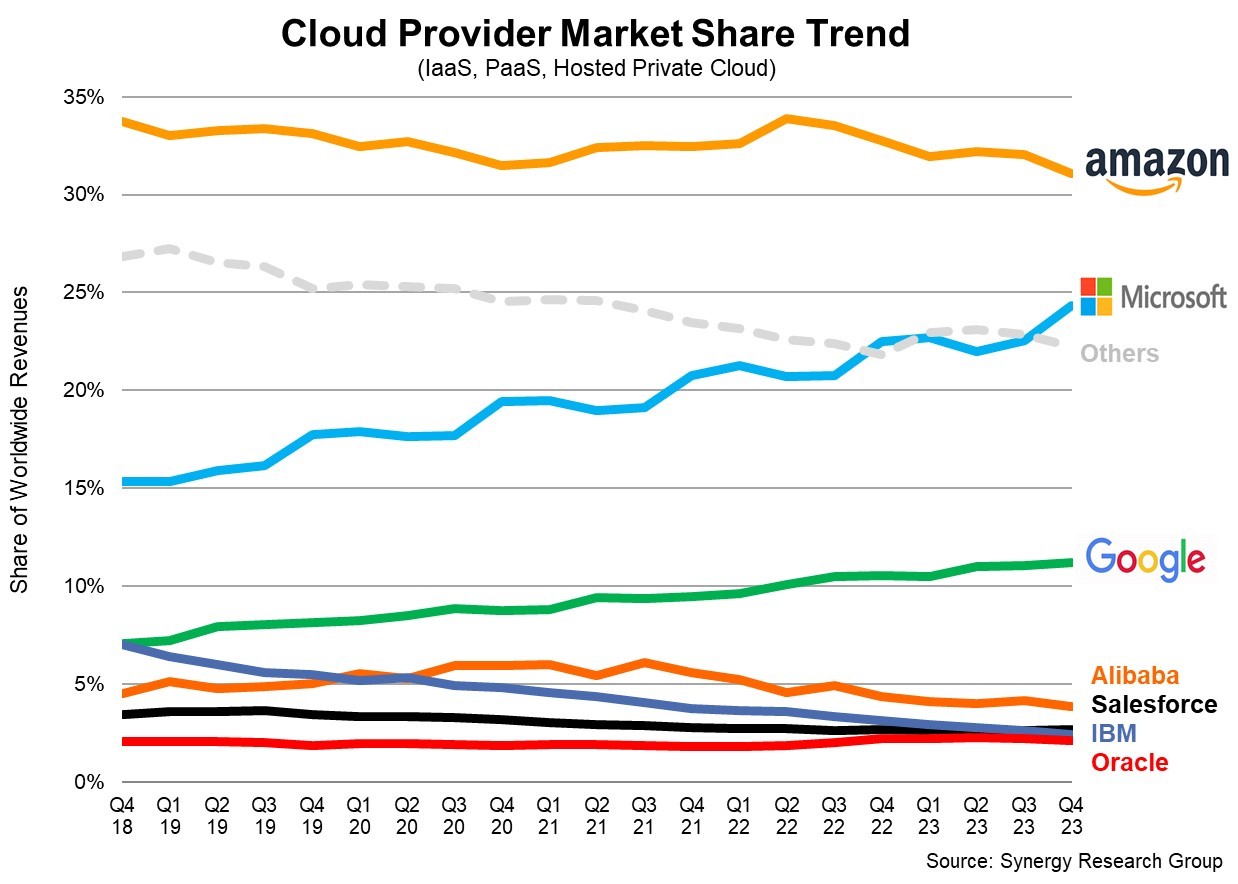

From the market perspective, AliCloud is currently the largest cloud provider in the Asia-Pacific region, including China, and the fourth largest globally, after Amazon, Microsoft, and Google, while its market share is far behind the top three. According to data from Synergy, in 2023Q4, Amazon still led the global cloud computing market (PaaS+IaaS) with a 31% share; Microsoft's share increased by 2 percentage points to 25% due to its collaboration with OpenAI; Google's share remained stable at around 11%. The combined market share of these three US companies reached 67%, while AliCloud had only 4%.

