XPeng Q2 Gross Margin Improves, Q3 Outlook Misses Expectations, Raising Market Concerns

Xpeng's gross margin for the second quarter was 14%, the fourth consecutive quarterly increase, compared to -3.9% in the same period last year and 12.9% in the first quarter of this year. The company attributed the gross margin improvement to the realization of technology cost reductions as well as technology realization revenues from the Volkswagen strategic partnership.

On August 20, Chinese electric car maker Xiaopeng Automobile released its second quarter 2024 financial results.

Losses Narrow, Gross Margin Improves for Fourth Consecutive Quarter

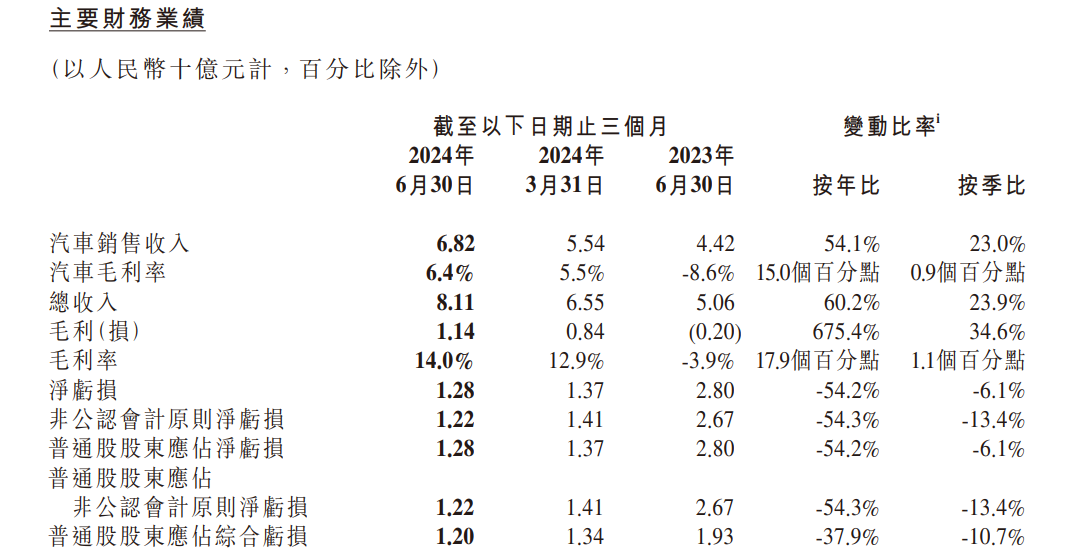

Earnings data showed that Xpeng Auto's total revenue for the second quarter was 8.11 billion yuan (RMB, same below), up 60.2% year-on-year and 23.9% sequentially. Revenue from auto sales was RMB6.82 billion, up 54.1% year-over-year and 23.0% sequentially. Revenue from services and other was $1.29 billion, up 102.5% year-over-year and 28.8% sequentially.

During the quarter, the company remained in the red, recording a net loss of $1.28 billion, which was narrower than both the $2.8 billion in the year-ago quarter and the $1.37 billion net loss in the previous quarter, and better than analysts' previous estimate of a loss of $1.44 billion. On a non-GAAP basis, the adjusted net loss was $1.22 billion, again down from $2.67 billion a year ago and $1.41 billion in the previous quarter.

Gross margin, which is most highly regarded by outsiders, recorded 14% in the second quarter, the fourth consecutive quarterly increase, and as a comparison, it was -3.9% in the same period last year and 12.9% in the first quarter of this year. In particular, automotive gross margin was 6.4%, compared to 8.6% in the same period last year and 5.5% in the first quarter of this year.

For the improvement in gross margin, Xpeng Auto attributed it to the realization of technology cost reduction and technology realization income from the VW strategic partnership.

In addition, He Xiaopeng, chairman and chief executive officer of Xpeng Auto, revealed that starting with the launch of the MONA M03 in August, the company will enter a strong product cycle, with a large number of all-new and facelifted models coming to market over the next three years.

The new product cycle is expected to further improve the company's financial position. xpeng Auto's Honorary Vice Chairman and Co-President Gu Hongdi said, “I expect our economies of scale, operating efficiencies, and cash flow to improve significantly with the sales growth in the global market driven by the big product cycle.”

In anticipation of the new product cycle, Xpeng has been investing more in developing new models and smart driving even though the company is still in the red. According to the earnings report, Xpeng spent 1.47 billion yuan on research and development in the second quarter of this year, an increase of 7.3 percent year-on-year and 8.6 percent sequentially. The company said the same- and year-over-year increases were mainly due to higher expenses related to new model development as a result of expanding its product portfolio to support future growth.

Cash and cash equivalents, restricted cash, short-term investments and time deposits amounted to RMB37.33 billion as of June 30, 2024, compared with RMB41.40 billion as of March 31, 2024, the company said.

