Q2 Profit Margins Hit Record High, JD-Related Stocks Surge

According to the earnings report, Jingdong's gross margin in the second quarter surged 137 basis points year-on-year to 15.8 percent, the highest level on record, recording year-on-year improvement for nine consecutive quarters.

On the evening of August 15, Chinese e-commerce giant Jingdong Group released its financial results for the second quarter of 2024, which ended on June 30, with an overall bright performance.

Product revenue flat year-on-year, service revenue shines

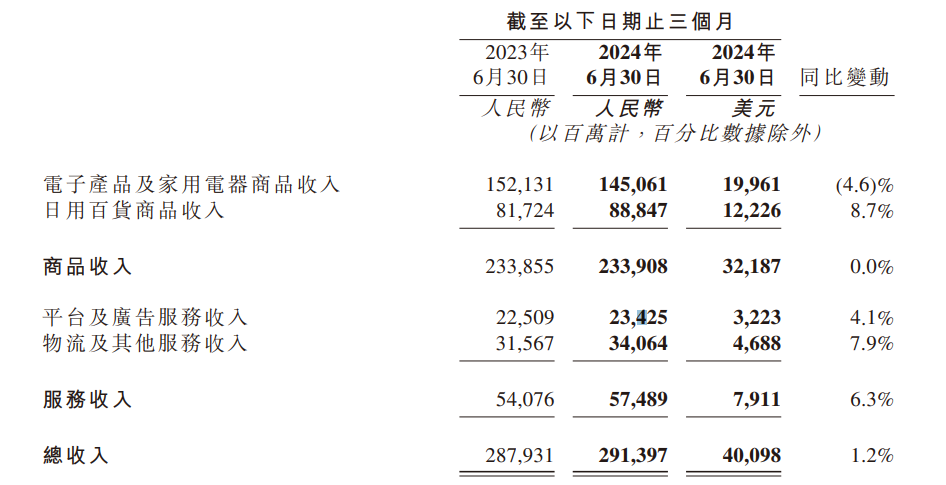

Jingdong realized net revenue of 291.4 billion yuan (RMB, same below) in the second quarter, up 1.2% year-on-year. Jingdong's revenue can be simply categorized into two parts, namely product revenue and service revenue.

● Net product revenue was flat year-over-year at 233.908 billion yuan.

The year-on-year flattening was mainly due to the “drag” on revenue from electronics and household appliances, which fell 4.6 percent year-on-year to 145.061 billion yuan in the second quarter. For this category's revenue decline, Jingdong gave reasons including seasonal factors, promotional activities and some home appliances last year's sales base is higher.

It is worth mentioning that at the end of July this year, the National Development and Reform Commission has issued a support policy in the area of trade-in, and home appliances are a key area of support measures. Xu Ran, CEO of Jingdong Group, said that the release of this new policy is expected to effectively promote the growth of home appliance sales. For Jingdong, it will provide some incremental growth, and the share of sales on the Jingdong platform for trade-ins is expected to increase in the near future.

Daily-use goods revenue amounted to RMB 88.847 billion, an increase of 8.7% year-on-year, the highest increase in the past two years. The supermarket category, in particular, saw double-digit year-on-year revenue growth for the second consecutive quarter. Jingdong's chief financial officer, Shan Rui, said in a post-earnings call that he believes the momentum will continue this year.

● Net service revenues fared a bit better, up 6.3% year-on-year to RMB57.489 billion.