Moreover, in recent years, increasingly fierce market competition has led to a year-on-year decline in AliCloud's revenue growth rate, with each quarter of 2023 seeing either single-digit growth or negative growth. According to IDC data, in 2023Q3, AliCloud held a 26.7% share of China's public cloud market (IaaS+PaaS), ranking first in the market, but its market share decreased by 5.8 percentage points year-on-year, while the shares of Huawei Cloud, China Telecom Cloud, and China Mobile Cloud increased.

Meanwhile, thanks to the rapid development of AI technology, the cloud computing industry is also accelerating. Synergy data shows that in 2023Q4, global enterprise spending on cloud computing reached $73.7 billion, an increase of $5.6 billion compared to the previous quarter, marking the highest quarterly growth rate in history, with the cloud computing market size growing by 19% compared to 2022; the United States remains the world's largest cloud market, with a scale exceeding that of the entire Asia-Pacific region, with the market size growing by 16% in Q4.

From this, it seems that AliCloud's initiation of a "price war" is a strategic choice in line with the actual trend.

Ali Cloud stated that the world is at a crucial moment transitioning from traditional computing to AI computing, with the majority of AI computing activities being carried out on public cloud platforms. The business model of cloud computing encompasses both network effects and economies of scale. Appropriately passing on benefits can help expand user base, thereby reducing costs in three aspects: supply chain procurement, R&D cost sharing, and resource idle time.

It has been disclosed that this price reduction may raise the average cost-saving rate to 23%. On the other hand, price reductions can also help small and medium-sized enterprise developers overcome the barriers in the cloud domain and expand revenue in the future to compensate for income loss.

Yuan Qian, President of AliCloud Intelligence International Business, believes that cloud infrastructure is a crucial cornerstone for future AI. She stated, "AliCloud continues to reduce cloud computing costs by leveraging scale and technological dividends, actively promoting full-stack technological innovations from underlying computing power to AI platforms and model services, increasing investment in localized services and ecosystem development to support global developers and enterprises in seizing growth opportunities brought by AIGC."

Multiple enhancements enrich application scenarios

In addition to this price reduction, AliCloud has also introduced a series of new AI products and ecosystem incentive policies targeting overseas markets.

It is understood that the new products are mainly aimed at AI training, inference, and application development:

- PAI Lingjun Intelligent Computing Service: Provides international customers with a comprehensive engineering platform and intelligent computing power for AI development, featuring high performance, high throughput, low latency, etc., supporting 3.2Tbs of network bandwidth. Through distributed scheduling and compilation, it can achieve up to 96% linear acceleration on ultra-large-scale training, significantly improving the efficiency of training and inference for large models.

- LLM Hosting Service: The product covers various development stages such as data labeling, model training, version control, and performance monitoring, reducing costs by 70% compared to before, and more than doubling the speed of product market launch.

