JD's Q1 revenue and net profit exceeded expectations, logistics department turned losses into profits

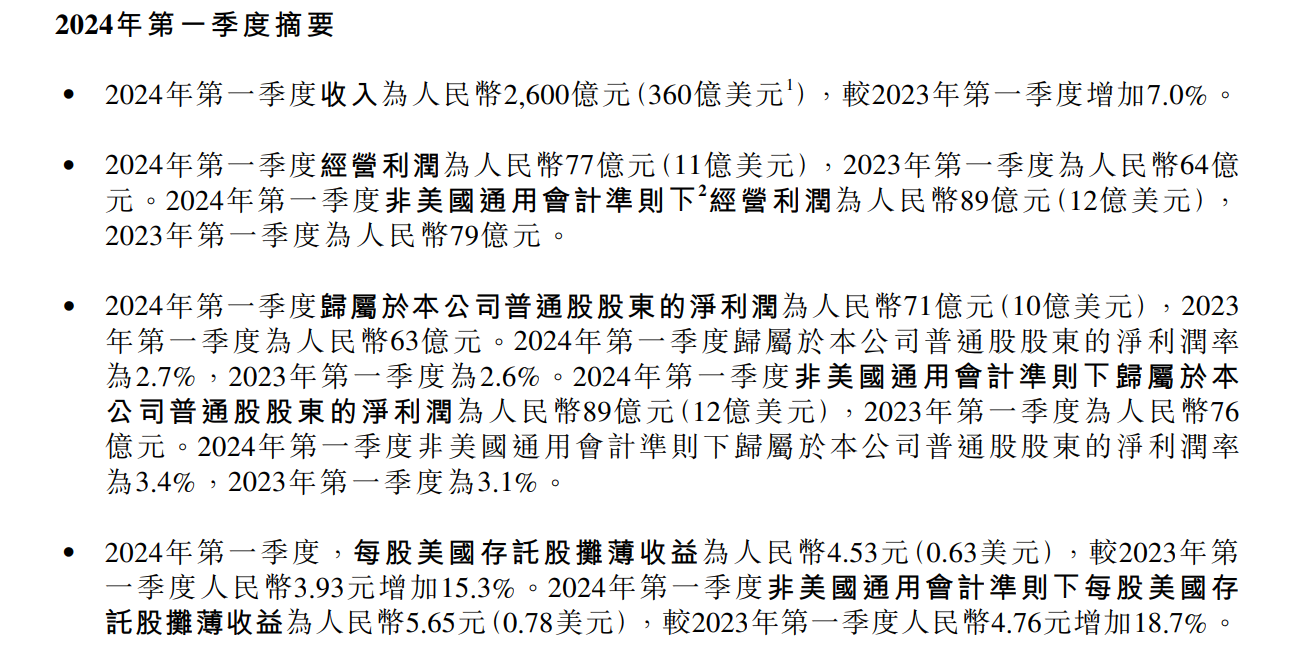

In the first quarter of 2024, JD's revenue was 260 billion yuan, an increase of 7.0% year-on-year. The net profit of Non GAAP in the first quarter was 8.9 billion yuan, a year-on-year increase of 17.2%, significantly exceeding market expectations.

On May 16th, Chinese retail giant JD.com released its first quarter performance report as of March 31, 2024.

Revenue net profit both exceeded expectations

According to data, JD's revenue in the first quarter of 2024 was 260 billion yuan, an increase of 7.0% year-on-year. The net profit of Non GAAP in the first quarter was 8.9 billion yuan, a year-on-year increase of 17.2%, significantly exceeding market expectations. The corresponding net profit margin was not 3.4%, compared to 3.1% in the same period last year and 2.7% in the previous quarter.

As of March 31, 2024, JD's total cash and cash equivalents, restricted cash, and short-term investments amounted to RMB 179.3 billion, compared to RMB 1977 billion in the previous year.

In terms of operational data, the number of quarterly active users has maintained double-digit year-on-year growth for two consecutive quarters, with a significant increase in user shopping frequency, NPS (Net Recommended Value), and the number of users in lower tier cities.

In terms of corporate expenses, JD's operating costs increased in the first quarter, with a year-on-year increase of 6.4% to 220.3 billion yuan.

