Li Auto Q2 Net Profit Halves, Li Xiang Calls HIMA The Strongest Competitor

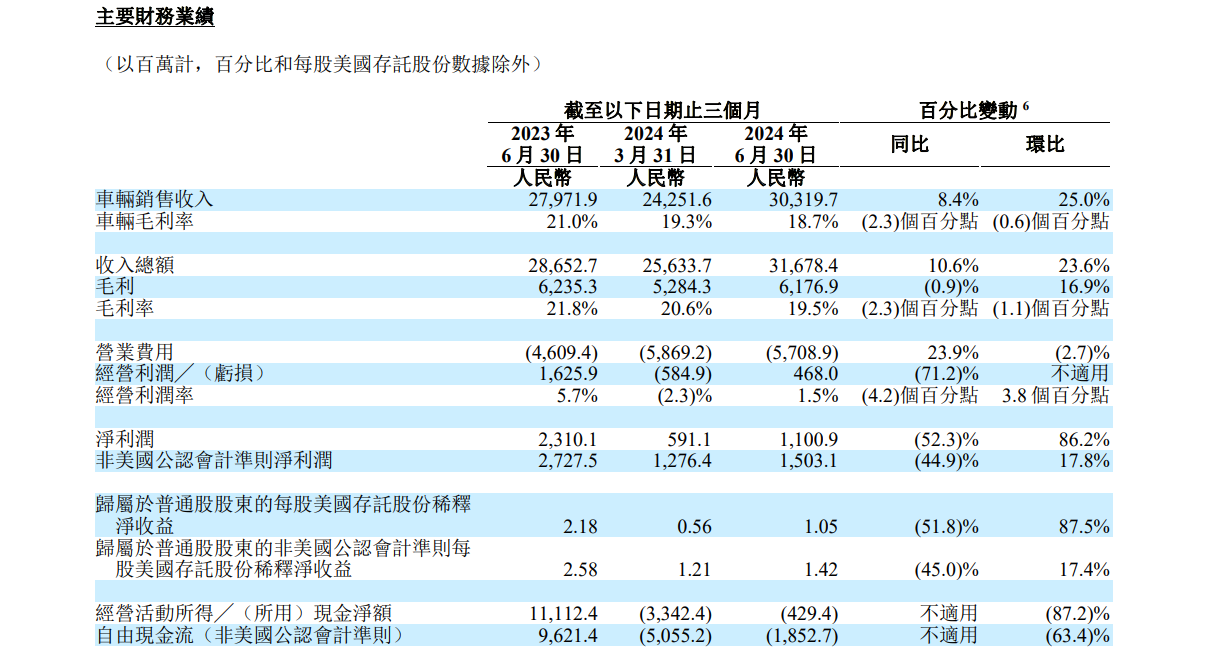

Li Auto's revenue reached 31.7 billion yuan in the second quarter, up 10.6 percent year-on-year, while net profit fell 52.3 percent to 1.1 billion yuan, a year-on-year slump. Meanwhile, gross margin was recorded at 19.5%, down from 21.8% a year earlier and 20.6% in the first quarter of this year.

On August 28, Li Auto announced its 2024 second quarter earnings report.

Li Auto's Q2 net profit slumps, auto gross margin slips

Li Auto's revenue reached 31.7 billion yuan (CNY, same below) in the second quarter, up 10.6 percent year-on-year and 16.9 percent sequentially, according to the earnings report. Of that, vehicle revenue was 30.3 billion yuan, up 8.4 percent year-on-year and 25 percent sequentially. The increase in revenue was driven by rising sales. In the second quarter, Li Auto's deliveries totaled 1,085,810,000 units, up 25.5% year-over-year.

On the earnings front, Li Auto's net profit for the second quarter was $1.1 billion, a 52.3% drop from the year-ago quarter, and a good performance from the year-ago quarter, up 86.2%. Adjusted net profit was $1.5 billion, down 44.9% year-on-year and up 17.8% sequentially.

Gross margin was recorded at 19.5%, down from 21.8% a year ago and 20.6% in the first quarter of this year. The margin for the auto business was 18.7%, again down from 21.0% in the same period last year and 19.3% in the first quarter of this year. Li Auto's automotive gross margin has been below 20% for the first two quarters of the year.

The main reason why Li Auto has seen its revenue grow while its earnings have twisted and fallen is because the company's car sales have seen a rise in the share of lower-priced models.

On April 24 of this year, the new Li L6 went on sale, priced from $249,800, Li Auto's first product priced at $300,000 or less. The car was a hit as soon as it was launched, and by the end of June, sales of the car exceeded 35,000 units. In June, for example, the Li Auto's deliveries for the month amounted to 47,774 units, of which more than 20,000 units were delivered of the Li L6, which almost supported half of the Li Auto's delivery figures for the month. Under these circumstances, it makes sense that Li's auto gross margin would decline.

However, even if Li Auto's gross margin declined, it was still the best among the new-energy carmakers. For comparison, NIO's auto gross margin was 9.2 percent in the first quarter, and Xpeng's was 6.4 percent in the second quarter.