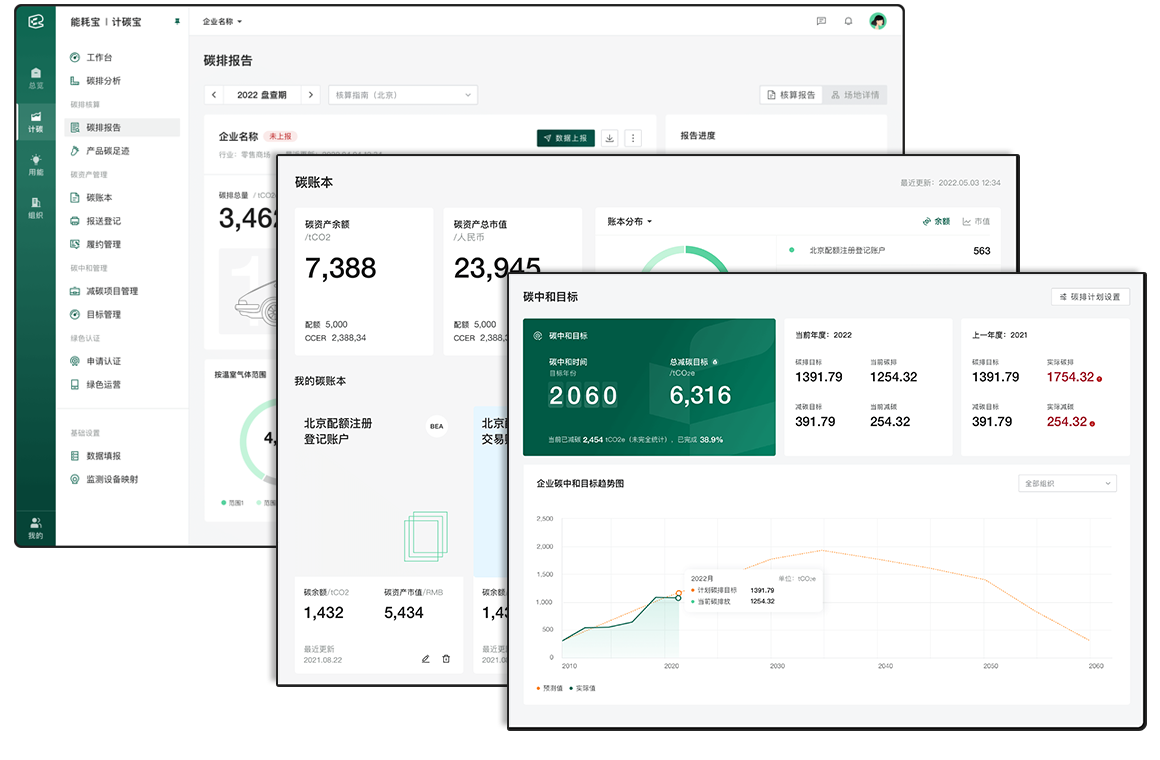

- Energy Treasure OpenAPI Service: Through carbon microservices and energy microservices, developers and ecosystem partners can create customized sustainable applications, flexibly calling Energy Treasure products for carbon footprint calculation, AI optimization of carbon emissions, energy consumption monitoring, prediction, and optimization capabilities. At the same time, it utilizes its knowledge base to strengthen the underlying AI model generation for more accurate results.

Regarding this price reduction, AliCloud has also launched service value-added activities. Under the condition of meeting the minimum purchase quantity, subscribing to one year of cloud services will entitle you to three months of TAM (Technical Account Manager) service for free, while subscribing to three years of cloud services will grant you one year of TAM service.

Overseas market matters

Last July, Tencent Cloud disclosed financial results, stating that it has over 10,000 partners globally; in 2023H1, revenue driven by overseas partners increased by 66% year-on-year. President Qiu Yuepeng believes, "There are still very significant opportunities in going overseas. Engaging in price wars overseas is not a good choice. Overseas customers value the cloud service provider's own products and technologies more."

In recent years, Huawei Cloud has also achieved rapid growth in its overseas business. Chen Liang, Vice President of Global Marketing and Sales Services at Huawei Cloud, announced at the "2023 China-Capital Overseas Africa · Huawei Cloud Summit" that Huawei Cloud's revenue in 2022 was 45.3 billion yuan. While maintaining high-speed growth domestically, it also achieved nearly double business growth in the entire overseas market.

According to the "2023 China Enterprises' Cloud Practices in Going Overseas Research Report" by iResearch Consulting, the overall market size of China's cloud going overseas reached 25.7 billion yuan in 2022, with a market growth rate of 42.8%. Looking at the landscape of the cloud going overseas market, cloud vendors with foreign backgrounds occupy the main share of the overseas market and have a dominant position in Europe and the United States; cloud vendors with Chinese backgrounds are accelerating their overseas layout, with rapid business growth and more influence in the Asia-Pacific region. From the perspective of supply, the overall growth rate of China's cloud market is tending to stabilize, and cloud vendors need to expand revenue sources through overseas markets.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.