Among them, performance expenses (mainly including procurement, warehousing, distribution, customer service, and payment processing expenses) increased by 9.3% year-on-year to 16.8 billion yuan. Marketing expenses amounted to 9.3 billion yuan, a year-on-year increase of 15.6%. The increase in marketing expenses is mainly due to the increase in promotional activities, including expenses related to the sponsorship of the Spring Festival Gala. Research and development expenses decreased by 3.6% year-on-year to 4 billion yuan. General and administrative expenses decreased by 21.0% year-on-year to 2 billion yuan, mainly due to a decrease in equity incentive expenses.

"We are pleased to start this year with a steady performance in the first quarter," said Xu Ran, CEO of JD.com. "2024 is a year of execution, and we see that various businesses have achieved tangible results. Especially our emphasis on user experience has led to a strong growth in the number of active users and user engagement in the quarter. We believe that JD's commitment to 'more fast, better and more efficient' user experience will continue to be recognized by consumers across China and will further enhance our development momentum in the future. In 2024, we are about to celebrate the 10th anniversary of listing on NASDAQ, and we are confident in continuing to create value for users, employees, shareholders, and the entire society, welcoming the next chapter."

CICC commented on JD's financial report that in the first quarter, JD's supermarket and advertising revenue recovered, and Non -GAAP net profit increased by 17.2% year-on-year to 8.9 billion yuan, exceeding market expectations by 20%. This was mainly due to JD's retail and logistics profit margins exceeding expectations, so it raised its target price by 28% to 41 US dollars, maintaining a "outperforming industry" rating.

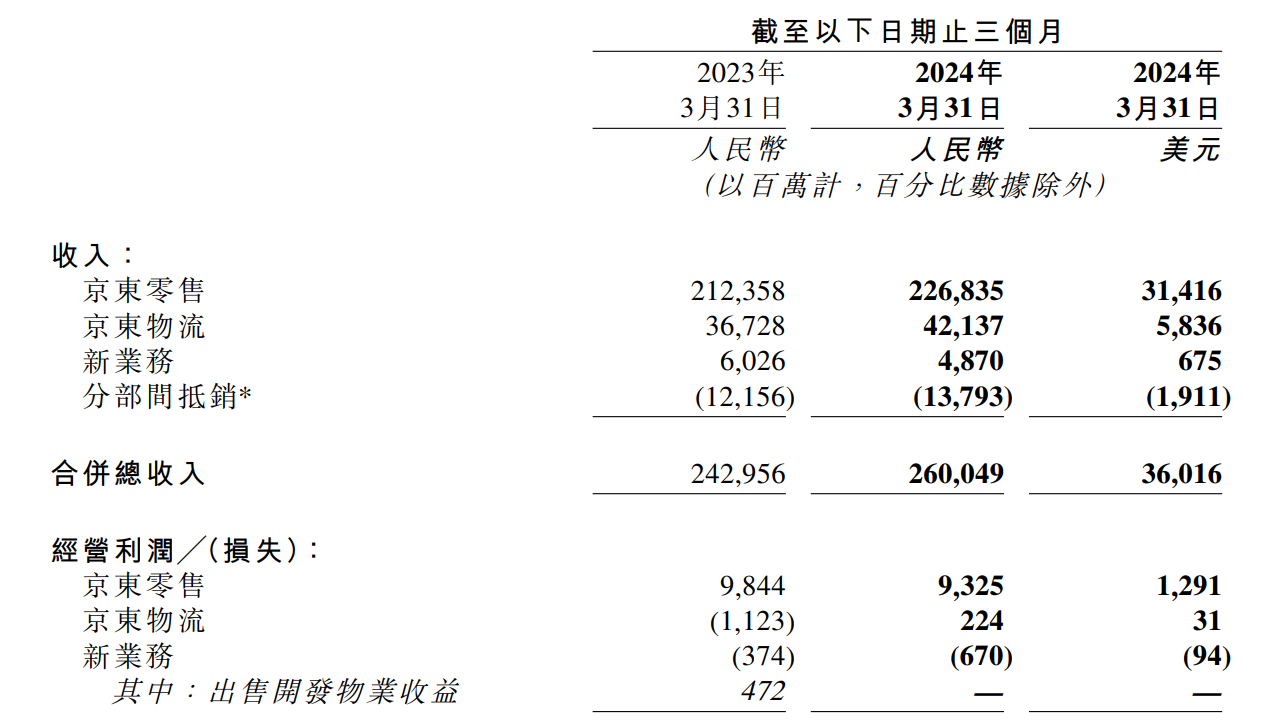

It is worth noting that JD stated in its financial report that starting from the first quarter of 2024, the company will report three divisions, namely JD Retail, JD Logistics, and New Business, to reflect changes in the reporting structure of the company's main operational decision-makers in reviewing its financial information based on its ongoing operational strategy.