Q3 Outlook Falls Short Of Expectations, Investment Banks Have Cut their Price Targets

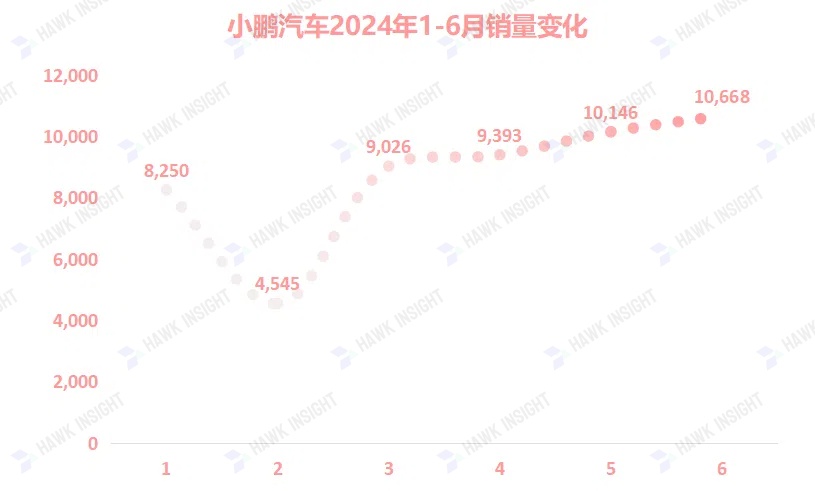

In the second quarter, Xiaopeng delivered 30,207 vehicles, up 30.2% from 23,205 in the same period in 2023. Cumulative sales for the first half of the year totaled 52,028 units, just under one-fifth of the annual target (280,000 units).

However, Xiaopeng's sales in overseas markets are steadily increasing. Overseas deliveries exceeded 10 percent in the second quarter, and the company expects overseas deliveries could exceed 15 percent in the third quarter.

For the outlook for the third quarter of 2024, Xiaopeng expects vehicle deliveries to be in the range of 41,000 to 45,000 units (i.e., a monthly average of between 13,700 and 15,000 units), an increase of about 2.5% to 12.5% year-on-year and higher than analysts' expectations of 40,000 units. Total revenue, on the other hand, is expected to be in the range of $9.1 billion to $9.8 billion, an increase of about 6.7% to 14.9% year-over-year, well below analysts' expectations of $10.6 billion.

The market doesn't seem very happy about the earnings report. Xiaopeng's U.S. stock was the first to react, closing at $6.77, down nearly 6%. The next day on Wednesday, Hong Kong stocks opened, Peng once fell more than 5%, after the decline has narrowed, as of press time, down 1.8%.

In addition to the decline in share price, a number of major banks have also lowered the target price of Xiaopeng. Bank of America Securities will Xiaopeng car's Hong Kong stock target price from 49.5 Hong Kong dollars to 39 Hong Kong dollars, Citi will target price from 32.2 Hong Kong dollars down to 29.8 Hong Kong dollars. BOCI lowered its target price to HK$46, saying that a return of investor confidence may require definitive information on new car orders and sales recovery momentum.

JPMorgan Chase cut its U.S. price target for Xiaopeng from $9 to $8, UBS lowered its U.S. price target slightly from $8.3 to $8.2, and Daiwa also cut its U.S. price target from $11 to $8.9.

Daiwa said Peng's first-half sales performance was relatively weak compared with its rivals, and in light of possible tariffs on its exports from the European Union and slower-than-expected new car deliveries, it cut its revenue forecast for this year and next year by 8% to 27%, and its sales forecasts by 22% and 38%, respectively.

MONA Pre-sale Orders Exceeded Last Year's G9 Performance At the Same Period.

In early August, Xpeng began pre-sales of M03, the first model of its second brand MONA, which is expected to be officially launched on August 27th.

As the first model of MONA series, M03 is positioned as an intelligent pure electric hatchback coupe, which will open up the 150,000-200,000 RMB mainstream market for Xpeng. It is understood that M03 will be the high end model will be equipped with intelligent driving system, means that the domestic models under 200,000 yuan will begin to appear the first echelon of intelligent driving technology.

He Xiaopeng revealed on the earnings call that up to now, the number of pre-sale orders for the M03 has exceeded the number of pre-sale orders for the G6 in the same period last year.

Mass deliveries will begin once MONA M03 is officially launched on August 27, he said. “Our supply chain partners are ready to work with us to support the rapid production of the MONA M03.” He Xiaopeng said, “We hope that the MONA M03 rapid production delivery speed will set a new record for Xpeng Auto.”

In addition to the MONA M03, Xpeng Auto will also launch its next generation sedan, the P7+, in the fourth quarter.

With a wheelbase of 3 meters and a length of more than 5 meters, the P7+ will focus on the family user market, according to the report. In addition, the P7+ will be the first model based on Xpeng Auto's new-generation ADAS hardware platform. he Xiaopeng said, “The P7+ not only exceeded our cost reduction targets in both ADAS-related hardware and vehicle overall quality, but also far surpassed the competitors in terms of technological innovation and cost advantages. ”

He Xiaopeng said on the call that he is confident that the company will significantly expand its market share as deliveries of the two new models continue to increase.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.