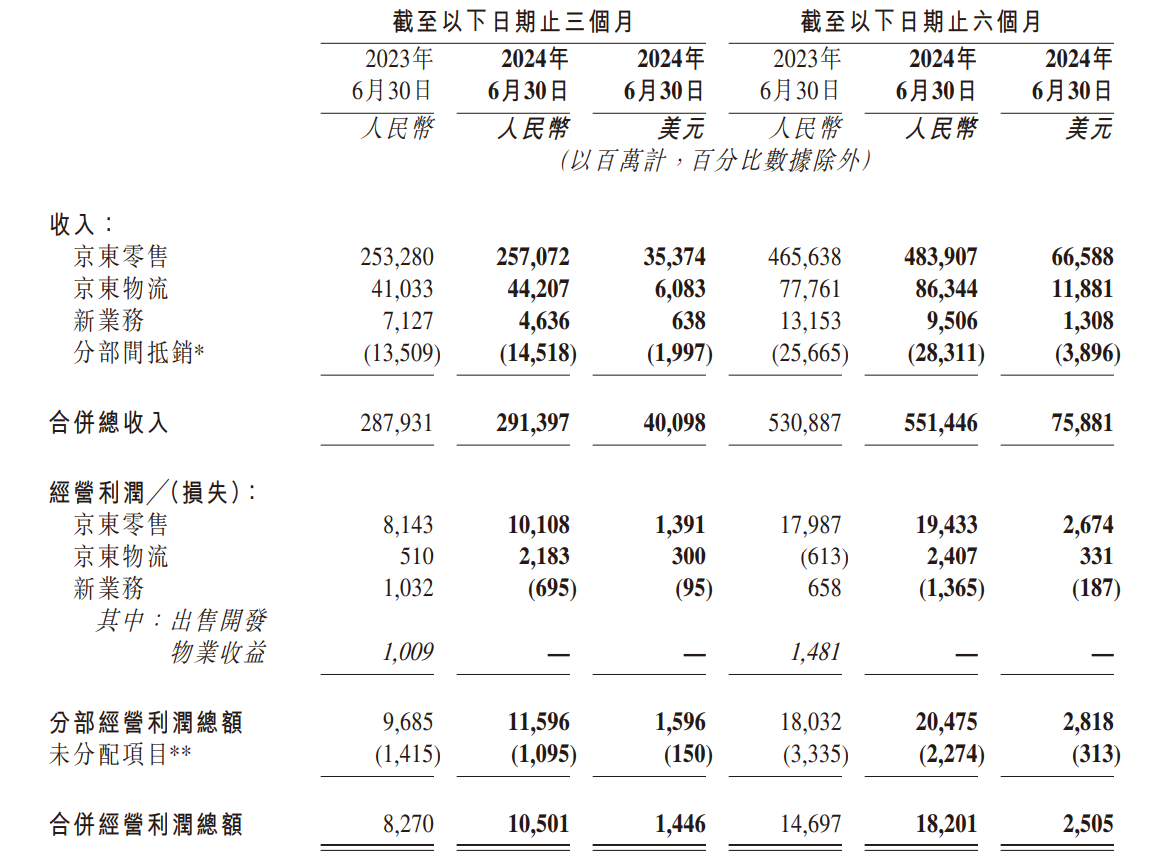

In the second quarter, logistics and other services revenue reached RMB 34.064 billion, up 7.9% year-on-year. It's worth noting that in the second quarter, Jingdong Logistics' revenue was RMB 44.2 billion, up 7.7% year-on-year; operating profit was RMB 2.183 billion, compared with RMB 510 million in the same period last year, with an operating margin of 4.9%, significantly higher than the 1.2% in the same period last year. As of the second quarter, Jingdong Logistics segment operating profit under non-GAAP has been profitable for five consecutive quarters, and the operating profit margin is also a record high since the listing of Jingdong Logistics.

Revenue from platform and advertising services rose 4.1 percent year-on-year to 23.425 billion yuan. Shan said the company's advertising revenue grew solidly year-on-year in the second quarter, growing faster than GMV as Jingdong further optimized the efficiency of its traffic allocation.Notably, Jingdong Retail's advertising revenue rebounded to double-digit year-on-year growth in the second quarter. “As we continue to drive user growth and improve user efficiency, we see significant room for advertising revenue growth.”

If we look not simply at the dimension of “goods and services” but at Jingdong's various business units, we will find that both Jingdong Logistics and Jingdong Retail performed well in the second quarter, but the loss situation of the new business has not improved.

Jingdong Retail revenue in the second quarter was 257.072 billion yuan, up 1.5 percent year-on-year. Jingdong Logistics revenue was 44.207 billion yuan, up 7.7 percent year-on-year. New business revenue was 4.630 billion yuan, down 35% year-on-year, further widening from the 16.6% loss in the previous quarter. Inter-segment offsets were $14.518 billion, compared to $13.509 billion in the same period last year.

For the continued loss in new business revenue, Jingdong explained that it was mainly due to increased losses in the Jingxi business and other businesses. The new businesses mainly include Dada, Jingdong Production and Development, Jingxi and overseas businesses.

Profit growth beats revenue, gross margins hit record highs

Jingdong's earnings performance in the second quarter was quite good.

According to the earnings report, net profit attributable to common shareholders for the second quarter was 14.5 billion yuan, a 69% jump year-over-year. The net profit margin was 5.0% for the first time ever, compared to 3.0% in the same period last year.

Meanwhile, Jingdong's gross margin in the second quarter surged 137 basis points year-on-year to 15.8%, its highest level ever, recording year-on-year improvement for the ninth consecutive quarter, with improvements in almost every product category and segment.

For the margin improvement, Jingdong attributed it mainly to improved supply chain efficiency.

Xu Ran said on the call that due to Jingdong's focus on price competitiveness, the company's gross margins have been trending up year-over-year each quarter for the past two years. That underscores Jingdong's improving supply chain capabilities, which enable it to continue to benefit from scale and efficiency.

There is still plenty of room for Jingdong's margins to rise in the long run, and Jingdong's margins will continue to improve with the healthy development of its business and improved operational efficiency, Shan said. He believes that Jingdong's long-term profit margins could reach high single-digit levels.

Looking ahead to the full year, we aim to achieve a growth rate higher than that of overall market retail sales of consumer goods,” Shan said. As we continue to make disciplined investments in user experience and market share expansion, we expect Jingdong Group's profits and margins to grow year-on-year.”

Jingdong-related stocks are stronger across the board

Good revenue and strong profitability have made the company's cash flow more robust.

By the end of the second quarter, Jingdong's 12-month free cash flow amounted to 56 billion yuan, compared with 33 billion yuan in the same period last year, a significant increase. Jingdong said the year-on-year increase in free cash flow was mainly driven by seasonal factors, strong profits and moderate capital expenditures.

As of June 30, 2024, Jingdong held cash, cash equivalents, restricted cash and short-term investments totaling 209.5 billion yuan, compared with 197.7 billion yuan at the end of last year.

In terms of share repurchases, during the second quarter, Jingdong repurchased a total of 137 million Class A common shares, equivalent to 68 million ADSs, or 4.5% of the common shares outstanding as of March 31, 2024. In the first half of the year, Jingdong repurchased a total of 7.1% of its outstanding ordinary shares as of the end of 2023. Jingdong said the progress reflects the company's commitment to creating value for shareholders.

All Jingdong-related stocks in Hong Kong on Friday (Aug. 16) strengthened on the back of the strong earnings report. Among them, Jingdong Group rose 6%, Jingdong Logistics rose more than 22%, Jingdong Health rose nearly 8%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.