CFO Li Tie said on a conference call that the company gave guidance for vehicle gross margins to be around 18 percent last quarter, and ultimately achieved a vehicle gross margin of 18.7 percent. The reason behind this achievement is not only because of the company's efforts, but also thanks to its product portfolio. Meanwhile, Li Tie also said it expects vehicle gross margins to pick up in the third quarter, probably around 19 percent, and the company's total gross margins to be in the mid to upper 20 percent range.

Li Auto continues to invest highly in research and development even as its net profit slumps. Li Auto spent $3 billion on R&D in the second quarter, up 24.8% year-over-year and down 0.7% sequentially.

In terms of capital position, as of June 30, 2024, Li Auto's cash position stood at ₹97.3 billion. In the second quarter, Li Auto's free cash flow was -$1.9 billion, compared to $9.6 billion in the same period last year and -$5.1 billion in the first quarter of this year.

Although it recorded negative free cash flow in the first two quarters of the year, Li Tie said the company has achieved positive free cash flow in June and July this year. Li Tie said the company is confident of maintaining positive free cash flow from the third quarter onwards as it optimizes its capital expenditure and improves operational efficiency.

Li Auto expects to deliver more than 500,000 units this year

Looking ahead to the third quarter, Li Auto expects vehicle deliveries in the third quarter of 2024 to be approximately 145,000 to 155,000 units (or a monthly average of 48,300-51,700 units), representing year-on-year growth of approximately 38.0% to 47.5%. Total revenue will reach 39.4 billion yuan to 42.2 billion yuan, a year-on-year increase of about 13.7% to 21.6%.

Senior Vice President Zou Liangjun believes that the company's recent strong sales performance is largely due to the competitive advantages of its products, including strong product power, adaptability, and the ability to respond quickly to market demand.

To boost sales, Li Auto has also invested more in marketing. In the second quarter, Li Auto's selling and administrative expenses recorded a 22 percent year-on-year increase to 2.8 billion yuan, according to the financial report.

Zou Liangjun said that in addition to traditional sales channels, Li Auto also increased its investment in marketing resources for online platforms such as Jitterbug in the second quarter of this year, and achieved significant results, bringing in a large number of potential users. At the same time, the company is also reforming its sales channels, allowing different regions to customize their sales strategies, thus enhancing the sales potential of different regions.

Zou Liangjun also shared Li Auto's current market share data. He said Li Auto's market share in the NEV (new energy vehicle) market of RMB 200,000 and above rose from 13.6 percent in the first quarter to 14.4 percent in the second quarter. “We aim to further increase our market share in this segment to around 16 percent in the last quarter of 2024.”

For its part, Li Auto said the company is confident that it will deliver more than 500,000 units for the full year amid a healthy passenger car market in the second half of the year. In March this year, Li Auto officially lowered its full-year sales guidance to 560,000 to 640,000 units from the original 800,000 units due to the unfavorable launch of the MEGA model.

Li Xiang: HIMA is the strongest competitor

Asked during a conference call how he sees the long-term competition between Huawei and Li Auto, Li Auto's Chairman and CEO Li Xiang said, “I think HIMA (Harmony Intelligent Mobility Alliance) is our strongest competitor in the market, and I think we will coexist in a healthy way for a long time.”

Li Xiang says the company's core attitude is to learn from Huawei's technology research and development system and business management system on a long-term, ongoing basis. “It's so important for us as a startup to have such a learning example.”

Since April of this year, Li Auto has repeatedly overtaken AITO, the brand Huawei has partnered with Ceres and which is currently the mainstay of HIMA's sales, to take the No. 1 spot in the new energy category.

Since its introduction, AITO's performance has been very impressive, has repeatedly exceeded Li Auto, asked the first new car-making forces. However, in April this year, affected by the AITOM7 Plus Shanxi Yuncheng accident, AITO's sales growth slowed down and began to lag behind Li Auto.

It is worth noting that on August 26, HIMA held a new product conference to announce the launch of AITO's new M7 Pro, priced from 249,800 yuan, which is the same price as the Li L6.

In addition to AITO, HIMA's model lineup also includes Luxeed, a collaboration between Huawei and Chery, and STELATO, a collaboration between Huawei and Baic Bluepark New Energy, which are similarly positioned to Li Auto in that they both focus on the mid-to-high end of the market, with pricing that spans 200,000 to 500,000 RMB, making them formidable rivals to Li Auto. Both Smart and Enjoy have new models scheduled to go on sale later this year to early next year.

In March this year, Li Auto's new car, MEGA, was launched unfavorably and failed to have the effect of boosting the company's sales. For the company's recent lack of new models to drive sales, Zou Liangjun said, “New models are only one of the reasons to drive sales growth. And in my opinion, efficient marketing operations is another way to drive sales growth, which is what we are currently promoting.”

As for the launch of new models, this may have to wait until the first half of next year, revealed Li Auto's president Ma Donghui, who said that the company will launch a number of 800-volt, high-voltage, all-electric models next year. He said, “Our external suppliers, partners, capacity planning and development progress are all progressing well according to plan. We are confident that we will ensure that the pure electric models will be delivered as planned.”

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.