Specifically, JD Retail (including components such as JD Health and JD Industrial) mainly engages in self operated business, platform business, and advertising services in China. JD Logistics includes both internal and external logistics services. The new businesses mainly include Dada, JD.com, Jingxi, and overseas businesses.

Specifically, let's take a look at the revenue situation of these three branches of JD.com in the first quarter.

JD's CEO: Optimistic Expectations for "618" Performance

Firstly, let's take a look at JD's pillar business - JD Retail. The first quarter financial report shows that JD Retail's revenue increased by 6.8% year-on-year to 226.84 billion yuan, with an operating profit of 9.33 billion yuan, a slight decrease from 9.84 billion yuan in the same period last year.

On April 16th this year, Liu Qiangdong, founder and chairman of JD Group, joined JD Supermarket and home appliance sales live streaming rooms in the form of AI digital humans. Within one hour, the viewing volume exceeded 20 million, and the entire transaction volume exceeded 50 million yuan. This live broadcast is the first entrepreneurial digital person live broadcast format in the industry.

Afterwards, JD Cloud Yanxi Digital People fully entered the JD sales live broadcast room, serving over 4,000 brand merchants and helping to increase idle time conversion by over 30%.

Xu Ran stated during the conference call that this not only reflects JD's technological capabilities, but also demonstrates the innovative implementation of AI related technological capabilities in the e-commerce field. In the future, JD.com will also firmly invest in technology around its core business, including the application of AI models.

In addition, in the first quarter, JD Health teamed up with multiple pharmaceutical companies including Pfizer and Sanofi to launch new specialty drugs online, continuously improving drug accessibility. JD Health also continues to deepen cooperation with pharmaceutical companies such as Shanghai Pharmaceutical, First Three Communist Party, and Mandy Pharmaceutical, continuously improving the one-stop experience of "retail medicine+services".

With only one month left until the Mid Year Shopping Festival "618", Xu Ran introduced JD's "618" strategy this year, stating that the theme of this year is "good and cheap", and emphasized that the sales pace this year is different from before. JD will further return to the essence of user shopping experience this year, and will directly start selling at 8 pm on May 31st.

Regarding the expectations for the upcoming "618" internal docking on JD.com, Xu Ran stated that overall, the performance of the expectations for "618" is still relatively optimistic. "The main characteristic of JD's business model is that we have an advantage in the scale and certainty of the supply chain. We also firmly believe that JD's' supply chain based, user experience centered 'business model is the most sustainable business model that can traverse different economic cycles. We are confident that JD will continue to gain market share in the long term."

JD Logistics turns losses into profits, new business losses expand

●JD Logistics

JD Logistics' revenue in the first quarter increased by 14.7% year-on-year to 42.14 billion yuan, better than the market estimate of 40.42 billion yuan. In the first quarter, JD Logistics achieved a operating profit of 224 million yuan, turning losses into profits, compared to a loss of 1.123 billion yuan in the same period last year.

While deeply cultivating the domestic market, JD Logistics is also accelerating its overseas layout.

In the first quarter, JD Logistics reached a strategic partnership with Evri, the largest package delivery company in the UK, to jointly create a two-way logistics service covering China and the UK. JD Logistics international express delivery service can achieve the fastest 3-day delivery worldwide. In addition, JD.com operates over 750 self pickup points for the omnichannel retail brand Ochama in Europe, providing consumers with more flexible delivery methods.

According to the company, JD Logistics is still continuing to assist Chinese brands in going global in a one-stop manner. In the first quarter, JD Logistics provided integrated supply chain logistics services for Miniso, covering warehousing and distribution in stores across Australia and Malaysia. Both sides will continue to explore more opportunities for global cooperation.

● New business

The revenue of the new business in the first quarter was 4.87 billion yuan, a decrease of 19.2% from 6.026 billion yuan in the same period last year, and the operating loss rate further expanded from 6.2% in the same period last year to 13.8%.

Among them, Dada Group, which is listed on the US stock market, also released its Q1 2024 financial report after the US stock market closed on the 15th. According to the financial report, Dada Group's total net revenue in the first quarter was 2.452 billion yuan, a year-on-year decrease of 3.3%. The net loss of Non GAAP in the first quarter was 194.8 million yuan, an increase from 182 million yuan in the same period last year.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.